Global Quicklime Market Size, Share, and COVID-19 Impact Analysis, By Product Type (High Calcium Quicklime, Dead-burned Magnesite, Hydrated Lime, and Quicklime Powder), By Application (Steel Manufacturing, Construction, Water Treatment, Chemical Manufacturing, and Glass Production), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Quicklime Market Insights Forecasts to 2035

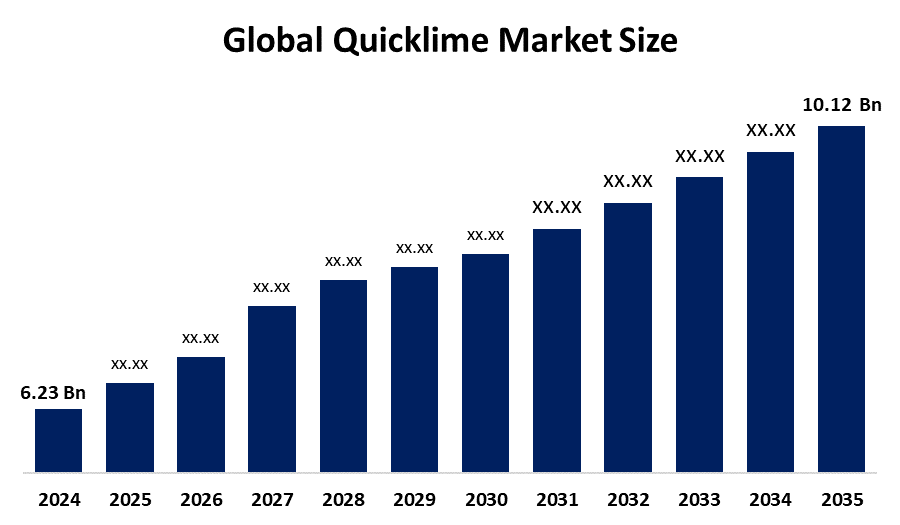

- The Global Quicklime Market Size Was Estimated at USD 6.23 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.51% from 2025 to 2035

- The Worldwide Quicklime Market Size is Expected to Reach USD 10.12 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Quicklime Market size was worth around USD 6.23 Billion in 2024, Growing to 6.51 Billion in 2025, and is predicted to grow to around USD 10.12 billion by 2035 with a compound annual growth rate (CAGR) of 4.51% from 2025 to 2035. The quicklime market presents opportunities due to the growing demand in wastewater treatment, steel production, construction, and environmental remediation. This demand is fueled by industrial expansion, infrastructure growth, and sustainability initiatives that support environmentally friendly materials and effective chemical processing applications globally.

Global Quicklime Market Forecast and Revenue Size

- 2024 Market Size: USD 6.23 Billion

- 2025 Market Size: USD 6.51 Billion

- 2035 Projected Market Size: USD 10.12 Billion

- CAGR (2025-2035): 4.51%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Market Overview

The manufacture, distribution, and consumption of quicklime (calcium oxide, CaO), a versatile alkaline chemical derived from calcining limestone, are all included in the quicklime market. Quicklime is a white, caustic, and alkaline material that is mostly produced by calcining limestone (calcium carbonate). Numerous end-use industries, including construction, metallurgy, chemical manufacture, water and wastewater treatment, and agriculture, are included in this market. Quicklime is used extensively in the metallurgical sector as a fluxing agent in the manufacturing of non-ferrous metals and in the construction industry for soil stabilization and cement. India’s Ministry of Mines launched the Sustainable Lime Production Incentives under the Atmanirbhar Bharat scheme, allocating INR 5 billion for low-emission kiln retrofits to achieve 2070 net-zero goals.

The demand for quicklime in construction and environmental applications is rising, and enterprises are looking for sustainable ways to comply with regulations, which seems to be driving the market's growth. The market for quicklime is expanding significantly due to rising demand in a number of industries. The growing need for quicklime in the steel industry, construction projects, and environmental uses, including flue gas treatment are important market driver.

Key Market Insights

- North America is expected to account for the largest share in the quicklime market during the forecast period.

- In terms of product type, the high calcium quicklime segment is projected to lead the quicklime market throughout the forecast period

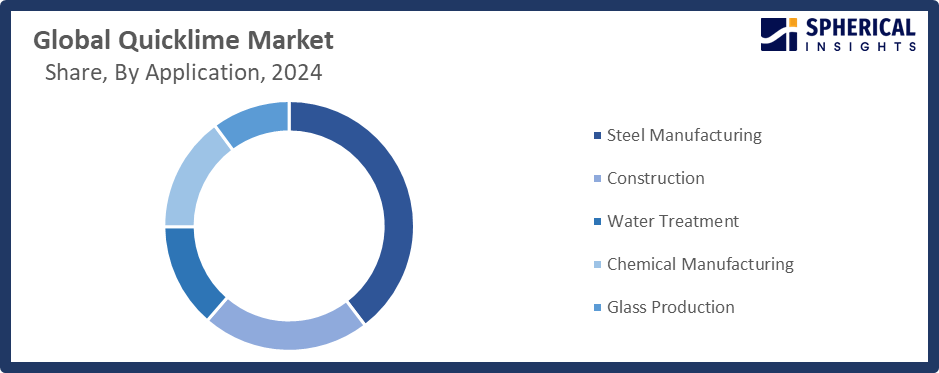

- In terms of application, the steel manufacturing segment captured the largest portion of the market

Quicklime Market Trends

- The increasing use of pH control and soil conditioning in agriculture.

- The growing use of desulfurization and refining in the metallurgical and steel sectors.

- The increasing use of energy-efficient and environmentally beneficial production technology, like low-emission kilns.

- The expansion of environmental uses, such as flue gas desulfurization and wastewater treatment.

- Growing urbanization and cement output are driving up demand for infrastructure and building.

- The use of lime byproducts in various industries and the circular economy are receiving more attention.

Report Coverage

This research report categorizes the quicklime market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the quicklime market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the quicklime market.

Driving factors:

The expanding steel manufacturing industry, which uses quicklime for pH control and soil amendment, has an important effect on the global quicklime market. The relationship between quicklime use and steel manufacturing emphasizes the material's critical role in promoting sustainable farming methods, which helps the market grow. The increasing use of precipitated calcium carbonate and the widespread use of quicklime in the building and construction sector are the main factors driving the quicklime market's expansion. The building industry is the main driver of the significant increase in demand for quicklime in the global market.

Restraining Factors:

The quicklime market is restricted by strict environmental regulations, high energy consumption during production, transportation issues, and health risks related to handling caustic materials. All of these factors raise operating costs and restrict market expansion across different industrial sectors.

Market Segmentation

The global quicklime market is divided into product type and application.

Global Quicklime Market, By Product Type:

The high calcium quicklime segment led the quicklime market, generating the largest revenue share. High-calcium quicklime is a vital component for processes including soil stabilization, water treatment, and flue-gas desulfurization due to its excellent chemical qualities, high reactivity, and affordability. Due to its exceptional quality and reactivity, High Calcium Quicklime is widely used in the steel and construction industries, which fuels market demand.

The dead-burned magnesite segment in the quicklime market is expected to grow at the fastest CAGR over the forecast period. The expansion of the dead-burned magnesite market is fueled by its specific uses in metallurgical operations, high-temperature industrial processes, and refractory materials where improved durability and thermal stability are needed.

Global Quicklime Market, By Application:

The steel manufacturing segment held the largest market share in the quicklime market. Quicklime's significance in the steel industry is being driven by the need for it in operations including fluxing, purification, and slag formation. Quicklime's crucial function in steel production processes, such as slag formation, impurity removal, and fluxing activities, is the main reason for the steel manufacturing industry.

Get more details on this report -

The construction segment in the quicklime market is expected to grow at the fastest CAGR over the forecast period. Rapid urbanization, infrastructure expansion, and rising investments in residential and commercial projects in emerging nations are the main drivers of the construction sector. Quicklime's use in the construction industry is increased by its ability to stabilize soil, produce cement, and treat concrete.

Regional Segment Analysis of the Global Quicklime Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America Quicklime Market Trends

North America is propelled by robust infrastructural development and high industrial demand. The region's well-established metallurgical and construction sectors, especially in the US and Canada, greatly increase quicklime demand for uses such as soil stabilization, cement production, and steel making. Furthermore, quicklime has been used more frequently in environmental remediation procedures due to the rising focus on environmental sustainability and the tighter laws governing wastewater treatment and air pollution control. The region's market expansion is further boosted by the existence of cutting-edge production facilities, technical advancements, and easily accessible raw resources. In March 2025, the U.S. Department of Energy unveiled the Lime Decarbonization Initiative under the Inflation Reduction Act, allocating USD 150 billion for carbon capture retrofits in lime kilns, enhancing production efficiency and compliance with the EPA's 2030 emissions targets.

U.S Quicklime Market Trends

The market for quicklime in the United States is expanding steadily due to ongoing demand from industrial and environmental applications. Quicklime's vital qualities are still needed by important end-use industries like chemical processing, steel manufacturing, and building. Market growth is also being aided by environmental laws and programs, including flue-gas desulfurization and water treatment. Even while traditional demand has leveled off, there is still potential due to advancements in production efficiency and new uses.

Canada Quicklime Market Trends

The usage of quicklime in a variety of industries, including mining, pulp and paper, and water treatment, is driving the market's modest increasing pace in Canada. Environmental and industrial applications are driving demand, especially as businesses deal with wastewater treatment and tailings handling. A robust baseline is influenced by stability in conventional building and metallurgical applications. Global price competitiveness and shifting export performance continue to put pressure on businesses.

Asia Pacific Quicklime Market Trends

The main factors driving the Asia-Pacific area are growing infrastructure developments, urbanization, and industrialization. Due to increased demand from the building, metallurgy, and chemical manufacturing industries, nations like China, India, Japan, and South Korea are significant contributors to the expansion of the regional market. Quicklime demand is greatly increased by rising steel and cement output, as well as extensive government infrastructure building projects. In June 2025, China's National Development and Reform Commission announced the Green Lime Manufacturing Protocol, which increases compliance in Hebei's steel belt by requiring carbon capture in 30% of plants and providing CNY 8 billion for research and development.

China Quicklime Market Trends

Increased demand from industries including steel production, infrastructure construction, and environmental cleanup is driving the continuous growth of the Chinese quicklime market. China is positioned more as a growing exporter than a major importer because domestic output is in line with domestic consumption. Quicklime's use in environmental applications is increasing due to increased focus on water treatment, soil remediation, and industrial emission controls.

Japan Quicklime Market Trends

The market for quicklime in Japan is expected to rise modestly, supported by a moderate increase in local production and consumption. Demand from the metallurgical, water-treatment, and infrastructure sectors is likely to generate additional improvements even though volumes are still relatively constant. While exports are still muted, imports have increased following a period of contraction. In order to meet Japan's stricter environmental regulations, producers are concentrating more on energy efficiency and regulatory compliance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global Quicklime market, along with a comparative evaluation primarily based on their Product Type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes Product Type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players in The Quicklime Market Include

- PPC Ltd.

- Graymont

- Nordkalk

- Carmeuse

- Omya AG

- ARA Chemie

- Lhoist Group

- Nirma Limited

- Cornelissen Group

- Illinois Lime Company

- Matsusaka Limestone Co.

- Mississippi Lime Company

- United States Lime and Minerals

- Others

Recent Development

- In July 2025, Pacific Lime and Cement Limited, formerly Mayur Resources Limited, launched its Quicklime business in Western Australia, delivering a high-quality, cost-effective solution for mining customers, supported by a complete supply chain extending directly to the mine gate.

- In July 2021, Lhoist North America and Maerz Ofenbau AG launched a new lime kiln in Montevallo, USA. The company also expanded dolomitic quicklime production in Marble Falls and New Braunfels, Texas, enabling access to previously untapped market areas.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the quicklime market based on the following segments:

Global Quicklime Market, By Product Type

- High Calcium Quicklime

- Dead-burned Magnesite

- Hydrated Lime

- Quicklime Powder

Global Quicklime Market, By Application

- Steel Manufacturing

- Construction

- Water Treatment

- Chemical Manufacturing

- Glass Production

Global Quicklime Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the quicklime market over the forecast period?The global quicklime market is projected to expand at a CAGR of 4.51% during the forecast period.

-

2. What is the market size of the quicklime market?The global quicklime market size is expected to grow from USD 6.23 billion in 2024 to USD 10.12 billion by 2035, at a CAGR 4.51% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the quicklime market?North America is anticipated to hold the largest share of the quicklime market over the predicted timeframe.

-

4. Who are the top companies operating in the global quicklime market?PPC Ltd., Graymont, Nordkalk, Carmeuse, Omya AG, ARA Chemie, Lhoist Group, Nirma Limited, Cornelissen Group, Illinois Lime Company, Matsusaka Limestone Co., Mississippi Lime Company, United States Lime and Minerals, and others.

-

5. What factors are driving the growth of the quicklime market?The quicklime market is driven by rising demand in steel, construction, chemical processing, and environmental applications, alongside infrastructure development, regulatory compliance, and increasing focus on sustainable industrial processes.

-

6. What are market trends in the quicklime market?The market trends include technological advancements in production, growing use in water treatment and emission control, increasing industrial consolidation, and rising demand in emerging economies for infrastructure and metallurgical applications.

-

7. What are the main challenges restricting wider adoption of the quicklime market?The market expansion is constrained by high production costs, environmental regulations, limited raw material availability in certain regions, and competition from alternative materials and more energy-efficient industrial solutions.

Need help to buy this report?