Global Residual DNA Testing Market Size, Share, and COVID-19 Impact Analysis, By Technology (Polymerase Chain Reaction, Threshold Assays, DNA Probe Hybridization, and Others), By Application (Monoclonal Antibodies, Cell & Gene Therapy, Vaccines, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Residual DNA Testing Market Insights Forecasts to 2035

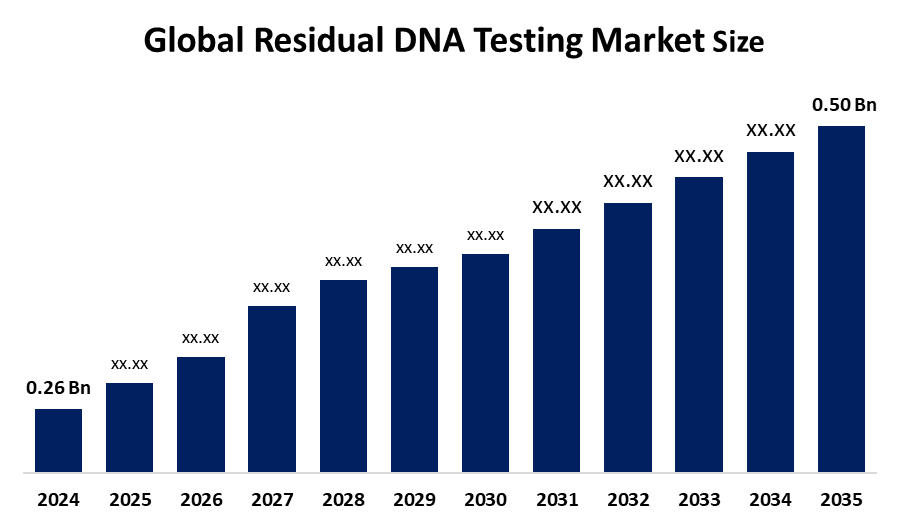

- The Global Residual DNA Testing Market Size Was Estimated at USD 0.26 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.13 % from 2025 to 2035

- The Worldwide Residual DNA Testing Market Size is Expected to Reach USD 0.50 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The global residual DNA testing market size was valued at USD 0.26 Billion in 2024 and is predicted to Grow to around USD 0.50 billion by 2035 with a compound annual growth rate (CAGR) of 6.13 % from 2025 to 2035. The growing biologics production, strict regulations, technological advancements in detection techniques, and the increasing demand for quality assurance in the pharmaceutical and biotechnology industries all present opportunities for growth in the residual DNA testing market.

Market Overview

The market for residual DNA testing encompasses the whole range of pharmaceutical products as well as their validation methods and support, including analytical techniques, kits, reagents, instruments, and services that are used to determine and characterize the trace amounts of host cell DNA that are regarded as impurities in biopharmaceuticals. This covers the testing of vaccinations, gene therapy products, and biologics. By confirming that the DNA levels are, in fact, below the extremely strict thresholds typically less than 10 ng per dose and less than 200 base pairs, as stated, the testing is an essential step for meeting the regulatory requirements and reducing the risk of oncogenicity, infectivity, and immunogenicity. For instance, in September 2024, the digital PCR (dPCR) platform, QIAcuity, Qiagen launched 100 new assays to enable precise and sensitive detection of uncommon mutations, copy number changes, and low-abundance infections. Stricter regulatory compliance requirements and an increase in biologics and biosimilar approvals are driving market expansion. Technological developments in DNA detection and quantification also drive market expansion.

Report Coverage

This research report categorizes the residual DNA testing market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the residual DNA testing market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the residual DNA testing market.

Global Residual DNA Testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 0.26 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.13% |

| 2035 Value Projection: | USD 0.50 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Technology |

| Companies covered:: | Bio-Rad Laboratories, Inc., Charles River Laboratories, Eurofins Scientific, F. Hoffmann-La Roche Ltd., FUJIFILM Corporation, Intertek Group plc, Jiagnsu Hillgene Biopharma Co., Ltd., Lonza, Maravai LifeSciences, Merck KGaA, QIAGEN, Sartorius AG, Thermo Fisher Scientific Inc., WuXi AppTec, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A number of important factors related to the quick development of the biopharmaceutical and biotechnology sectors are driving the residual DNA testing market. The need for residual DNA testing is being driven by the increase in biologics and biosimilars being approved worldwide. The increasing manufacturing of biologics, vaccines, and biosimilars, which necessitate strict quality control procedures to guarantee product safety and regulatory compliance, is one of the main motivators. Manufacturers are increasingly using DNA testing solutions to guarantee product purity and compliance as regulatory bodies impose strict safety and quality assessments. This is driving market expansion in the pharmaceutical, biotechnology, and contract testing sectors.

Restraining Factors

High testing costs, intricate validation processes, a lack of technical know-how, laborious analytical procedures, and difficulties standardizing across various biologic manufacturing platforms and regulatory environments are all factors restricting the residual DNA testing market.

Market Segmentation

The residual DNA testing market share is classified into technology and application.

- The polymerase chain reaction segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the technology, the residual DNA testing market is divided into polymerase chain reaction, threshold assays, DNA probe hybridization, and others. Among these, the polymerase chain reaction segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. High sensitivity, precision, and quick detection are what propel the polymerase chain reaction (PCR) market. In biopharmaceutical quality control, PCR-based techniques are frequently used to find traces of leftover DNA in biologic products. The growing use of sophisticated molecular testing methods, the need to comply with regulations, and the growing manufacturing of biologics and cell- and gene-based treatments are the reasons behind the polymerase chain reaction (PCR) market.

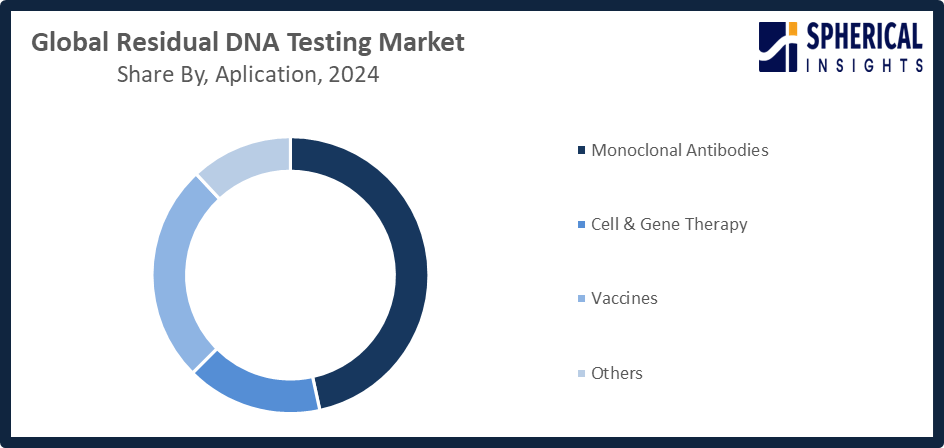

- The monoclonal antibodies segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the residual DNA testing market is divided into monoclonal antibodies, cell & gene therapy, vaccines, and others. Among these, the monoclonal antibodies segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growing manufacturing of monoclonal antibody-based biologics worldwide and their extensive therapeutic usage are driving the monoclonal antibodies market. Strict regulatory requirements for residual DNA testing to guarantee product safety and efficacy maintain the segment's dominance. Due to the growing need for targeted medicines, ongoing advancements in antibody-based treatments, and the expansion of biopharmaceutical manufacturing operations globally, it is projected to rise at a high compound annual growth rate throughout the projection period.

Get more details on this report -

Regional Segment Analysis of the Residual DNA Testing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the residual DNA testing market over the predicted timeframe.

North America is anticipated to hold the largest share of the residual DNA testing market over the predicted timeframe. The existence of major pharmaceuticals, contract research organizations, and high-tech manufacturing plants greatly supports the adoption of residual DNA testing solutions in a big way. The American Type Culture Collection (ATCC) established a strategic partnership with the U.S. Pharmacopeia (USP) on May 28, 2025, which resulted in the creation of comprehensive reference standards for host cell DNA impurities, thus leading to the adoption of such technologies in vaccine and gene therapy pipelines. Moreover, strict regulatory policies, for example U.S. Food and Drug Administration, make it a must for the FDA to carry out and thus the quality control through residual DNA testing.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR in the residual DNA testing market during the forecast period. Asia Pacific is propelled by the region's growing biopharmaceutical production base. The manufacturing of biologics is expanding significantly in nations like China, India, Japan, and South Korea owing to favorable government regulations, increased healthcare spending, and growing demand for reasonably priced biopharmaceuticals. On March 10, 2025, the National Medical Products Administration (NMPA) in China released updated biological product registration standards that required sophisticated residual DNA testing using qPCR and NGS for all recombinant therapies. This simplified market access while enforcing <10 ng/dose limitations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the residual DNA testing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bio-Rad Laboratories, Inc.

- Charles River Laboratories

- Eurofins Scientific

- F. Hoffmann-La Roche Ltd.

- FUJIFILM Corporation

- Intertek Group plc

- Jiagnsu Hillgene Biopharma Co., Ltd.

- Lonza

- Maravai LifeSciences

- Merck KGaA

- QIAGEN

- Sartorius AG

- Thermo Fisher Scientific Inc.

- WuXi AppTec

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2025, Thermo Fisher Scientific launched a USD 2 billion investment plan in the US to enhance innovation, manufacturing, and economic competitiveness, focusing on advanced residual DNA testing and life sciences solutions.

- In February 2025, Bio-Rad announced the acquisition of Stilla Technologies to strengthen its digital PCR portfolio, expanding applications in cell and gene therapy, infectious disease detection, and residual DNA testing.

- In September 2024, Eurofins Scientific launched expanded BioPharma product testing services in the US following its acquisition of Infinity Laboratories, enhancing capabilities in residual DNA testing and quality assurance for biologics.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the residual DNA testing market based on the below-mentioned segments:

Global Residual DNA Testing Market, By Technology

- Polymerase Chain Reaction

- Threshold Assays

- DNA Probe Hybridization

- Others

Global Residual DNA Testing Market, By Application

- Monoclonal Antibodies

- Cell & Gene Therapy

- Vaccines

- Others

Global Residual DNA Testing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the residual DNA testing market over the forecast period?The global residual DNA testing market is projected to expand at a CAGR of 6.13% during the forecast period.

-

2. What is the market size of the residual DNA testing market?The global residual DNA testing market size is expected to grow from USD 0.26 billion in 2024 to USD 0.50 billion by 2035, at a CAGR of 6.13 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the residual DNA testing market?North America is anticipated to hold the largest share of the residual DNA testing market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global residual DNA testing market?Bio-Rad Laboratories, Inc., Charles River Laboratories, Eurofins Scientific, F. Hoffmann-La Roche Ltd., FUJIFILM Corporation, Intertek Group plc, Jiagnsu Hillgene Biopharma Co., Ltd., Lonza, Maravai LifeSciences, Merck KGaA, QIAGEN, Sartorius AG, Thermo Fisher Scientific Inc., WuXi AppTec, and Others.

-

5. What factors are driving the growth of the residual DNA testing market?Growth of the residual DNA testing market is driven by increasing biologics production, stringent regulatory requirements, technological advancements in detection methods, rising adoption of cell and gene therapies, and expanding biopharmaceutical R&D.

-

6. What are the market trends in the residual DNA testing market?High-sensitivity PCR and next-generation sequencing technology integration, testing service outsourcing, analytical process automation, and an increased emphasis on compliance and quality assurance in biologics production are some of the major trends.

-

7. What are the main challenges restricting the wider adoption of the residual DNA testing market?High testing costs, complicated validation processes, a lack of technical know-how, long analytical schedules, difficulties standardizing testing techniques across various biologic products, and international regulatory frameworks all restrict market expansion.

Need help to buy this report?