Global Radiotherapy Patient Positioning Devices Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Immobilization Systems, Positioning Accessories, Markers, and Others), By Application (Prostate Cancer, Breast Cancer, Lung Cancer, Head and Neck Cancer, and Others), By End-User (Hospitals, Cancer Research Institutes, Ambulatory Surgical Centers, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: HealthcareGlobal Radiotherapy Patient Positioning Devices Market Insights Forecasts to 2035

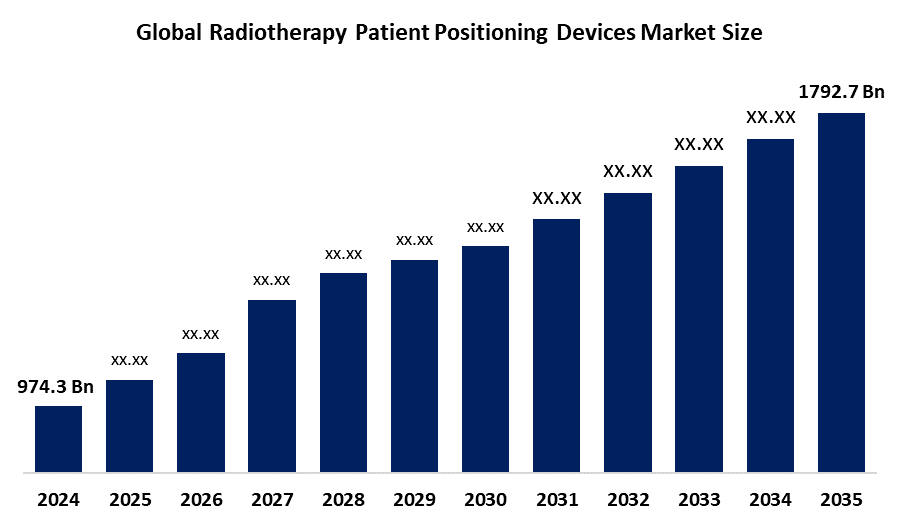

- The Global Radiotherapy Patient Positioning Devices Market Size Was Estimated at USD 974.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.7% from 2025 to 2035

- The Worldwide Radiotherapy Patient Positioning Devices Market Size is Expected to Reach USD 1792.7 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting,The Global radiotherapy patient positioning devices market size was worth around USD 974.3 Million in 2024 and is predicted to Grow to around USD 1792.7 Million by 2035 with a compound annual growth rate (CAGR) of 5.7% from 2025 to 2035. The radiotherapy patient positioning devices market is predominantly growing internationally owing to the rising number of cancer cases and existing advances in technology, which continue to drive the need for precise delivery.

Market Overview

The radiotherapy patient positioning devices market refers to the global market for the range of devices that are used for patient positioning in radiotherapy treatment. The devices are highly advanced and are used for accurately positioning patients undergoing radiotherapy so that the rays are accurately directed at the targeted site without any damage caused to the adjacent body parts. The drivers for the market are the growing number of cases of cancer across the world, the rising use of advanced radiotherapy, and various advancements being introduced, which improve the comfort and positioning capabilities of the patients.

In May 2025, the UK Department of Health announced plans to invest £70 million in installing new, advanced LINAC machines for radiotherapy across 28 hospitals. The move is intended to modernize the outdated equipment, promote high-precision treatments, increase the scope of treatments offered to patients, and encourage the widespread use of innovative patient positioning solutions. Untapped opportunities exist within the development of innovative AI-integrated and affordable positioning solutions, most notably within emerging markets where cases of cancer are rising. The major players within this industry, such as Elekta AB, Varian Medical Systems, CDR Systems, and CIVCO Radiotherapy, receive support from governments and investments within the field of oncology to promote continuous innovation within the field of advanced patient positioning solutions.

Report Coverage

This research report categorizes the radiotherapy patient positioning devices market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the radiotherapy patient positioning devices market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the radiotherapy patient positioning devices market.

Global Radiotherapy Patient Positioning Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 974.3 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.7% |

| 2035 Value Projection: | USD 1792.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Application |

| Companies covered:: | CIVCO Radiotherapy, Varian Medical Systems, Elekta AB, Bionix Radiation Therapy, Orfit Industries, CDR Systems, Brainlab, Qfix, MacroMedics, IZI Medical Products, Medtronic plc, GE Healthcare, Klarity Medical Products, Panacea Medical Technologies, Others, and key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing incidence of cancer, the demand for accurate and effective radiation therapy, the adoption of advanced radiation therapy technologies such as IMRT and IGRT, and advancements in technologies to provide greater accuracy, repeatability, and patient convenience are pegged as the factors driving the global radiotherapy patient positioning systems market. The increasing global geriatric population, who become vulnerable to cancer, also drives the market. Furthermore, development in emerging nations with improved healthcare infrastructure, awareness about early cancer detection, and investment in cancer-related facilities and radiation therapy equipment by governments, as well as private investors, are also boosting the adoption of patient positioning systems.

Restraining Factors

The radiotherapy positioning devices market, globally, is faced with challenges of high technology cost, unavailability in low- and middle-income nations, and a lack of skilled professionals to operate the devices. The cost factor, resistance to technology adoption, and reimbursements are some factors that slow down market growth.

Market Segmentation

The radiotherapy patient positioning devices market share is classified into product type, application, and end-user.

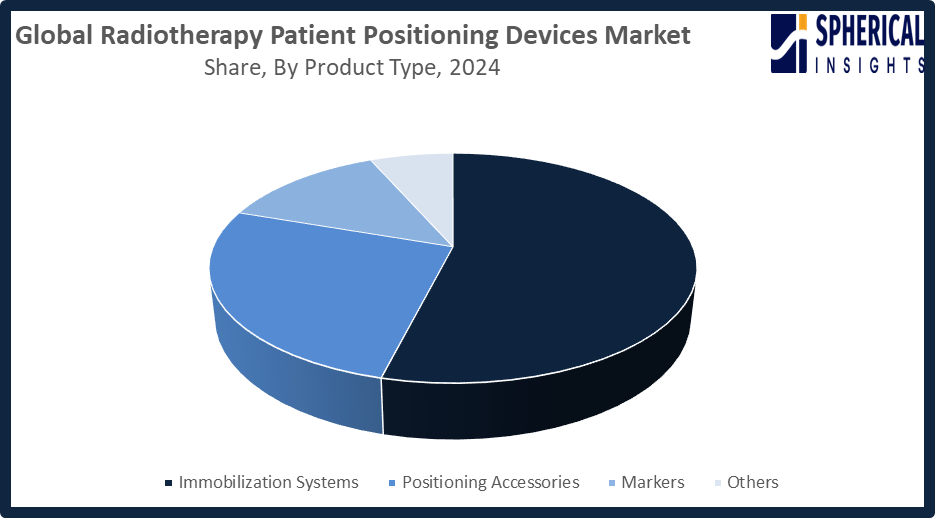

- The immobilization systems segment dominated the market in 2024, approximately 54% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the radiotherapy patient positioning devices market is divided into immobilization systems, positioning accessories, markers, and others. Among these, the immobilization systems segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Immobilization systems are required for maintaining patients in a fixed and precise position with reduced movement during radiotherapy, thus increasing the demand for such systems as radiotherapy technology advances. The current advancements in radiotherapy technology mean that efficient systems for immobilizing the body are needed, and this has become one of the principal drivers for the growth of the respective market.

Get more details on this report -

- The breast cancer segment accounted for the largest share in 2024, approximately 30% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the radiotherapy patient positioning devices market is divided into prostate cancer, breast cancer, lung cancer, head and neck cancer, and others. Among these, the breast cancer segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. A primary application area of the technology is in breast cancer patients' positioning systems, where accuracy is one of the factors required for targeted treatment to prevent the heart and lungs from being damaged. Increased cancer cases, early cancer detection campaigns, and the implementation of deep inspiration breath-hold technology contribute to the rising demand. It is important to integrate the latest positioning technology to improve the accuracy of cancer radiotherapy.

- The hospitals segment accounted for the highest market revenue in 2024, approximately 58% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-user, the radiotherapy patient positioning devices market is divided into hospitals, cancer research institutes, ambulatory surgical centers, and others. Among these, the hospitals segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The hospital category leads due to their integrated cancer treatment and technology access. Increasing incidence and the need for better cancer treatment are also driving spending on modernized radiotherapy equipment, such as devices for patient positioning. The advent of personalized medicine is significantly fueling the adoption of precise and flexible positioning systems, ensuring robust growth in the market.

Regional Segment Analysis of the Radiotherapy Patient Positioning Devices Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the radiotherapy patient positioning devices market over the predicted timeframe.

North America is anticipated to hold the largest share of the radiotherapy patient positioning devices market over the predicted timeframe. The market for radiotherapy patient positioning devices in North America is projected to have the 32% share due to the presence of developed healthcare infrastructure and a large incidence of cancer, along with the adoption of advanced radiotherapy technology such as IMRT and IGRT in this region. The factors that drive the growth of this market are large investments by governments and the private sector for cancer treatments, along with proper reimbursement policies for cancer treatments. The United States has the largest market for radiotherapy patient positioning devices because of advancements in technology and spending by the market leaders in this country. In March 2025, the US Congress passed the ROCR Act of 2025 to modernize Medicare radiation oncology payments by promoting value-based care, protecting access, and stimulating investment in innovative radiation therapies.

Asia Pacific is expected to grow at a rapid CAGR in the radiotherapy patient positioning devices market during the forecast period. The Asia Pacific market is expected to have 28% market share of the radiotherapy patient positioning devices market, with the increasing incidence of cancer, development of healthcare infrastructure, and adoption of advanced radiotherapy technologies. China and India head the Asia Pacific market due to their huge populations and investment in advanced cancer facilities. In February 2025, the Indian Union Budget 2025-26 focused on cancer care with the opening of 200 day-care centers, development in radiotherapy facilities, and waiver of customs duties, making it easy to adopt these positioning devices.

The European radiotherapy patient positioning devices market, driven by advanced healthcare infrastructure, increasing cases of cancer, and the adoption of advanced radiotherapy technology, remains fueled by strong government support and public-private collaborations in Europe. Germany leads this industry with its established healthcare infrastructure and strong investment in oncology equipment and precise treatments. In May 2025, Horizon Europe supported joint research efforts under the EU Mission on Cancer, advancing radiotherapy technology and improving cancer treatment capacity in Europe.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the radiotherapy patient positioning devices market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CIVCO Radiotherapy

- Varian Medical Systems

- Elekta AB

- Bionix Radiation Therapy

- Orfit Industries

- CDR Systems

- Brainlab

- Qfix

- MacroMedics

- IZI Medical Products

- Medtronic plc

- GE Healthcare

- Klarity Medical Products

- Panacea Medical Technologies

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, CQ Medical acquired Bionix’s Radiation Therapy business unit, expanding its patient positioning and marking product portfolio. The acquisition strengthens CQ Medical’s commitment to precision radiotherapy, while Bionix continues independently with its Ambulatory Care unit, specializing in Ear, Nose, and Throat solutions from Maumee, Ohio.

- In June 2025, the IAEA-MedAccess Partnership launched innovative financing for radiation medicine in low- and middle-income countries, reducing barriers to radiotherapy equipment acquisition and promoting sustainable procurement models, thereby enhancing access to advanced treatment technologies, including essential patient positioning devices.

- In May 2025, GE HealthCare announced plans to expand its radiation oncology portfolio and introduced the AI-enabled MR Contour DL at the ESTRO 2025 Congress in Vienna. The company also showcased Intelligent Radiation Therapy (iRT) software, streamlining workflows for faster, more precise radiation treatment.

- In September 2024, CQ Medical, formed from CIVCO Radiotherapy and Qfix, announced it will showcase its enhanced patient radiotherapy positioning products and live demonstrations at the 66th ASTRO Annual Meeting in Washington, D.C., highlighting the brand’s focus on intelligence, empathy, and innovative healthcare solutions.

- In May 2023, Brainlab launched ExacTrac Dynamic Surface, a single-camera system for surface-guided radiation therapy (SGRT). It enables continuous patient monitoring during breath-hold treatments and standardizes radiotherapy workflows. The product was unveiled at the ESTRO Annual Meeting 2023 in Vienna, showcasing advanced patient positioning and monitoring solutions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the radiotherapy patient positioning devices market based on the below-mentioned segments:

Global Radiotherapy Patient Positioning Devices Market, By Product Type

- Immobilization Systems

- Positioning Accessories

- Markers

- Others

Global Radiotherapy Patient Positioning Devices Market, By Application

- Prostate Cancer

- Breast Cancer

- Lung Cancer

- Head and Neck Cancer

- Others

Global Radiotherapy Patient Positioning Devices Market, By End-User

- Hospitals

- Cancer Research Institutes

- Ambulatory Surgical Centers

- Others

Global Radiotherapy Patient Positioning Devices Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the radiotherapy patient positioning devices market over the forecast period?The global radiotherapy patient positioning devices market is projected to expand at a CAGR of 5.7% during the forecast period.

-

2.What is the radiotherapy patient positioning devices market?The radiotherapy patient positioning devices market includes equipment designed to accurately align and immobilize patients for precise, effective radiation cancer treatments.

-

3.What is the market size of the radiotherapy patient positioning devices market?The global radiotherapy patient positioning devices market size is expected to grow from USD 974.3 million in 2024 to USD 1792.7 million by 2035, at a CAGR of 5.7% during the forecast period 2025-2035.

-

4.Which region holds the largest share of the radiotherapy patient positioning devices market?North America is anticipated to hold the largest share of the radiotherapy patient positioning devices market over the predicted timeframe.

-

5.Who are the top 10 companies operating in the global radiotherapy patient positioning devices market?CIVCO Radiotherapy, Varian Medical Systems, Elekta AB, Bionix Radiation Therapy, Orfit Industries, CDR Systems, Brainlab, Qfix, MacroMedics, IZI Medical Products, and Others.

-

6.What factors are driving the growth of the radiotherapy patient positioning devices market?The market is driven by rising cancer prevalence, increasing adoption of advanced radiotherapy techniques, technological innovations enhancing precision and comfort, growing healthcare infrastructure, and government initiatives supporting oncology care worldwide.

-

7.What are the market trends in the radiotherapy patient positioning devices market? KKey trends include the adoption of advanced immobilization systems, integration of AI and imaging technologies, personalized positioning solutions, and growing demand for precision radiotherapy treatments.

-

8.What are the main challenges restricting the wider adoption of the radiotherapy patient positioning devices market?The main challenges restricting the wider adoption of the radiotherapy patient positioning devices market include high cost and reimbursement issues, a shortage of skilled professionals, and various workflow and integration challenges.

Need help to buy this report?