Global Refractories Market Size, Share, and COVID-19 Impact Analysis, By Form (Bricks & Shaped and Monolithic & Unshaped, and Others), By Product (Clay and Non-Clay), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Refractories Market Size Insights Forecasts to 2035

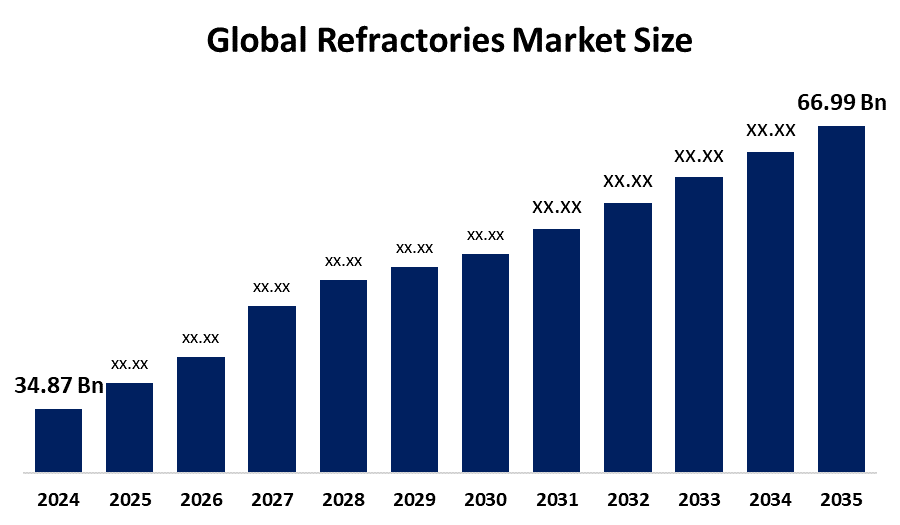

- The Global Refractories Market Size Was Estimated at USD 34.87 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.12% from 2025 to 2035

- The Worldwide Refractories Market Size is Expected to Reach USD 66.99 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Refractories Market Size was worth around USD 34.87 Billion in 2024 and is predicted to Grow to around USD 66.99 Billion by 2035 with a compound annual growth rate (CAGR) of 6.12% from 2025 and 2035. The market for refractories has several opportunities to grow due to driven by the need for sophisticated, energy-efficient high-temperature materials that improve operational performance and decrease downtime, as well as growing infrastructure and industrial expansion, particularly in industries like steel, cement, glass, and non-ferrous metals.

Market Overview

Refractories are inorganic, non-metallic materials that are specially designed to tolerate extremely high temperatures often exceeding 538 °C/1000 °F without losing their chemical identity, form, or structural integrity. The demand for steel and refractories is increasing as nations like China, Vietnam, and India expand their infrastructure and building projects. Refractory consumption is further strengthened by green steel programs in Europe and Asia, which incentivize investments in new EAF setups. Because cement kilns run at temperatures higher than 1400°C, the refractory lining must be replaced on a regular basis. Cement production is rising as a result of the Asia Pacific and African regions' rapid urbanization and population increase, which is driving the construction of roads, bridges, and residential and commercial structures. Furthermore, the demand for basic and non-basic refractories is increasing due to plans for capacity development by significant cement makers in nations like Nigeria, Indonesia, and India.

In July 2025, Monolithisch India Limited is ramping up its production capacity from 132,000 Tonnes Per Annum to 156,000 TPA. This strategic move aims to bolster the company's dominance in the unshaped refractories and cater more effectively to the evolving demands of the secondary steel sector.

Report Coverage

This research report categorizes the refractories market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the refractories market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the refractories market.

Global Refractories Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 34.87 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.12% |

| 2035 Value Projection: | USD 66.99 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 169 |

| Tables, Charts & Figures: | 142 |

| Segments covered: | By Form, By Product and COVID-19 Impact Analysis |

| Companies covered:: | RHI Magnesita, Vesuvius PLC, Saint-Gobain, Imerys, Krosaki Harima Corporation, Shinagawa Refractories Co., Ltd., HarbisonWalker International, Morgan Advanced Materials, Puyang Refractories Group Co., Ltd., Resco Products, Chosun Refractories Co., Ltd., Refratechnik Group, IFGL Refractories Ltd., Sujia Refractories Co., Ltd., Lier Group Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The refractories market is driven by the growing population has forced governments to concentrate on building safer housing, infrastructure, and associated facilities, particularly in developing nations like China, India, and Brazil. Products like cement, glass, steel, and other non-metallic minerals have become more widely used as a result of the infrastructure-building activities. Refractory is needed throughout the heat-intensive manufacturing process for these items. Therefore, it is anticipated that the refractory business would increase in tandem with the anticipated future expansion of the demand for these products. Market participants' perspectives have been profoundly altered by government measures to recognize the product's significance in the production of cement and steel. Additionally, encouraging the market will strengthen local capacity to produce refractories in order to satisfy the expanding demand.

Restraining Factors

The refractories market is restricted by factors like price volatility for raw materials. Because China is a major supplier of essential commodities like bauxite, magnesia, and graphite, export limits and environmental crackdowns might affect worldwide prices.

Market Segmentation

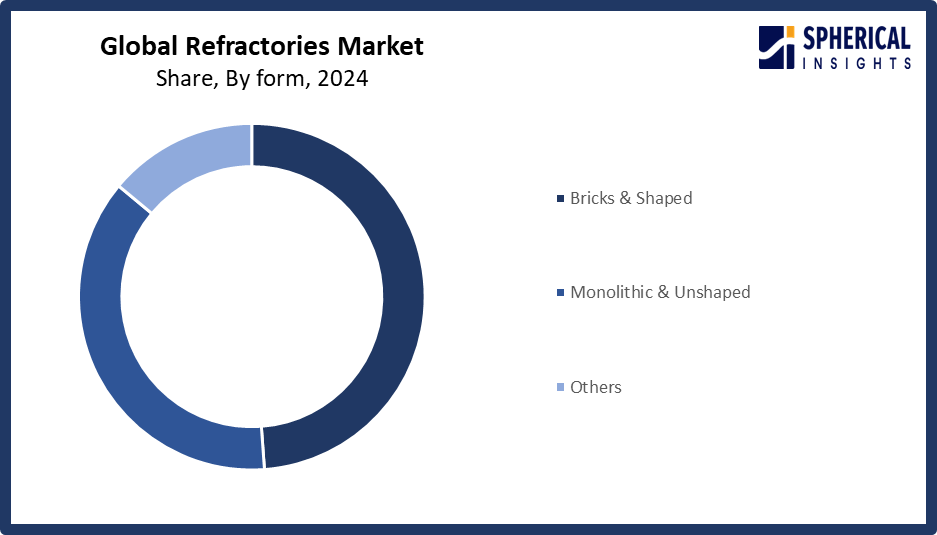

The refractories market share is classified into form and product.

- The bricks & shaped segment dominated the market in 2024, accounting for approximately 49% and is projected to grow at a substantial CAGR during the forecast period.

Based on the form, the refractories market is divided into bricks & shaped and monolithic & unshaped, and others. Among these, the bricks & shaped segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven by refractory shapes, such as bricks and blocks, which are stacked to create insulating walls for boilers, furnaces, and other thermal process vessels. Generally, refractory mortar is used to cement refractory bricks together. Further examples of refractory shapes are honeycomb structures that retain a metal catalyst and allow for easy exposure to a stream of reactive gases or other reactants, or catalyst supports, which are frequently made of porous structures with large surface areas.

Get more details on this report -

- The Clay segment accounted for the largest share in 2024, accounting for approximately 66% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product, the refractories market is divided into clay and non-clay. Among these, the clay segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is due to the manufacturers of iron and metal products using a lot of clay elements to make fireclay bricks and insulating products. Additionally, the market domination of this category will be strengthened by the easy availability of raw materials for the production of refractory clay goods.

Regional Segment Analysis of the Refractories Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share, representing nearly 65.7% of the refractories market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share, representing nearly 65.7% of the refractories market over the predicted timeframe. In the Asia Pacific market, the market is rising, driven by the developing steel and cement industries in nations like China, India, Japan, and Southeast Asia. The region's increasing urbanization and infrastructural development are driving up demand for clinker and crude steel manufacturing. For effective operation and thermal resistance, a variety of shaped and unshaped refractories are essential in electric arc furnaces, rotary kilns, and basic oxygen furnaces. Refractories are also being used continuously as a result of private sector investments in the housing, transportation, and energy sectors, as well as government-supported infrastructure initiatives.

North America is expected to grow at a rapid CAGR, representing nearly 7% in the refractories market during the forecast period. The North American area has a thriving market for refractories due to the recovery of local steel output, and continued expenditures in EAF plants are driving growth in the North American refractory market. With the help of legislative incentives like the Bipartisan Infrastructure Law and the Inflation Reduction Act, the manufacturing and infrastructure sectors in the United States and Canada are experiencing a renaissance. These actions increase the need for refractory materials in the non-ferrous metals, cement, and steelmaking sectors. High-performance, thermal shock-resistant refractories designed for intermittent operations are especially needed as blast furnaces give way to EAFs.

The European refractories market is expected to grow at the quickest rate during the projected period. The refractory market in Europe is expanding as a result of the increased drive for carbon-neutral manufacturing and green steel production. Leading manufacturers in Sweden, Austria, and Germany are making significant investments in hydrogen-based DRI and EAF technologies as part of their decarbonization plans. New refractory formulations that can survive frequent heat cycling and greater oxidation conditions are needed for these transitions. Modern kilns, ladles, and furnaces with more robust and energy-efficient refractory linings are being forced by the European Union's strict environmental standards and carbon pricing mechanisms.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the refractories market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- RHI Magnesita

- Vesuvius PLC

- Saint-Gobain

- Imerys

- Krosaki Harima Corporation

- Shinagawa Refractories Co., Ltd.

- HarbisonWalker International

- Morgan Advanced Materials

- Puyang Refractories Group Co., Ltd.

- Resco Products

- Chosun Refractories Co., Ltd.

- Refratechnik Group

- IFGL Refractories Ltd.

- Sujia Refractories Co., Ltd.

- Lier Group Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2024, Shinagawa Refractories Co., Ltd. announced the acquisition of Gouda Refractories Group B.V., a prominent Netherlands-based refractory manufacturer. This acquisition marks a key step in advancing Shinagawa’s Vision 2030 and aligns with its 6th Mid-Term Management Plan by expanding its footprint across the EMEA region. It enables Shinagawa to enter new end-use markets, including non-ferrous metals, petrochemicals, and waste-to-energy.

- In July 2023, RHI Magnesita announced its plans to acquire the U.S., India, and Europe operations of Seven Refractories, a specialist supplier of non-basic monolithic refractory with a recorded revenue of USD 110 million and PBT of USD 12 million in 2022. The company has a vast portfolio of various end-use applications across the global market. This acquisition will bring innovative product categories and technological advancements to deliver a major change in consumer offerings.

- In June 2023, INTOCAST AG announced its decision to acquire EXUS Refractories S.p.A., an Italy-based company. This acquisition will help the company strengthen its portfolio of refractory products.

- In February 2023, Vesuvius Group announced its plans to invest USD 61 million to expand its refractory manufacturing bases across India within three to five years. These investments will bring a 35% increase in the company’s monthly production capacity with the expansion of its plant at the Taratala unit in Kolkata.

- In January 2023, RHI Magnesita successfully acquired the Indian refractory division of Dalmia Bharat Refractories Limited (DBRL). This move will bolster RHI Magnesita's production capabilities in India, adding nearly 300,000 tons of annual capacity, especially in both shaped and unshaped refractories.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the refractories market based on the below-mentioned segments:

Global Refractories Market, By Form

- Bricks & Shaped

- Monolithic & Unshaped

- Others

Global Refractories Market, By Product

- Clay

- Non-Clay

Global Refractories Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Refractories market over the forecast period?The global Refractories market is projected to expand at a CAGR of 6.12% during the forecast period.

-

2. What is the market size of the Refractories market?The global Refractories market size is expected to grow from USD 34.87 Billion in 2024 to USD 66.99 Billion by 2035, at a CAGR of 6.12% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Refractories market?Asia Pacific is anticipated to hold the largest share of the Refractories market over the predicted timeframe.

-

4. Who are the top 15 companies operating in the global Refractories market?RHI Magnesita, Vesuvius PLC, Saint-Gobain, Imerys, Krosaki Harima Corporation, Shinagawa Refractories Co., Ltd., HarbisonWalker International, Morgan Advanced Materials, Puyang Refractories Group Co., Ltd., Resco Products, Chosun Refractories Co., Ltd., Refratechnik Group, IFGL Refractories Ltd., Sujia Refractories Co., Ltd., Lier Group Co., Ltd., and Others.

-

5. What factors are driving the growth of the Refractories market?The Refractories market growth is driven by increased infrastructure development and industrialization, growing production of iron and steel and cement, technological developments for high-performance materials, a growing focus on sustainability and energy efficiency, and rising demand from high-temperature industries like non-ferrous metals, glass, and petrochemicals.

-

6. What are the market trends in the Refractories market?The refractories market trends include rising demand from steel, cement & non‑ferrous industries, unshaped refractories and advanced forms, focus on sustainability, recycling and low‑carbon solutions, technological innovation & customization, and technological innovation & customization.

-

7. What are the main challenges restricting wider adoption of the Refractories market?The Refractories market trends include include severe fluctuations in the price of raw materials and supply chain limitations brought on by reliance on a small number of nations for essential inputs like magnesite and bauxite.

Need help to buy this report?