Global Potato Flake Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Standard Potato Flakes, Low Moisture Potato Flakes, and Specialty Potato Flakes), By Application (Food Processing, Snacks, Bakery, Soups, and Sauces, and Others), By End User (Household, Food Service, Industrial), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Potato Flake Market Insights Forecasts to 2035

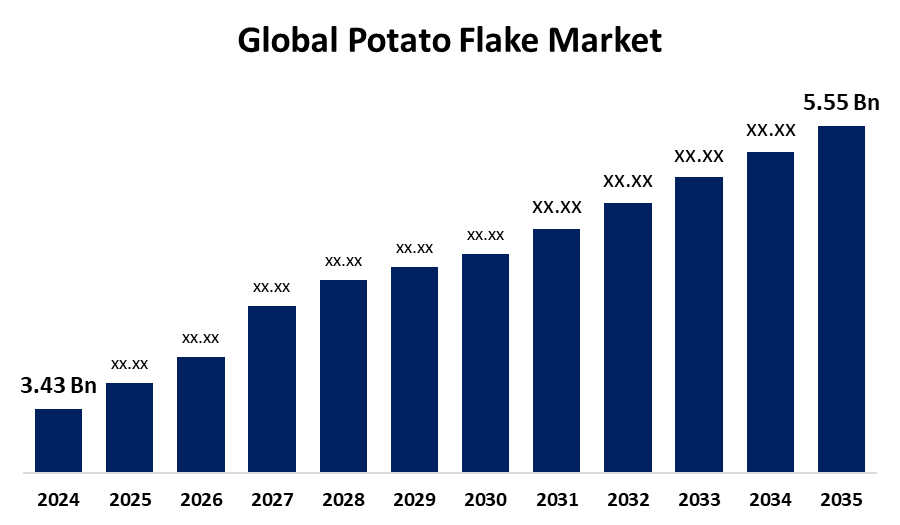

- The Global Potato Flake Market Size Was Estimated at USD 3.43 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.47% from 2025 to 2035

- The Worldwide Potato Flake Market Size is Expected to Reach USD 5.55 Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the Forecast Period.

Get more details on this report -

The Global Potato Flake Market Size was Worth around USD 3.43 Billion in 2024 and is predicted to Grow to around USD 5.55 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 4.47% from 2025 and 2035. The potato flake market size is propelled by increasing demand for easy and ready-to-consume foods, food service industry growth, increasing snacking patterns globally, technological advancements in processing, and expanding applications in bakery, soups, sauces, and pet foods industries.

Market Overview

The Potato Flakes Market Size is the business of manufacturing and selling dried potato flakes. The flakes are prepared from potatoes that have been cooked, mashed, and dehydrated into a stable product that is used as a food ingredient in items like snacks, soups, sauces, bakery products, and convenience foods. Potato flakes have the advantage of a long shelf life, less storage space, easy transportation, and economies compared to fresh potatoes. They also rehydrate rapidly without loss of taste or texture, which makes them extremely useful in food processing. With these advantages, food manufacturers can make a diverse range of products with consistent quality and nutritional content, which is an appeal to consumers as well as the food industry. Moreover, advances like low-moisture and specialty potato flakes with improved nutritional profiles, enhanced processing methods with greater taste and texture, and environmentally friendly packaging are assisting manufacturers in satisfying changing consumer demands and governmental regulations. Such advances are fueling the continued growth of the potato flake market around the world.

Report Coverage

This research report categorizes the potato flake market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the potato flake market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the potato flake market.

Global Potato Flake Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.43 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.47% |

| 2035 Value Projection: | USD 5.55 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Application, By End User, By Region |

| Companies covered:: | Idaho Pacific Corporation, McCain Foods Limited, Lamb Weston Holdings, Inc., Bobs Red Mill Natural Foods Inc., Basic American Foods, Agrarfrost GmbH & Co. KG, Aviko B.V., Emsland Group, KMC Kartoffelmelcentralen a.m.b.a., PepsiCo, Inc., R. J. Van Drunen & Sons Inc., Agristo NV, and Other Key Comapnies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Urbanization and busy lifestyles have contributed to higher demand for easy-to-prepare, quick foods. Potato flakes need low cooking time and effort, making them a great ingredient for food service operators and households wanting to save preparation time. Increased demand for ready-to-use products further heavily drives demand for potato flakes across the world. Potato flakes are also an important ingredient in many snack foods such as chips, crackers, and extrusion products. The growing worldwide snacking trend, fueled by the younger population and evolving food consumption patterns, boosts the consumption of such snacks. The trend compels manufacturers to employ potato flakes due to their textural and flavor advantages, thus further widening the market.

Restraining Factors

The manufacture of potato flakes is reliant to a great extent on the supply and price of fresh potatoes. Seasonal changes, crop diseases, droughts, and supply chain disruptions can cause significant fluctuations in raw potato prices. As raw material prices go up, manufacturing expenses rise, narrowing profit margins and leading to possible increased prices for final consumers, ultimately decreasing demand. Additionally, while potato flakes have a satisfactory shelf life, they are hygroscopic, or they readily absorb moisture. If not packed in airtight containers, particularly in humid or poorly controlled conditions, the product can clump or spoil. This constrains distribution in areas of weak storage infrastructure and adds to packaging and logistical costs.

Market Segmentation

The potato flake market share is classified into product type, application, and end user.

- The standard potato flakes segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the potato flake market is divided into standard potato flakes, low-moisture potato flakes, and specialty potato flakes. Among these, the standard potato flakes segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to standard potato flakes having a broad application base mashed potatoes, snacks, soups, sauces, and bakery. The fact that they can rapidly rehydrate and provide consistent flavor and texture gives them a staple status in industrial and consumer applications alike. This versatility across food categories drives their broad acceptance and market leadership.

- The snacks segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the potato flake market is divided into food processing, snacks, bakery, soups and sauces, and others. Among these, the snacks segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth is attributed to consumers are more and more looking for fast, convenient snack foods that complement busy lifestyles. Potato flakes are the perfect choice for producing snacks such as chips, crisps, and extruded snacks. Their short preparation time, convenience of handling, and extended shelf life contribute to making potato flakes a popular choice, boosting intense demand from snack producers and making snacks the leading application segment.

- The food service segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the end user, the potato flake market is divided into household, food service, and industrial. Among these, the food service segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The growth is driven by foodservice operators who prefer potato flakes due to ease of application, extended shelf life, and consistent quality. These qualities make kitchen operations easier, minimize preparation time, and provide consistent taste and texture throughout servings. Such efficiency is highly necessary in commercial kitchens to satisfy customers and cover peak demand times.

Regional Segment Analysis of the Potato Flake Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the potato flake market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the potato flake market over the predicted timeframe. North America's fast lifestyle supports a heavy demand for convenience food such as instant mashed potatoes, prepared meals, and snack foods. Potato flakes, which are so simple to prepare and store, fit perfectly with consumers' desire for low-effort meals. The common utilization of potato flakes in home food preparation and commercial food service maintains continually high usage. The United States and Canada are two of the world's largest potato producers, with prime growing areas in Idaho, Washington, and Alberta. This regional availability provides a consistent, low-cost supply of raw potato material for the manufacture of potato flakes.

Asia Pacific is expected to grow at a rapid CAGR in the potato flake market during the forecast period. The rapid expansion of fast-food chains and snack food companies in Asia-Pacific is contributing immensely to the demand for potato flakes. Flakes are a major component of offerings such as potato snacks, patties, and instant mashed potatoes consumed in QSRs and frozen food segments. With growing youth populations, urban working-class professionals with little time, and growing Western influence on cuisine consumption, consumption of such processed foods is witnessing a boom. This food service and snack industry demand is one of the key drivers of market acceleration.

Europe is predicted to hold a significant share of the potato flake market throughout the estimated period. Europe boasts a historical dining culture revolving around potatoes, which form part of staple foods in most European nations like Germany, the UK, and France. Such cultural affinity results in a consistent demand for potato products, including potato flakes. Potato flakes find extensive applications in processed foods, baby food, snack foods, and convenience foods. The popularity and acceptability of potato ingredients in the regular diet contribute to maintaining Europe's significant market position in potato flakes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the potato flake market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Idaho Pacific Corporation

- McCain Foods Limited

- Lamb Weston Holdings, Inc.

- Bobs Red Mill Natural Foods, Inc.

- Basic American Foods

- Agrarfrost GmbH & Co. KG

- Aviko B.V.

- Emsland Group

- KMC Kartoffelmelcentralen a.m.b.a.

- PepsiCo, Inc.

- R. J. Van Drunen & Sons, Inc.

- Agristo NV

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2025, McCain Foods introduced a hybrid potato food that has elements of crisps and chips, with a crispy exterior and a fluffy inside. Composed in Salt & Vinegar and Firecracker Chilli flavors, this new product meets changing consumer preferences.

- In January 2025, GreenFay Farm Foods, a local Indian player, inaugurated a new world-class potato flakes manufacturing unit in Gujarat during January 2025. The plant has a capacity of 2,200 kg per hour and is designed to service both domestic and export markets.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the potato flake market based on the below-mentioned segments:

Global Potato Flake Market, By Product Type

- Standard Potato Flakes

- Low Moisture Potato Flakes

- Specialty Potato Flakes

Global Potato Flake Market, By Application

- Food Processing

- Snacks

- Bakery

- Soups and Sauces

- Others

Global Potato Flake Market, By End User

- Household

- Food Service

- Industrial

Global Potato Flake Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the potato flake market over the forecast period?The global potato flake market is projected to expand at a CAGR of 4.47% during the forecast period.

-

2. What is the market size of the potato flake market?The global potato flake market size is expected to grow from USD 3.43 Billion in 2024 to USD 5.55 Billion by 2035, at a CAGR of 4.47% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the potato flake market?North America is anticipated to hold the largest share of the potato flake market over the predicted timeframe.

Need help to buy this report?