Global Probiotic Drinks Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Plant-Based, Dairy-Based), By Bacteria (Bifid Bacterium, Lactobacillus, Streptococcus, Others), By Distribution Channel (Offline, Online), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Food & BeveragesGlobal Probiotic Drinks Market Insights Forecasts to 2033

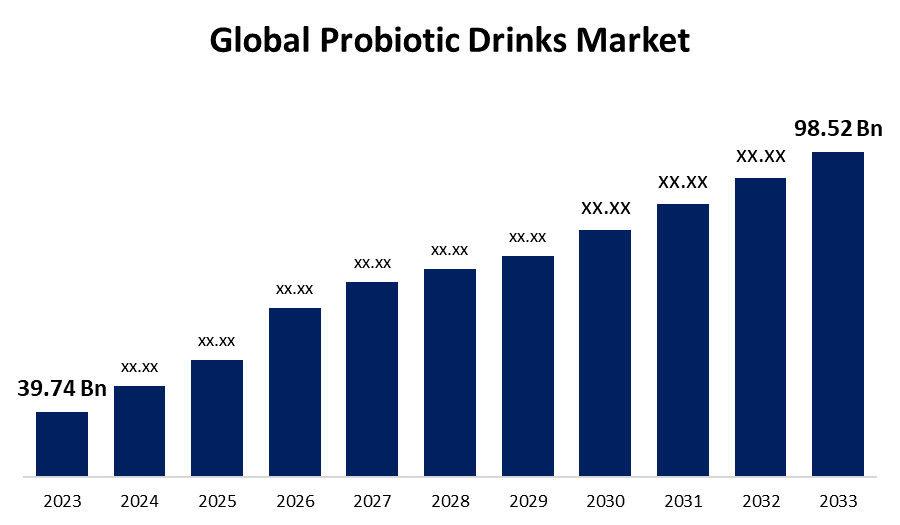

- The Global Probiotic Drinks Market Size was Valued at USD 39.74 Billion in 2023.

- The Market Size is Growing at a CAGR of 9.5% from 2023 to 2033.

- The Worldwide Probiotic Drinks Market Size is Expected to Reach USD 98.52 Billion by 2033.

- South America expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Probiotic Drinks Market Size is Anticipated to Exceed USD 98.52 Billion by 2033, Growing at a CAGR of 9.5% from 2023 to 2033.

Market Overview

living microorganisms that provide specific health benefits to consumption and are known to support gut health and improve the digestive system to run smoothly are called probiotics. Probiotic drinks usually have a smooth mouthfeel as well as are made using dairy products. Probiotics significantly enhance the qualities and advantages. The market for probiotic drinks is expanding due to their increased nutritional value. In addition to these numerous advantages, customers favor probiotic drinks over standard soft drinks. The leading companies in the industry have spread their product offers with a wide variety of genuine fruit-based probiotic drinks in response to the growing demand for probiotic drinks that contain only natural and pure components. Moreover, they have access to modern technology, and millennials keep up with health-related information and adjust their eating habits accordingly. Additionally, due to issues with obesity and overweight, customers have shifted toward fitness and workouts. Consumers therefore support plant-based, low-calorie, and functional foods. Probiotic drinks are also balanced and boosting. However, the primary drivers propelling the market are the rise in busy lives and on-the-go habits, which have raised demand for probiotic drinks that are useful and quickly accessible.

Report Coverage

This research report categorizes the market for the global probiotic drinks market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global probiotic drinks market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global probiotic drinks market.

Global Probiotic Drinks Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 39.74 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 9.5% |

| 2033 Value Projection: | USD 98.52 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Bacteria, By Distribution Channel, By Region. |

| Companies covered:: | PepsiCo, Yakult Honsha Co. Ltd., GoodBelly Probiotics, Bio-K Plus International Inc., Fonterra Co-operative Group, Lifeway Foods, Inc., Nestle SA, Chobani, LLC, Danone S.A., GCMMF (Amul), NextFoods, Harmless Harvest, Cargill Incorporated, Beliv, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Probiotic drinks, especially those made with natural ingredients and low sugar content, are gaining popularity among health-conscious consumers. Probiotic drinks are predicted to rise at a rapid rate due to the efforts of major market participants to maintain their dominance through the introduction of high-quality products and collaborations with well-known regional nutraceutical brands. However, these drinks also support mental health because it has been illustrated by numerous research that gut health and mood are related. As a result, its use promotes the reduction of autism, obsessive-compulsive disorder (OCD), depression, and stress. Furthermore, by allowing the body to produce its natural antibodies, the products can improve the immune system. Drinking probiotics can help with weight loss, immune system function, and digestive health by maintaining a healthy balance of stomach bacteria. Daily consumption of these drinks promotes nutrient absorption and bowel movement. The prevalence of digestive disorders such as irritable bowel syndrome (IBS), constipation, and gastroesophageal reflux disease (GERD) has been increasing globally. Probiotic drinks are perceived as a natural and effective way to reduce symptoms associated with these conditions, thus driving their market growth in the forecast period.

Restraining Factors

Probiotic cultures are sensitive to temperature and storage conditions. Variations in temperature during transportation and storage can lead to the degradation of live cultures, reducing the efficacy of the product and potentially diminishing consumer trust. This necessitates careful storage and distribution logistics, which can increase costs and limit market reach, especially in regions with inadequate infrastructure. In addition, it is quite difficult to keep live probiotic cultures in drinks viable and stable for the duration of their shelf life which limits the market growth for probiotic drinks.

Market Segmentation

The global probiotic drinks market share is classified into product type, bacteria, and distribution channel

- The dairy-based segment is expected to hold the largest share of the global probiotic drinks market during the forecast period.

Based on product type, the global probiotic drinks market is divided into plant-based and dairy-based. Among these, the dairy-based segment is expected to hold the largest share of the probiotic drinks market during the forecast period. Dairy-based production is more profitable and requires lower production costs, according to the production industries. Probiotic drinks with a dairy base are the most popular among consumers and have the highest market share. Fermented probiotic drinks with a milk or yogurt base are the most effective way to improve kids' and senior adults' digestive tracts. If consumed daily, these fermented milk probiotic drinks, which include the Lactobacillus strain, are capable of significantly improving digestion and boosting immunity.

- The lactobacillus segment is expected to grow at fastest pace in the global probiotic drinks market during the forecast period.

Based on the bacteria, the global probiotic drinks market is divided into bifid bacterium, lactobacillus, streptococcus, and others. The glass segment is expected to grow at the fastest pace in the probiotic drinks market during the forecast period. The strain Lactobacillus is widely used for producing these products, and its demand has grown during the study. Numerous health advantages of lactobacillus strains involve strengthening gut health, improving the immune system, easier digestion, and possibly lowering the risk of certain diseases. The increasing demand for probiotic drinks containing lactobacillus can be linked to these features.

- The online segment is expected to grow at greatest pace in the global probiotic drinks market during the forecast period.

Based on the distribution channel, the global probiotic drinks market is divided into offline and online. The online segment is expected to grow at the greatest pace in the probiotic drinks market during the forecast period. Consumers, including home consumers and health care organizations, are encouraged to purchase probiotic drinks through e-commerce portals due to the growing usage of these platforms in developing countries as well as the growing quantity of promotions and discounts these sites provide. Moreover, due to the simplicity of access and security offered by these platforms, online sales channels have enjoyed remarkable growth in conjunction with recent technical advancements and rapid digitalization which drive the market growth for probiotic drinks.

Regional Segment Analysis of the Global Probiotic Drinks Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

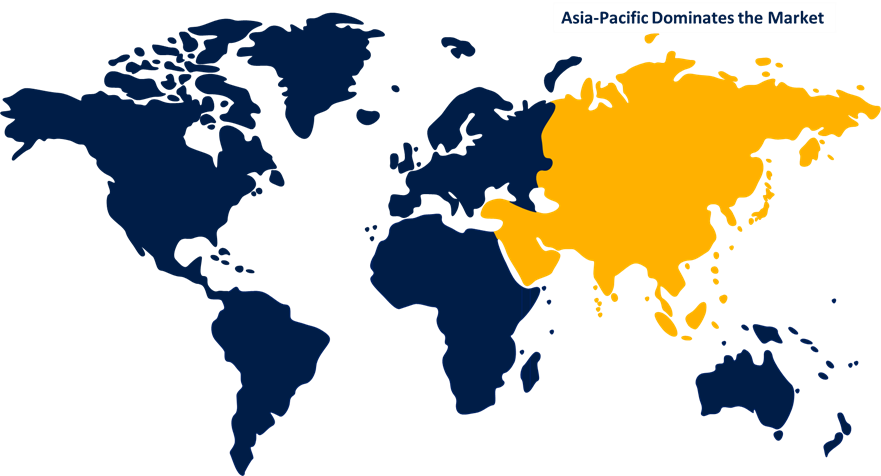

Asia Pacific is anticipated to hold the largest share of the global probiotic drinks market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global probiotic drinks market over the predicted timeframe. In India, people consume more yogurt as a digestive drink. Leading companies are making significant R&D investments to provide a range of edible probiotic yogurts in various flavors. These yogurt-based probiotic drinks are regarded as healthy snacks in the nation since they provide an adequate number of proteins, minerals, and vitamins. However, China, Japan, and India are the region's three principal markets. The International Probiotics Association (IPA) states that one of the biggest probiotics markets in the world is China. Good news for producers and suppliers: sales throughout the nation have been steadily increasing. The primary foods that provide ingested probiotics are dairy products along with other fermented foods (eggs, veggies, and soy included). For instance, Epigamia developed the first lactose-free curd in India with two strains that are good for the gut: Lactobacillus Acidophilus and Bifidobacteria. This was called Epigamia Artisanal Curd. A healthy digestive system requires these two strains. Furthermore, Yakult Light was introduced by Yakult Danone India, a 50:50 joint venture between Danone and Yakult Honsha. An innovative take on their unique probiotic drink that has less sugar and the vitamins E and D along with Yakult's famous Lactobacillus casei strain Shirota (LcS). It is expected that the success of these product launches will promote an ideal environment for Indian makers of probiotic drinks.

South America is expected to grow at the fastest pace in the global probiotic drinks market during the forecast period. One of the sectors in the region that has increased the fastest is the functional drink market.In addition, a growing middle class, increasing health problems, and more probiotic drinks becoming available will be driving the product's demand in this region in a projected timeframe.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global Probiotic Drinks along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PepsiCo

- Yakult Honsha Co. Ltd.

- GoodBelly Probiotics

- Bio-K Plus International Inc.

- Fonterra Co-operative Group

- Lifeway Foods, Inc.

- Nestle SA

- Chobani, LLC

- Danone S.A.

- GCMMF (Amul)

- NextFoods

- Harmless Harvest

- Cargill Incorporated

- Beliv

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, Mighty Pop, a recently released carbonated drink with a focus on immune system and digestive health, uses the power of prebiotics, probiotics, and postbiotics to provide customers with the boost in digestive health they need. Beliv, the company that makes Mighty Pop, has a new beverage line that is “progressive” in the soda market and “the first of its kind to advance pre-, pro-, and postbiotics,” according to Clayton Santos, director of R&D. Beliv offers a portfolio of products that includes carbonated drinks, juices, waters, and other functional beverages. Beliv purchased the ready-to-drink (RTD) cold brew coffee brand High Brew in 2023.

- In February 2023, an attempt to reawaken a dormant development engine, Japan's Yakult Honsha is taking advantage of China's economic reform as an opportunity to restore its footing in a long-standing core market for its probiotic drinks. Late last month, the business opened its seventh plant in China, increasing its capacity to produce 900,000 bottles per day in the city of Wuxi. Due to lockdowns connected to the coronavirus, the opening was postponed far beyond the initial April 2022 schedule.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global probiotic drinks market based on the below-mentioned segments:

Global Probiotic Drinks Market, By Product Type

- Plant-Based

- Dairy-Based

Global Probiotic Drinks Market, By Bacteria

- Bifid Bacterium

- Lactobacillus

- Streptococcus

- Others

Global Probiotic Drinks Market, By Distribution Channel

- Offline

- Online

Global Probiotic Drinks Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which region holds the largest share of the global probiotic drinks market?Asia Pacific is anticipated to hold the largest share of the global probiotic drinks market over the predicted timeframe.

-

2. What is the market growth rate of the global probiotic drinks market?The market size is growing at a CAGR of 9.5% from 2023 to 2033.

-

3. What is the market size of the global probiotic drinks market?The Global Probiotic Drinks Market is expected to grow from USD 39.74 billion in 2023 to USD 98.52 billion by 2033, at a CAGR of 9.5% during the forecast period 2023-2033.

-

4. Which are the key companies that are currently operating within global probiotic drinks market?PepsiCo, Yakult Honsha Co. Ltd., GoodBelly Probiotics, Bio-K Plus International Inc., Fonterra Co-operative Group, Lifeway Foods, Inc., Nestle SA, Chobani, LLC, Danone S.A., GCMMF (Amul), NextFoods, Harmless Harvest, Cargill Incorporated, Beliv, Others

Need help to buy this report?