Global Railway Wiring Harness Market Size, Share, and COVID-19 Impact Analysis, By Train (Metro, Light Train, High Speed Train/ Bullet Train), By Cable (Power Cable, Jumper Cable, Transmission Cable), By Material (Copper, Aluminum, Others), By Application (HVAC, Brake Harness, Lighting Harness, Traction System Harness, Infotainment), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Railway Wiring Harness Market Insights Forecasts to 2033

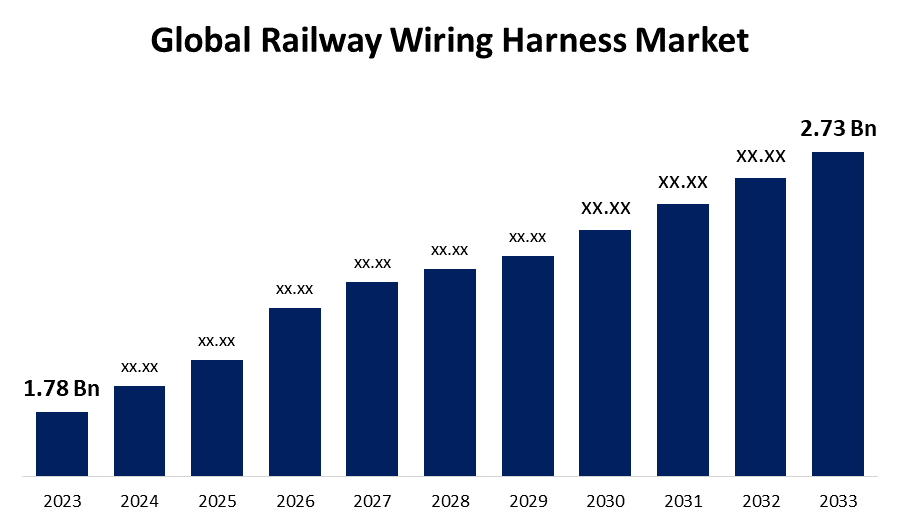

- The Global Railway Wiring Harness Market Size was Valued at USD 1.78 Billion in 2023

- The Market Size is Growing at a CAGR of 4.37% from 2023 to 2033

- The Worldwide Railway Wiring Harness Market Size is Expected to Reach USD 2.73 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Railway Wiring Harness Market Size is Anticipated to Exceed USD 2.73 Billion by 2033, Growing at a CAGR of 4.37% from 2023 to 2033.

Market Overview

Wiring harnesses are critical components of railway infrastructure because they are used to safely transport electric power and signals from the source to the desired system. This guarantees safe and efficient power transfer with low losses, making wiring harnesses an essential component of the railway network. The market is expected to increase significantly due to ongoing developments and quick advancements targeted at improving economies, energy efficiency, effectiveness, reliability, and the overall quality of railway infrastructure and transportation. Furthermore, the market is expected to be driven by ongoing advances in the electrical and mechanical systems used in the railway industry. For instance, in October 2023, UKB Electronics, India's top electrical and electronics manufacturer, got approval from the Research Designs and Standards Organization (RDSO) and railway coach manufacturers to sell many products to Indian Railways. Additionally, the company received orders from Indian Railways to provide wire harness systems for the manufacture of several types of passenger coaches. The growing popularity of self-driving trains, as well as the growing demand for energy-efficient wiring systems, will present several prospects for the market. Furthermore, the rising use of safety sensors, such as foggy invisibility circumstances and autonomous signal control systems, is likely to create various growth opportunities.

Report Coverage

This research report categorizes the market for the global railway wiring harness market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global railway wiring harness market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global railway wiring harness market.

Global Railway Wiring Harness Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.78 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.37% |

| 2033 Value Projection: | USD 2.73 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Train, By Cable, By Material, By Application, By Region |

| Companies covered:: | Furukawa, Leoni, Hitachi, Nexans, Prysmian, TE Connectivity, Samvardhana Motherson, General Cable, Taihan, NKT, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The railway wiring harness market is driven by the benefits provided by this technology, such as real-time monitoring, audibility, and information scalability. Urbanization and progressive economic growth around the world have resulted in greater investments in the rail and transit sectors to improve the quality of public transport. To boost overall rail connectivity, developing countries' governments are implementing new rail projects as well as updating and expanding their existing rail infrastructure. The adoption of high-speed rail (HSR) transport is rapidly expanding as ridership in HSR-operated countries grows to take advantage of improved transportation options. In addition, the industry is being driven by an increase in smart city projects.

Restraining Factors

Most trains operate in an open environment that is subject to weather fluctuations. Water leaks wear out cables and can cause interior corrosion, resulting in problems for numerous train systems. Wire harness corrosion might thus be a substantial impediment to the railway wire harness business.

Market Segmentation

The global railway wiring harness market share is classified into train, cable, material, and application.

- The high-speed train/ bullet train segment is expected to hold the largest share of the global Railway Wiring Harness market during the forecast period.

Based on the train, the global railway wiring harness market is categorized into metro, light train, and high-speed train/ bullet train. Among these, the high-speed train/ bullet train segment is expected to hold the largest share of the global railway wiring harness market during the forecast period. A growing focus on high-speed rail programmers, as well as government involvement in efforts aimed at enhancing transportation and modernizing railway infrastructure, have contributed to the segment's rise. Furthermore, the benefits provided by high-speed rail and bullet trains, such as efficient freight movement and the capacity to cover enormous geographic areas in a short period of time with accuracy, are likely to drive demand for these advanced rail systems even higher.

- The power cable segment is expected to grow at the fastest CAGR during the forecast period.

Based on the cable, the global railway wiring harness market is categorized into power cable, jumper cable, and transmission cable. Among these, the power cable segment is expected to grow at the fastest CAGR during the forecast period. Power cables are often used in railways to deliver power to the trains. Transmission cables are also commonly utilized to transmit data and information.

- The copper segment is expected to hold a significant share of the global railway wiring harness market during the forecast period.

Based on the material, the global railway wiring harness market is categorized into copper, aluminum and others. Among these, the copper segment is expected to hold a significant share of the global railway wiring harness market during the forecast period. Copper is commonly used in wiring harnesses because both metals are good conductors of electricity. As a result, it is commonly utilized for wiring electrical grids. Furthermore, the necessity for an energy-efficient wiring system is critical since it ensures effective electricity utilization and eliminates leaks and short circuits.

- The Infotainment segment is predicted to dominate the global railway wiring harness market during the forecast period.

Based on the application, the global railway wiring harness market is categorized into HVAC, brake harness, lighting harness, traction system harness, and Infotainment. Among these, the Infotainment segment is predicted to dominate the global railway wiring harness market during the forecast period. Train wire harness demand worldwide is anticipated to be driven by the growing need for high-tech infotainment systems like voice assistants, automated passenger info boards, and other people. The infotainment system can receive and analyze real-time information about rail links and business news while seamlessly integrating into each train's onboard screens, which are equipped with GPS systems. With such an expansion in electronics systems on board, the need for wiring harnesses is expected to rise dramatically throughout the projection period.

Regional Segment Analysis of the Global Railway Wiring Harness Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

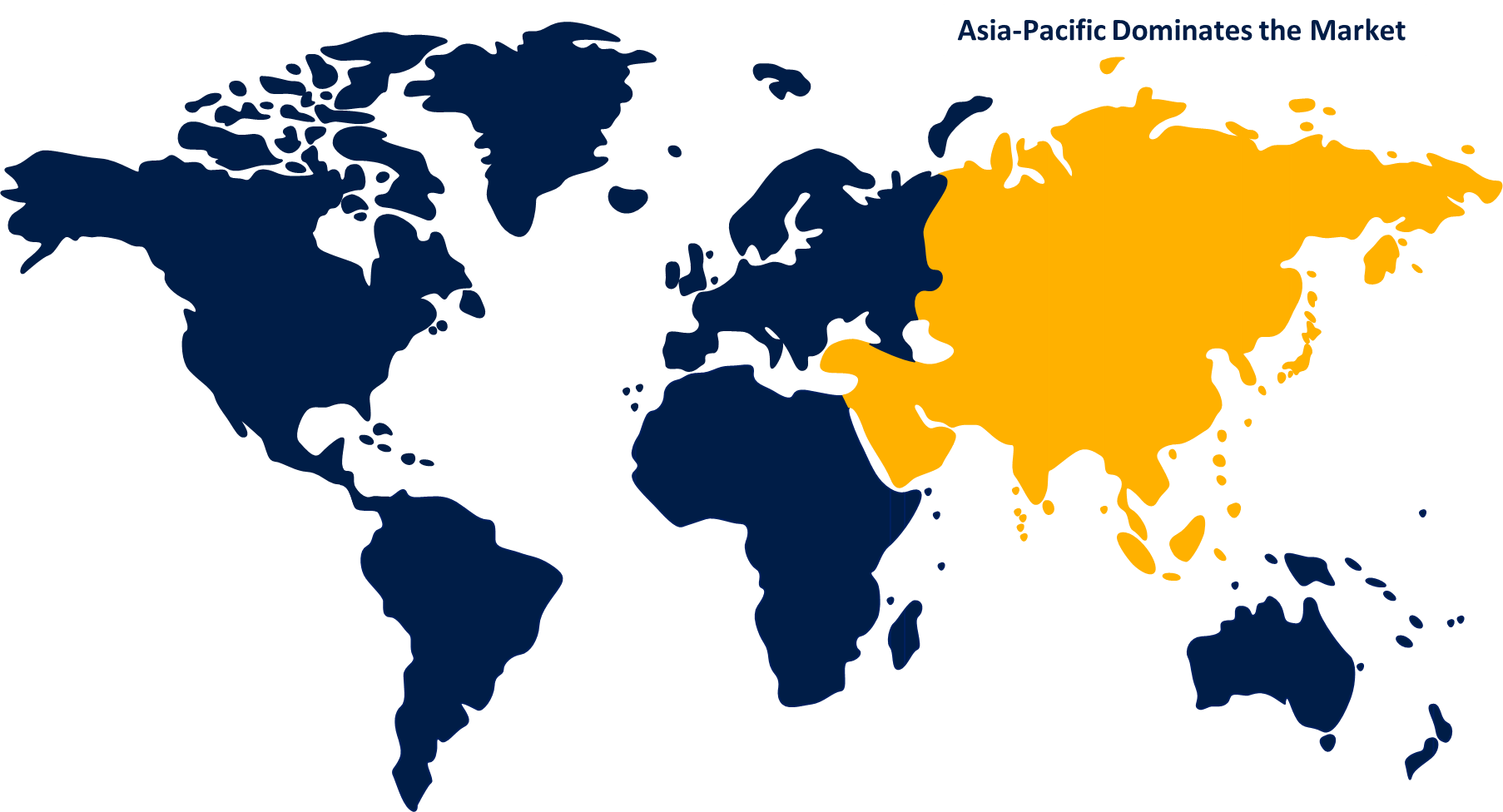

Asia Pacific is projected to hold the largest share of the global railway wiring harness market over the forecast period.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the global railway wiring harness market over the forecast period. Asia Pacific's growing markets will continue to grow significantly, particularly in the urban rail and mainline infrastructure construction sectors. Urbanization in countries such as China and India have fueled the region's industrial expansion. The majority of the population in these developing countries relies on public transport for their daily commute. The European Investment Bank (EIB) inked a USD 182 million financing deal with the Indian government for the second phase of the Pune Metro Rail project in Maharashtra in 2021 during a virtual signing ceremony. This project is projected to improve urban mobility for a broad population, particularly the working class. The Maharashtra Metro Rail Corporation will be the project's implementing agency. This has generated a business opportunity for the railway wire harness industry because these trains carry a variety of innovative equipment that require additional wiring

Europe is expected to grow at the fastest CAGR growth of the global railway wiring harness market during the forecast period. Europe is the leading manufacturer of rail equipment and high-tech rolling stock. The European railway sector has adopted technologically advanced rail systems and is improving its infrastructure and high-tech communication. All of these factors contribute to the growth of the railway wiring harness market in this region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global railway wiring harness market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Furukawa

- Leoni

- Hitachi

- Nexans

- Prysmian

- TE Connectivity

- Samvardhana Motherson

- General Cable

- Taihan

- NKT

- Others

Key Market Developments

- In October 2022, HUBER+SUHNER has bought Phoenix Dynamics. This strategic move intends to boost HUBER+SUHNER's position in the railway wire harness industry while also giving the company access to Phoenix Dynamics' expertise in custom cable assembly and design.

- In January 2022, NKT finalized the acquisition of Ventcroft, a strategic step to strengthen its position in fire-resistant power line technology. This acquisition allows NKT to efficiently address the growing need for fire-resistant power cables in the railway industry, further cementing its position in the market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global railway wiring harness market based on the below-mentioned segments:

Global Railway Wiring Harness Market, By Train

- Metro

- Light Train

- High Speed Train/ Bullet Train

Global Railway Wiring Harness Market, By Cable

- Power Cable

- Jumper Cable

- Transmission Cable

Global Railway Wiring Harness Market, By Material

- Copper

- Aluminum

- Others

Global Railway Wiring Harness Market, By Application

- HVAC

- Brake Harness

- Lighting Harness

- Traction System Harness

- Infotainment

Global Railway Wiring Harness Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global railway wiring harness market over the forecast period?The Global Railway Wiring Harness Market Size is Expected to Grow from USD 1.78 Billion in 2023 to USD 2.73 Billion by 2033, at a CAGR of 4.37% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global railway wiring harness market?Asia Pacific is projected to hold the largest share of the global railway wiring harness market over the forecast period.

-

3. Who are the top key players in the railway wiring harness market?Furukawa, Leoni, Hitachi, Nexans, Prysmian, TE Connectivity, Samvardhana Motherson, General Cable, Taihan, NKT, and others.

Need help to buy this report?