Global Rare Earth Metals Leaching Chemicals Market Size, Share, and COVID-19 Impact Analysis, By Type (Hydrochloric Acid, Sulfuric Acid, Nitric Acid, Ammonium Sulphate, Citric Acid, and Others), By End User (Electronics, Renewable Energy, Automotive, Defense, Healthcare, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Rare Earth Metals Leaching Chemicals Market Insights Forecasts to 2035

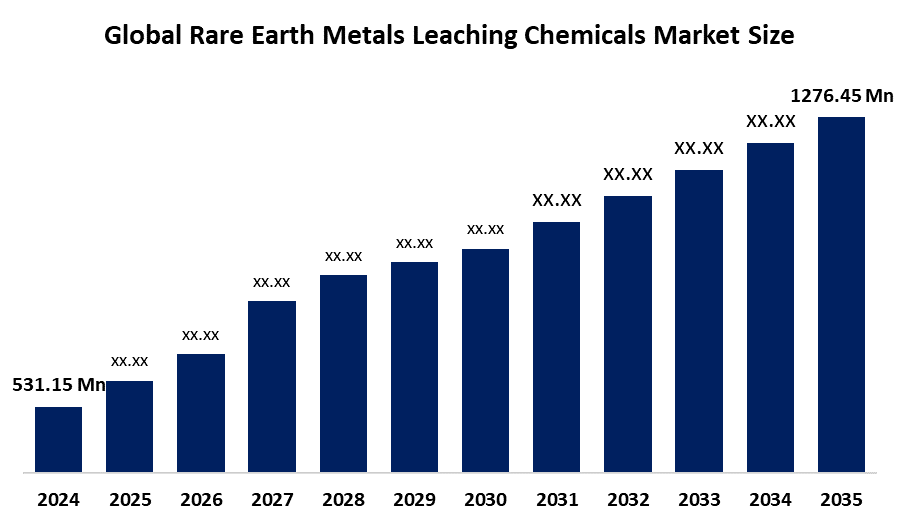

- The Global Rare Earth Metals Leaching Chemicals Market Size Was Estimated at USD 531.15 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.3% from 2025 to 2035

- The Worldwide Rare Earth Metals Leaching Chemicals Market Size is Expected to Reach USD 1276.45 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global rare earth metals leaching chemicals market size was worth around USD 531.15 million in 2024 and is predicted to grow to around USD 1276.45 million by 2035 with a compound annual growth rate (CAGR) of 8.3% from 2025 to 2035. The rare earth metals leaching chemicals market is primarily growing due to the surging demand for rare earth elements in high-tech industries, especially for electric vehicles, renewable energy systems, and consumer electronics. This demand necessitates efficient extraction and processing methods using these specialized chemicals.

Market Overview

The global rare earth metals leaching chemicals market refers to the production and use of chemical agents, such as acids, alkalis, and complexants, designed to extract rare earth elements (REEs) from ores and secondary materials. These chemicals are essential in hydrometallurgical processes used in producing magnets, batteries, renewable energy technologies, and advanced electronics. Market growth is primarily driven by surging demand for REEs in electric vehicles, wind turbines, and digital devices, alongside increased investment in efficient and eco-friendly extraction methods. Opportunities lie in technological advancements that reduce environmental impact, the expansion of recycling-based REE recovery, and the development of selective, high-yield leaching agents. Key market participants include Solvay, BASF SE, Lanxess, Tetra Tech, Cytec Industries, and regional chemical suppliers supporting rare earth extraction operations, particularly across the Asia Pacific and North America. In October 2025, the United States and Australia launched a strategic partnership to strengthen critical mineral and rare earth supply chains essential to their commercial and defense sectors. Through coordinated investment and economic policy tools, both nations aim to build resilient, diversified markets while expanding existing mining and processing capacity ahead of new developments expected in 2026.

Report Coverage

This research report categorizes the rare earth metals leaching chemicals market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the rare earth metals leaching chemicals market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the rare earth metals leaching chemicals market.

Global Rare Earth Metals Leaching Chemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 531.15 Million |

| Forecast Period: | 2024 – 2035 |

| Forecast Period CAGR 2024 – 2035 : | CAGR of 8.3% |

| 024 – 2035 Value Projection: | USD 1276.45 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By End User |

| Companies covered:: | Solvay S.A., BASF SE, OxyChem, Aurubis, Olin Corporation, UBE Corporation, MP Materials Corp., LANXESS AG, Gujarat Alkalies and Chemical Limited (GACL), Westlake Chemical Partners, Gujarat State Fertilizers & Chemicals Limited (GSFC), And Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global rare earth metals leaching chemicals market is driven by rising demand for rare earth elements in clean energy technologies, including wind turbines, electric vehicles, and advanced electronics. Growing investment in efficient extraction methods is increasing the need for specialized leaching agents that improve yield and reduce environmental impact. Expansion of mining activities, especially in the Asia Pacific region, further boosts chemical consumption. Additionally, technological advancements in hydrometallurgy, tightening regulations on traditional mining, and the shift toward recycling rare earth materials are accelerating the adoption of innovative leaching chemicals, supporting market growth across industrial and energy sectors.

Restraining Factors

The rare earth metals leaching chemicals market faces restraints such as stringent environmental regulations, high toxicity and disposal challenges of leaching agents, and increasing pressure for sustainable extraction. Volatile rare earth prices and reliance on limited mining regions further hinder investment, slowing the adoption of conventional leaching chemicals.

Market Segmentation

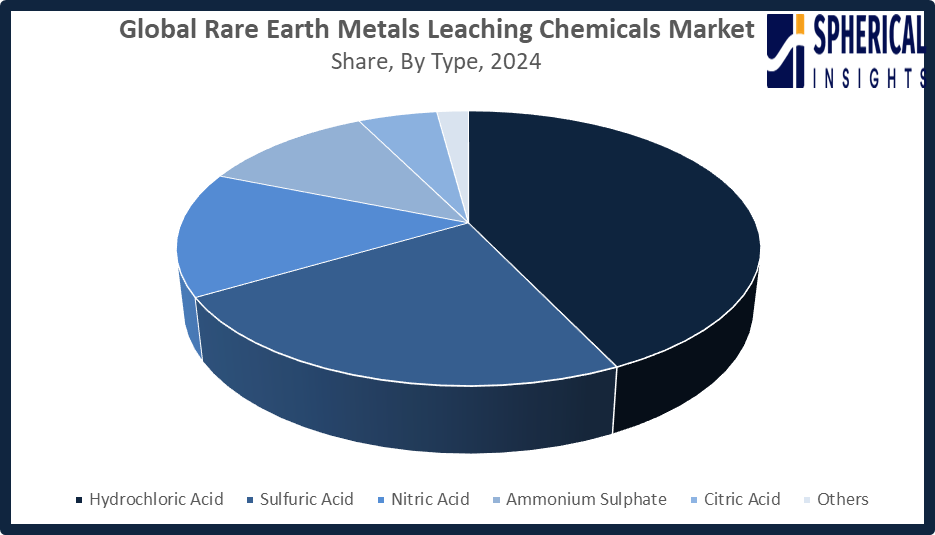

The rare earth metals leaching chemicals market share is classified into type and end user.

- The hydrochloric acid segment dominated the market in 2024, approximately 43% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the rare earth metals leaching chemicals market is divided into hydrochloric acid, sulfuric acid, nitric acid, ammonium sulphate, citric acid, and others. Among these, the hydrochloric acid segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The hydrochloric acid segment dominates the rare earth metals leaching chemicals market due to its high efficiency in extracting both light and heavy rare earth elements, cost-effectiveness, and wide acceptance among industries. Its strong leaching capability, compatibility with large-scale hydrometallurgical processes, and reliability in producing high-purity outputs have made it the preferred choice among mining and processing operations worldwide.

Get more details on this report -

- The electronics segment accounted for the highest market revenue in 2024, approximately 35% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the rare earth metals leaching chemicals market is divided into electronics, renewable energy, automotive, defense, healthcare, and others. Among these, the electronics segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Growth within the electronics segment in rare earth metals leaching chemicals due to the demand for rare earth elements in smartphones, laptops, and other consumer electronic items. This has led to rapid technological advancements, miniaturization of devices, and increased usage of high-performance electronic components, thus demanding efficient extraction and processing of rare earths.

Regional Segment Analysis of the Rare Earth Metals Leaching Chemicals Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the rare earth metals leaching chemicals market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the rare earth metals leaching chemicals market over the predicted timeframe. Asia Pacific is anticipated to hold a 55% share of the rare earth metals leaching chemicals market, led primarily by China, which dominates global rare earth production and processing. Growth is driven by abundant rare earth reserves, strong government support, and high demand from electronics, renewable energy, and automotive industries. Australia and India are also contributing, expanding mining and processing capacities. The region’s established infrastructure, cost-effective production, and strategic focus on technological innovation further reinforce its leading position in the global leaching chemicals market. In 2024, China’s rare earth industry advanced significantly through strengthened policies, enhanced resource exploration, sustainability measures, and rising global standard-setting influence. Marking the nation’s 75th anniversary, these developments reinforced China’s dominance in rare earths and offer strategic lessons for Western countries, especially the U.S., seeking secure, competitive supply chains.

North America is expected to grow at a rapid CAGR in the rare earth metals leaching chemicals market during the forecast period. North America is rapidly growing in the rare earth metals leaching chemicals market, with an approximate 18% market share, driven mainly by the United States and Canada. Growth is fueled by strategic government initiatives to secure domestic rare earth supply chains, investments in mining and processing infrastructure, and efforts to reduce reliance on Chinese imports. Rising demand from defense, electronics, and renewable energy sectors further accelerates the adoption of advanced leaching chemicals, supporting efficient and sustainable rare earth extraction. In August 2025, DOD backed MP Materials' advanced U.S. efforts to rebuild a domestic rare earth supply chain and reduce reliance on China. As geopolitical tensions and trade risks rise, the company’s progress highlights growing Western urgency to secure critical minerals essential for EVs, wind turbines, defense systems, and advanced electronics.

Europe is witnessing growth in the rare earth metals leaching chemicals market, led by Germany, France, and Sweden. Expansion is driven by the European Union’s Critical Raw Materials Act, which promotes domestic extraction, processing, and recycling of rare earths. Increasing demand from the automotive, electronics, and renewable energy sectors, combined with government incentives for sustainable and secure supply chains, is accelerating the adoption of advanced leaching chemicals across the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the rare earth metals leaching chemicals market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Solvay S.A.

- BASF SE

- OxyChem

- Aurubis

- Olin Corporation

- UBE Corporation

- MP Materials Corp.

- LANXESS AG

- Gujarat Alkalies and Chemical Limited (GACL)

- Westlake Chemical Partners

- Gujarat State Fertilizers & Chemicals Limited (GSFC)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2025, Solvay announced a strategic agreement with Permag (US) and Less Common Metals (UK) to ensure a secure supply of rare earth materials. The partnership provides Permag with a stable, predictable supply of Samarium, a critical element for producing high-performance magnets and magnetic assemblies.

- In April 2025, MP Materials stopped shipping rare earth concentrate to China, stating that exporting under 125% tariffs is commercially unviable and contrary to U.S. national interests, reinforcing efforts to strengthen America’s domestic critical minerals supply chain.

- In April 2025, Solvay inaugurated its rare earths production line for permanent magnets at its La Rochelle facility, marking a major step toward supporting Europe’s strategic ambitions. This expansion enables Solvay to supply rare earth materials for permanent magnets, strengthening its position as a global leader in the rare earths sector.

- In May 2025, BASF announced a strategic shift in its copper hydrometallurgy business to meet rising global copper demand and support more sustainable processing. Alongside advancing its LixTRA product line, the company will focus on developing next-generation, higher-efficiency leaching aids to improve resource performance and operational sustainability.

- In March 2024, Solvay and Carester signed an MOU to establish a strategic partnership focused on developing rare earth manufacturing opportunities for Europe’s permanent magnet value chain. The collaboration combines Solvay’s industrial expertise with Carester’s recycling capabilities and upstream market knowledge to strengthen the region’s rare earth ecosystem.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the rare earth metals leaching chemicals market based on the below-mentioned segments:

Global Rare Earth Metals Leaching Chemicals Market, By Type

- Hydrochloric Acid

- Sulfuric Acid

- Nitric Acid

- Ammonium Sulphate

- Citric Acid

- Others

Global Rare Earth Metals Leaching Chemicals Market, By End User

- Electronics

- Renewable Energy

- Automotive

- Defense

- Healthcare

- Others

Global Rare Earth Metals Leaching Chemicals Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the rare earth metals leaching chemicals market over the forecast period?The global rare earth metals leaching chemicals market is projected to expand at a CAGR of 8.3% during the forecast period.

-

2. What is the market size of the rare earth metals leaching chemicals market?The global rare earth metals leaching chemicals market size is expected to grow from USD 531.15 million in 2024 to USD 1276.45 million by 2035, at a CAGR of 8.3% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the rare earth metals leaching chemicals market?Asia Pacific is anticipated to hold the largest share of the rare earth metals leaching chemicals market over the predicted timeframe.

-

4. What is the rare earth metals leaching chemicals market?The rare earth metals leaching chemicals market refers to the global industry for chemical agents used to extract and separate rare earth elements (REEs) from their ore.

-

5. Who are the top 10 companies operating in the global rare earth metals leaching chemicals market?Solvay S.A., BASF SE, OxyChem, Aurubis, Olin Corporation, UBE Corporation, MP Materials Corp., LANXESS AG, Gujarat Alkalies and Chemical Limited (GACL), Westlake Chemical Partners, and Others.

-

6. What factors are driving the growth of the rare earth metals leaching chemicals market?The growth of the rare earth metals leaching chemicals market is driven by the increasing demand for rare earths in key sectors such as electric vehicles (EVs), wind turbines, and electronics.

-

7. What are the market trends in the rare earth metals leaching chemicals market?Market trends in rare earth metals leaching chemicals include a shift toward eco-friendly chemicals like organic acids and ionic liquids, driven by sustainability goals and tighter environmental regulations.

-

8. What are the main challenges restricting the wider adoption of the rare earth metals leaching chemicals market?The main challenges restricting the wider adoption of the rare earth metals leaching chemicals market stem from significant environmental impacts, high operational costs, technical limitations, and complex geopolitical factors.

Need help to buy this report?