Global Probiotics Dietary Supplements Market Size, Share, and COVID-19 Impact Analysis, By Form (Chewables & Gummies, Capsules, Powders, Tablets & Softgels, and Others), By End-Use (Infants, Children, Adults, and Geriatric), By Application (Sports Fitness, Energy & Weight Management, General Health, Bone & Joint Health, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Probiotics Dietary Supplements Market Insights Forecasts to 2035

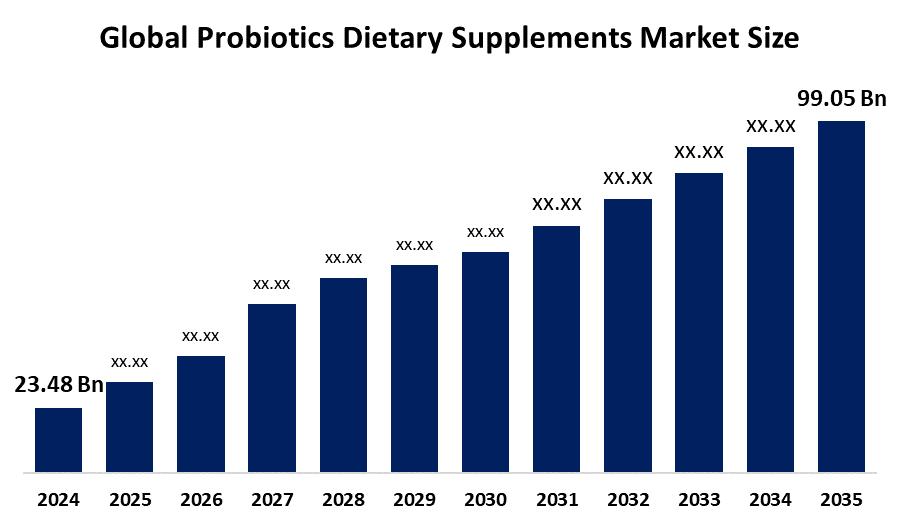

- The Global Probiotics Dietary Supplements Market Size Was Estimated at USD 23.48 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 13.98% from 2025 to 2035

- The Worldwide Probiotics Dietary Supplements Market Size is Expected to Reach USD 99.05 Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Probiotics Dietary Supplements Market Size was worth around USD 23.48 Billion in 2024 and is predicted to grow to around USD 99.05 Billion by 2035 with a compound annual growth rate (CAGR) of 13.98% from 2025 and 2035. The market for probiotics dietary supplements has a number of opportunities to grow due to upsurging innovations in delivery systems and continual advancements in gut microbiome research for developing next-generation probiotics.

Market Overview

The global probiotic dietary supplement industry focuses on products containing live microorganisms that provide health benefits, especially for gut health and immune function. Probiotics refer to live bacteria and yeasts that have beneficial effects on the body, while probiotic supplements add to the existing supply of friendly microbes. The supplements aid in fighting off less friendly types and boost immunity against infections. The emergence of next-generation probiotics as novel therapeutics for improving human health as it not only for conventional use as foods or dietary supplements but also tailored for pharmaceutical applications.

Innovation and market expansion are anticipated as a result of major players' growing R&D expenditures for developing new supplements. For instance, in October 2025, it was reported that researchers have developed a new iron supplement that pairs iron with probiotics and probiotics to improve absorption and reduce side effects. Furthermore, research suggested the effectiveness of pairing probiotics with prebiotic fibre and vitamins for immune and metabolic health.

Report Coverage

This research report categorizes the probiotics dietary supplements market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the probiotics dietary supplements market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the probiotics dietary supplements market.

Global Probiotics Dietary Supplements Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 23.48 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 13.98% |

| 2035 Value Projection: | USD 99.05 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Form, By End-Use, By Application and By Region |

| Companies covered:: | Church & Dwight Co., Inc., Reckitt Benckiser Group PLC, Nestle S.A., Yakult Honsha Co., Ltd., BioGaia AB, Amway Corporation, Procter & Gamble Company, Willmar Schwabe GmbH & Co. KG, BIOHM Health, Optibac Probiotics Inc., NOW Foods, Herbalife Nutrition Ltd., Morishita Jintan Co., Ltd., PharmaCare Laboratories Pty Ltd, Metagenics, Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The probiotics dietary supplements market is driven by consumers' increasing gut health awareness and overall wellness. As per the World Health Organization, ‘live microorganisms which when administered in adequate amounts confer a health benefit on the host.’ Consumption of a prebiotic supplement aids in improving scores on memory tests in people over the age of 60, which is propelling the probiotics dietary supplements market. It was estimated that over 60% of the human population has a reduced ability to digest lactose due to low levels of lactase enzyme activity.

Restraining Factors

The probiotics dietary supplements market is restricted by factors like increased R&D and manufacturing costs. Further, the storage & shelf life issues associated with probiotic dietary supplements are challenging the market growth.

Market Segmentation

The probiotics dietary supplements market share is classified into form, end-use, and application.

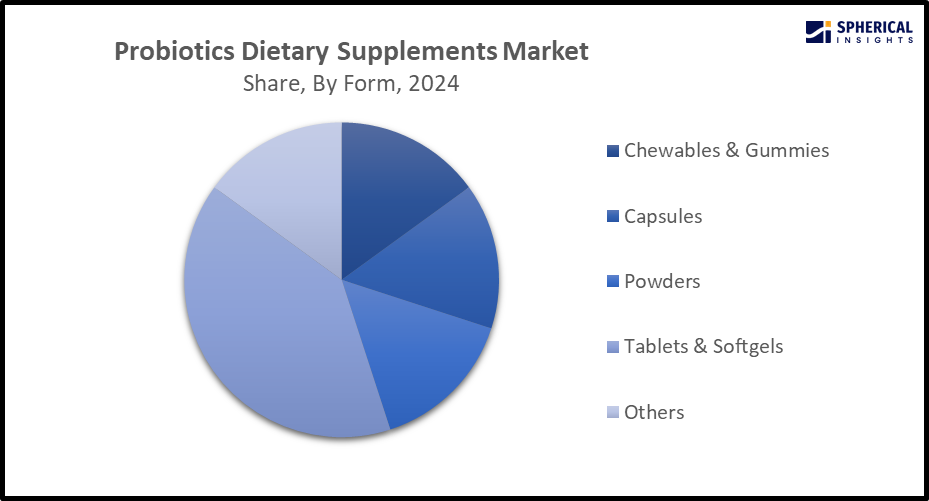

- The tablets & softgels segment dominated the market with the largest share of over 40.2% in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the form, the probiotics dietary supplements market is divided into chewables & gummies, capsules, powders, tablets & softgels, and others. Among these, the tablets & softgels segment dominated the market with the largest share of over 40.2% in 2024 and is projected to grow at a substantial CAGR during the forecast period. Softgel capsules are the most suitable for liquid or fat-soluble formulas due to the complete encapsulation of ingredients in gelatin or similar materials, while tablets are able to pack the highest concentration of ingredients within a single tablet, offering the most options for dosages. Further, their ease of use, precise dosage, and longer shelf life, as well as ongoing development of high-quality probiotics tablets and capsule form supplements are driving the market demand in the tablets & softgels segment.

Get more details on this report -

- The adults segment accounted for the largest market share of over 56.0% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use, the probiotics dietary supplements market is divided into infants, children, adults, and geriatric. Among these, the adults segment accounted for the largest market share of over 56.0% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Probiotics are used for improving digestion and restoring normal flora. Various bowel problems like diarrhea, irritable bowel, and other conditions, including eczema, vaginal infections, and UTIs, are treated with probiotics in adults. An increased daily consumption of probiotics dietary supplements among adults is propelling the segmental market.

- The general health segment accounted for a significant market share of about 17.0% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the probiotics dietary supplements market is divided into sports fitness, energy & weight management, general health, bone & joint health, and others. Among these, the general health segment accounted for a significant market share of about 17.0% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Probiotics are typically marketed as dietary supplements, intended to maintain health in generally healthy populations; unlike drugs cannot claim to treat or cure disease. Use of probiotics for supporting immune function, reducing the risk of infections & allergies, is propelling the segmental market expansion.

Regional Segment Analysis of the Probiotics Dietary Supplements Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the Probiotics Dietary Supplements market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of over 34.0% in the probiotics dietary supplements market over the predicted timeframe. The market ecosystem in North America is strong, due to the presence of nutraceutical tech startups like Virta, OmniActive, Zoe, Atkins, and Elysium that are funded and secured with series A+ funding. The market for probiotics dietary supplements has been driven by the region's increasing emphasis on preventative healthcare and probiotics' fit for preventing health issues. The United States is dominating the North America probiotics dietary supplement market, accounting for about 65-80%, owing to consumers' growing health consciousness and preference for nutritious foods.

Middle East & Africa is expected to grow at a rapid CAGR of 12.0% in the Probiotics Dietary Supplements market during the forecast period. The Middle East & Africa region has a thriving market for Probiotic Dietary Supplements due to its youthful population and the development of advanced and novel probiotic strains. South Africa is anticipated to witness the fastest CAGR in the regional market, driven by a proactive approach towards preventing healthcare and consumers' increasing consciousness about nutrition.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the probiotics dietary supplements market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Church & Dwight Co., Inc.

- Reckitt Benckiser Group PLC

- Nestle S.A.

- Yakult Honsha Co., Ltd.

- BioGaia AB

- Amway Corporation

- Procter & Gamble Company

- Willmar Schwabe GmbH & Co. KG

- BIOHM Health

- Optibac Probiotics Inc.

- NOW Foods

- Herbalife Nutrition Ltd.

- Morishita Jintan Co., Ltd.

- PharmaCare Laboratories Pty Ltd

- Metagenics, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2025, Nature Made, the leading national vitamin and supplement broadline brand, announced the launch of clinically studied innovations and new formulations within its Digestive portfolio to deliver a range of probiotic, prebiotic, and fibre supplements for daily gut health support and benefits based on specific wellness needs.

- In December 2024, BioGaia launched a new probiotic supplement, BioGaia Gastrus PURE ACTION, designed for people with sensitive digestive systems. BioGaia Gastrus PURE ACTION is formulated with the proprietary, patented probiotic strains L. reuteri DSM 17938 and L. reuteri ATCC PTA 6475, carefully selected for their clinically proven efficacy in managing digestive issues and enhancing gastrointestinal health.

- In August 2024, Actial Nutrition, the U.S. distributor of VSL#3, a multi-strain probiotic medical food, launched VSL4 Gut, a shelf-stable daily probiotic supplement formulated to support optimal digestion and promote regularity for all.

- In June 2024, Israeli agrifood startup Wonder Veggies is aiming to launch the “world’s first probiotic fresh produce” with partners next year using technology enabling probiotic bacteria to penetrate plant tissue and serve as endophytes.

- In April 2024, Vibrant Health released Trilogy, a daily 3-in-1 multivitamin plus omega-3 and probiotic supplement designed to simplify wellness routines without compromising quality. The multivitamin provides vitamins A, B12, C, D3, E, and essential minerals like selenium, magnesium, and zinc.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the probiotics dietary supplements market based on the below-mentioned segments:

Global Probiotics Dietary Supplements Market, By Form

- Chewables & Gummies

- Capsules

- Powders

- Tablets & Softgels

- Others

Global Probiotics Dietary Supplements Market, By End-Use

- Infants

- Children

- Adults

- Geriatric

Global Probiotics Dietary Supplements Market, By Application

- Sports Fitness

- Energy & Weight Management

- General Health

- Bone & Joint Health

- Others

Global Probiotics Dietary Supplements Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the probiotics dietary supplements market?The global probiotics dietary supplements market size is expected to grow from USD 23.48 Billion in 2024 to USD 99.05 Billion by 2035, at a CAGR of 13.98% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the probiotics dietary supplements market?North America is anticipated to hold the largest share of the probiotics dietary supplements market over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global Probiotics dietary supplements Market from 2024 to 2035?The market is expected to grow at a CAGR of around 13.98% during the period 2024–2035.

-

4. Who are the top companies operating in the Global Probiotics dietary supplements Market?Key players include Church & Dwight Co., Inc., Reckitt Benckiser Group PLC, Nestle S.A., Yakult Honsha Co., Ltd., BioGaia AB, Amway Corporation, Procter & Gamble Company, Willmar Schwabe GmbH & Co. KG, BIOHM Health, Optibac Probiotics Inc., NOW Foods, Herbalife Nutrition Ltd., Morishita Jintan Co., Ltd., PharmaCare Laboratories Pty Ltd, and Metagenics, Inc.

-

5. Can you provide company profiles for the leading probiotics dietary supplements manufacturers?Yes. For example, Church & Dwight Co., Inc. is an American consumer goods company focusing on personal care, household products, and speciality products, was founded in 1847 and is headquartered in Ewing, New Jersey. Reckitt Benckiser Group PLC is a British multinational consumer goods company headquartered in Slough, United Kingdom, that manufactures health, hygiene, and nutrition products.

-

6. What are the main drivers of growth in the probiotics dietary supplements market?Consumers' increasing gut health awareness and increased consumption among the older age population are major market growth drivers of the probiotics dietary supplements market.

-

7. What challenges are limiting the probiotics dietary supplements market?Increased R&D and manufacturing costs, as well as storage-related issues, remain key restraints in the probiotics dietary supplements market.

Need help to buy this report?