Global Protective Relay Market Size, Share, and COVID-19 Impact Analysis, By Technology (Numerical/IED, Static, and Electromechanical), By End-User (Utilities, Industrial, and Commercial & Infrastructure), and by Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Energy & PowerGlobal Protective Relay Market Insights Forecasts to 2035

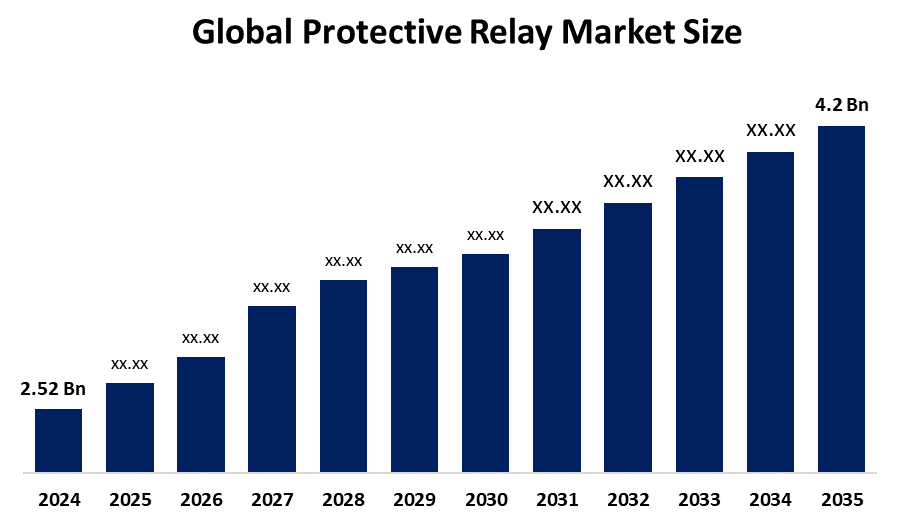

- The Global Protective Relay Market Size Was Estimated at USD 2.52 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.75 % from 2025 to 2035

- The Worldwide Protective Relay Market Size is Expected to Reach USD 4.2 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Protective relay Market Size was worth around USD 2.52 Billion in 2024 and is predicted to Grow to around USD 4.2 Billion by 2035 with a compound annual growth rate (CAGR) of 4.75% from 2025 to 2035. Protective relay market opportunities include smart grid expansion, renewable integration, substation automation, digital relays adoption, aging power infrastructure upgrades, and rising electricity demand across industrial and utility sectors.

Market Overview

The Protective Relay Market Size refers to devices used in electrical power systems to detect faults and automatically isolate affected sections, ensuring equipment safety and grid reliability. Market growth is driven by rising electricity consumption, increasing grid complexity, and the shift toward smart and digital substations. According to the International Energy Agency, global electricity demand is expected to grow by over 3% annually, increasing the need for advanced protection systems. Government initiatives supporting smart grid deployment, renewable energy integration, and power infrastructure modernization are further accelerating adoption. Recent developments include the growing use of numerical and digital relays, IEC 61850-based communication, and AI-enabled fault diagnostics, improving response time, reliability, and real-time grid monitoring across utilities and industrial applications.

Report Coverage

This research report categorizes the protective relay market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the protective relay market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the protective relay market.

Global Protective Relay Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.52 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 4.75% |

| 2035 Value Projection: | USD 4.2 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Technology, By End-User |

| Companies covered:: | ABB Ltd., Siemens AG, Schneider Electric SE, General Electric, Mitsubishi Electric Corporation, Eaton Corporation, Basler Electric Company, Rockwell Automation Inc., Toshiba Energy System & Solution Corporation, Omron Corporation, Fuji Electric Co. Ltd, Littelfuse Inc. and Others players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rising electricity demand and grid expansion are key drivers of the protective relay market. Global power consumption is projected to grow at over 3% annually, increasing fault risks in complex networks. Rapid integration of renewables, which accounted for nearly 30% of global electricity generation, requires advanced protection systems. Aging transmission and distribution infrastructure, with over 40% of substations older than 25 years, is boosting replacement demand. Additionally, growing industrial automation and investments in smart grids are accelerating adoption of digital and numerical protective relays worldwide.

Restraining Factors

High initial investment costs, complex installation requirements, lack of skilled professionals, interoperability issues with legacy systems, and cybersecurity concerns in digital relays restrict wider adoption, particularly among small utilities and developing power infrastructure markets.

Market Segmentation

The protective relay market share is classified into technology and end-user.

- The numerical/IED segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the technology, the protective relay market is divided into numerical/IED, static, and electromechanical. Among these, the numerical/IED segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The Numerical/IED segment held the largest share in 2024 and is expected to grow at a significant CAGR because numerical relays offer advanced microprocessor-based protection, multi-function capability, real-time diagnostics, and seamless integration with smart grid systems, unlike static or electromechanical types. About 60–85% of market share in 2024 was captured by digital/numerical relays due to their superior accuracy, communication features, and automation support.

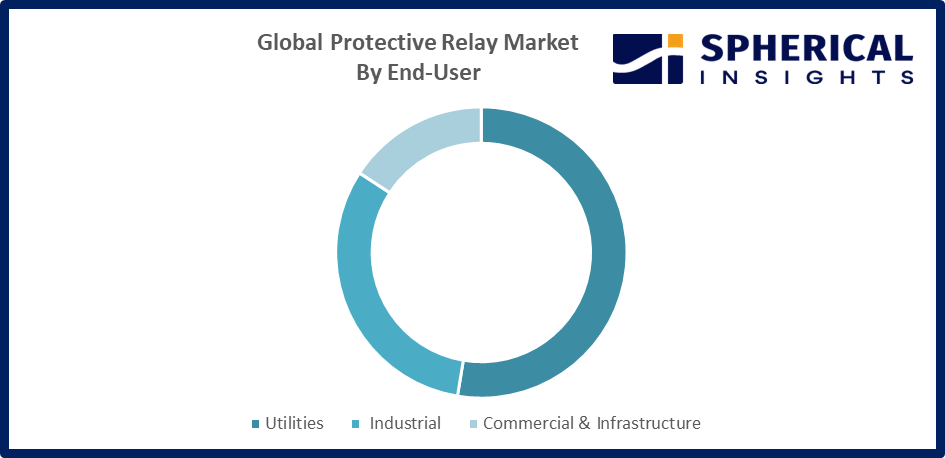

- The utilities segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-user, the protective relay market is divided into utilities, industrial, and commercial & infrastructure. Among these, the utilities segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is because utilities (transmission & distribution and independent power producers) invest heavily in protective relays to ensure grid reliability, fault isolation, and substation automation, with utilities capturing around 61.30% of market share in 2025 due to grid modernization and renewable integration efforts.

Get more details on this report -

Regional Segment Analysis of the Protective Relay Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the Protective Relay market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the protective relay market over the predicted timeframe. The Asia Pacific region is expected to hold the largest share of the protective relay market over the forecast period because it accounted for around 34% of global market revenue in 2024, driven by huge investments in transmission & distribution infrastructure, rapid industrialization, and growing electricity demand in China, India, Japan, and other emerging economies. Supportive smart grid and renewable integration programs further accelerate adoption.

North America is expected to grow at a rapid CAGR in the protective relay market during the forecast period. North America is expected to grow at a rapid CAGR in the protective relay market due to large-scale grid modernization and aging infrastructure upgrades. Over 70% of U.S. transmission lines are more than 25 years old, driving replacement demand. Additionally, rising renewable integration accounting for over 25% of electricity generation and increased investments in smart substations and digital protection systems are accelerating adoption across utilities and industrial facilities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the protective relay market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- General Electric

- Mitsubishi Electric Corporation

- Eaton Corporation

- Basler Electric Company

- Rockwell Automation Inc.

- Toshiba Energy System & Solution Corporation

- Omron Corporation

- Fuji Electric Co. Ltd

- Littelfuse Inc.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2023, ABB has launched a Relay Retrofit Program to modernize protection and control systems by replacing aging SPACOM relays with the latest REX610 protection relays, extending switchgear life, enhancing reliability, and simplifying installation from engineering to testing. The program supports seamless upgrades with minimal downtime and improved communication standards (IEC 61850).

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the protective relay market based on the below-mentioned segments:

Global Protective Relay Market, By Technology

- Numerical/IED

- Static

- Electromechanical

Global Protective Relay Market, By End-User

- Utilities

- Industrial

- Commercial & Infrastructure

Global Protective Relay Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the protective relay market over the forecast period?The global protective relay market is projected to expand at a CAGR of 4.75% during the forecast period.

-

2. What is the market size of the protective relay market?The global protective relay market size is expected to grow from USD 2.52 billion in 2024 to USD 4.2 billion by 2035, at a CAGR of 4.75 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the protective relay market?Asia Pacific is anticipated to hold the largest share of the protective relay market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global protective relay market?ABB Ltd., Siemens AG, Schneider Electric SE, General Electric, Mitsubishi Electric Corporation, Eaton Corporation, Basler Electric Company, Rockwell Automation Inc., Toshiba Energy System & Solution Corporation, Omron Corporation, Fuji Electric Co. Ltd, and Littelfuse Inc.

-

5. What factors are driving the growth of the protective relay market?Rising electricity demand, smart grid deployment, renewable energy integration, aging power infrastructure upgrades, industrial automation growth, and increasing investments in transmission and distribution networks.

-

6. What are the market trends in the protective relay market?Digital and numerical relays adoption, smart grid integration, IEC 61850 communication, AI‑based diagnostics, and renewable‑optimized protection solutions are key protective relay market trends.

-

7. What are the main challenges restricting the wider adoption of the protective relay market?High initial costs, complex installation, lack of skilled professionals, interoperability issues with legacy systems, and cybersecurity concerns in digital relay networks limit wider protective relay adoption.

Need help to buy this report?