Global Pressure Sensitive Adhesives Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Tapes, Labels, Graphic Films, Others), By Chemistry (Acrylic, Rubber, Silicone, Others), By Technology (Water-based, Solvent-based, Hot-melt, Radiation), By End-Use Industry (Automotive & Transportation, Electronics, Consumer Goods, Medical & Healthcare, Packaging, Building & Construction, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Chemicals & MaterialsGlobal Pressure Sensitive Adhesives Market Insights Forecasts to 2032

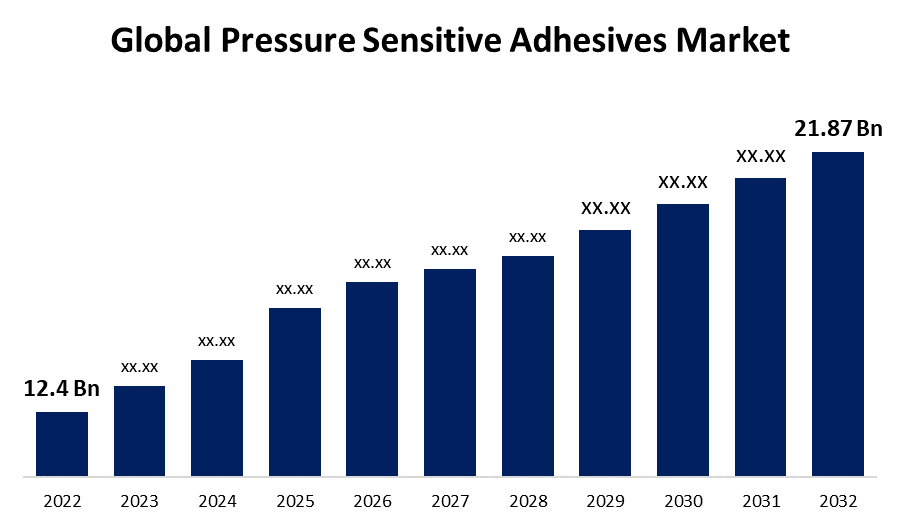

- The Global Pressure Sensitive Adhesives Market Size was valued at USD 12.4 Billion in 2022.

- The Market is Growing at a CAGR of 5.8% from 2022 to 2032

- The Worldwide Pressure Sensitive Adhesives Market Size is expected to reach USD 21.87 Billion by 2032

- North America is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Pressure Sensitive Adhesives Market Size is expected to reach USD 21.87 Billion by 2032, at a CAGR of 5.8% during the forecast period 2022 to 2032.

Pressure sensitive adhesives are a sort of non-reactive adhesive that bonds to a substrate when pressure is applied on them. To activate the glue, no solvent, water, or heat is required. Surface parameters like as uniformity, energy density, and contamination clearance are also critical for good bonding. Pressure sensitive adhesives are intended to develop and retain a bind at ambient temperature. At low temperatures, these adhesives often lose their tack, and at high temperatures, they lose their shear holding capacity. Pressure sensitive adhesives are extremely adaptable. They're everywhere, from food labels and packaging to bandages and electronics. PSAs are nearly unavoidable in daily life given that they are utilized for labels, tapes, films, postage stamps, and a variety of sticky applications. Pressure-sensitive adhesive tapes are widely employed in the manufacture of virtually any kind of equipment and are extremely useful for fastening and placing conductors, preventing lateral movement, identifying parts, excluding moisture, and many other purposes. The pressure sensitive adhesives market is expanding rapidly as a result of the increased demand for electronic gadgets as they become more compact. Furthermore, the growing demand for light-weight automobiles leads to increased automotive manufacturing, which is the key driver driving market expansion.

Global Pressure Sensitive Adhesives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 12.4 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.8% |

| 2032 Value Projection: | USD 21.87 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Chemistry, By Technology, By End-Use Industry, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Arkema, 3M, Sika AG, Ashland, Inc., AkzoNobel N.V., Henkel AG & Co. KGaA, The Dow Chemical Company, Avery Dennison Corporation, H.B. Fuller Company, Franklin Adhesives & Polymers., Pidilite Industries Ltd., Jubilant Industries Ltd., BASF SE, LG Chem, Ellsworth Adhesives, Bostik SA, Evonik Industries AG and other key venders. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Pressure sensitive adhesive tapes are utilized in the manufacturing of various types of equipment and are extremely useful for holding and placing conductors, preventing relative movement, identifying parts, and keeping moisture out. Potential applications for PSA tapes are being discovered practically every day, and as a result, the utilization of pressure sensitive adhesive in tapes is expected to increase. Pressure sensitive adhesive labels have several advantages, including the fact that they are self-adhesive, work with virtually all substances and forms, and lack the need for heat, solvent, or water to cling to packaging. These labels are inexpensive, flexible, and simple to apply. As a result of these characteristics, the widespread application of pressure sensitive adhesives in labels is predicted to rise rapidly.

The growing demand for flexible packaging, particularly in the food and beverage industries, has become one of the main factors affecting the growth of the pressure sensitive adhesives market. Because of their capability to establish a robust and dependable seal that preserves food in good condition and devoid of infection, PSAs are commonly utilized in food packaging. PSAs are also utilized in other industries, such as automotive, where their contents can be found in safety and cautionary labels as well as component identification labels throughout the supply chain. All of these factors work together to increase demand for pressure sensitive adhesives, boosting worldwide market expansion.

Restraining Factors

However, rising raw material prices are a significant concern influencing producers and may stifle industry expansion. Acrylic polymers, rubber-based polymers, silicone polymers, tackifiers, and additives are the key raw ingredients utilized in the production of PSAs. In addition, a shortage of a critical raw material used in the manufacturing process of water-based and other adhesives poses a significant issue in the adhesives market.

Market Segmentation

By Product Type Insights

The tapes segment is witnessing significant CAGR growth over the forecast period.

On the basis of sports, the global pressure sensitive adhesives market is segmented into tapes, labels, graphic films, and others. Among these, the tapes segment is witnessing significant CAGR growth over the forecast period. This is due to the widespread adoption of tapes for container sealing in the packing industry. Also, they are employed in a variety of assembly End-uses, including automotive and electronic manufacturing. The product's eco-friendliness, easy access to usage, and reduced weight as compared to conventional joining and fastening techniques are projected to stimulate demand in manufacturing industries.

By Chemistry Insights

The acrylic segment is dominating the market with the largest revenue share over the forecast period.

On the basis of chemistry, the global pressure sensitive adhesives market is segmented into the acrylic, rubber, silicone, and others. Among these, the acrylic segment is dominating the market with the largest revenue share of 53.6% over the forecast period. This is due to the growing popularity of acrylic-based PSAs, which are resistant to corrosion and sunlight. Acrylics are among the most widely utilized and adaptable materials in the pressure sensitive adhesives market. They are made by combining appropriate acrylic monomers, which are then cross-linked to generate the desired polymer. They are commonly used on parchment and polarized surfaces such as steel, glass, aluminum, zinc, polycarbonate, tin, and PVC.

By Technology Insights

The water-based segment is expected to hold the largest share of the global pressure sensitive adhesives market during the forecast period.

Based on the technology, the global pressure sensitive adhesives market is divided into water-based, solvent-based, hot-melt, and radiation. Among these, the water-based segment is expected to hold the largest share of the global pressure sensitive adhesives market during the forecast period. Pressure sensitive adhesives with a significant molecular weight and limited dissolution are produced using water-based technology. As a result, it has poor biodegradability. As a consequence, these adhesives do not build in the food chain. This technology's pressure sensitive adhesives may also rapidly adsorb on wastewater treatment sludge and assure effluent segregation during typical wastewater treatment procedures; they are durable under specified handling and application circumstances and operate as flame retardants. They are also used to make general purpose permanent labels, detachable labels, and medicinal labels.

By End-Use Industry Insights

The packaging segment accounted for the largest revenue share of more than 34.2% over the forecast period.

On the basis of End-Use Industry, the global pressure sensitive adhesives market is segmented into automotive & transportation, electronics, consumer goods, medical & healthcare, packaging, building & construction, and others. Among these, the packaging segment is dominating the market with the largest revenue share of 34.2% over the forecast period. This is because of the importance it serves in transportation and logistics. In addition, the necessity to enhance consumer appeal creates an opportunity to make packaging appealing. The increased e-commerce industry has also fueled the rise of the packaging business, owing to the requirement for security and long-term reliability during transportation and delivery. This has fueled the expansion of the packaging industry's market for pressure sensitive adhesives. Tapes and self-adhesive labels' user-friendliness and immediate bonding speed are the primary drivers boosting product demand in the packaging business.

Regional Insights

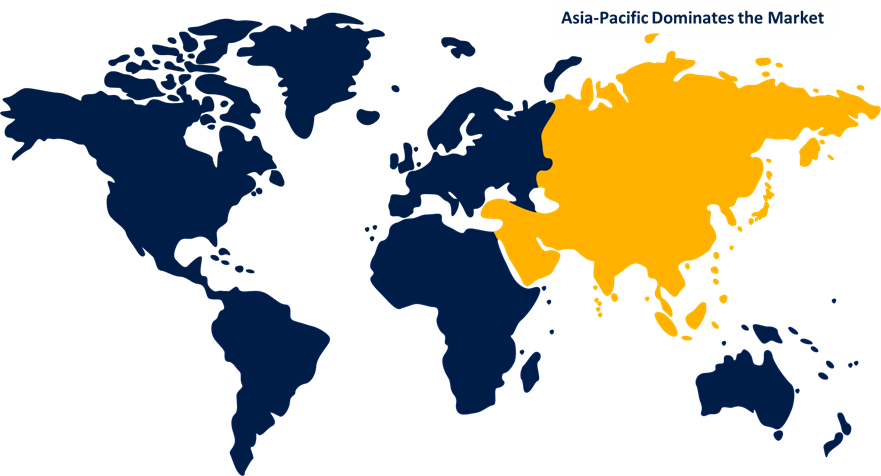

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the market with more than 38.7% market share over the forecast period. The swiftly growing industrial sector and rising overseas investments in the region's economies are likely to drive regional market expansion. The packaging sector in the Asia Pacific has enormous potential. It is a market that is experiencing rapid growth as the food and beverage (FMCG) industry expands to satisfy the growing demands of the general population with high disposable income. Furthermore, it is on the rise as a result of the rapid growth of e-commerce, where labels are commonly utilized for packaging and delivery. China and India, for example, are quickly increasing their e-commerce infrastructure. As a result, the need for medical equipment has risen in these countries.

North America, on the contrary, is expected to grow the fastest during the forecast period. Because of strict fuel economy and volatile organic compound (VOC) emission rules, this industry is driving market expansion. During the projected period, the United States is expected to have the biggest market share in this region. With rising corporate and public investment in cutting-edge technological innovation, new materials, and sustainability, UV/EB-based PSAs are expected to rise rapidly across North America.

List of Key Market Players

- Arkema

- 3M

- Sika AG

- Ashland, Inc.

- AkzoNobel N.V.

- Henkel AG & Co. KGaA

- The Dow Chemical Company

- Avery Dennison Corporation

- H.B. Fuller Company

- Franklin Adhesives & Polymers.

- Pidilite Industries Ltd.

- Jubilant Industries Ltd.

- BASF SE

- LG Chem

- Ellsworth Adhesives

- Bostik SA

- Evonik Industries AG

Key Market Developments

- On June 2023, Ahlstrom has introduced release liners to aid in the development of more environmentally friendly double-sided Pressure Sensitive Adhesive (PSA) tapes. The new products, Acti-V® Industrial RF Brown and Acti-V® Industrial RF Natural, are an extension of Ahlstrom's Acti-V Industrial dedicated range of high-performance release liners that offer novel options to environmentally conscious tape producers due to the use of post-consumer recycled fiber and unbleached cellulose fibers.

- On April 2023, Innovia Films has recently applied surface technology to material science by inventing RayofaceTM AQBSA, a specially developed printable coated cavitated BOPP facestock film. The film is 58 microns thick, has a printed top coating, and an adhesive receptive coated surface on the reverse side. It is intended for pressure sensitive labeling (PSL) applications.

- On November 2022, Solvay introduced Reactsurf® 2490, a novel APE-free1 polymerizable surfactant developed as a major emulsifier for acrylic, vinyl-acrylic, and styrene-acrylic latex systems. Reactsurf® 2490 increases emulsion performance to provide improved functional and aesthetic benefits in exterior coatings and pressure sensitive adhesives (PSAs) when compared to traditional surfactants, even at high temperatures.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Pressure Sensitive Adhesives Market based on the below-mentioned segments:

Pressure Sensitive Adhesives Market, Product Type Analysis

- Tapes

- Labels

- Graphic Films

- Others

Pressure Sensitive Adhesives Market, Chemistry Analysis

- Acrylic

- Rubber

- Silicone

- Others

Pressure Sensitive Adhesives Market, Technology Analysis

- Water-based

- Solvent-based

- Hot-melt

- Radiation

Pressure Sensitive Adhesives Market, End-Use Industry Analysis

- Automotive & Transportation

- Electronics

- Consumer Goods

- Medical & Healthcare

- Packaging

- Building & Construction

- Others

Pressure Sensitive Adhesives Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Pressure Sensitive Adhesives market?The Global Pressure Sensitive Adhesives Market is expected to grow from USD 12.4 billion in 2022 to USD 21.87 billion by 2032, at a CAGR of 5.8% during the forecast period 2022-2032.

-

2. Which are the key companies in the market?Arkema, 3M, Sika AG, Ashland, Inc., AkzoNobel N.V., Henkel AG & Co. KGaA, The Dow Chemical Company, Avery Dennison Corporation, H.B. Fuller Company, Franklin Adhesives & Polymers., Pidilite Industries Ltd., Jubilant Industries Ltd., BASF SE, LG Chem, Ellsworth Adhesives, Bostik SA, Evonik Industries AG.

-

3. Which segment dominated the Pressure Sensitive Adhesives market share?The packaging segment in end-use Industry type dominated the Pressure Sensitive Adhesives market in 2022 and accounted for a revenue share of over 34.2%.

-

4. What are the elements driving the growth of the Pressure Sensitive Adhesives market?The ability to overcome adhesion issues across a wide range of substrates and coatings in the packaging industry is a key element driving market growth for pressure sensitive tapes and labels.

-

5. Which region is dominating the Pressure Sensitive Adhesives market?Asia Pacific is dominating the Pressure Sensitive Adhesives market with more than 38.7% market share.

-

6. Which segment holds the largest market share of the Pressure Sensitive Adhesives market?The acrylic segment based on chemistry type holds the maximum market share of the Pressure Sensitive Adhesives market.

Need help to buy this report?