Global Drag Reducing Agent Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Polymers, Suspensions, Biological Additives, and Surfactants), By End User (Oil & Gas, Civil Work, Fire Fighting, Marine, Irrigation, Biomedical, Chemical, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Chemicals & MaterialsGlobal Drag Reducing Agent Market Insights Forecasts to 2035

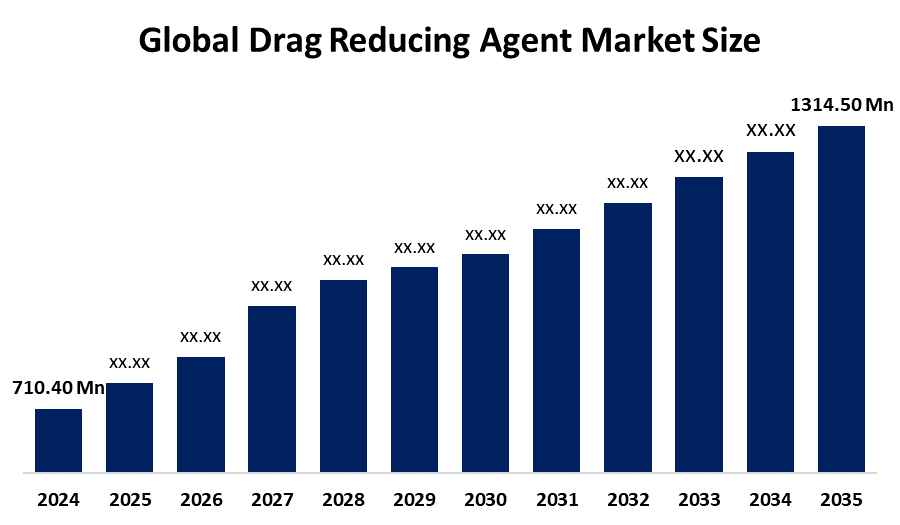

- The Global Drag Reducing Agent Market Size Was Estimated at USD 710.40 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.75% from 2025 to 2035

- The Worldwide Drag Reducing Agent Market Size is Expected to Reach USD 1314.50 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Drag Reducing Agent Market Size was worth around USD 710.40 Million in 2024 and is predicted to grow to around USD 1314.50 Million by 2035 with a compound annual growth rate (CAGR) of 5.75 % from 2025 to 2035. The market for drag reducing agents is expected to grow and innovate in a number of industries worldwide due to factors like rising demand for oil and gas pipelines, improved energy efficiency, expanding industrial applications, technological advancements, and rising infrastructure development investments.

Global Drag Reducing Agent Market Forecast and Revenue Outlook

- 2024 Market Size: USD 710.40 Million

- 2035 Projected Market Size: USD 1314.50 Million

- CAGR (2025-2035): 5.75%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Market Overview

The Drag Reducing Agent (DRA) Market Size is a specialized worldwide industry that focuses on the development, production, and marketing of polymeric chemical additives that are injected into pipelines to reduce turbulent friction. These improve fluid flow dynamics, increase throughput, and lower energy costs in hydrocarbon transportation infrastructures. These substances, which are usually polymers or surfactants, are added to liquids, mostly water and hydrocarbons, in order to reduce turbulence and improve flow efficiency. For Instance, in April 2024, Indian Oil Corporation Ltd. launched a patented titanium halide-based process for producing ultra-high molecular weight drag reducing polymer powder, achieving over 90% conversion and intrinsic viscosity exceeding 10 dL/g, marking a significant advancement in drag reducing agent technology. The market for drag-reducing agents is predicted to be driven by the oil and gas industry's expected investment in these technologies to streamline its operations. The growing need for enhanced oil recovery (EOR) methods and the requirement for operational efficiency in the oil and gas sector are driving a notable expansion in the global market for drag reduction agents (DRAs).

Key Market Insights

- North America is expected to account for the largest share in the drag reducing agent market during the forecast period.

- In terms of product type, the polymers segment is projected to lead the drag reducing agent market throughout the forecast period

- In terms of end user, the oil & gas segment captured the largest portion of the market

Drag Reducing Agent Market Trends

- Growth in uses for water and wastewater treatment

- Combining automation and digital monitoring for optimal dosage

- Growing environmental laws that encourage sustainable solutions

- Increasing focus on cutting operating expenses and conserving energy

- Growing use in pipeline transportation for gas and oil to improve flow efficiency

- Technological developments in polymers are enhancing drag reduction capabilities

Report Coverage

This research report categorizes the drag reducing agent market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the drag reducing agent market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the drag reducing agent market.

Drag Reducing Agent Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 710.40 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.75% |

| 2035 Value Projection: | USD 1314.50 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product Type. By End Users |

| Companies covered:: | Oil Flux, Innospec, Sinopec, Halliburton, NuGenTec, Flowchem LLC, Monsoon Oilfield Ltd, Qflo Polymer Solutions, Baker Hughes Company, The Zoranoc Oilfield Chemical, Liquid Power Specialty Products Inc., and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving factors

The oil and gas industry's growing need for effective fluid transportation, where lowering frictional pressure losses in pipelines increases flow capacity and lowers energy consumption, is the main factor propelling the drag reducing agent (DRA) market. The market is rising mostly because of the increasing demand to boost pipeline throughput and lower operating costs. Additional growth potential are created by the expansion of pipeline networks worldwide and the development of infrastructure in emerging economies. Demand is also increasing as a result of growing industrial uses, such as chemical processing and water treatment.

Restraining Factor

High product costs, restricted compatibility with specific fluids, regulatory obstacles, and environmental concerns are some of the factors limiting the market for drag-reducing agents. Additionally, widespread adoption and commercial expansion are hindered by a lack of technical know-how and awareness in emerging regions.

Market Segmentation

The global drag reducing agent market is divided into product type and end user.

Global Drag Reducing Agent Market, By Product Type:

- The polymers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on product type, the global drag reducing agent market is segmented into polymers, suspensions, biological additives, and surfactants. Among these, the polymers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Drag-reducing compounds based on polymers are very good at lowering pipeline frictional resistance. They are suited for a variety of fluids and pipeline conditions since they may be modified and altered to meet individual needs. Long-lasting drag reduction capabilities in pipelines are provided by polymer-based DRAs, which remain stable over a broad variety of temperature and pressure conditions.

The biological additives segment in the drag reducing agent market is expected to grow at the fastest CAGR over the forecast period. Increased environmental restrictions, the need for sustainable and biodegradable solutions, and increased awareness of the ecological impact within the oil and gas industry are the main factors driving the expansion of the biological additives market. Bio-based chemicals are therefore becoming more popular as environmentally benign substitutes, bolstering the market's

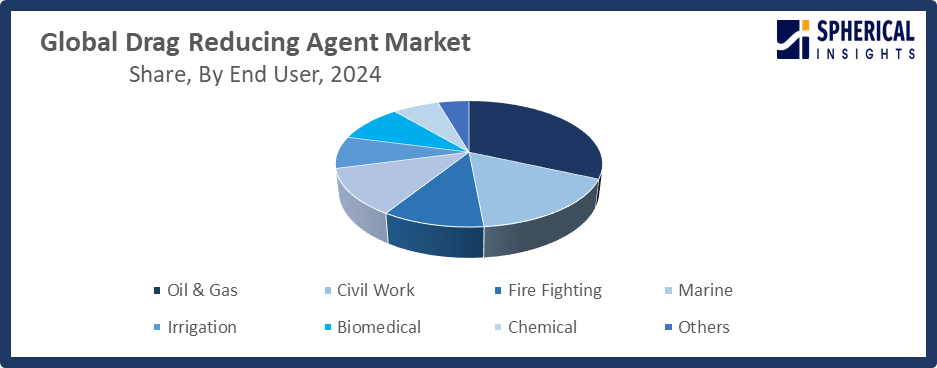

Global Drag Reducing Agent Market, By End User:

- The oil & gas segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on end user, the global drag reducing agent market is segmented into oil & gas, civil work, firefighting, marine, irrigation, biomedical, chemical, and others. Among these, the oil & gas segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The oil and gas sector is largely dependent on pipelines to move massive amounts of gas and oil over long distances, and DRAs are essential in lowering frictional losses, which raise the energy costs associated with fluid transportation. Through capacity optimization and frictional resistance reduction, DRAs help lower the energy needed to pump gas and oil through pipelines.

Get more details on this report -

The civil work segment in the drag reducing agent market is expected to grow at the fastest CAGR over the forecast period. The growing usage of DRAs in concrete and construction materials to enhance workability and lower friction during pumping and installation procedures is what is driving the expansion of the civil work segment. Urbanization, growing infrastructure development, and government programs encouraging environmentally friendly building methods are all driving demand in this market.

Regional Segment Analysis of the Global Drag Reducing Agent Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America Drag Reducing Agent Market Trends

North America is expected to hold the largest share of the global drag reducing agent market over the forecast period.

Get more details on this report -

North America can be attributed to a number of important elements, such as the region's developed oil and gas infrastructure, the rise in pipeline transportation operations, and the rising energy demand. Government initiatives encourage DRA implementation to improve pipeline efficiency and reduce environmental impacts without expensive additions, such as the strict U.S. methane emission regulations under the Inflation Reduction Act. New announcements highlight this momentum: Baker Hughes signed a contract in July 2025 to provide its FLO DRA product line to offshore pipelines around the U.S. Gulf Coast, increasing throughput by up to 300,000 barrels per day.

U.S Drag Reducing Agent Market Trends

Growing pipeline transportation activities and rising energy consumption are driving the drag reducing agent (DRA) industry in the United States. Market expansion has also been aided by government attempts to upgrade outdated pipeline infrastructure and improve flow efficiency. In March 2025, Innospec launched an expansion of its drag-reducing agent (DRA) production capacity at its Pleasanton, Texas facility. The new capacity, set to launch in Q4 2025, aims to meet rising global and domestic demand.

Canada Drag Reducing Agent Market Trends

The market for drag-reducing agents (DRAs) in Canada is expanding due to the growing use of these products in oil sands activities and heavy crude transportation that uses a lot of pump energy. The Canada Energy Regulator (CER) established a system in March 2025 for allocating DRA expenses in the Keystone (South Bow) Pipeline System to guarantee that tolls are fair and reasonable. It is a specific instance of how regulatory decisions are influencing cost allocation procedures.

Asia Pacific Drag Reducing Agent Market Trends

Asia Pacific is expected to grow at the fastest CAGR in the drag reducing agent market during the forecast period.

The rise of the Asia Pacific region is mostly due to rising energy consumption, fast industrialization, and the expansion of pipeline infrastructure in developing nations like China, India, and Southeast Asia. The region's governments are making significant investments in gas and oil pipeline projects in an effort to improve energy security and lessen reliance on imported processed products. Recent announcements include BASF’s 2025 partnership with regional oil operators to deliver customized offshore DRAs for deepwater fields. New launches include Indian Oil’s patented ultra-high molecular weight DRA polymer and Baker Hughes’ eco-friendly formulations, enhancing sustainable pipeline performance.

China Drag Reducing Agent Market Trends

China's need for DRAs has increased as a result of government initiatives to modernize oil and gas transportation and enforce cost-efficiency measures, especially in long-distance pipelines carrying crude and refined products. Government programs that encourage DRA integration for efficiency include the 2024–25 Energy Conservation Plan, which requires CO2 reductions per GDP unit, and the Pipe China network expansion, which aims to build 60,000 km of additional pipes by 2030.

Japan Drag Reducing Agent Market Trends

Large-scale DRA deployment suffers from Japan's inadequate crude pipeline infrastructure; the nation primarily depends on imported oil, truck and coastal tanker transportation, and has only one major pipeline. With Japan's environmental policies emphasizing energy efficiency, carbon reduction, and clean technology, a slight increase in the use of DRA is anticipated, especially among specialty refineries and coastal transport companies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global drag reducing agent market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players In The Drag Reducing Agent Market Include

- Oil Flux

- Innospec

- Sinopec

- Halliburton

- NuGenTec

- Flowchem LLC

- Monsoon Oilfield Ltd

- Qflo Polymer Solutions

- Baker Hughes Company

- The Zoranoc Oilfield Chemical

- Liquid Power Specialty Products Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2025, Baker Hughes launched its FLO product line drag-reducing agents (DRAs) under a new contract to supply two major offshore oil pipelines in the U.S. Gulf Coast, enhancing light and heavy crude transport to Texas and Louisiana processing facilities.

- In October 2022, Infineum launched its expansion into the pipeline sector with the acquisition of Entegris’s Pipeline and Industrial Materials (PIM) business, including Flowchem, Val-Tex, and Sealweld brands, strengthening its global drag reducing agent (DRA) portfolio and specialty chemical capabilities.

- In July 2021, LiquidPower Specialty Products Inc. (LSPI) announced the acquisition of an equity interest in Safe Marine Transfer, LLC (SMT), aiming to deliver its market-leading drag reducing agents (DRAs) subsea via SMT’s patented all-electric dual barrier subsea storage and delivery systems.

- In March 2021, Indian Oil Corporation (IOCL) announced a partnership with Dorf Ketal Chemicals India to manufacture its patented drag reducing agents (DRAs) at Dorf Ketal’s Dahej facility in Gujarat, leveraging IOCL’s technology to strengthen domestic DRA production and supply capabilities.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the drag reducing agent market based on the following segments:

Global Drag Reducing Agent Market, By Product Type

- Polymers

- Suspensions

- Biological Additives

- Surfactants

Global Drag Reducing Agent Market, By End User

- Oil & Gas

- Civil Work

- Fire Fighting

- Marine

- Irrigation

- Biomedical

- Chemical

- Others

Global Drag Reducing Agent Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the drag reducing agent market over the forecast period?The global drag reducing agent market is projected to expand at a CAGR of 5.75% during the forecast period.

-

2. What is the market size of the drag reducing agent market?The global drag reducing agent market size is expected to grow from USD 710.40 million in 2024 to USD 1314.50 million by 2035, at a CAGR 5.75% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the drag reducing agent market?North America is anticipated to hold the largest share of the drag reducing agent market over the predicted timeframe.

-

4. Who are the top companies operating in the global drag reducing agent market?Oil Flux, Innospec, Sinopec, Halliburton, NuGenTec, Flowchem LLC, Monsoon Oilfield Ltd, Qflo Polymer Solutions, Baker Hughes Company, The Zoranoc Oilfield Chemical, Liquid Power Specialty Products Inc., and others

-

5. What factors are driving the growth of the drag reducing agent market?The Drag Reducing Agent market growth is driven by increasing demand for efficient fluid transport, energy conservation, technological advancements, expanding industrial applications, and infrastructure development in emerging economies.

-

6. What are market trends in the drag reducing agent market?Innovative polymer technologies, expanding oil and gas pipeline use, environmentally friendly solutions, digital monitoring integration, and forays into the chemical processing and water treatment industries are some of the market trends.

-

7. What are the main challenges restricting wider adoption of the drag reducing agent market?The main challenges to wider use in emerging markets include high product costs, regulatory restrictions, restricted fluid compatibility, environmental concerns, and a lack of technical knowledge.

Need help to buy this report?