Global Regenerated Cellulose Market Size, Share, and COVID-19 Impact Analysis, By Type (Fibers and Films), By Manufacturing Process (Viscose, Cuprammonium, N-methyl-morpholine-N-oxide (NMMO), and Acetate), By Source (Wood-Pulp, Non-Wood Pulp, and Recycled Pulp/De-inked Pulp), By End-user Industry (Fabrics, Automotive, Agriculture, Packaging, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Regenerated Cellulose Market Insights Forecasts to 2035

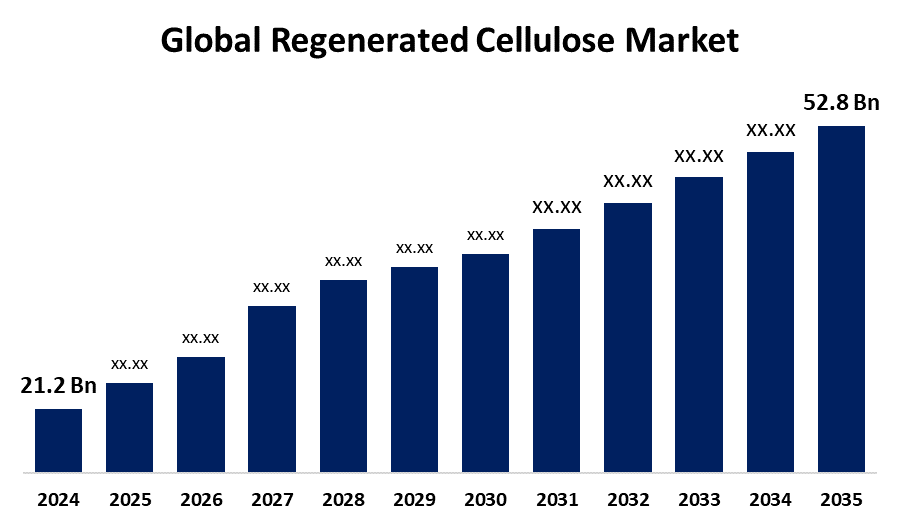

- The Global Regenerated Cellulose Market Size Was Estimated at USD 21.2 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.65% from 2025 to 2035

- The Worldwide Regenerated Cellulose Market Size is Expected to Reach USD 52.8 Billion by 2035

- Asia Pacific is Expected to Grow the Fastest During the Forecast Period.

Get more details on this report -

The Global Regenerated Cellulose Market Size was Worth around USD 21.2 Billion in 2024 and is Predicted to Grow to around USD 52.8 Billion By 2035 with a Compound Annual Growth Rate (CAGR) of 8.65% from 2025 to 2035. An increasing demand for eco-friendly fabrics and the use of regenerated cellulose in personal care & hygienic products are driving the regenerated cellulose market globally.

Market Overview

The regenerated cellulose market is the industry encompassing the production and consumption of materials made by chemically processing and reconstituting natural cellulose into fibers or films. Regenerated cellulose is a material manufactured from natural cellulose, which is the main structural component of plants, that has been dissolved, chemically modified, and then regenerated into a new form, often as a fiber or film. The regenerated cellulosic fibers have some excellent properties such as high wet tenacity, good absorbency, soft, lustrous, easily dyeable, biodegradability, good drape ability, and others, which help them to be used as an alternative to synthetic fibers. The market demand for regenerated cellulose is driven by its versatility and renewable nature, which makes it a sustainable alternative to synthetic fibers and plastics. There is increasing demand for eco-friendly fibers across diverse end-use sectors, including the fabric industry, automotive industry, agriculture industry, packaging industry, and others, which ultimately drives the market demand for regenerated cellulose. Further, the adoption of novel innovative manufacturing technologies with the shifting lifestyles and rapid urbanization is escalating the market growth. The growing awareness about personal hygiene, biodegradability, and sustainability is contributing to bolster the market growth opportunity for regenerated cellulose.

Report Coverage

This research report categorizes the regenerated cellulose market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the regenerated cellulose market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the regenerated cellulose market.

Global Regenerated Cellulose Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 21.2 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 8.65% |

| 2035 Value Projection: | USD 52.8 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By Source, By End-user Industry and COVID-19 Impact Analysis. |

| Companies covered:: | Birla Cellulose, Grasim Industries, CVL Rayon, Domtar Corporation, Fulida Textile Group, Eastman Chemical Company, Hyosung Corporation, Sateri Holding Group, Kelheim Fibres, Indorama Ventures, Nanjing Chemical Fiber, Thai Rayon, TENCEL, Lenzing AG, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

An increasing demand for eco-friendly fabrics is driving the demand for regenerated cellulose fabrics as a sustainable alternative to conventional textiles, offering a blend of natural and man-made properties, which ultimately results in propelling the market. The widespread use of regenerated cellulose in personal care and hygienic products, owing to its absorbency, flexibility, and biodegradability, is driving the market expansion. The inclination towards sustainable practices in the fashion and textile industries is driving the market demand in the sporting goods sector.

Restraining Factors

The high manufacturing prices of regenerated cellulose are challenging the market growth. Further, the concerns associated with controlling the structure of regenerated cellulose may hamper the market.

Market Segmentation

The regenerated cellulose market share is classified into type, manufacturing process, source, and end-user industry.

- The fibers segment dominated the regenerated cellulose market in 2024 and is projected to grow at the fastest CAGR during the forecast period.

Based on the type, the regenerated cellulose market is divided into fibers and films. Among these, the fibers segment dominated the regenerated cellulose market in 2024 and is projected to grow at the fastest CAGR during the forecast period. It was estimated that the world production of regenerated cellulose fiber is about 3 million metric tons per year, accounting for approximately 5% of global man-made fiber production. Its increasing use in the textile and apparel industry is driving the market in the fibers segment.

- The viscose segment dominated the regenerated cellulose market in 2024 and is projected to grow at a significant CAGR during the forecast period.

Based on the manufacturing process, the regenerated cellulose market is divided into viscose, cuprammonium, N-methyl-morpholine-N-oxide (NMMO), and acetate. Among these, the viscose segment dominated the regenerated cellulose market in 2024 and is projected to grow at a significant CAGR during the forecast period. It involves the conversion of wood pulp into a soluble form, which then regenerates into fibers through a wet spinning process. The use of viscose manufacturing technology in the manufacturing of fashionable dresses, innerwear, outerwear, sportswear, bedding, and other products is driving market demand.

- The wood-pulp segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the source, the regenerated cellulose market is divided into wood-pulp, non-wood pulp, and recycled pulp/de-inked pulp. Among these, the wood-pulp segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Wood pulp is the primary raw material used in the production of regenerated cellulose fibers such as viscose, modal, and lyocell. Its widespread application, owing to its high tensile strength, high wet tenacity, abrasion resistance, and absorbing capacity, is propelling the market demand.

- The fabrics segment dominated the regenerated cellulose market in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the end-user industry, the regenerated cellulose market is divided into fabrics, automotive, agriculture, packaging, and others. Among these, the fabrics segment dominated the regenerated cellulose market in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. Regenerated cellulose fibers such as viscose and lyocell are used in fabrics due to their softness, breathability, and moisture absorption properties.

Regional Segment Analysis of the Regenerated Cellulose Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the regenerated cellulose market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the regenerated cellulose market over the predicted timeframe. The rising focus on sustainability, driving demand for eco-friendly materials across textiles, packaging, and automotive industries, is propelling the regenerated cellulose market. The emphasis on developing innovative textiles that are made from renewable and biodegradable materials, including regenerated cellulose, is contributing to driving the market growth.

Asia Pacific is expected to grow at a rapid CAGR in the regenerated cellulose market during the forecast period. Sustainability trends and interest in sustainable textiles, in nations like China and India driving the adoption of cellulose-derived fabrics, which ultimately results in propelling the market of regenerated cellulose. Further, the rising need for sustainable packaging solutions from the food & beverage, healthcare, and personal care industries is contributing to driving the market demand.

Europe is anticipated to hold a significant share of the regenerated cellulose market during the projected timeframe. The growing need for regenerated cellulose across the automotive industry, especially in the manufacturing of lightweight and fuel-efficient vehicles, is driving the market demand. Further, the consumer demand for sustainable alternatives to synthetic materials, as well as the versatility of regenerated cellulose across diverse industries, is propelling the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the regenerated cellulose market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Birla Cellulose

- Grasim Industries

- CVL Rayon

- Domtar Corporation

- Fulida Textile Group

- Eastman Chemical Company

- Hyosung Corporation

- Sateri Holding Group

- Kelheim Fibres

- Indorama Ventures

- Nanjing Chemical Fiber

- Thai Rayon

- TENCEL

- Lenzing AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2022, the Swedish textile-to-textile recycling innovator Renewcell signed a Letter of Intent with Birla Cellulose, the pulp and fiber business of Grasim Industries Ltd. A flagship company of Aditya Birla Group and one of the world’s largest man-made cellulosic fibre producers, concerning a long-term commercial collaboration for man-made cellulosic fiber production.

- In January 2022, GP Cellulose announced an $80 million investment in its Alabama River Cellulose mill, aimed at enhancing the mill’s fluff pulp production capacity.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the regenerated cellulose market based on the below-mentioned segments:

Global Regenerated Cellulose Market, By Type

- Fibers

- Films

Global Regenerated Cellulose Market, By Manufacturing Process

- Viscose

- Cuprammonium

- N-methyl-morpholine-N-oxide (NMMO)

- Acetate

Global Regenerated Cellulose Market, By Source

- Wood-Pulp

- Non-Wood Pulp

- Recycled Pulp/De-inked Pulp

Global Regenerated Cellulose Market, By End-user Industry

- Fabrics

- Automotive

- Agriculture

- Packaging

- Others

Global Regenerated Cellulose Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the regenerated cellulose market over the forecast period?The global regenerated cellulose market is projected to expand at a CAGR of 8.65% during the forecast period.

-

2. What is the market size of the regenerated cellulose market?The global regenerated cellulose market size is expected to grow from USD 21.2 Billion in 2024 to USD 52.8 Billion by 2035, at a CAGR of 8.65% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the regenerated cellulose market?North America is anticipated to hold the largest share of the regenerated cellulose market over the predicted timeframe.

Need help to buy this report?