Global Power Over Ethernet Switch Market Size, Share, and COVID-19 Impact Analysis, By Type (Managed and Unmanaged), By End-User (Commercial, Industrial, and Residential), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Power Over Ethernet Switch Market Insights Forecasts to 2035

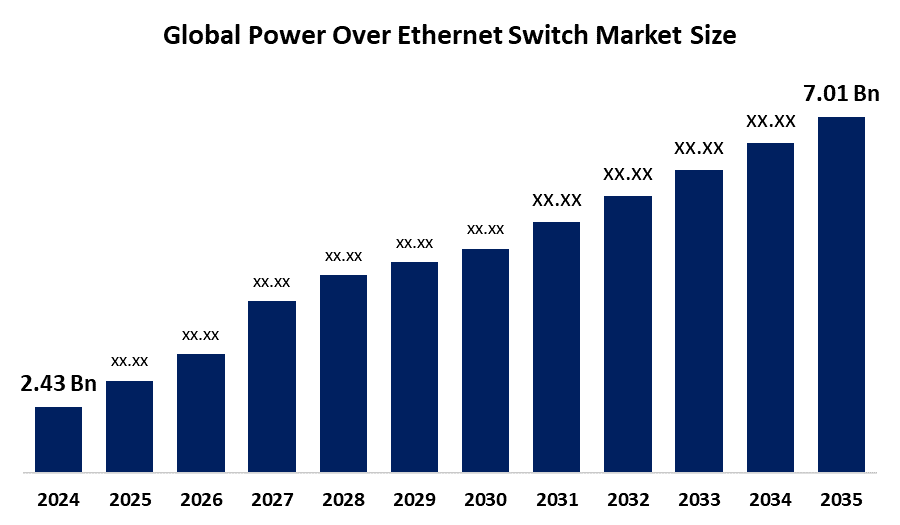

- The Global Power Over Ethernet Switch Market Size Was Estimated at USD 2.43 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.11% from 2025 to 2035

- The Worldwide Power Over Ethernet Switch Market Size is Expected to Reach USD 7.01 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Power Over Ethernet Switch Market Size was worth around USD 2.43 Billion in 2024 and is predicted to grow to around USD 7.01 Billion by 2035 with a compound annual growth rate (CAGR) of 10.11% from 2025 and 2035. The market for power over ethernet switch has a number of opportunities to grow because of the increasing number of Internet of Things devices. PoE switches offer effective power and data transport solutions. Additionally, there is a growing need for PoE switches that simplify installs and lower infrastructure costs due to the growing use of smart building technologies like security and intelligent lighting.

Market Overview

A network device called a power over ethernet switch integrates electrical power and data transmission into a single Ethernet cable connection. The global hyperscale capacity doubles every four years, reaching 1,000 active locations, with a further 120–130 facilities added annually. 51% of that footprint is in the US alone, and 60% of installed racks are owned by Amazon, Microsoft, and Google. Every new campus has tens of thousands of top of rack and spine leaf switches installed, which directly adds to the increased demand for Ethernet switches in the market. High speed Ethernet port shipments are expected to surpass previous upgrade cycles by 2028, compounding at a rate of 50% every year. Hyperscalers are rapidly moving from 400 Gbit/s to 800 Gbit/s fabrics by 2025, the majority of AI clusters are anticipated to employ 800 Gbit/s switch uplinks. Businesses like 25 Gbit/s as an incremental step up from 10 Gbit/s because it reuses existing copper or OM3 fiber infrastructure while delivering 2.5 times throughput at a slight premium. Deterministic congestion control and link level telemetry will be codified through standards development inside the Ultra Ethernet Consortium to guarantee that these speeds scale consistently.

The General Services Administration in the United States has made it mandatory for all new federal buildings to use smart building technologies by 2025. These include security systems, HVAC control, and intelligent lighting, all of which can profit from PoE infrastructure. PoE solution demand in federal construction projects is mostly driven by this policy. In July 2023, Allied Telesis, Inc. launched the IE220 Series of industrial grade switches ruggedized for enduring performance in harsh environments, such as those found in OT networks and outdoor installations.

Report Coverage

This research report categorizes the power over ethernet switch market size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the power over ethernet switch market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the power over ethernet switch market.

Global Power Over Ethernet Switch Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.43 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 10.11% |

| 2035 Value Projection: | USD 7.01 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By End Use, By Region |

| Companies covered:: | Cisco Systems Huawei Technologies Hewlett Packard Enterprise Aruba Juniper Networks Broadcom Analog Devices Texas Instruments Microchip Technology Dell Technologies Netgear Belden Inc. ZTE Corporation FiberHome Advantech Co., Ltd. Allied Telesis, Inc. and Other, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Power Over Ethernet Switch Market Size is driven by the growing use of IP based devices, such as VoIP phones and security cameras. Power over Ethernet switches are becoming more and more necessary as businesses look to improve their network infrastructure. By providing power and data via a single wire, these devices streamline installations and lower the complexity and expense of conventional configurations. An increased focus on energy efficiency in a variety of sectors helps the global market for PoE switches. Solutions that reduce energy usage without sacrificing performance are being used by organizations more and more. PoE switches support these sustainability objectives by allowing devices to obtain power straight from the network. As companies realize the potential for lower energy costs and environmental effects, this trend is probably going to propel market expansion.

Restraining Factors

The Power Over Ethernet Switch Market Size is restricted by factors like the high initial cost of PoE switches in comparison to conventional network switches. Adoption may be hampered by the greater cost for residential and small business users. There is also fierce competition in the market, with several companies selling comparable goods.

Market Segmentation

The power over ethernet switch market share is classified into type and end-user.

- The managed segment dominated the market in 2024, accounting for approximately 56.3% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the power over ethernet switch market size is divided into managed and unmanaged. Among these, the managed segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven due to their advanced capabilities, which include traffic control, enhanced security, and network monitoring. These switches are ideal for larger networks or those that require a high level of control and reliability, like those found in commercial or industrial environments. As businesses continue to embrace digital transformation, it is projected that the demand for managed PoE switches will increase significantly.

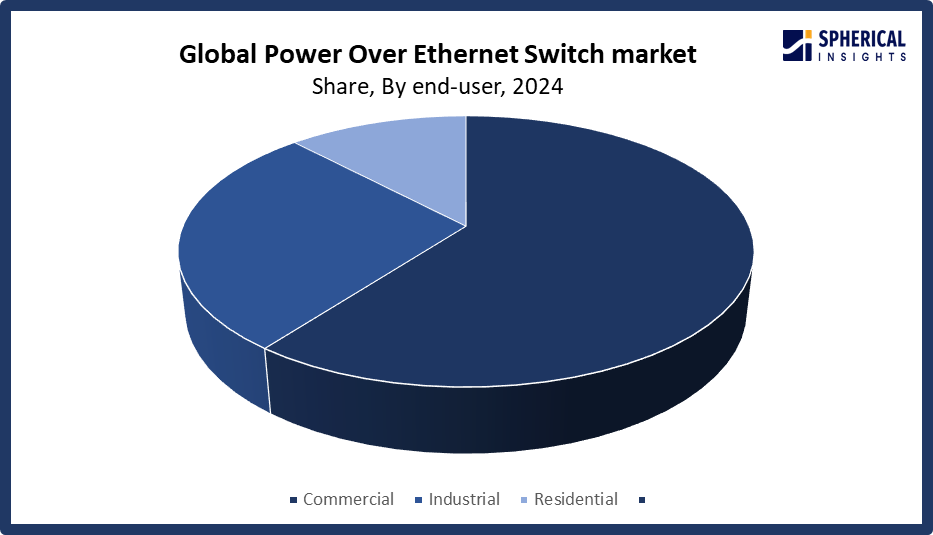

- The commercial segment accounted for the largest share in 2024, accounting for approximately 60% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-user, the power over ethernet switch market is divided into commercial, industrial, and residential. Among these, the commercial segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is due to the widespread use of PoE switches in workplaces, retail establishments, healthcare facilities, and educational institutions. One major factor driving growth in these environments is the requirement for effective network solutions to handle VoIP phones, wireless access points, and IP cameras. Demand from the commercial sector is still high as companies continue to use smart and digital technology.

Get more details on this report -

Regional Segment Analysis of the Power Over Ethernet Switch Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share, representing nearly 35% of the power over ethernet switch market over the predicted timeframe.

North America is anticipated to hold the largest share, representing nearly 35% of the power over ethernet switch market over the predicted timeframe. In the North America market, the is rising because to the presence of significant market players and the early adoption of cutting-edge technologies. The market expansion is mostly driven by the region's established infrastructure and the growing use of smart building technologies. The widespread use of VoIP phones, wireless access points, and IP cameras across multiple industries in North America is driving the demand for PoE switches.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR, representing nearly 15.1% in the power over ethernet switch market during the forecast period. The Asia Pacific area has a thriving market for power over ethernet switch due to the region's fast urbanization, rising investments in smart city initiatives, and the expanding IT and telecommunications industry. PoE switches are in great demand since nations like China, Japan, and India are leading the way in infrastructural development and technology breakthroughs. Market expansion is further fueled by the region's increasing emphasis on smart technologies and digital transformation.

Europe's power over ethernet switch market propelled by the area's emphasis on industrial automation and smart city initiatives. Countries like France, the UK, and Germany are making significant investments in IoT technology and smart infrastructure, which call for reliable network solutions. The region's need for PoE switches is further increased by the growing emphasis on security and the uptake of sophisticated communication technologies. Throughout the predicted period, Europe is anticipated to continue growing steadily.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the power over ethernet switch market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cisco Systems

- Huawei Technologies

- Hewlett Packard Enterprise Aruba

- Juniper Networks

- Broadcom

- Analog Devices

- Texas Instruments

- Microchip Technology

- Dell Technologies

- Netgear

- Belden Inc.

- ZTE Corporation

- FiberHome

- Advantech Co., Ltd.

- Allied Telesis, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, Just Add Power integrated its Advanced Matrix Programmer system configuration software with the Intellinet Network Solutions 54 Port L3 Fully Managed PoE Switch. This collaboration allows for enhanced flexibility in AV over IP deployments, particularly in commercial and enterprise settings requiring high port density and advanced routing capabilities.

- In August 2025, Zyxel launched the XGS1935 52HP, a 48 port Gigabit PoE switch designed for small and medium sized businesses. It offers a 176Gbps switching capacity and supports 802.3at PoE with a total power budget of 375W, making it suitable for IP phones, access points, and surveillance systems.

- In April 2025, Omnitron Systems unveiled compact Single Pair Power over Ethernet switches and injectors in April 2025. These devices extend Ethernet and PoE up to 1,000 meters over 2 wire Single Pair Ethernet cables, enhancing connectivity in industrial and smart building applications.

- In January 2025, Lantronix introduced its 28 port SM24TBT4XPA Managed 2.5G Ethernet PoE network switch at the 2025 BICSI Winter Conference & Exhibition. This switch features IEEE 1588v2 precision clock synchronization, catering to applications in smart buildings, wireless networks, and surveillance systems.

- In September 2023, Digi Key launched PDS 204GCO. It is a next generation outdoor Power over Ethernet switch for smart cities. It allows WiFi access points, security network cameras, and many other IoT devices to receive power and data over standard Ethernet cables, leaving network infrastructure completely unaltered.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the power over ethernet switch market based on the below-mentioned segments:

Global Power Over Ethernet Switch Market, By Type

- Managed

- Unmanaged

Global Power Over Ethernet Switch Market, By End-User

- Commercial

- Industrial

- Residential

Global Power Over Ethernet Switch Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the power over ethernet switch market over the forecast period?The global power over ethernet switch market is projected to expand at a CAGR of 10.11% during the forecast period.

-

2.What is the market size of the power over ethernet switch market?The global power over ethernet switch market size is expected to grow from USD 2.43 Billion in 2024 to USD 7.01 Billion by 2035, at a CAGR of 10.11% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the power over ethernet switch market?North America is anticipated to hold the largest share of the power over ethernet switch market over the predicted timeframe.

-

4.Who are the top 15 companies operating in the global power over ethernet switch market?Cisco Systems, Huawei Technologies, Hewlett Packard Enterprise Aruba, Juniper Networks, Broadcom, Analog Devices, Texas Instruments, Microchip Technology, Dell Technologies, Netgear, Belden Inc., ZTE Corporation, FiberHome, Advantech Co., Ltd., Allied Telesis, Inc., and Others.

-

5.What factors are driving the growth of the power over ethernet switch market?The power over ethernet switch market growth is because of the increasing number of Internet of Things devices, PoE switches offer effective power and data transport solutions. PoE switches, which can ease installations and lower infrastructure costs, are also in high demand due to the growing use of smart building technologies like IP cameras, smart lighting, and HVAC systems.

-

6.What are market trends in the power over ethernet switch market?The power over ethernet switch market trends include advancements in PoE standards, integration of artificial intelligence, expansion of multi gigabit PoE, growth of smart building infrastructure, and shift towards managed PoE switches.

-

7.What are the main challenges restricting wider adoption of the power over ethernet switch market?The power over ethernet switch market trends include legacy infrastructure compatibility problems, such as outdated cabling and non-standard devices. Furthermore, the quantity and variety of devices that can be supported concurrently are limited by power constraints.

Need help to buy this report?