Global Radiology Information Systems Market Size, Share, and COVID-19 Impact Analysis, By Product (Integrated RIS and Standalone RIS), By Deployment Mode (Web-based, Cloud-based, and On-premise), By End Use (Hospitals & Clinics, Outpatient Department (OPD) Clinics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Radiology Information Systems Market Insights Forecasts to 2035

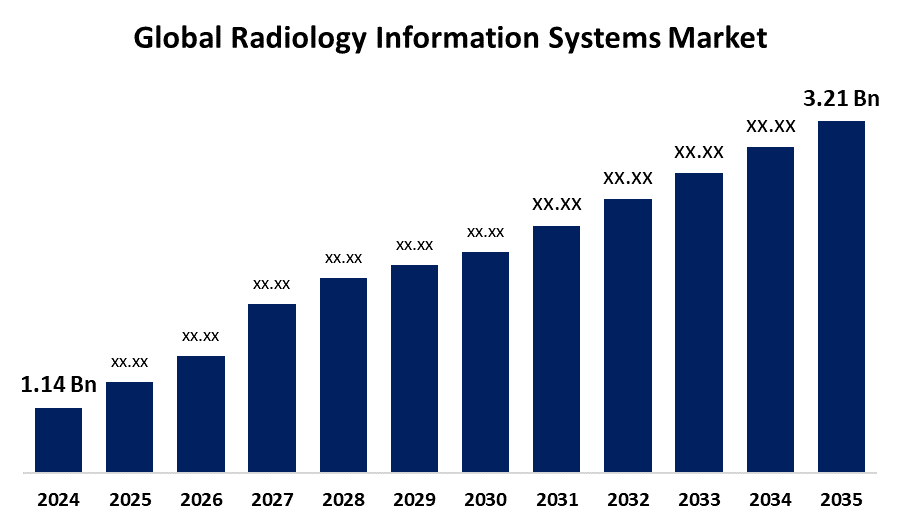

- The Global Radiology Information Systems Market Size Was Estimated at USD 1.14 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.87% from 2025 to 2035

- The Worldwide Radiology Information Systems Market Size is Expected to Reach USD 3.21 Billion by 2035

- Asia Pacific is Expected to Grow the Fastest during the forecast period.

Get more details on this report -

The Global Radiology Information Systems Market Size was worth around USD 1.14 Billion in 2024 and is predicted to grow to around USD 3.21 Billion by 2035 with a compound annual growth rate (CAGR) of 9.87% from 2025 to 2035. The market growth is boosted by the advancements in RIS, driven by AI and cloud technologies are transforming radiology with faster, more accurate diagnoses. These innovations are vital for enhancing patient care and streamlining healthcare operations.

Market Overview

The radiology information systems market refers to a specialized, networked software platform for managing patient data and medical imaging procedures in the healthcare industry. Its main functions include tracking orders for radiological imaging, scheduling, reporting, billing, and storing diagnostic imaging patient records.

The incorporation of cutting-edge technologies like cloud computing and artificial intelligence (AI), radiology information systems is developing quickly. Cloud-based RIS provides better scalability, data accessibility, and remote collaboration, while AI improves diagnostic accuracy and automates processes like image analysis and report production. Better clinical results and more efficient workflow are made possible by the rising emphasis on interoperability, which enables smooth interaction with PACS, EHRs, and HIS. Furthermore, RIS is being utilized more and more for predictive analytics, which helps with early disease detection and individualized treatment planning. These developments are transforming RIS into an essential instrument for more intelligent, expedient, and patient-focused healthcare delivery.

Report Coverage

This research report categorizes the radiology information systems market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the radiology information systems market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the radiology information systems market.

Radiology Information Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.14 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 9.87% |

| 2035 Value Projection: | USD 3.21 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 291 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product, By Deployment Mode, By End Use and By Region |

| Companies covered:: | DeepHealth, Veradigm LLC, Epic Systems Corporation, Siemens Healthineers AG, General Electric Company, Pro Medicus, Ltd., IBM, Oracle, Koninklijke Philips N.V., MedInformatix, Inc., McKesson Corporation, Fischer Medical, EIZO Corporation, Esaote SPA, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The increasing need for improved medical imaging is being propelled by an increase in the number of instances of chronic diseases and the growth of radiology practices. Care coordination and operational efficiency are being improved by cloud-based technologies and AI integration. The industry's transition to unified, interoperable technologies is best illustrated by innovations such as VRIS and the Exa Platform. Better patient outcomes and quicker, more precise diagnoses are made possible by these advancements. All things considered, RIS is still essential to updating and simplifying healthcare delivery.

Restraining Factors

The market growth is hindered by the expense of setting up and maintaining RIS, particularly for smaller healthcare facilities. There is additional operational and financial hardship when moving away from legacy systems. Government programs and flexible pricing are examples of supportive measures that are necessary to promote wider acceptance and growth.

Market Segmentation

The Radiology Information Systems Market Share is classified into product, deployment mode, and end use.

- The integrated RIS segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product, the radiology information systems market is classified into integrated RIS and standalone RIS. Among these, the integrated RIS segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the use of integrated RIS-PACS solutions in radiology departments, which has been fueled by the increasing demand for efficient workflows. This cohesive strategy improves data management and decreases manual coordination, which increases efficiency. Clinical workflows across sites are guaranteed to run smoothly thanks to integration with EHRs. These solutions therefore promote improved patient care, increase productivity, and reduce errors.

- The web-based segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the deployment mode, the radiology information systems market is divided into web-based, cloud-based, and on-premise. Among these, the web-based segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by the unmatched flexibility provided by web-based RIS, which permits remote access and quicker reaction times for better patient care. It is a more affordable option than traditional systems due to its lower initial costs and low hardware needs. Additional value is added by improved security and simple updates. Web-based RIS is a clever, scalable solution for contemporary healthcare institutions because of these advantages.

- The hospitals & clinics segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end use, the radiology information systems market is classified into hospitals & clinics, outpatient department (OPD) clinics, and others. Among these, the hospitals & clinics segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the use of integrated RIS-PACS solutions in radiology departments, fueled by the growing need for better patient care and efficient processes. Clinics and hospitals are always under pressure to improve diagnostic precision while cutting down on the time and expense of radiological treatments. By putting RIS into place, these organizations may better organize visits, manage patient data and imaging files, and enhance communication between radiologists and other medical specialists. The integration of all hospital databases that link all of the equipment and systems in a care setting is done by large healthcare IT companies.

Regional Segment Analysis of the Radiology Information Systems Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the radiology information systems market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the radiology information systems market over the predicted timeframe. The regional growth can be attributed to the significant improvements in medical imaging operations, which were brought about by the developments in RIS, the rise in radiologists, and the introduction of new software systems by existing providers. Better patient compliance and regional expansion have resulted from the process's simplification and simplification with the introduction of a comprehensive RIS with integrated PACS.

Asia Pacific is expected to grow at a rapid CAGR in the radiology information systems market during the forecast period. The region's growth is being driven in large part by the expansion of healthcare infrastructure, especially in emerging economies like Indonesia, the Philippines, and India, as well as rising investments in healthcare IT solutions to enhance the quality of patient care. The requirement to effectively handle the increasing amount of medical data and images is another factor driving the demand for digital and integrated RIS.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the radiology information systems market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DeepHealth

- Veradigm LLC

- Epic Systems Corporation

- Siemens Healthineers AG

- General Electric Company

- Pro Medicus, Ltd.

- IBM

- Oracle

- Koninklijke Philips N.V.

- MedInformatix, Inc.

- McKesson Corporation

- Fischer Medical

- EIZO Corporation

- Esaote SPA

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2024, DeepHealth, a RadNet, Inc. subsidiary that provides AI-powered health and radiology informatics, opened a new office in Bengaluru as part of its expansion into the Indian market. This technology cluster creates creative developments and supports DeepHealth's ambition to improve healthcare delivery.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the radiology information systems market based on the below-mentioned segments:

Global Radiology Information Systems Market, By Product

- Integrated RIS

- Standalone RIS

Global Radiology Information Systems Market, By Deployment Mode

- Web-based

- Cloud-based

- On-premise

Global Radiology Information Systems Market, By End Use

- Hospitals & Clinics

- Outpatient Department (OPD) Clinics

- Others

Global Radiology Information Systems Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the radiology information systems market over the forecast period?The global radiology information systems market is projected to expand at a CAGR of 9.87% during the forecast period.

-

2. What is the market size of the radiology information systems market?The global radiology information systems market size is expected to grow from USD 1.14 Billion in 2024 to USD 3.21 Billion by 2035, at a CAGR of 9.87% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the radiology information systems market?North America is anticipated to hold the largest share of the radiology information systems market over the predicted timeframe.

Need help to buy this report?