Global Red Bean Paste Market Size, Share, and COVID-19 Impact Analysis, By Formulation Type (Smooth Paste, Chunky Paste, Reduced-Sugar/Low-Sugar, and Organic/All-Natural), By Application (Bakery & Confectionery, Dairy & Ice Cream, and Ready Meals & Snacks), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Red Bean Paste Market Insights Forecasts To 2035

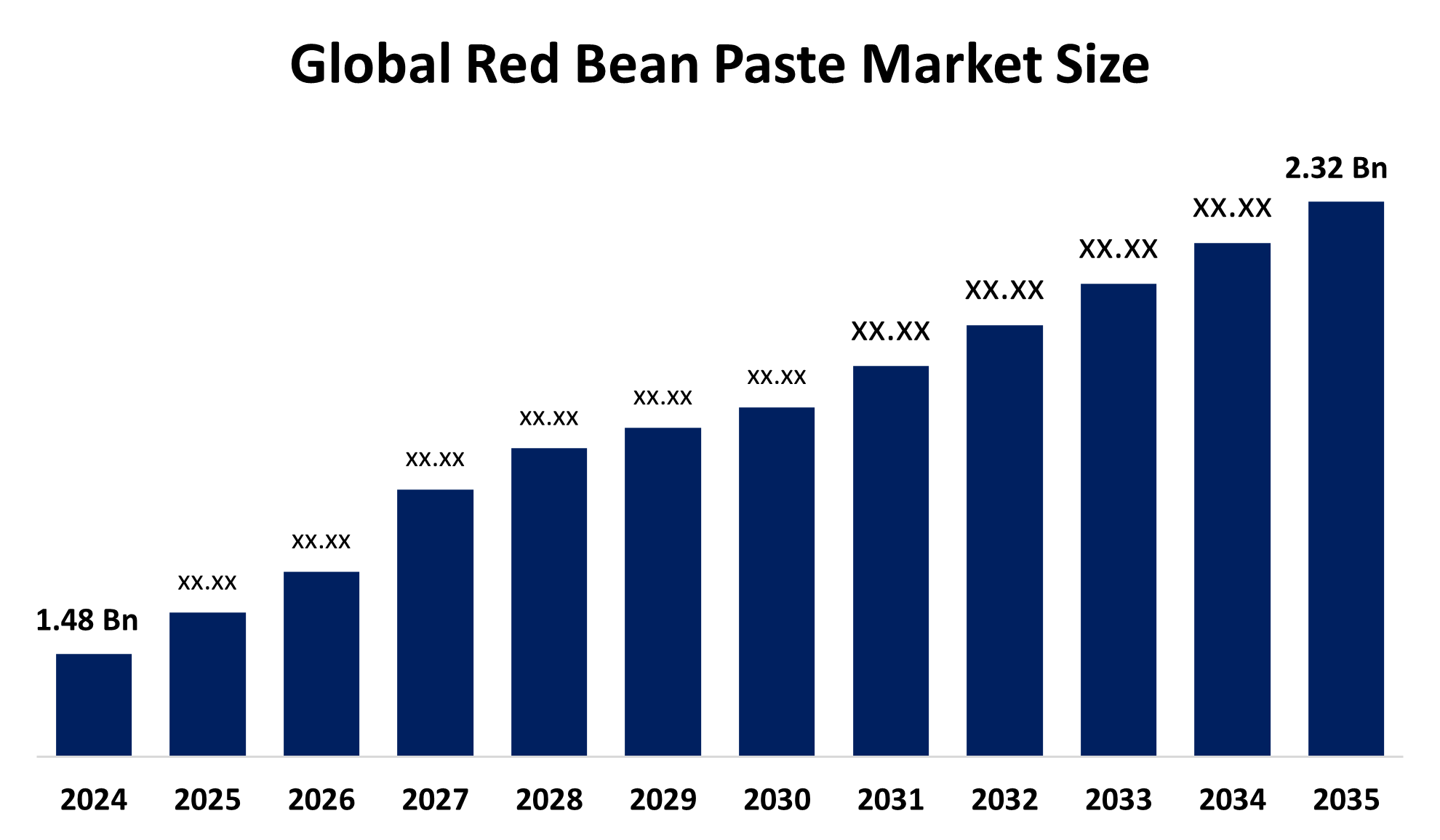

- The Global Red Bean Paste Market Size Was Estimated at USD 1.48 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.17% from 2025 to 2035

- The Worldwide Red Bean Paste Market Size is Expected to Reach USD 2.32 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Red Bean Paste Market Size was worth around USD 1.48 Billion in 2024 and is Predicted To Grow to around USD 2.32 Billion by 2035 with a compound annual growth rate (CAGR) of 4.17% from 2025 to 2035. The growing demand for traditional Asian confections, the growing popularity of red bean paste as a flexible ingredient in a variety of culinary applications, and the global trend towards the adoption of healthier and natural food products are the main drivers of this market's growth.

Market Overview

The global red bean paste market refers to either sweetened or unsweetened, which is made from adzuki beans and widely used in baked goods, confectioneries, and traditional Asian desserts, providing taste, texture, and nutritional value. The market for red bean paste is expanding steadily due to consumers' growing desire for classic and genuine flavours in baked goods and confections. Strong demand is maintained, especially throughout Asian regions, by its cultural significance in Asian cuisine as well as its nostalgic and distinctive flavour appeal. Red bean paste is high in protein, fibre, and other vital elements and is a natural and minimally processed substitute for other sweet fillings. Growing health consciousness also propels market expansion.

The market's reach is being broadened by innovative product creation, as producers are using red bean paste in savoury dishes, snacks, drinks, and fusion foods other than classic desserts. With the introduction of novel products that combine tradition and modernity, the global market for red bean paste is changing. For instance, Orion Vietnam debuted ChocoPie Matcha Red Bean in June 2025, combining the flavours of matcha and red beans. In response to the increasing demand for fusion confections and seasonal specialities, Atami Bataa Anpan later introduced autumn delights in September 2025 that featured blends of red beans and chestnuts.

This innovation expands its use across a variety of culinary creations and responds to changing consumer preferences. Thick Broad Bean Sauce, which combines red bean paste with bold flavour and rich texture to produce a balanced taste profile, opens up new possibilities for fusion cooking. This adaptability enhances customer attention and propels market acceptance worldwide by appealing to both savoury and sweet cuisines.

Report Coverage

This research report categorizes the red bean paste market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the red bean paste market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the red bean paste market.

Global Red Bean Paste Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024 : | USD 1.48 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.17% |

| 2035 Value Projection: | USD 2.32 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Formulation Type, By Application, By Region |

| Companies covered:: | Hokkaido Bean Paste Co., Ltd., Taiwan Sugar Corporation, Kyoei Foods Co., Ltd., Morinaga & Co., Ltd., Shirakiku Co., Ltd., Marukyo Co., Ltd., Yamasa Corporation, Nisshin Seifun Group Inc., Nihon Shokuhin Kako Co., Ltd., Fujiya Co., Ltd., Kikkoman Corporation, Kuze Fuku & Sons, Nakamura Tokichi Honten Co., Ltd., Mitsui & Co., Ltd., and Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The global red bean paste market is driven by rising consumption of traditional Asian desserts and bakery products, expanding bakery and confectionery sectors, and growing health awareness due to red beans’ protein and fiber content. Consumer preference for natural, plant-based ingredients, convenience-focused packaged foods, and innovative product formats supports market growth. Export demand from global food brands and increasing availability through e-commerce platforms further boost accessibility and sales, while ready-to-use, flavored, and frozen variants attract younger demographics, fueling domestic and international market expansion. Rising availability of red bean paste through online retail platforms is expected to strengthen consumer accessibility and accelerate sales growth worldwide. U.S. Census Bureau data shows strong e-commerce growth.

Restraining Factors

The market for red bean paste is constrained by factors such as the high sugar content, limited shelf life, and price instability brought on by the seasonality of the red bean supply. Regional variations in quality, competition from substitute fillings, and high production expenses to preserve texture and quality all affect taste consistency and pricing. Furthermore, low awareness in Western markets hinders further adoption and global market expansion by slowing entry into major retail channels.

Market Segmentation

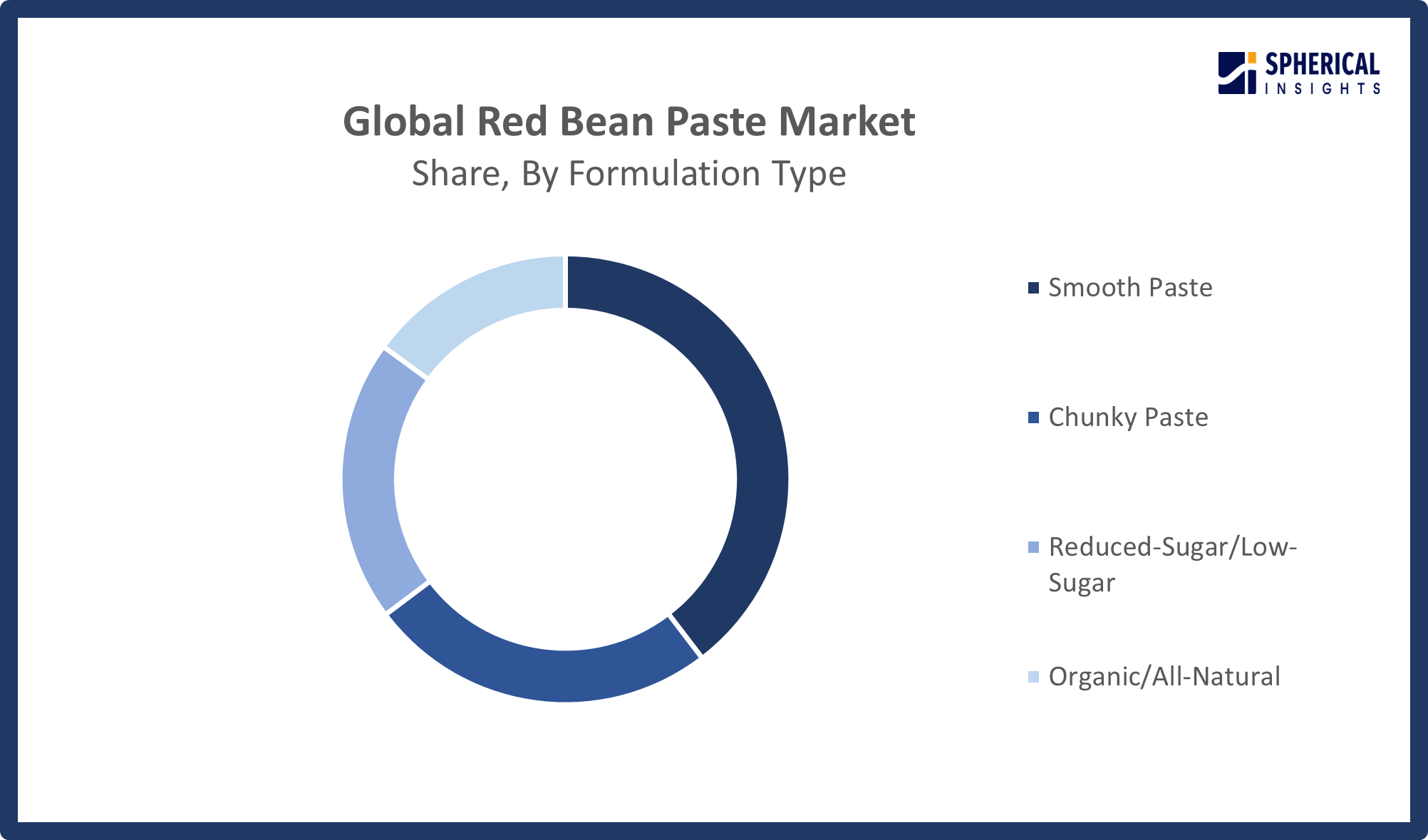

The red bean paste market share is classified into formulation type and application.

- The smooth paste segment dominated the market in 2024 with approximately 58% and is projected to grow at a substantial CAGR during the forecast period.

Based on the formulation type, the red bean paste market is divided into smooth paste, chunky paste, reduced-sugar/low-sugar, and organic/all-natural. Among these, the smooth paste segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Its adaptability and simplicity of usage in confections, bakery goods, and classic desserts like mochi, buns, and pastries are what propel its broad use. It is highly favoured by both manufacturers and customers due to its smooth texture, which guarantees consistency, facilitates blending with other components, and improves product quality. The segment's solid market position and anticipated expansion are further supported by the growing demand for items that are ready to use and convenience-focused.

Get more details on this report -

- The bakery & confectionery segment accounted for the largest share in 2024, approximately 62% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the red bean paste market is divided into bakery & confectionery, dairy & ice cream, and ready meals & snacks. Among these, the bakery & confectionery segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Red bean paste is widely used in cakes, pastries, buns, mochi, and other sweet delights, which is driving this segment's growth. Further bolstering its strong position and projected growth is the growing consumer demand for both traditional and fusion bakery items in Asian and worldwide markets. Because it is used in huge quantities in cakes, pastries, and buns as well as in industrial baking lines, bakery and confectionery are thought to be the most common applications.

Regional Segment Analysis of the Red Bean Paste Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share with approximately 35% of the Red Bean Paste market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the red bean paste market over the predicted timeframe. The red bean paste market is dominated by the Asia Pacific region, which holds the greatest market share because of its gastronomic and cultural significance. The main markets for red bean paste are China, Japan, and South Korea, where it is a common component in regional snacks and desserts. The market in this area is anticipated to keep expanding due to the growing demand for traditional Asian confections and the long-standing use of red bean paste in a variety of food products.

North America is expected to grow market share with approximately 32% at a rapid CAGR in the red bean paste market during the forecast period. The growing popularity of Asian food and the expanding availability of red bean paste products through a variety of distribution channels are driving the growth of the North American red bean paste market. The introduction of red bean paste in fusion and other creative culinary products, together with the development in multicultural food trends, has all helped to fuel the region's expanding demand.

Europe is expected to grow at a rapid CAGR in the red bean paste market during the forecast period. The expansion of the bakery and confectionery industries, growing consumer awareness of Asian cuisines, and the growing desire for fusion desserts are the main drivers of this rise. Furthermore, the availability of e-commerce and creative product formats are increasing usage throughout the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the red bean paste market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hokkaido Bean Paste Co., Ltd.

- Taiwan Sugar Corporation

- Kyoei Foods Co., Ltd.

- Morinaga & Co., Ltd.

- Shirakiku Co., Ltd.

- Marukyo Co., Ltd.

- Yamasa Corporation

- Nisshin Seifun Group Inc.

- Nihon Shokuhin Kako Co., Ltd.

- Fujiya Co., Ltd.

- Kikkoman Corporation

- Kuze Fuku & Sons

- Nakamura Tokichi Honten Co., Ltd.

- Mitsui & Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, Chestnut Anpan, Anpan Manju, and Bataa Andorayaki are among the dishes in Atami Bataa Anpan's autumn menu that highlight creative flavours for the holiday season by combining red bean paste with seasonal ingredients.

- In June 2025, Orion Vietnam launched ChocoPie Matcha Red Bean, featuring matcha-flavored cake layers filled with sweet red bean cream, creating a fusion of traditional and modern flavors for consumers.

- In May 2025, in recognition of its exceptional quality, flavour, and consistency, Monde Selection presented Hong Kong-style Red Bean Paste with the Gold Quality Award. This award emphasises the product's superiority and strengthens its standing in both domestic and foreign markets.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the red bean paste market based on the below-mentioned segments:

Global Red Bean Paste Market, By Formulation Type

- Smooth Paste

- Chunky Paste

- Reduced-Sugar/Low-Sugar

- Organic/All-Natural

Global Red Bean Paste Market, By Application

- Bakery & Confectionery

- Dairy & Ice Cream

- Ready Meals & Snacks

Global Red Bean Paste Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Red Bean Paste market over the forecast period?The global Red Bean Paste market is projected to expand at a CAGR of 4.17% during the forecast period.

-

2. What is the market size of the Red Bean Paste market?The global Red Bean Paste market size is expected to grow from USD 1.48 Billion in 2024 to USD 2.32 Billion by 2035, at a CAGR of 4.17% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Red Bean Paste market?Asia Pacific is anticipated to hold the largest share of the Red Bean Paste market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global Red Bean Paste market?Hokkaido Bean Paste Co., Ltd., Taiwan Sugar Corporation, Kyoei Foods Co., Ltd., Morinaga & Co., Ltd., Shirakiku Co., Ltd., Marukyo Co., Ltd., Yamasa Corporation, Nisshin Seifun Group Inc., Nihon Shokuhin Kako Co., Ltd., and Fujiya Co., Ltd.

-

5. What factors are driving the growth of the Red Bean Paste market?Rising demand for traditional and fusion Asian desserts, increased production of baked goods and confections, growing health consciousness that favours natural, high-protein, and high-fiber ingredients, and innovation in product formats like low-sugar, ready-to-use, and flavoured pastes, as well as growing e-commerce and retail distribution channels, are the main factors driving the red bean paste market.

-

6. What are the market trends in the Red Bean Paste market?Rising use in fusion desserts and drinks, a growing desire for natural and low-sugar formulations, creative product formats like flavoured and ready-to-use pastes, seasonal and artisanal offerings, and growing distribution through e-commerce and foreign markets are some of the major trends in the red bean paste market.

-

7. What are the main challenges restricting wider adoption of the Red Bean Paste market?Concerns about the high sugar content, short shelf life, seasonal variations in supply, competition from substitute fillings, high production costs, inconsistent quality, and little knowledge in Western markets are the main obstacles preventing the widespread use of red bean paste.

Need help to buy this report?