Global Refrigerated Trailer Market Size, Share, and COVID-19 Impact Analysis, By Trailer (Single-Temperature and Multi-Temperature), By Axle (Single Axle, Tandem Axle, and Triple Axle), By Power Source (Diesel-Powered, Electric-Powered, and Solar-Assisted), By End Use (Food & Beverage, Healthcare, Retail & E-Commerce, and Logistics & Transportation), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Information & TechnologyGlobal Refrigerated Trailer Market Insights Forecasts to 2035

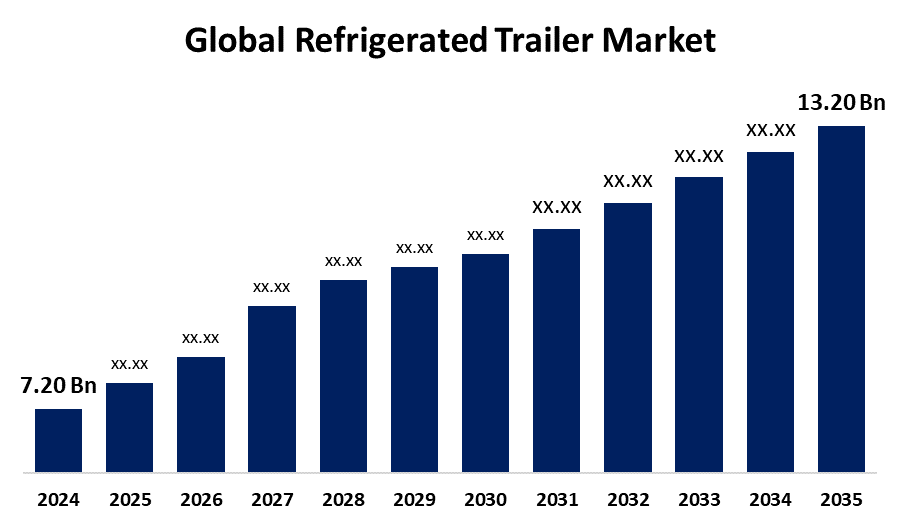

- The Global Refrigerated Trailer Market Size Was Estimated at USD 7.20 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.66% from 2025 to 2035

- The Worldwide Refrigerated Trailer Market Size is Expected to Reach USD 13.20 Billion by 2035

- Asia Pacific is Expected to Grow the Fastest during the forecast period.

Get more details on this report -

The Global Refrigerated Trailer Market Size was Worth around USD 7.20 Billion in 2024 and is Predicted to Grow to around USD 13.20 Billion by 2035 with a compound annual growth rate (CAGR) of 5.66% from 2025 to 2035. The rising demand for safe, timely delivery of perishable goods. Technological advancements and regulatory support are accelerating innovation and efficiency across the sector.

Market Overview

The refrigerated trailer market refers to a transport device with temperature control intended to protect delicate or perishable items while in transit. Regardless of the outside weather, it maintains a constant interior temperature with the help of an onboard refrigeration system and insulated walls.

Energy-efficient materials, electric refrigeration units, and real-time telematics are some of the major innovations. Businesses like Utility Trailer and Grupo Lala are spearheading the transition to environmentally friendly transportation options. With the help of big businesses like Frialsa and Emergent Cold LatAm, infrastructure is growing. Cold chain capabilities are being improved through market consolidation and strategic alliances. All things considered, the industry is heading for a more intelligent, environmentally friendly, and cohesive future.

The demand for sophisticated refrigerated transport solutions is being greatly increased by Mexico's expanding pharmaceutical and healthcare industries. Investment in cold chain infrastructure is fueled by the necessity of precise temperature control for vaccinations, specialty medications, and blood products. Smart monitoring technology use is accelerating due to growing pharmaceutical manufacturing and regulatory compliance requirements. At the same time, the food and beverage sector is growing quickly due to changing customer tastes and urbanization. Refrigerated logistics is changing as a result of this expansion, as well as needs from retail and HoReCa. Together, these industries are driving Mexico's cold chain ecosystem to become more resilient and tech-driven.

Report Coverage

This research report categorizes the refrigerated trailer market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the refrigerated trailer market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the refrigerated trailer market.

Global Refrigerated Trailer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7.20 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.66% |

| 2035 Value Projection: | USD 13.20 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Power Source, By End Use, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Wabash National Corporation, Gray & Adams Ltd., Schmitz Cargobull AG, Hyundai Translead, Inc., Great Dane LLC, Fahrzeugwerk Bernard Krone GmbH & Co. KG, Utility Trailer Manufacturing Company, Lamberet SAS, CIMC Vehicles Group Co., Ltd., Kögel Trailer GmbH & Co. KG, Carrier Transicold, Manac, Thermo King, Singamas Container, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing need for cold chain logistics is being driven by the requirement to carry perishable goods safely. Concerns about food safety and e-commerce are driving investments in cutting-edge temperature-controlled systems. Trailer performance and operating efficiency are being improved by technological advancements such as energy-efficient technologies and Internet of Things-enabled monitoring. The transition to dependable refrigerated transportation is further supported by stringent regulatory requirements. The requirement for prompt, fresh product delivery is growing as the food and beverage industry expands. When taken as a whole, these indicators suggest that the refrigerated logistics industry is seeing ongoing growth and innovation.

Restraining Factors

The small and mid-sized logistics companies, high upfront costs and continuing maintenance requirements that may be unaffordable. The technological intricacy of refrigeration systems necessitates frequent maintenance and trained operators, which makes operations more difficult. Furthermore, the industry is vulnerable to changes in fuel prices and environmental issues due to its reliance on diesel engines, particularly in light of stricter emissions laws.

Market Segmentation

The refrigerated trailer market share is classified intotrailer, axle, power source, and end use.

- The single temperature segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the trailer, the refrigerated trailer market is divided into single-temperature and multi-temperature. Among these, the single temperature segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by the expansion of e-commerce, stringent supply chain regulations requiring temperature control, and rising demand for perishable items are all factors driving segment growth. This tendency is also being supported by the requirement for effective transportation of goods that demand consistent, homogeneous temperatures, such as dairy, animal products, and pharmaceuticals.

- The tandem axle segment accounted for the largest share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the axle, the refrigerated trailer market is divided into single axle, tandem axle, and triple axle. Among these, the tandem axle segment accounted for the largest share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The segmental growth is due to the growing customer desire for sophisticated handling systems, the requirement for increased stability during transit, and the rising demand for high-capacity trailers. Better weight distribution provided by tandem axles improves performance and safety. The tandem axle market is expanding as a result of companies' efforts to increase load capacity, stabilize vehicles, and integrate sophisticated suspension systems.

- The diesel-powered segment accounted for the largest share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the power source, the refrigerated trailer market is divided into diesel-powered, electric-powered, and solar-assisted. Among these, the diesel-powered segment accounted for the largest share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The segmental growth is due to its wide refueling infrastructure, cost-effectiveness for long-distance haulage, and demonstrated dependability. In contrast to electric systems, diesel-powered refrigerated trailers are renowned for their strong performance, particularly in challenging environments, and their capacity to run continuously for prolonged periods without requiring recharging. Easy operation is guaranteed by the abundance of diesel fuelling stations around the world, especially in areas with poor access to infrastructure for electric charging.

- The food and beverage segment accounted for the largest share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the end use, the refrigerated trailer market is divided into food & beverage, healthcare, retail & e-commerce, and logistics & transportation. Among these, the food and beverage segment accounted for the largest share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The segmental growth is due to the rising trend of online meal delivery, the expansion of global supply chains, and the rising demand for perishable foods. For example, the necessity for dependable refrigerated transport solutions to preserve product freshness across the supply chain has increased due to the growth of e-commerce platforms for groceries and food delivery services, such as Walmart and Amazon Fresh.

Regional Segment Analysis of the Refrigerated Trailer Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the refrigerated trailer market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the refrigerated trailer market over the predicted timeframe. The region's need for refrigerated trailers to transport perishable items has increased due to the quick expansion of e-commerce and online grocery shopping, as customers seek fresher and faster deliveries. Stricter environmental laws, like California's LEV program and impending zero-emission requirements, are also encouraging businesses to use more environmentally friendly chilled transportation choices, like electric-powered trailers.

Asia Pacific is expected to grow at a rapid CAGR in the refrigerated trailer market during the forecast period. In this region, the quickly growing food export sector in the region especially prominent in nations like China, India, and Southeast Asia. With the help of government initiatives like India's National Cold Chain Policy, which aims to improve storage and transportation infrastructure and decrease food waste, the region is seeing a shift toward upgrading cold chain operations. The market is also being helped by the rising demand for temperature-sensitive goods like chemicals and medications. Reliable last-mile cold delivery solutions are becoming more and more in demand as a result of Southeast Asia's e-commerce platforms' rapid expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the refrigerated trailer market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Wabash National Corporation

- Gray & Adams Ltd.

- Schmitz Cargobull AG

- Hyundai Translead, Inc.

- Great Dane LLC

- Fahrzeugwerk Bernard Krone GmbH & Co. KG

- Utility Trailer Manufacturing Company

- Lamberet SAS

- CIMC Vehicles Group Co., Ltd.

- Kögel Trailer GmbH & Co. KG

- Carrier Transicold

- Manac

- Thermo King

- Singamas Container

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2025, Birds Eye, in collaboration with DFDS and Sunswap, debuted solar-powered refrigerated trailers in the UK to improve the sustainable transportation of frozen goods. The effort supports Birds Eye's carbon-reduction goals by deploying innovative battery-electric refrigeration systems driven by rooftop solar panels.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the refrigerated trailer market based on the below-mentioned segments:

Global Refrigerated Trailer Market, By Trailer

- Single-Temperature

- Multi-Temperature

Global Refrigerated Trailer Market, By Axle

- Single Axle

- Tandem Axle

- Triple Axle

Global Refrigerated Trailer Market, By Power Source

- Diesel-Powered

- Electric-Powered

- Solar-Assisted

Global Refrigerated Trailer Market, By End Use

- Food & Beverage

- Healthcare

- Retail & E-Commerce

- Logistics & Transportation

Global Refrigerated Trailer Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the refrigerated trailer market over the forecast period?The global refrigerated trailer market is projected to expand at a CAGR of 5.66% during the forecast period.

-

2. What is the market size of the refrigerated trailer market?The global refrigerated trailer market size is expected to grow from USD 7.20 Billion in 2024 to USD 13.20 Billion by 2035, at a CAGR of 5.66% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the refrigerated trailer market?North America is anticipated to hold the largest share of the refrigerated trailer market over the predicted timeframe.

Need help to buy this report?