Global Proteomic Biomarker Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Reagents, Instruments, and Services), By Application (Drug Discovery, Diagnostics, Personalized Medicine, Clinical Research, and Others), By End-User (Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Diagnostic Laboratories, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Proteomic Biomarker Market Size Insights Forecasts to 2035

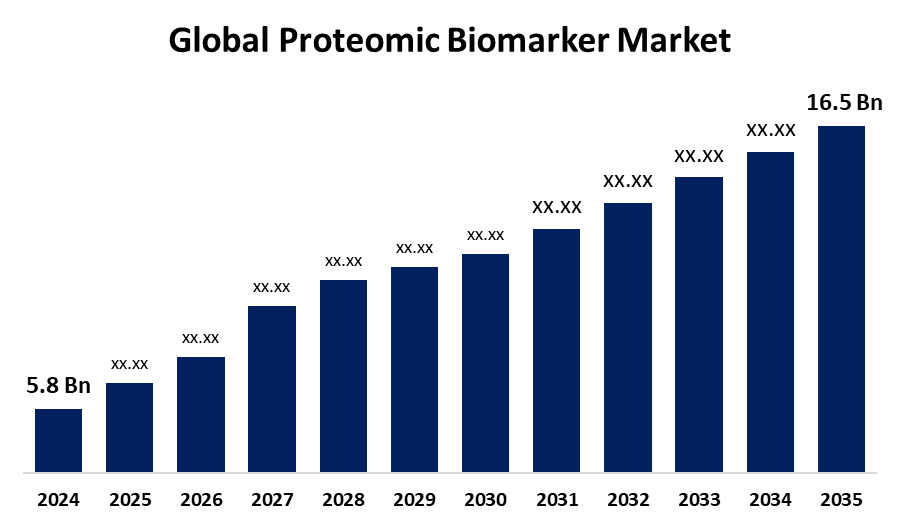

- The Global Proteomic Biomarker Market Size Was Estimated at USD 5.8 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.97% from 2025 to 2035

- The Worldwide Proteomic Biomarker Market Size is Expected to Reach USD 16.5 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Proteomic Biomarker Market Size was worth around USD 5.8 billion in 2024 and is predicted to grow to around USD 16.5 billion by 2035 with a compound annual growth rate (CAGR) of 9.97% from 2025 to 2035. The increasing prevalence of chronic diseases, demand for personalized medicine, and proteomic technological advancements are driving the proteomic biomarker market globally.

Market Overview

The proteomic biomarker market is the industry that emphasizes the identification, development, and use of protein-based biomarkers for applications, including disease diagnostics, drug discovery, and personalized medicine. Proteomic biomarker provides the key information about the dynamic nature of proteins, including their functionality, post-translational modifications, interaction with other biological molecules, and response to environmental factors. With the continuous evolution of proteomics in oncology biomarker discovery, technologies including MS and antibody- and affinity-based methods have been developed for driving the development of biomarkers that can be used for early detection of cancer and personalized therapeutic strategies. Implementation of targeted therapies supporting individualized medicine through biomarker discovery, identification of drug targets, and follow-up therapy responses. Further, the integration of AI and machine learning is revolutionizing the proteomic biomarker landscape and bringing breakthroughs in identifying and validating biomarkers, thereby driving the development of new diagnostic tools and therapies.

Report Coverage

This research report categorizes the proteomic biomarker market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the proteomic biomarker market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the proteomic biomarker market.

Global Proteomic Biomarker Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.8 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.97% |

| 2035 Value Projection: | USD 16.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 298 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Product Type, By Application, By End-User, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Thermo Fisher Scientific Inc., Agilent Technologies Inc., Bio-Rad Laboratories, Inc., Danaher Corporation, Waters Corporation, Bruker Corporation, GE Healthcare, PerkinElmer, Inc., Merck KGaA, Shimadzu Corporation, Siemens Healthineers, Roche Diagnostics, Qiagen N.V., Luminex Corporation, Illumina, Inc., Becton, Dickinson and Company, Caprion Proteomics Inc., Meso Scale Diagnostics, LLC., Proteome Sciences plc, Olink Proteomics, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing prevalence of chronic diseases is anticipated to drive the market demand as there is ongoing development of novel biomarker panels for improving early disease diagnosis and therapeutic response. The use of proteomics for the development of personalized medicine by facilitating the detection of protein biomarkers is propelling the market. Additionally, technological advancement in proteomics, including improvement in MS technology for measuring the new features of biological systems in order to improve the diagnosis of medical conditions, is propelling the market growth.

Restraining Factors

The increased cost of proteomics research and development, and limited accessibility of sophisticated protein analysis equipment, especially in small laboratories and research institutes, are challenging the market.

Market Segmentation

The proteomic biomarker market share is classified into product type, application, and end-user.

- The reagents segment accounted for a significant market share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the proteomic biomarker market is divided into reagents, instruments, and services. Among these, the reagents segment accounted for a significant market share in 2024 and is projected to grow at a substantial CAGR during the forecast period. Reagents and kits used in proteomic biomarker enable researchers to explore the vast proteome, facilitating the identification, quantification, and characterization of proteins with unprecedented precision. An upsurging innovation in reagent formulations and the development of specialized kits for specific biomarkers are propelling the market growth.

- The drug discovery segment dominated the proteomic biomarker market in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the proteomic biomarker market is divided into drug discovery, diagnostics, personalized medicine, clinical research, and others. Among these, the drug discovery segment dominated the proteomic biomarker market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Proteomics is a valuable approach for drug target discovery, accelerating discovery processes that include drug action, toxicity, resistance, and efficacy under examination. Integration of proteomics into drug development with reduced time and cost associated with drug discovery is propelling the market.

- The pharmaceutical & biotechnology companies segment dominated the proteomic biomarker market in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-user, the proteomic biomarker market is divided into pharmaceutical & biotechnology companies, academic & research institutes, diagnostic laboratories, and others. Among these, the pharmaceutical & biotechnology companies segment dominated the proteomic biomarker market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Proteomics helps pharmaceutical and biotechnology companies with the discovery of novel targets and an intricate understanding of the therapeutic activity and their various activities in vitro and in vivo. Collaborations between pharmaceutical firms and research organizations for facilitating the development of novel biomarkers and therapeutic pipeline integration are driving the market growth.

Regional Segment Analysis of the Proteomic Biomarker Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the proteomic biomarker market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the proteomic biomarker market over the predicted timeframe. Advancements in mass spectrometry, along with increasing emphasis on research in personalized medicine, are driving the proteomic biomarker market. Further, the presence of advanced healthcare infrastructure, robust research & development activities is promoting the market growth.

Asia Pacific is expected to grow at a rapid CAGR in the proteomic biomarker market during the forecast period. The increasing healthcare expenditures and expanding research capabilities are driving the proteomic biomarker market. Development in next-generation sequencing technologies for providing high-precision protein analysis and mass spectrometry is propelling the market growth of proteomic biomarker.

Europe is anticipated to hold a significant share of the proteomic biomarker market during the predicted timeframe. The presence of well-established healthcare systems and the adoption of advanced diagnostic technologies are driving the proteomic biomarker market. Further, the increasing adoption of proteomics technology by the pharmaceutical companies is driving the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the proteomic biomarker market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Thermo Fisher Scientific Inc.

- Agilent Technologies Inc.

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Waters Corporation

- Bruker Corporation

- GE Healthcare

- PerkinElmer, Inc.

- Merck KGaA

- Shimadzu Corporation

- Siemens Healthineers

- Roche Diagnostics

- Qiagen N.V.

- Luminex Corporation

- Illumina, Inc.

- Becton, Dickinson and Company

- Caprion Proteomics Inc.

- Meso Scale Diagnostics, LLC.

- Proteome Sciences plc

- Olink Proteomics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the proteomic biomarker market based on the below-mentioned segments:

Global Proteomic Biomarker Market, By Product Type

- Reagents

- Instruments

- Services

Global Proteomic Biomarker Market, By Application

- Drug Discovery

- Diagnostics

- Personalized Medicine

- Clinical Research

- Others

Global Proteomic Biomarker Market, By End-User

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Diagnostic Laboratories

- Others

Global Proteomic Biomarker Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the proteomic biomarker market over the forecast period?The global proteomic biomarker market is projected to expand at a CAGR of 9.97% during the forecast period.

-

2.What is the market size of the proteomic biomarker market?The global proteomic biomarker market size is expected to grow from USD 5.8 Billion in 2024 to USD 16.5 Billion by 2035, at a CAGR of 9.97% during the forecast period 2025-2035.

-

3.Which region holds the largest share of the proteomic biomarker market?North America is anticipated to hold the largest share of the proteomic biomarker market over the predicted timeframe.

Need help to buy this report?