Global Rapid Infuser Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Handheld Devices and Trolley Mounted Devices) By Application (Trauma & Emergency, Anesthesia, Surgical Care, Labor & Delivery, Intensive Care, and Others) By End User (Hospitals, Ambulatory Surgery Centers, Specialty Clinics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Rapid Infuser Market Size Insights Forecasts to 2035

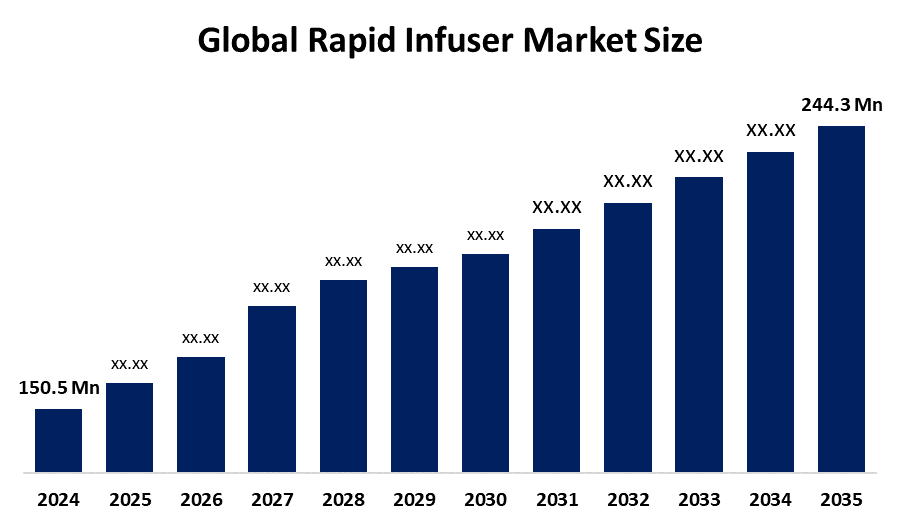

- The Global Rapid Infuser Market Size Was Estimated at USD 150.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.5% from 2025 to 2035

- The Worldwide Rapid Infuser Market Size is Expected to Reach USD 244.3 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Rapid Infuser Market Size was worth around USD 150.5 Million in 2024 and is predicted to Grow to around USD 244.3 Million by 2035 with a compound annual growth rate (CAGR) of 4.5% from 2025 to 2035. The market for rapid infusers is expanding with increased cases of trauma, complicated surgeries, and long-term conditions requiring quick fluid resuscitation. Progress in technology, compact intelligent devices, military healthcare modernization, and patient stabilization are also driving demand worldwide.

Market Overview

The market for global rapid infusers includes devices that are used to deliver fluids and blood products quickly, important for stabilizing patients in emergency cases. The systems are important in trauma care, complicated surgeries, and critical care units, providing for quick fluid resuscitation to avoid hypovolemic shock and other life-threatening situations. Important drivers driving the market growth are the increasing frequency of trauma, complicated procedures, and chronic illnesses necessitating rapid fluid resuscitation. Advances in technology, including battery-powered portability and intelligent air sensing technology, add to the flexibility and security of rapid infusers to be adaptable to both pre-hospital and hospital settings. Moreover, military modernization initiatives for health are introducing rapid infusers into routine tactical medical packs, further diversifying their use. Increased emphasis on patient safety and the necessity of quick hemodynamic stabilization are also adding to the market's growth.

Innovation within the market is characterized by innovation in automated fluid warming devices, the incorporation of real-time monitoring, and the development of battery-powered portable infusion devices. Market opportunities are fueled by the growing need for effective and rapid fluid delivery systems in emergency and critical care environments. Use of rapid infusers is anticipated to increase as clinicians pursue enhanced patient outcomes as well as minimized complications related to delayed fluid administration. Key market participants are Belmont Medical Technologies, Stryker Corporation, ICU Medical, Inc., Fresenius Kabi, ZOLL Medical Corporation, Terumo Corporation, and Teleflex Incorporated. These players are leading in the development and offering of sophisticated rapid infusion systems. In 2024, the U.S. FDA cleared 510(k) for ICU Medical Inc.'s Plum Duo infusion pump with LifeShield safety software. This clearance allows broader availability of high-tech rapid infuser systems in U.S. healthcare, enhancing patient safety and clinical efficiency.

Report Coverage

This research report categorizes the rapid infuser market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the rapid infuser market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the rapid infuser market.

Global Rapid Infuser Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 150.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.5% |

| 2035 Value Projection: | USD 244.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 284 |

| Tables, Charts & Figures: | 132 |

| Segments covered: | By Product Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Becton Dickinson (BD), Fresenius Kabi, ICU Medical, Stryker Corporation, 3M Company, Smiths Medical, Teleflex Incorporated, GE HealthCare, Biegler GmbH, Belmont Medical Technologies, ZOLL Medical Corporation, Terumo Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for rapid infusers is largely growing due to the global rise in trauma cases and emergency operations has increased the need for quick and effective fluid delivery systems. Advances in technology, such as the creation of portable, battery-powered devices that come equipped with real-time monitoring and automated control features, have increased the safety and effectiveness of these systems. Moreover, the increasing burden of chronic disorders like cardiovascular diseases and diabetes requires repetitive and regulated administration of drugs and fluids, fueling further market growth. Increasing healthcare infrastructure development in emerging markets also fuels the uptake of sophisticated medical devices, such as rapid infusers. These considerations cumulatively highlight the fundamental importance of rapid infusion systems to contemporary medical practice.

Restraining Factors

The market for rapid infusers is hampered by growth challenges presented by high device pricing, sophisticated operation that necessitates specialized training, and low awareness in certain geographies. Strict regulatory clearances, issues with reimbursement, and risk of device malfunction or abuse negatively impact adoption. All these factors combined impact patient safety, confidence in the market, and mass adoption of rapid infusion systems.

Market Segmentation

The rapid infuser market share is classified into product type, application, and end user.

- The trolley mounted devices segment dominated the market in 2024, approximately 66% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the rapid infuser market is divided into handheld devices and trolley mounted devices. Among these, the trolley mounted devices segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The trolley mounted devices' growth is driven by their high infusion capacity, advanced monitoring and warming features, and suitability for use in hospitals and surgical centers. Their efficiency in managing large-volume fluid resuscitation during trauma and major surgeries further strengthens their demand in critical and emergency care applications.

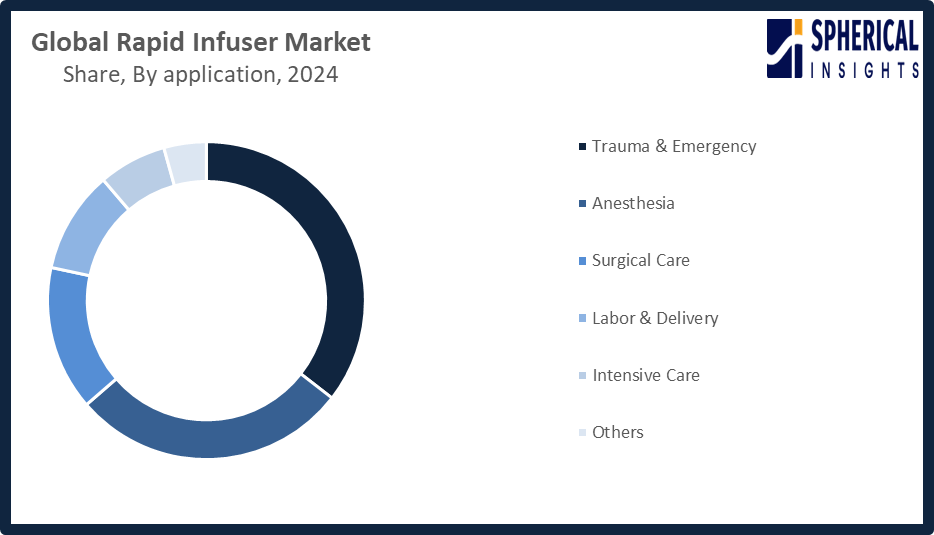

- The trauma & emergency segment accounted for the largest share in 2024, approximately 35% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the rapid infuser market is divided into trauma & emergency, anesthesia, surgical care, labor & delivery, intensive care, and others. Among these, the trauma & emergency segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The trauma and emergency segment growth is propelled by the growing number of road accidents, deep injuries, and hemorrhagic cases that need urgent fluid resuscitation. The increasing need for fast, consistent blood and fluid delivery systems in emergency rooms and pre-hospital settings also fuels the segment's growth worldwide.

Get more details on this report -

- The hospitals segment accounted for the highest market revenue in 2024, approximately 60% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the rapid infuser market is divided into hospitals, ambulatory surgery centers, specialty clinics, and others. Among these, the hospitals segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth of the hospitals segment is due to the significant patient influx for surgical, trauma, and critical care procedures, and the extensive use of sophisticated rapid infuser systems. Higher investments in healthcare facilities and the increasing focus on enhancing patient safety and emergency response capacities further fuel this segment's growth.

Regional Segment Analysis of the Rapid Infuser Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the rapid infuser market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the rapid infuser market over the predicted timeframe. North America is expected to maintain a 38% market share of the rapid infuser market throughout the forecast period based on its established healthcare infrastructure, high rate of trauma cases, and extensive adoption of sophisticated medical technologies. The United States, specifically, leads the regional market with its advanced hospital networks, widespread emergency care facilities, and adequate reimbursement policies. Also, government aid towards trauma care schemes and regular investment in critical care and surgery equipment further strengthen the demand. Canada also contributes through increased hospital modernization and enhanced patient safety focus.

Asia Pacific is expected to grow at a rapid CAGR in the rapid infuser market during the forecast period. Asia Pacific is rapidly growing in the rapid infuser market over the forecast period, approximate market share of 20%, due to enhanced healthcare investments, elevated trauma and surgical volumes, and heightened awareness of advanced medical technologies. The growth is led by countries such as China and India, fueled by growing hospital infrastructure, increased government efforts toward enhancing emergency and critical care services, and accelerating uptake of novel infusion devices. Furthermore, enhanced access to healthcare in urban as well as semi-urban areas stimulates market growth throughout the region.

Europe commanded a large percentage of the world's rapid infuser market, attributed to strong healthcare infrastructure, high prevalence of chronic diseases, and growing use of cutting-edge infusion technologies. Germany, France, and the United Kingdom topped the market, backed by high-performing healthcare systems, government expenditures, and attention to patient safety and drug effectiveness. Strong focus on upgrading healthcare facilities and the implementation of state-of-the-art medical technologies in the region aided the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the rapid infuser market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Becton Dickinson (BD)

- Fresenius Kabi

- ICU Medical

- Stryker Corporation

- 3M Company

- Smiths Medical

- Teleflex Incorporated

- GE HealthCare

- Biegler GmbH

- Belmont Medical Technologies

- ZOLL Medical Corporation

- Terumo Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2025, Teleflex Incorporated announced the completion of its acquisition of BIOTRONIK’s Vascular Intervention business. This addition expands Teleflex’s interventional access portfolio, strengthens its global cath lab presence, and establishes a strong position in the growing peripheral intervention market, enhancing distribution for peripheral-indicated products.

- In April 2025, ICU Medical Inc. received FDA 510(k) clearance for the Plum Solo precision IV pump, complementing the dual-channel Plum Duo. The company also gained clearance for updated Plum Duo and LifeShield software, marking the launch and expansion of the ICU Medical IV Performance Platform.

- In October 2024, BD (Becton, Dickinson and Company) introduced the BD Intraosseous Vascular Access System, designed for rapid fluid or medication delivery in critical emergencies by inserting a needle into the bone marrow when IV access is difficult.

- In August 2023, GE HealthCare introduced CardioVisio for Atrial Fibrillation (AFib), a digital platform that helps clinicians visualize longitudinal data from multiple sources and supports evidence-based decision-making aligned with the latest AFib management and treatment guidelines.

- In June 2023, ICU Medical, Inc., a global leader in medical device innovation, announced the launch of the Level 1 H-1200 Fast Flow Fluid Warmer. This device efficiently warms blood, blood products, and IV solutions for patients facing blood loss, post-surgical hypothermia risk, or urological irrigation procedures.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the rapid infuser market based on the below-mentioned segments:

Global Rapid Infuser Market, By Product Type

- Handheld Devices

- Trolley Mounted Devices

Global Rapid Infuser Market, By Application

- Trauma & Emergency

- Anesthesia

- Surgical Care

- Labor & Delivery

- Intensive Care

- Others

Global Rapid Infuser Market, By End User

- Hospitals

- Ambulatory Surgery Centers

- Specialty Clinics

- Others

Global Rapid Infuser Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the rapid infuser market over the forecast period?The global rapid infuser market is projected to expand at a CAGR of 4.5% during the forecast period.

-

2. What is the market size of the rapid infuser market?The global rapid infuser market size is expected to grow from USD 150.5 million in 2024 to USD 244.3 million by 2035, at a CAGR of 4.5% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the rapid infuser market?North America is anticipated to hold the largest share of the rapid infuser market over the predicted timeframe.

-

4. What is the rapid infuser market?The rapid infuser market is a segment of the medical device industry focused on the sale of devices that administer large volumes of intravenous fluids, such as blood or solutions, quickly and efficiently during medical emergencies or surgeries.

-

5. Who are the top 10 companies operating in the global rapid infuser market?Becton Dickinson (BD), Fresenius Kabi, ICU Medical, Stryker Corporation, 3M Company, Smiths Medical, Teleflex Incorporated, GE HealthCare, Biegler GmbH, Belmont Medical Technologies, ZOLL Medical Corporation, Terumo Corporation.

-

6. What factors are driving the growth of the rapid infuser market?The growth of the rapid infuser market is driven by an increase in emergency and trauma cases, a rise in surgical procedures, and technological advancements in smart, automated systems.

-

7. What are the market trends in the rapid infuser market?Market trends in the rapid infuser market include the growing demand for more compact, portable, and user-friendly devices, the integration of wireless connectivity for remote monitoring, and the development of automated systems to reduce human error.

-

8. What are the main challenges restricting wider adoption of the rapid infuser market?The main challenges restricting wider adoption of the rapid infuser market include high costs, complex technology requiring extensive training, regulatory hurdles, and reliability and safety concerns.

Need help to buy this report?