Global Refractory Lining Optimization Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Bricks, Monolithic, Castables, Ceramic Fiber, and Others), By Optimization Technique (Thermal Analysis, Structural Analysis, Material Selection, Installation Methods, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Advanced MaterialsGlobal Refractory Lining Optimization Market Insights Forecasts to 2035

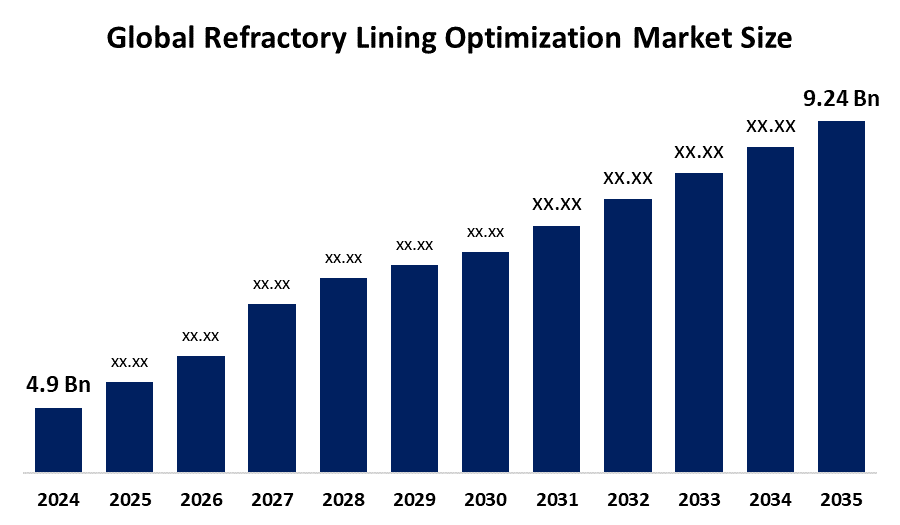

- The Global Refractory Lining Optimization Market Size Was Estimated at USD 4.9 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.94% from 2025 to 2035

- The Worldwide Refractory Lining Optimization Market Size is Expected to Reach USD 9.24 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Refractory Lining Optimization Market size was worth around USD 4.9 Billion in 2024 and is predicted to grow to around USD 9.24 Billion by 2035 with a compound annual growth rate (CAGR) of 5.94% from 2025 to 2035. The growing demand for long-lasting, economical, and energy-efficient refractory solutions in a variety of high-temperature industries, including petrochemicals, steel, cement, and glass. Refractory lining optimization has emerged as a crucial area for investment and innovation as companies place a greater emphasis on sustainability and operational efficiency.

Market Overview

The global refractory lining optimization market refers to improving the design, performance, and lifetime of refractory linings in industrial furnaces and reactors to increase energy efficiency, durability, and operational dependability. The expanding use of sophisticated refractory goods and optimisation methods in heavy industries, especially steel production, is propelling the rapid growth of the global refractory lining optimisation market. Through digital monitoring, predictive maintenance, and thermal analysis, these advancements increase boiler longevity, decrease downtime, and improve energy efficiency. Industries including cement, glass, and non-ferrous metals are being forced to invest in environmentally friendly refractory materials like low-cement castable and ceramic fibres, which are known for their excellent insulation and lower emissions, due to growing environmental restrictions and sustainability goals. Additionally, equipment longevity and resource efficiency are being enhanced by innovative installation techniques and material selection procedures. Market expansion is also aided by government programs that support sustainable manufacturing practices.

In order to prevent failures, guarantee worker safety, and maintain consistent product quality, industries use structural analysis and real-time monitoring. The market for refractory lining optimisation is still expanding due to the increased emphasis on sustainability and dependability.

As part of the Make in India campaign, Calderys is investing in a new refractory production hub in Odisha, India, in 2025 to satisfy the expanding demand in the manufacturing, energy, and infrastructure sectors. In the meantime, lightweight and ultra-lightweight linings for high-temperature kilns are being introduced by refractory suppliers in an effort to improve energy efficiency, lower heat loss, streamline maintenance, and reduce downtime.

Report Coverage

This research report categorizes the refractory lining optimization market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the refractory lining optimization market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the refractory lining optimization market.

Global Refractory Lining Optimization Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.9 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.94% |

| 2035 Value Projection: | USD 9.24 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Product Type, By Optimization Technique and By Region |

| Companies covered:: | Vesuvius plc, RHI Magnesita, Saint-Gobain, Morgan Advanced Materials, HarbisonWalker International, Imerys, Shinagawa Refractories, Krosaki Harima Corporation, Resco Products, Inc., Calderys, Plibrico Company, LLC, Puyang Refractories Group Co., Ltd., Chosun Refractories Co., Ltd., IFGL Refractories Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increased emphasis on resource efficiency and sustainability across process industries is a key factor propelling the refractory lining optimisation market. To cut emissions and boost energy efficiency, industries like cement, glass, and non-ferrous metals are investing in environmentally friendly refractory materials like low-cement castables and ceramic fibres. Innovations in material selection and installation methods save waste and increase equipment longevity. Government programs that support energy saving and sustainable industrial practices are also driving market expansion and supporting international environmental and efficiency objectives.

Restraining Factors

The high initial cost of innovative refractory materials and installation is a major barrier to the refractory lining optimization market. Widespread adoption is further hampered by the scarcity of qualified workers for correct installation, frequent maintenance needs, and price swings for raw materials. Particularly in cost-sensitive industrial industries, these obstacles may impede market growth.

Market Segmentation

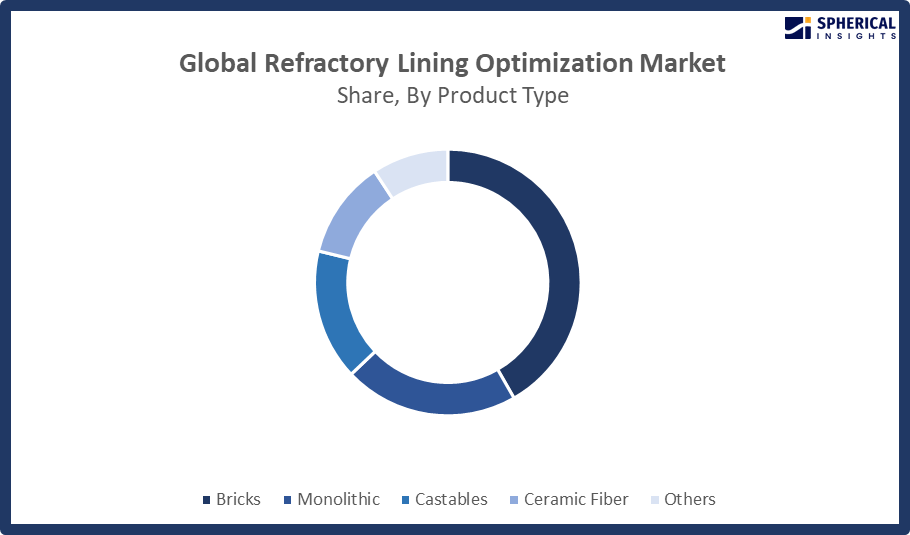

The Refractory Lining Optimization market share is classified into product type and optimization technique.

- The bricks segment dominated the market in 2024, approximately 42% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the refractory lining optimization market is divided into bricks, monolithic, castables, ceramic fiber, and others. Among these, the bricks segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. In the steel and cement sectors, they are favoured for lining furnaces, kilns, and reactors due to their uniform forms and simplicity of installation. However, cutting-edge technologies that provide better thermal insulation and shorter installation times are gradually replacing the market for bricks. Manufacturers are improving the performance characteristics of refractory bricks by using new materials and manufacturing techniques to increase their service life and lower maintenance needs as a result of the continuous move towards more effective and long-lasting refractory solutions.

Get more details on this report -

- The thermal analysis segment accounted for the largest share in 2024, approximately 45% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the optimization technique, the refractory lining optimization market is divided into thermal analysis, structural analysis, material selection, installation methods, and others. Among these, the thermal analysis segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The foundation of refractory optimization is thermal analysis, which allows companies to evaluate the thermal performance of refractory linings and pinpoint areas in need of improvement. In order to anticipate temperature distribution, optimize lining thickness, and model heat transport, advanced thermal analysis technologies like computational fluid dynamics and infrared thermography are being used more. Industries can improve overall process efficiency, lower heat losses, and save a substantial amount of energy by utilizing thermal analysis. The efficiency of thermal analysis in refractory optimization is being further improved by the incorporation of digital monitoring and real-time data analytics

Regional Segment Analysis of the Refractory Lining Optimization Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share with approximately 42% of the Refractory Lining Optimization market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the refractory lining optimization market over the predicted timeframe. The fast growth of the steel, cement, and petrochemical industries in large economies like China, India, Japan, and South Korea is what propels this dominant position. Strong demand for cutting-edge refractory solutions is being driven by the region's solid industrial expansion as well as rising investments in energy and infrastructure projects. The use of refractory lining optimisation in the Asia Pacific is being accelerated by government programs that support energy efficiency, environmental sustainability, and industrial modernization.

North America is expected to grow the fastest market share with approximately 38% at a rapid CAGR in the refractory lining optimization market during the forecast period. It is distinguished by a developed industrial base, cutting-edge technology, and a strong emphasis on sustainability and innovation. Particularly in the steel, energy, and chemical industries, the region is seeing an increase in the use of digital optimization techniques, predictive maintenance, and environmentally friendly refractory materials. driven by the continuous shift to a circular economy, strict environmental rules, and technological developments. It is anticipated that both areas will continue to grow steadily due to continuous investments in sustainability programs and industrial modernization.

Europe is expected to grow at a rapid CAGR in the refractory lining optimization market during the forecast period. Driven by the continuous shift to a circular economy, strict environmental rules, and technological developments. It is anticipated that both areas will continue to grow steadily due to continuous investments in sustainability programs and industrial modernisation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the refractory lining optimization market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Vesuvius plc

- RHI Magnesita

- Saint-Gobain

- Morgan Advanced Materials

- HarbisonWalker International

- Imerys

- Shinagawa Refractories

- Krosaki Harima Corporation

- Resco Products, Inc.

- Calderys

- Plibrico Company, LLC

- Puyang Refractories Group Co., Ltd.

- Chosun Refractories Co., Ltd.

- IFGL Refractories Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2024, to improve refractory lining efficiency through digital monitoring, predictive maintenance, and sustainable practices, RHI Magnesita introduced its "4PRO" performance partnership concept. In the steel and cement industries, the effort places a strong emphasis on lowering energy losses and increasing furnace life.

- In March 2024, for tunnel-kiln cars in the brick industry, Rath Group produced an energy-efficient lightweight refractory lining technology that reduced specific energy consumption by up to 70% and greatly increased operational efficiency.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the refractory lining optimization market based on the below-mentioned segments:

Global Refractory Lining Optimization Market, By Product Type

- Bricks

- Monolithic

- Castables

- Ceramic Fiber

- Others

Global Refractory Lining Optimization Market, By Optimization Technique

- Thermal Analysis

- Structural Analysis

- Material Selection

- Installation Methods

- Others

Global Refractory Lining Optimization Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. the What is CAGR of the Refractory Lining Optimization market over the forecast period?The global Refractory Lining Optimization market is projected to expand at a CAGR of 5.94% during the forecast period.

-

2. What is the market size of the Refractory Lining Optimization market?The global Refractory Lining Optimization market size is expected to grow from USD 4.9 Billion in 2024 to USD 9.24 Billion by 2035, at a CAGR of 5.94% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Refractory Lining Optimization market?Asia Pacific is anticipated to hold the largest share of the Refractory Lining Optimization market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global Refractory Lining Optimization market?Vesuvius plc, RHI Magnesita, Saint-Gobain, Morgan Advanced Materials, HarbisonWalker International, Imerys, Shinagawa Refractories, Krosaki Harima Corporation, Resco Products, Inc., and Calderys

-

5. What factors are driving the growth of the Refractory Lining Optimization market?The growing need for high-performance materials in the steel, cement, and glass industries, technological developments in digital monitoring and predictive maintenance, sustainability initiatives, and the need to increase furnace efficiency, decrease downtime, and prolong equipment lifespan are all driving the growth of the refractory lining optimization market.

-

6. What are the market trends in the Refractory Lining Optimization market?The development of environmentally friendly refractory materials, the growing use of digital monitoring and predictive maintenance tools, and the rising need for lightweight, high-performance linings to improve thermal efficiency and decrease downtime are some of the major market trends in the global refractory lining optimization market.

-

7. What are the main challenges restricting wider adoption of the Refractory Lining Optimization market?Wider implementation of refractory lining optimisation is hampered by high installation costs, a shortage of experienced labour, and complicated maintenance needs. Additionally, market progress is hampered by the delayed adoption of digital technology and the volatility of raw material prices.

Need help to buy this report?