Global PropTech Market Size, Share, and COVID-19 Impact Analysis, By Property Type (Residential and Commercial and Industrial), By Solution (Software and Services), By Deployment (Cloud and On-premise), By End-user (Housing Associations, Property Managers/ Agents, Property Investors, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Information & TechnologyGlobal PropTech Market Size Forecasts to 2035

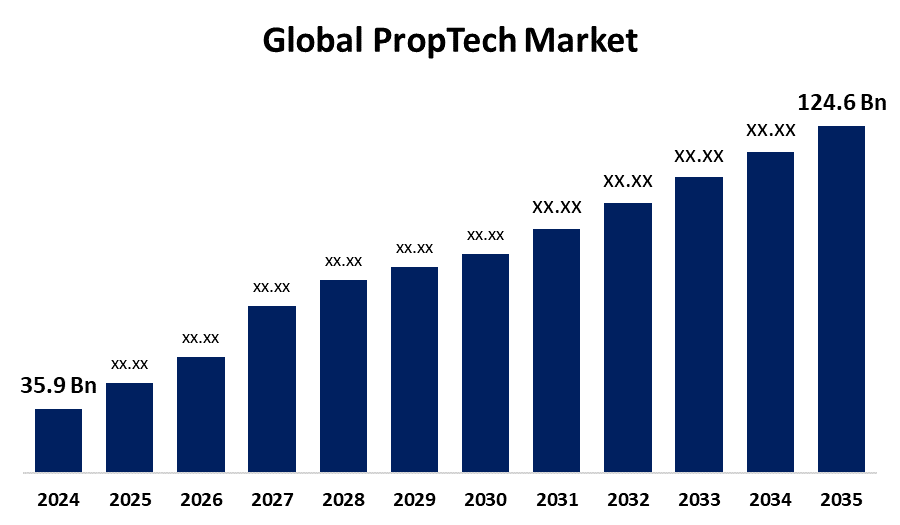

- The Global PropTech Market Size Was Estimated at USD 35.9 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.98% from 2025 to 2035

- The Worldwide PropTech Market Size is Expected to Reach USD 124.6 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global proptech market size was worth around USD 35.9 billion in 2024 and is predicted to grow to around USD 124.6 billion by 2035 with a compound annual growth rate (CAGR) of 11.98% from 2025 to 2035. The integration of advanced technologies is transforming real estate by enhancing efficiency, decision-making, and customer experience. PropTech will continue driving transparency, convenience, and innovation across the industry.

Market Overview

The proptech market refers to the innovation and streamlining of the real estate sector through the application of digital technologies and information technology (IT). It includes platforms and solutions that help with real estate investing, management, renting, and purchasing. At every stage of a real estate transaction, PropTech solutions seek to increase productivity, lower expenses, and improve user experiences. FinTech applications for real estate, shared real estate platforms, and smart home technology are important market niches.

PropTech is revolutionizing the real estate sector by improving client satisfaction, efficiency, and transparency. Transactions are becoming more efficient, and investment returns are increasing with the use of AI, VR, and data-driven tools. The need for digital solutions in real estate was further heightened by the COVID-19 pandemic. Automation, AI-powered tools, and virtual tours are changing how people purchase and manage real estate. These developments are propelling the PropTech market's global growth and development.

Report Coverage

This research report categorizes the proptech market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the proptech market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the proptech market.

Global PropTech Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 35.9 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.98% |

| 2035 Value Projection: | USD 124.6 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Property Type, By Solution, By Deployment, By End-user, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Ascendix Technologies, Qualia, Zumper Inc., Proptech group, Opendoor, Homelight, Altus Group, Enertiv, Guesty Inc., Reggora, HoloBuilder, Inc., Vergesense, Zillow, Inc., Coadjute, ManageCasa, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The extensive use of cutting-edge technology, including cloud computing, AI, IoT, ML, VR, and big data. These tools improve customer service, expedite property management, and provide more in-depth information for wiser choices. Tenant satisfaction and operational efficiency are increasing through asset management solutions and property management software (PMS). Big data is revolutionizing real estate risk management, marketing campaigns, and investment methods. The smooth integration of services is made possible by cloud computing, particularly in the operations of multifamily properties. Customer experiences in real estate have changed as a result of the COVID-19 pandemic's acceleration of digital adoption. PropTech is expected to promote more efficiency, convenience, and transparency in the real estate industry going forward.

Restraining Factors

The market growth is hindered by the proptech's quick development frequently outpaces current laws, making adoption and legal compliance difficult. Implementation may be hampered by navigating the complicated laws about loans, data protection, and technological licensing. Uncertainty and regulatory restrictions may be difficult for SMEs and new users to handle. It is necessary to carefully align operations with changing compliance standards to ensure moral and legal compliance.

Market Segmentation

The proptech market share is classified into property type, solutions, deployment, and end users.

- The residential segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the property type, the proptech market is classified into residential and commercial, and industrial. Among these, the residential segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the technology developments in the real estate industry's residential segment. Tech businesses have been more interested in the residential industry since they offer services like virtual open houses and digital closings. Advances in technology have made it simpler for potential homebuyers to take the first steps.

- The software segment accounted for the largest share in 2024 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the solutions, the proptech market is categorized into software and services. Among these, the software segment accounted for the largest share in 2024 and is estimated to grow at a remarkable CAGR during the forecast period. The segmental growth can be attributed to the users can rent, purchase, list, discover real estate agents, advertise, and many other functions all on one platform or piece of software through the integrated platform. It aids businesses and organizations in improving consumer satisfaction, financing options, and corporate efficiency. As a result, it provides users with a complete solution that meets their needs.

- The on-premise segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the deployment, the proptech market is categorized into cloud, on-premise. Among these, the on-premise segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the It offers the user total control over the solution and allows them to create data fields and documents according to their specifications. The potential for customization to match software features and service segments with the demands of the company is one of the main advantages of this deployment.

- The housing association segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end users, the proptech market is categorized into housing associations, property managers/ agents, property investors, and others. Among these, the housing association segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the growing need for townships and apartment societies. Furthermore, these systems' capacity to track payments, manage mortgages, and manage rentals helps housing associations run their businesses more effectively, which raises their market share.

Regional Segment Analysis of the PropTech Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the proptech market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the proptech market over the predicted timeframe. The regional growth can be attributed to the region the existence of well-known companies in the area, including Altus Group, Zumper Inc., Opendoor, and Ascendix Technologies. One of the most stable and promising industries in North America is the real estate sector, which is expanding. The area is regarded as a technological early adopter. Around 43% of the housing market is made up of the tech-savvy millennial population in the area, which is increasing demand for smart homes with Internet of Things-enabled devices. Consequently, this is contributing to the expansion of the North American market.

Asia Pacific is expected to grow at a rapid CAGR in the proptech market during the forecast period. The region's growth is being driven by the rise of proptech investment throughout the Asia-Pacific region. China and India have the biggest proptech markets in Asia-Pacific, per the research of industry experts. The region's proptech businesses are concentrating on growing, maturing, and requesting more capital. Furthermore, it is anticipated that the region will embrace proptech software more frequently as a result of technological advancements like voice commands, machine learning, artificial intelligence, and data analytics that enhance its functionality.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the proptech market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ascendix Technologies

- Qualia

- Zumper Inc.

- Proptech group

- Opendoor

- Homelight

- Altus Group

- Enertiv

- Guesty Inc.

- Reggora

- HoloBuilder, Inc.

- Vergesense

- Zillow, Inc.

- Coadjute

- ManageCasa

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2024, Fashinza Jamil Ahmad, cofounder, established Marrfa, a SaaS firm that provides answers to the real estate market's trust deficit. It will initially operate in India and the UAE.

- In September 2022, HDFC Capital, in cooperation with Startup India, launched a new platform called Real Estate Tech Innovators to uncover, award, and celebrate inventions in fintech, sales tech, construction tech, and sustainability tech. The platform intends to invest in around 15 Indian property technology firms.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the proptech market based on the below-mentioned segments:

Global PropTech Market, By Property Type

- Residential

- Commercial and Industrial

Global PropTech Market, By Solution

- Software

- Services

Global PropTech Market, By Deployment

- Cloud

- On-premise

Global PropTech Market, By End-user

- Housing Associations

- Property Managers/ Agents

- Property Investors

- Others

Global PropTech Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the proptech market over the forecast period?The global proptech market is projected to expand at a CAGR of 11.98% during the forecast period.

-

2. What is the market size of the proptech market?The global proptech market size is expected to grow from USD 35.9 Billion in 2024 to USD 124.6 Billion by 2035, at a CAGR of 11.98% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the proptech market?North America is anticipated to hold the largest share of the proptech market over the predicted timeframe.

Need help to buy this report?