Global Redispersible Polymer Powder Market Size, Share, and COVID-19 Impact Analysis, By Type (Acrylic Redispersible Polymer Powder, Vinyl Acetate-Ethylene Redispersible Polymer Powder, Veova Redispersible Polymer Powder, Styrene-Butadiene Redispersible Polymer Powder, Others), By Application (Tilling & Flooring, Plastering, Mortars, Insulation Systems), By End Use (Residential Construction, Non-Residential Construction, Industrial Construction), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Redispersible Polymer Powder Market Insights Forecasts to 2035

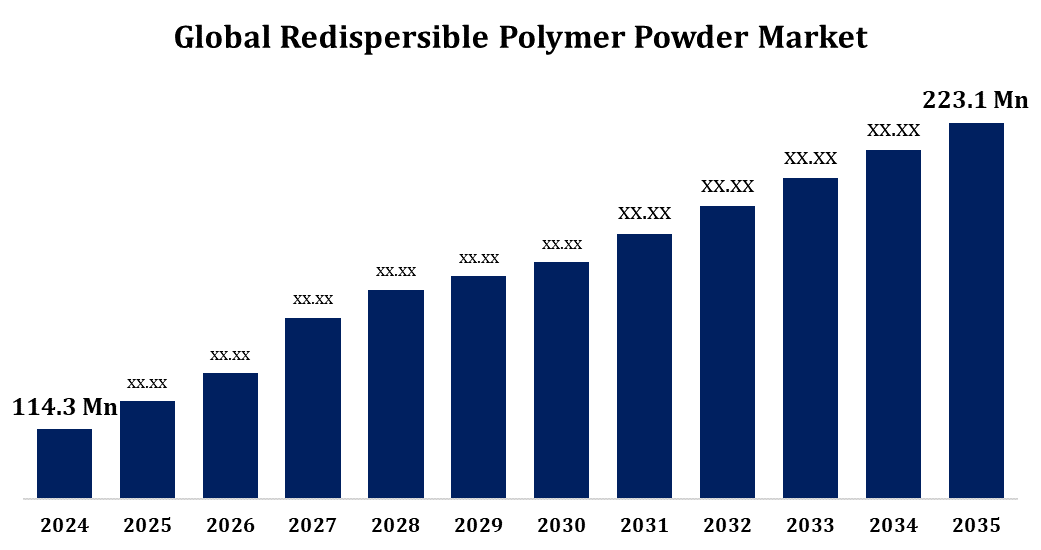

- The Redispersible Polymer Powder Market was valued at USD 114.3 Million in 2024.

- The Market Size is growing at a CAGR of 6.92% from 2025 to 2035.

- The Global Redispersible Polymer Powder Market Size is expected to reach USD 223.1 Million By 2035.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Redispersible Polymer Powder Market is expected to reach USD 223.1 Million By 2035, at a CAGR of 6.92% during the forecast period 2025 to 2035.

The redispersible polymer powder market is experiencing robust growth, driven by increasing demand in construction applications such as tile adhesives, self-levelling compounds, mortars, and exterior insulation and finish systems (EIFS). RDP enhances flexibility, adhesion, water resistance, and workability in cement-based formulations, making it a preferred additive in modern construction practices. Rapid urbanization, infrastructure development, and rising focus on sustainable, energy-efficient buildings further fuel market expansion. Asia-Pacific dominates the global market, led by China and India, due to large-scale construction activities and government-backed housing projects. Europe and North America also contribute significantly, supported by renovation trends and stringent environmental regulations promoting low-VOC materials. Innovations in polymer chemistry and increasing use of dry-mix mortar products are expected to accelerate market growth over the forecast period.

Redispersible Polymer Powder Market Value Chain Analysis

The redispersible polymer powder market value chain comprises several key stages, beginning with raw material suppliers who provide vinyl acetate, ethylene, and acrylic-based monomers. These are processed by manufacturers through spray drying to produce RDP. Technology providers play a critical role by offering advanced production equipment and formulations to enhance efficiency and product quality. The RDP is then supplied to distributors and end-use industries, primarily in construction, where it is blended into dry-mix mortars, tile adhesives, and insulation systems. Downstream participants, including construction firms and contractors, utilize these formulations in residential, commercial, and infrastructure projects. Regulatory bodies also influence the value chain by setting environmental and safety standards. Integration, innovation, and logistics optimization are key factors driving competitiveness and value creation across the chain.

Redispersible Polymer Powder Market Opportunity Analysis

The redispersible polymer powder market offers significant growth opportunities driven by multiple factors. Rapid urbanization and infrastructure development in emerging economies such as China, India, and Southeast Asia are fueling demand for RDP in construction applications. The global shift towards sustainable and eco-friendly building practices is also creating opportunities for low-VOC and green RDP formulations. Technological advancements in production processes, such as improved spray-drying techniques and bio-based polymer innovations, are enhancing product performance and cost-effectiveness. Moreover, the market is expanding beyond traditional construction uses into sectors like industrial coatings, packaging, textiles, and automotive, offering diverse application avenues. These trends, supported by rising investments in R&D and government initiatives for energy-efficient infrastructure, are expected to drive steady market growth with a promising outlook through 2029 and beyond.

Global Redispersible Polymer Powder Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 114.3 Million |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 6.92% |

| 2035 Value Projection: | USD 223.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Type, By Application, By End Use, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Divnova Specialities (India), Akzo Nobel N.V. (Netherland), Ashland Global Holding (U.S.), Hexion Inc (U.S.), Synthomer Plc (U.K), Wacker Chemie AG (Germany), Puyang Yintai Industrial (China), Acquos (Australia), The Dow Chemicals Company (U.S.), Benson Polymers Limited (India), BASF SE (Germany), Dairen Chemical Corporation (Taiwan), Organic Kimya (Turkey), Bosson Union Tech (China), and other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Redispersible Polymer Powder Market Dynamics

Rapid growth in the construction industry in emerging countries is driving the market growth

The rapid expansion of the construction industry in emerging countries is a major driver of the redispersible polymer powder (RDP) market. China, India, Brazil, and Southeast Asian economies are witnessing significant infrastructure development, urbanization, and rising demand for residential and commercial spaces. This surge has increased the use of cement-based applications, where RDP enhances properties such as adhesion, flexibility, water resistance, and durability. Government initiatives promoting affordable housing, smart cities, and green buildings further boost RDP consumption in dry-mix mortars, tile adhesives, and external insulation systems. Additionally, growing awareness of sustainable and energy-efficient construction materials supports the shift towards advanced polymer-based formulations. With supportive regulatory frameworks and increased foreign investments, emerging markets are expected to remain central to RDP market expansion over the coming years.

Restraints & Challenges

The redispersible polymer powder (RDP) market encounters several challenges that impact its growth and profitability. One major issue is the volatility in raw material prices, especially for petrochemical-based inputs like vinyl acetate and ethylene, which can affect production costs. Additionally, increasingly strict environmental regulations regarding VOC emissions are pushing manufacturers to invest in cleaner, more sustainable production methods, raising operational expenses. The market also faces strong competition from alternative materials, such as liquid polymers and conventional additives, which can be more cost-effective in certain applications. Moreover, the spray-drying process used in RDP production is energy-intensive and poses safety risks such as dust explosions, demanding strict quality and safety measures. These factors together present operational and strategic challenges for companies operating in the RDP market.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Redispersible Polymer Powder Market from 2025 to 2035. The growth is primarily driven by the expansion of the construction sector across the U.S. and Canada. Increasing demand for high-performance building materials in residential, commercial, and infrastructure projects is fueling RDP adoption, particularly in tile adhesives, self-levelling compounds, and insulation systems. The region’s strong emphasis on sustainable and energy-efficient construction also supports the shift toward eco-friendly, low-VOC formulations. Renovation and retrofitting activities, especially in aging urban infrastructure, are further contributing to market demand. Vinyl acetate ethylene (VAE) remains the most widely used polymer type, offering excellent flexibility and adhesion. Meanwhile, the development of advanced RDP formulations tailored for North American climate conditions and regulations continues to open new growth avenues for manufacturers and suppliers.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2025 to 2035. The growth is driven by rapid urbanization, infrastructure development, and increased construction activities across countries like China, India, Indonesia, and Vietnam. The rising demand for durable, energy-efficient buildings and government-led initiatives such as smart cities and affordable housing projects are significantly boosting RDP usage in tile adhesives, self-leveling compounds, plasters, and EIFS. The region benefits from abundant raw material availability and a well-established manufacturing base, making it a strategic hub for RDP production. Vinyl acetate ethylene (VAE)-based powders are widely used due to their cost-effectiveness and strong bonding properties, while acrylic-based variants are gaining popularity for exterior applications. Continuous capacity expansion and innovation by local and global players further strengthen Asia-Pacific’s dominance in the RDP market.

Segmentation Analysis

Insights by Type

The acrylic redispersible polymer powder segment accounted for the largest market share over the forecast period 2025 to 2035. Known for its excellent weather resistance, UV stability, and strong adhesion, acrylic RDP is increasingly preferred for exterior applications such as plasters, EIFS, and tile adhesives. Its superior flexibility and durability, along with resistance to water and freeze-thaw cycles, make it suitable for harsh environmental conditions. Additionally, the rising focus on sustainable and low-VOC construction materials is driving demand for acrylic-based formulations, which support green building practices. As a result, acrylic RDP is gaining significant traction and is now among the fastest-growing polymer types in the market. Continued innovation and tailored product development are expected to further boost its adoption across global construction sectors.

Insights by Application

The tiling and flooring segment accounted for the largest market share over the forecast period 2025 to 2035. RDP is widely used in tile adhesives and flooring compounds due to its ability to enhance adhesion, flexibility, water resistance, and crack-bridging properties. These features ensure durable, long-lasting installations, making RDP a key component in both new construction and renovation projects. The segment is witnessing rising demand across residential, commercial, and industrial applications, driven by increasing preferences for low-maintenance and aesthetically appealing flooring solutions. Additionally, the shift toward eco-friendly and energy-efficient building practices supports the use of RDP, which offers low VOC emissions and improved performance. With the growing emphasis on quality finishes and sustainable materials, the tiling and flooring segment continues to expand steadily in the global RDP market.

Insights by End Use

The residential construction segment accounted for the largest market share over the forecast period 2025 to 2035. Increasing urbanization, rising demand for affordable housing, and a growing focus on energy-efficient and modern living spaces are fueling the need for advanced building materials. RDP is extensively used in residential applications such as tile adhesives, wall plasters, grouts, and self-leveling compounds, offering enhanced adhesion, flexibility, and water resistance. These performance benefits contribute to the durability and longevity of residential structures. The growing emphasis on sustainable and low-VOC construction materials further supports the adoption of RDP in the housing sector. Additionally, ongoing innovations in polymer technology are enabling more efficient and user-friendly RDP formulations, making them ideal for both new housing developments and renovation projects across urban and semi-urban areas.

Recent Market Developments

- In April 2020, Celanese Corporation has finalized the acquisition of Nouryon’s Elotex brand, a leading producer of redispersible polymer powders.

Competitive Landscape

Major players in the market

- Divnova Specialities (India)

- Akzo Nobel N.V. (Netherland)

- Ashland Global Holding (U.S.)

- Hexion Inc (U.S.)

- Synthomer Plc (U.K)

- Wacker Chemie AG (Germany)

- Puyang Yintai Industrial (China)

- Acquos (Australia)

- The Dow Chemicals Company (U.S.)

- Benson Polymers Limited (India)

- BASF SE (Germany)

- Dairen Chemical Corporation (Taiwan)

- Organic Kimya (Turkey)

- Bosson Union Tech (China)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2025 to 2035.

Redispersible Polymer Powder Market, Type Analysis

- Acrylic Redispersible Polymer Powder

- Vinyl Acetate-Ethylene Redispersible Polymer Powder

- Veova Redispersible Polymer Powder

- Styrene-Butadiene Redispersible Polymer Powder

- Others

Redispersible Polymer Powder Market, Application Analysis

- Tilling & Flooring

- Plastering

- Mortars

- Insulation Systems

Redispersible Polymer Powder Market, End Use Analysis

- Residential Construction

- Non-Residential Construction

- Industrial Construction

Redispersible Polymer Powder Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Redispersible Polymer Powder Market?The global Redispersible Polymer Powder Market is expected to grow from USD 114.3 million in 2024 to USD 223.1 million by 2035, at a CAGR of 6.92% during the forecast period 2025-2035.

-

2. Who are the key market players of the Redispersible Polymer Powder Market?Some of the key market players of the market are Divnova Specialities (India), Akzo Nobel N.V.(Netherland), Ashland Global Holding (U.S.), Hexion Inc (U.S.), Synthomer Plc (U.K), Wacker Chemie AG (Germany), Puyang Yintai Industrial (China), Acquos (Australia), The Dow Chemicals Company (U.S.), Benson Polymers Limited (India), BASF SE (Germany), Dairen Chemical Corporation (Taiwan), Organic Kimya (Turkey), Bosson Union Tech (China).

-

3. Which segment holds the largest market share?The residential construction segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?