Global Rapid RNA Testing Kit Market Size, Share, and COVID-19 Impact Analysis, By Product Type (PCR-based Kits, Isothermal Amplification Kits, CRISPR-based Kits, and Others), By Application (Clinical Diagnostics, Research, Forensic Testing, and Others), By Distribution Channel (Online Stores, Pharmacies, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Rapid RNA Testing Kit Market Insights Forecasts to 2035

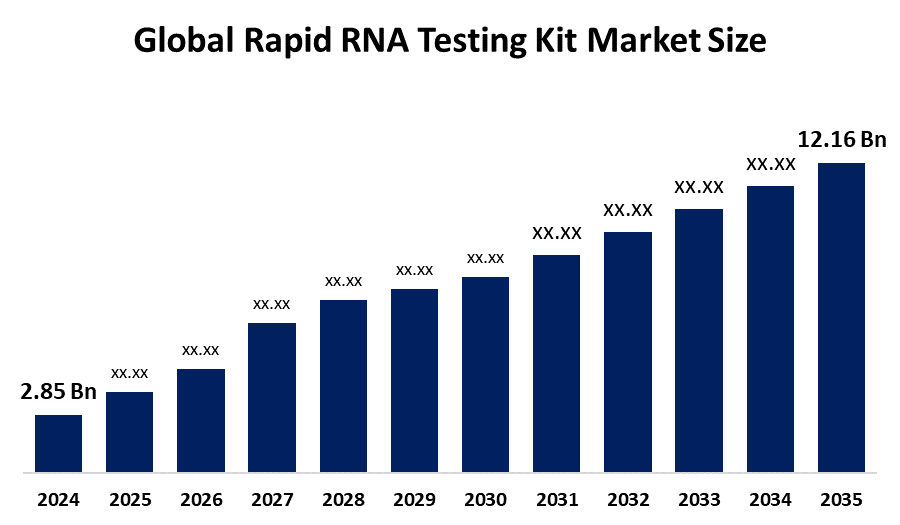

- The Global Rapid RNA Testing Kit Market Size Was Estimated at USD 2.85 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 14.1% from 2025 to 2035

- The Worldwide Rapid RNA Testing Kit Market Size is Expected to Reach USD 12.16 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Rapid RNA Testing Kit Market Size was worth around USD 2.85 Billion in 2024 and is predicted to grow to around USD 12.16 Billion by 2035 with a compound annual growth rate (CAGR) of 14.1% from 2025 to 2035. The increasing cases of RNA virus infections such as COVID-19 and influenza, advancements in diagnostic technologies, greater demand for point-of-care testing, and the robust support of the government towards pandemic preparedness and early detection drive the growth of the market for rapid RNA testing kits.

Market Overview

The Global Rapid RNA Test Kit Market Size refers to the diagnostic kits intended to identify ribonucleic acid (RNA) sequences quickly, primarily for the detection of RNA viruses such as SARS-CoV-2, influenza, HIV, and RSV. The kits have their primary applications in clinical diagnosis, emergency response for outbreaks, research, and point-of-care testing, where results are delivered faster than with normal RT-PCR tests. Their fast turnaround times also make them critical to timely treatment decisions and containment during outbreaks of viral illness. Growth in the market is led by the increase in infectious diseases caused by RNA viruses and the growing demand for decentralized, near-patient testing. The COVID-19 pandemic accelerated the broad awareness and adoption of quick RNA testing solutions among healthcare systems globally. Technologies such as CRISPR-based testing, isothermal amplification technologies (e.g., LAMP), and lab-on-a-chip miniaturized platforms have improved test speed, accuracy, and accessibility, paving the way for expanded applications in urban communities and far-flung regions.

Opportunity exists for expanding the uses of testing from human disease to veterinary disease diagnosis, agriculture, and environmental surveillance. Besides, growing worldwide focus on pandemic readiness, infectious disease monitoring, and incorporating quick diagnostics in public health planning will also sustain solid growth in the market for rapid RNA testing kits. Long-term market leaders in durable goods, such as Abbott Laboratories, Thermo Fisher Scientific, Cepheid, and Bio-Rad Laboratories, and new biotech start-ups, are making research and development a priority in an effort to propel test performance enhancement as well as satisfy unmet diagnostic demands, such as never before. The United States Department of Health and Human Services (HHS), through BARDA, funded OraSure Technologies approximately $7.5 million to create a rapid antigen test for Marburg Virus Disease. The grant will accelerate test development and regulatory approval, enhancing the nation's capacity to rapidly respond to future outbreaks.

Get more details on this report -

- The clinical diagnostics segment accounted for the largest share in 2024, approximately 66% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the rapid RNA testing kit market is divided into clinical diagnostics, research, forensic testing, and others. Among these, the clinical diagnostics segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This segment is growing due to the increasing demand for early and accurate diagnosis of infectious diseases and genetic disorders. RNA testing kits play a crucial role in clinics due to their quick detection of pathogens, supporting timely treatment. The mounting prevalence of chronic diseases and interest in personalized medicine further enhance the demand for RNA-based testing in clinical diagnostics.

- The online stores segment accounted for the highest market revenue in 2024, approximately 48% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the rapid RNA testing kit market is divided into online stores, pharmacies, and others. Among these, the online stores segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Online stores have emerged as the primary channel of distribution for RNA testing kits, driven by e-commerce growth and consumer demand for contactless, convenient shopping. Consumers enjoy a broad range of products, competitive prices, and doorstep delivery. The COVID-19 pandemic further fueled this trend, leading both healthcare professionals and consumers to embrace online portals for safe and effective purchases.

North America is anticipated to hold the largest share of the rapid RNA testing kit market over the predicted timeframe.

North America is projected to hold the largest share of the rapid RNA testing kit market throughout the forecast period, accounting for approximately 35% of the market. This dominance is attributed to its advanced healthcare infrastructure, high concentration of leading biotechnology companies, and significant investments in molecular diagnostics. The United States leads the regional market, driven by the growing demand for rapid disease diagnosis, rising prevalence of infectious and genetic disorders, and the widespread adoption of RNA-based testing in clinical and research applications. Additionally, government funding and heightened public awareness, particularly in the fields of personalized medicine and pandemic preparedness, further contribute to market growth.

Get more details on this report -

The Asia Pacific region is expected to register the fastest CAGR in the rapid RNA testing kit market during the forecast period, capturing around 21% of the market share. This growth is fueled by expanding healthcare infrastructure, increased government investments, and growing awareness of early disease detection. China and India are at the forefront of this regional expansion, driven by their large populations and high burden of infectious diseases. These countries are heavily investing in molecular diagnostics and point-of-care testing solutions, creating strong market opportunities across the region.

In Europe, the rapid RNA testing kit market is expanding steadily, supported by a well-established public health infrastructure, stringent regulatory frameworks, and strong government initiatives for infectious disease surveillance and diagnosis. Countries such as Germany, France, and the United Kingdom are leading this growth through substantial investments in molecular diagnostic technologies, personalized medicine, and early disease detection programs. Moreover, the region’s emphasis on point-of-care testing, outbreak preparedness, and the extensive network of hospitals and diagnostic laboratories further strengthen its market position.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the rapid RNA testing kit market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

Thermo Fisher Scientific

QIAGEN

Danaher

Abbott Laboratories

Roche Diagnostics

Merck KGaA

Quidel Corporation

Hologic

Bio-Rad Laboratories

PerkinElmer

Luminex Corporation

BD (Becton Dickinson)

Agilent Technologies

Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2024, Roche launched the cobas Respiratory Flex Test, the first to feature its proprietary TAGS (Temperature-Activated Generation of Signal) technology. This innovative multiplex PCR test identifies up to 15 respiratory pathogens in a single test using advanced color, temperature, and data processing for accurate, efficient diagnostics.

- In June 2024, Bio-Rad Laboratories launched the ddSEQ Single-Cell 3' RNA Seq Kit and Omnition v1.1 software for single-cell transcriptome research. Designed for use with the ddSEQ Cell Isolator, the kit enables fast, efficient, and affordable single-cell gene expression and regulation analysis.

- In October 2022, Roche introduced three next-generation SARS-CoV-2 rapid antigen tests (2.0) for self and professional use in CE Mark-accepting countries, including Rapid Antigen Test 2.0, Nasal 2.0 for professionals, and Antigen Self-Test Nasal for self-testing.

- In February 2021, Thermo Fisher Scientific opened a new manufacturing facility in Bengaluru to produce CoviPath COVID-19 RT-PCR test kits. Developed in India, the kits suit local conditions and offer over 99.5% sensitivity and specificity, detecting viral targets with low mutation rates.

- In January 2020, Bio-Rad Laboratories launched the SEQuoia Complete Stranded RNA Library Prep Kit, offering a simplified workflow for comprehensive transcriptome analysis. It supports diverse sample types, including degraded RNA, providing researchers with a holistic and efficient RNA-Seq library preparation solution.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the rapid RNA testing kit market based on the below-mentioned segments:

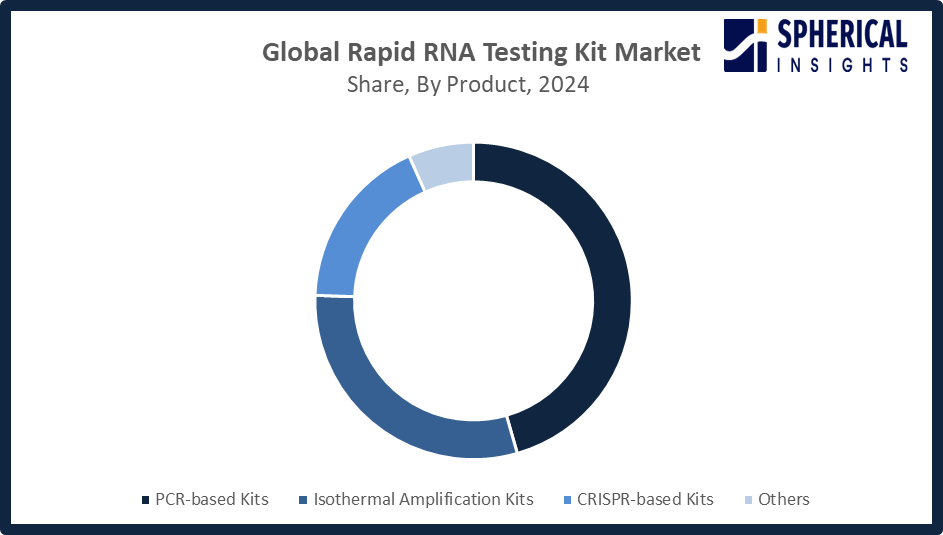

Global Rapid RNA Testing Kit Market, By Product Type

- PCR-based Kits

- Isothermal Amplification Kits

- CRISPR-based Kits

- Others

Global Rapid RNA Testing Kit Market, By Application

- Clinical Diagnostics

- Research

- Forensic Testing

- Others

Global Rapid RNA Testing Kit Market, By Distribution Channel

- Online Stores

- Pharmacies

- Others

Global Rapid RNA Testing Kit Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.85 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 14.1% |

| 2035 Value Projection: | USD 12.16 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Thermo Fisher Scientific, QIAGEN, Danaher, Abbott Laboratories, Roche Diagnostics, Merck KGaA, Quidel Corporation, Hologic, Bio-Rad Laboratories, PerkinElmer, Luminex Corporation, BD (Becton Dickinson), Agilent Technologies, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Global Rapid RNA Testing Kit Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the rapid RNA testing kit market over the forecast period?The global rapid RNA testing kit market is projected to expand at a CAGR of 14.1% during the forecast period.

-

2.What is the rapid RNA testing kit market?The rapid RNA testing kit market refers to the global industry for diagnostic kits that can quickly detect specific RNA sequences, such as those from viruses such as COVID-19, influenza, and others.

-

3.What is the market size of the rapid RNA testing kit market?The global rapid RNA testing kit market size is expected to grow from USD 2.85 Billion in 2024 to USD 12.16 Billion by 2035, at a CAGR of 14.1% during the forecast period 2025-2035.

-

4.Which region holds the largest share of the rapid RNA testing kit market?North America is anticipated to hold the largest share of the rapid RNA testing kit market over the predicted timeframe.

-

5.Who are the top 10 companies operating in the global rapid RNA testing kit market?Thermo Fisher Scientific, QIAGEN, Danaher, Abbott Laboratories, Roche Diagnostics, Merck KGaA, Quidel Corporation, Hologic, Bio-Rad Laboratories, PerkinElmer, Luminex Corporation, BD (Becton Dickinson), Agilent Technologies, and Others.

-

6.What factors are driving the growth of the rapid RNA testing kit market?The rapid RNA testing kit market is growing rapidly due to the rising prevalence of infectious diseases, continuous technological advancements, and increasing demand for rapid and accurate diagnostic solutions.

-

7.What are the market trends in the rapid RNA testing kit market?Market trends in rapid RNA testing kits include the growth of point-of-care and at-home testing, advancements in multiplex and AI-powered kits, and expanding applications beyond infectious diseases to areas like food and environmental safety.

-

8.What are the main challenges restricting wider adoption of the rapid RNA testing kit market?Challenges restricting the wider adoption of rapid RNA testing kits include concerns over accuracy, high costs, supply chain complexities, and regulatory hurdles.

Need help to buy this report?