Global Red Hematite Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Natural Red Hematite and Synthetic Red Hematite), By Application (Pigments, Jewelry, Construction, Metallurgy, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Red Hematite Market Size Insights Forecasts to 2035

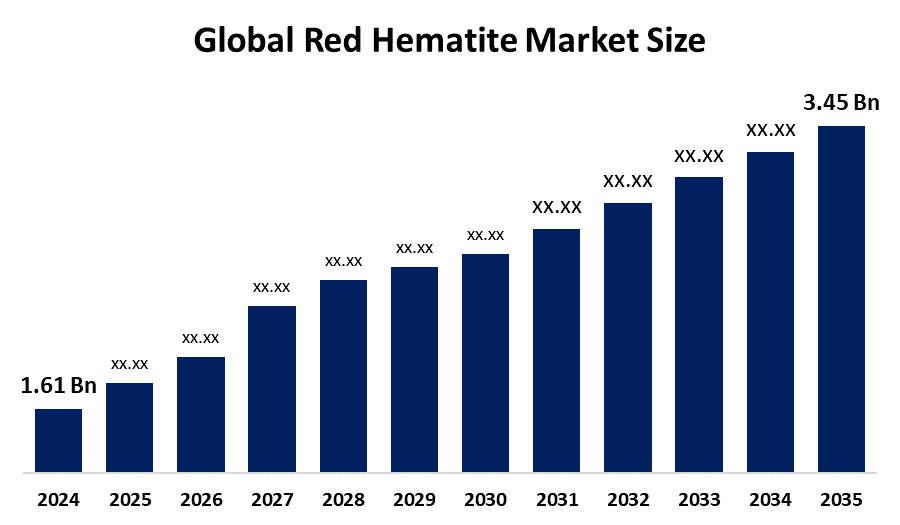

- The Global Red Hematite Market Size Was Estimated at USD 1.61 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.17% from 2025 to 2035

- The Worldwide Red Hematite Market Size is Expected to Reach USD 3.45 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Red Hematite Market Size was worth around USD 1.61 Billion in 2024 and is predicted to Grow to around USD 3.45 Billion by 2035 with a compound annual growth rate (CAGR) of 7.17% from 2025 and 2035. The market for red hematite has several opportunities to grow because of its vital role in the production of steel, the growing need for environmentally acceptable pigments, the abundance of natural resources, the development of mining technology, and the expansion of infrastructure and construction projects around the world, particularly in emerging nations.

Market Overview

Red hematite, a naturally occurring iron oxide mineral, is primarily composed of ferric oxide. The building industry's rapid growth is largely responsible for the increasing popularity of red hematite. Red hematite is a durable pigment used in building materials and provides long lasting color. Urbanization, particularly in emerging markets, is putting upward pressure on demand for red hematite as housing and commercial development have a higher requirement for building materials. The market for red hematite is bolstered by the growing trend in sustainable building and improvements in building technology, since red hematite is often found in sustainable building materials. The rising use of red hematite in jewelry is also a significant factor driving market growth. Due to its appearance and purported medicinal properties, red hematite is becoming more popular among jewelry makers. The demand for red hematite is driven by consumer interest in unique and customized jewelry as a result of market pressure. Additionally, rising disposable incomes and lifestyle transformations in emerging economic markets are contributing to the jewelry sector's growth, which increases the demand for red hematite.

The Indian Mines Ministry has suggested a change to the royalty rate, which would reduce it to 10% for beneficiated low grade hematite iron ore, while maintaining higher rates for raw or higher-grade ore. This seeks to encourage the processing of low and medium grade hematite, particularly banded hematite quartzite, or BHQ, instead of allowing it to be wasted. On January 25, Arrow Minerals Limited is pleased to announce highly favourable metallurgical testwork results which demonstrate the premium quality of the iron ore at its Simandou North project in Guinea.

Report Coverage

This research report categorizes the red hematite market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the red hematite market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the red hematite market.

Global Red Hematite Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.61 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.17% |

| 2035 Value Projection: | USD 3.45 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 182 |

| Tables, Charts & Figures: | 147 |

| Segments covered: | By Product Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Rio Tinto Group, Vale S.A., BHP Billiton, Anglo American plc, ArcelorMittal, Cleveland Cliffs Inc., Atlas Iron Pty Ltd., Lodestone Mines Ltd., Vijit Worldwide, LKAB Minerals, Vedanta Limited, Ferrexpo plc, Chadormalu Mining and Industrial Company, Societe du Djebel Djerissa, Lloyds Metals and Energy Limited, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The red hematite market is driven due to the increasing demand for green and sustainable products. Reduced building practices and natural pigments in building products have created new market opportunities for red hematite. Demand is also increasing in many industries, including paints and coatings, for more ecofriendly pigments. The awareness of the environmental impact of synthetic pigments and the trend toward natural colors can create significant growth opportunities for the red hematite market. In addition, the jewelry market is starting to see the use of red hematite, which is also a significant opportunity.

Restraining Factors

The red hematite market is restricted by factors like the high cost of extraction and processing deters growth opportunities. Substantial capital and technological investments required for the extraction and processing of red hematite lead to high production costs.

Market Segmentation

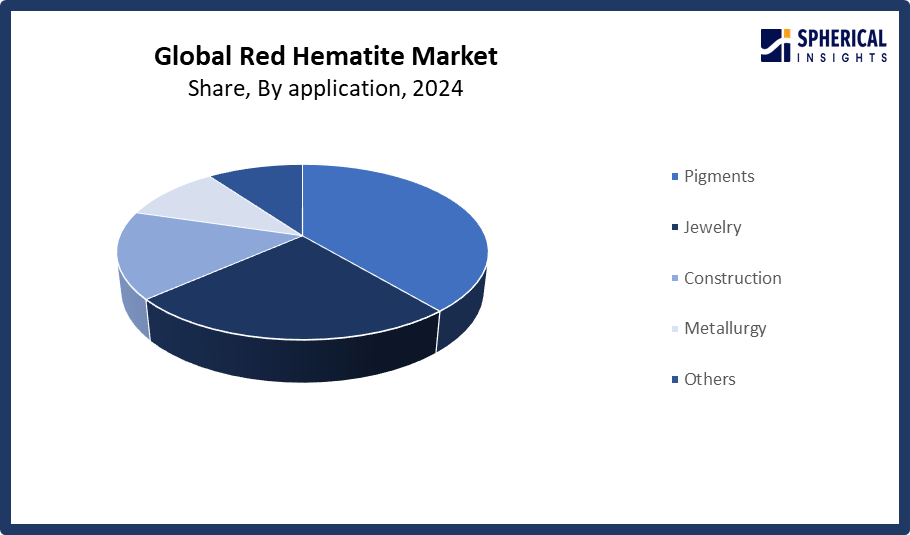

The red hematite market share is classified into product type and application.

- The natural red hematite segment dominated the market in 2024, accounting for approximately 60% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the red hematite market is divided into natural red hematite and synthetic red hematite. Among these, the natural red hematite segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is due to its numerous applications in sectors like pigments and metallurgy, the natural red hematite fraction has a relatively sizable market share. It is highly regarded for its valuable properties, such as high iron content and stability, which can be advantageous in industrial applications. The rising demand for sustainable and ecofriendly products is contributing even more, to the demand for natural red hematite, in view of its standing as a naturally occurring mineral with little environmental impact.

- The pigments segment accounted for the largest share in 2024, accounting for approximately 55% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the red hematite market is divided into pigments, jewelry, construction, metallurgy, and others. Among these, the pigments segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is due to the red hematite's superior coloring qualities and permanence, the pigment industry is one of its biggest users. Because it produces vivid and durable hues, red hematite is frequently used as a pigment in paints, varnishes, and ceramics. The market for red hematite is being driven mostly by the expanding need for premium pigments in the automotive and construction sectors. The demand for red hematite in the pigment industry is also being increased by the growing trend of adopting ecofriendly and natural pigments.

Get more details on this report -

Regional Segment Analysis of the Red Hematite Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share, representing nearly 40% of the red hematite market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the red hematite market over the predicted timeframe. In the Asia Pacific market, the market is rising due to the rapid industrialization and urbanization of countries such as China, India, and Japan. The rapid growth of the metallurgical and construction sectors in the region is a primary contributor to the increasing demand for red hematite. In 2023, the regional market accounted for around 40% of the global red hematite market share. The market in the region is expected to expand further as infrastructure development investments increase and demand for building materials rises. In addition, the growing electronics and automotive sectors are also driving the Asia Pacific region's demand for red hematite.

India is one of the top producers of red hematite. About 35% of India's iron ore reserves are found in places like Odisha, which have substantial quantities of banded hematite quartz. In FY25, India produced 182.6 billion metric tons of iron ore between April and November 2024, a 3.0% annual increase.

North America is expected to grow at a rapid CAGR, representing nearly 25% in the red hematite market during the forecast period. The North America area has a thriving market for red hematite due to the strong expansion of the automotive and construction sectors. The demand for red hematite in North America is being driven by the growing emphasis on environmentally friendly building techniques and the usage of ecofriendly materials in construction. The market is also being helped by the expanding trend of employing natural pigments in paints and coatings, among other applications. It is anticipated that the existence of significant market participants and the continuous research and development efforts to improve the characteristics and uses of red hematite will open up new growth prospects in this area.

The United States is the market leader for hematite weighting materials, accounting for about 37% of the global market. This dominance is a result of ongoing shale exploration, sophisticated oil and gas infrastructure, and the existence of significant industry players. The increased focus on environmentally friendly building practices and the use of ecofriendly building materials is also driving up demand for red hematite in the US.

Europe has a significant market share in red hematite, making up around 20% of the global market in 2023. Red hematite is in high demand due to the region's significant automotive and construction sectors. The usage of ecofriendly materials in construction and the growing emphasis on sustainable building techniques is also driving the market. Europe's red hematite market is being driven largely by the rising demand for premium pigments in a variety of applications, such as paints and coatings. It is anticipated that the region's emphasis on R&D and the presence of important market participants would open up new growth prospects.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the red hematite market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Rio Tinto Group

- Vale S.A.

- BHP Billiton

- Anglo American plc

- ArcelorMittal

- Cleveland Cliffs Inc.

- Atlas Iron Pty Ltd.

- Lodestone Mines Ltd.

- Vijit Worldwide

- LKAB Minerals

- Vedanta Limited

- Ferrexpo plc

- Chadormalu Mining and Industrial Company

- Societe du Djebel Djerissa

- Lloyds Metals and Energy Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2025, Fortescue acquired Red Hawk Mining Ltd, which includes the Blacksmith Iron Ore Project. The project has 243 billion tonnes of iron ore resource with 59.3% Fe, and is being planned as a Direct Shipping Ore project starting first ore expected in 2025.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the red hematite market based on the following segments:

Global Red Hematite Market, By Product Type

- Natural Red Hematite

- Synthetic Red Hematite

Global Red Hematite Market, By Application

- Pigments

- Jewelry

- Construction

- Metallurgy

- Others

Global Red Hematite Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the red hematite market over the forecast period?The global red hematite market is projected to expand at a CAGR of 7.17% during the forecast period.

-

2. What is the market size of the red hematite market?The global red hematite market size is expected to grow from USD 1.61 Billion in 2024 to USD 3.45 Billion by 2035, at a CAGR of 7.17% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the red hematite market?Asia Pacific is anticipated to hold the largest share of the red hematite market over the predicted timeframe.

-

4. Who are the top 15 companies operating in the global red hematite market?Rio Tinto Group, Vale S.A., BHP Billiton, Anglo American plc, ArcelorMittal, Cleveland Cliffs Inc., Atlas Iron Pty Ltd., Lodestone Mines Ltd., Vijit Worldwide, LKAB Minerals, Vedanta Limited, Ferrexpo plc, Chadormalu Mining and Industrial Company, Societe du Djebel Djerissa, Lloyds Metals and Energy Limited, and Others.

-

5. What factors are driving the growth of the red hematite market?The red hematite market growth is driven by increased mining operations, improvements in extraction technology, expanding infrastructure development in emerging nations, rising use in pigments and coatings, and rising demand for steel production.

-

6. What are the market trends in the red hematite market?The red hematite market trends include rising demand in steel manufacturing, increased use of red hematite pigments, technological advancements, expansion of mining projects, and growing focus on sustainable and environmentally friendly mining practices.

-

7. What are the main challenges restricting wider adoption of the red hematite market?The red hematite market trends include mining related environmental issues, volatile iron ore prices, high extraction and processing costs, regulatory limitations, and competition from synthetic pigments and other sources of iron ore.

Need help to buy this report?