Global Positive Airway Pressure Devices Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Automatic Positive Airway Pressure (APAP) Devices, Continuous Positive Airway Pressure (CPAP) Devices, Bi-level Positive Airway Pressure (BiPAP) Devices), By End Use (Hospitals and Sleep Labs, Home Care, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Industry: HealthcareGlobal Positive Airway Pressure Devices Market Size Insights Forecasts to 2035

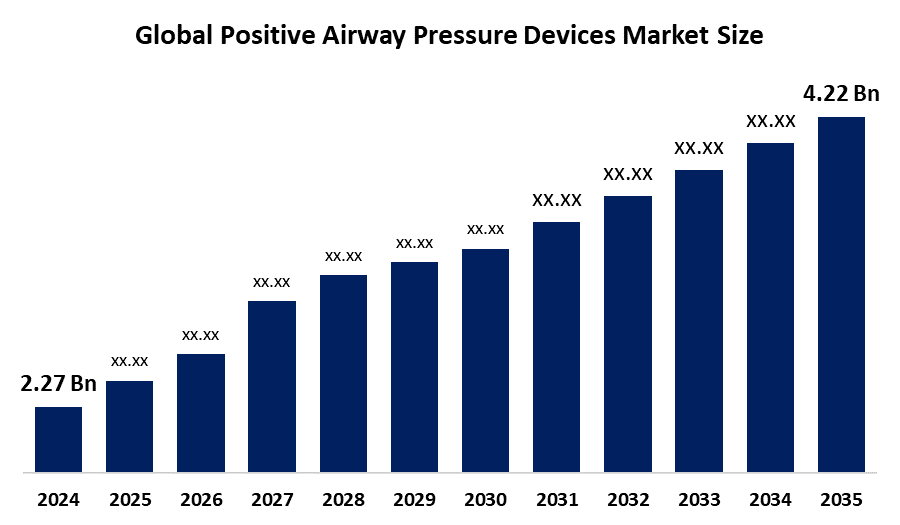

- The Global Positive Airway Pressure Devices Market Size Was Estimated at USD 2.27 billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.8% from 2025 to 2035

- The Worldwide Positive Airway Pressure Devices Market Size is Expected to Reach USD 4.22 billion by 2035

- Asia Pacific is expected to grow the largest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Global Positive Airway Pressure Devices Market Size Was Worth Around USD 2.27 Billion In 2024 And Is Predicted To Grow To Around USD 4.22 Billion By 2035 With A Compound Annual Growth Rate (CAGR) Of 5.8% From 2025 To 2035. The rising incidence of sleep apnea, technological developments, increased knowledge and diagnosis of sleep disorders, and improved healthcare infrastructure are all factors contributing to this growth. The market is being stimulated by the rising prevalence of cardiac problems, diabetes, depression, and hypertension.

Market Overview

The PAP device market is the global industry that develops, manufactures, distributes, and sells medical devices that use pressurized air to keep the airways open while sleeping or providing respiratory support. PAP Devices treat sleep-related breathing problems and include all types of obstructive sleep apneas OSA, central sleep apneas and certain cases of chronic respiratory insufficiency. PAP Devices provide a continuous or variable stream of air through a mask to prevent the airway from collapsing and to increase the amount of oxygen being delivered to the user. Market growth is primarily driven by an increased incidence of sleep apnea, a growing awareness of Sleep Health, advancements in technology to create small, portable, and Smart PAP Devices, and the increasing availability of Home Health Care Services that allow for the use of PAP Devices.

NovaResp received USD 2 million in a seed-plus round led by Concrete Ventures with participation from angels and Invest Nova Scotia in late 2022. Further, progress product development and regulatory approval for their cMAP AI algorithm, which predicts apneas for lower-pressure therapy.

NovaResp secured a USD 3 million seed extension with Concrete Ventures, under the direction of Dr Neil Smith. This is for Invest Nova Scotia and other organisations like CABHI to finance clinical trials for individualised CPAP adherence.

Around 2022, Cathay Capital strategically invested in CPAP.com to help the e-commerce leader in the USD 3.7 billion OSA industry for sleep apnea device sales.

Report Coverage

This research report categorises the Positive Airway Pressure Devices Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the positive airway pressure devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the positive airway pressure devices market.

Global Positive Airway Pressure Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.27 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.8% |

| 2035 Value Projection: | USD 4.22 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By End Use, By Regional Analysis |

| Companies covered:: | Armstrong Medical Inc., BMC Medical, Breas Medical, Drive DeVilbiss Healthcare, Fisher & Paykel Healthcare Limited, Koninklijke Philips N.V., Lowenstein Medical UK Ltd, React Health (3B Medical), ResMed, SEFAM, Transcend Inc. (Somnetics International, Inc.), Trudell Medical (Vyaire), Wellell (Apex Medical), and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Positive Airway Pressure Devices Market Size is experiencing significant growth; there are three primary drivers for this trend. First, the increased prevalence of sleep apnea among patients and rising awareness regarding the existence of sleep-related disorders have increased demand for both the diagnosis and treatment of sleep apnea. In addition to introducing new products, Philips has made significant investments in these initiatives, resulting in greater confidence among consumers in their ability to obtain a good night's sleep. The second primary driver of growth is technological advancements that have improved patients' experiences using CPAP systems, as well as improved the effectiveness of treatment. The emergence of new and advanced forms of Globalization, changing lifestyle practices, and the deteriorating diet of individuals have all contributed to an increase in the number of people suffering from Sleep Apnoea. The combination of increases in Obesity and a decrease in physical activity has caused obstructive ngu apnea levels to continue rising.

Restraining Factors

The positive airway pressure (PAP) devices industry is affected by both high-cost devices limiting their accessibility, as well as people being noncompliant with using them as a result of having discomfort or inconvenience. Other factors affecting the PAP market may include stricter regulations and a lack of reimbursement options, which may slow down the approval and adoption of PAP products. In addition, there is an uneven distribution network for PAPs that limits product penetration into developing countries but increases the overall awareness of PAPs.

Market Segmentation

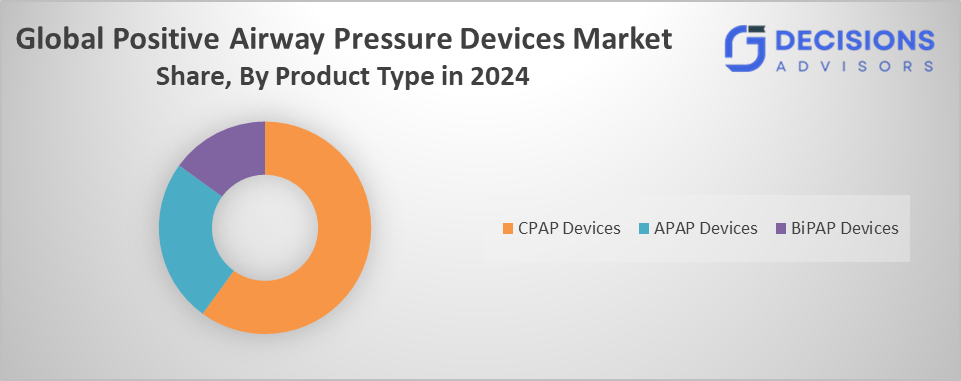

The positive airway pressure devices market share is classified into product type and end use.

- The continuous positive airway pressure (CPAP) devices segment accounted for the largest market share in 2024 and is projected to grow at a substantial CAGR over the forecast period.

Based on the product type, the Positive Airway Pressure Devices Market Size is segmented into automatic positive airway pressure (APAP) devices, continuous positive airway pressure (CPAP) devices, and bi-level positive airway pressure (BiPAP) devices. Among these, the continuous positive airway pressure (CPAP) devices segment accounted for the largest market share in 2024 and is projected to grow at a substantial CAGR over the forecast period. This is because sleep apnea, especially obstructive sleep apnea (OSA), is becoming more common. Technological innovations that improve patient compliance and encourage adoption include integrated humidifiers, auto-adjusting pressure settings, and improved comfort features. Additionally, the emergence of travel-friendly and portable CPAP equipment is improving user experience and expanding market penetration, as is the incorporation of smart connectivity features for remote monitoring.

The bi-level positive airway pressure (BiPAP) devices segment of the positive airway pressure devices market is expected to expand at the fastest CAGR during the projected period. The increase in the number of patients who are prescribed BiPAP pressure support for moderate to severe obstructive sleep apnea and other respiratory diseases like congestive heart failure and COPD (chronic obstructive pulmonary disease) has been the main driver for this growth. One of the advantages of BiPAP devices is their ability to provide two different pressures, which makes them comfortable for patients with various medical needs requiring high pressure levels. New pressure algorithms, user-friendly controls, and improved recognition of complex sleep disorders are all parts of the technology's fast and wide acceptance.

Get more details on this report -

- The hospitals and sleep labs segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end use, the Positive Airway Pressure Devices Market Size is divided into hospitals and sleep labs, home care, and others. Among these, the hospitals and sleep labs segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Reflecting the move toward at-home, patient-centred sleep therapy. This is because home-based PAP treatment is more convenient, comfortable, and can be incorporated into daily routines without sacrificing clinical efficacy; patients prefer it. The cost-effectiveness, scalability, and alignment of home therapy with chronic disease management strategies are acknowledged by providers.

The home care settings segment of the positive airway pressure (PAP) devices market is anticipated to grow at a significant rate during the forecast period. The main factor for this market expansion is the patients' increasing choice for home therapy, which is cheaper, more comfortable, and more convenient. Technological advancements in small, easy-to-use PAP devices have made home therapy more accessible to patients and are therefore promoting their treatment adherence. The mass adoption and acceptance of telehealth services, remote patient monitoring, and sleep apnea education are some of the factors that are contributing to the market growth. The COVID-19 pandemic played a major role in hastening the transition to home care by promoting telemedicine, increasing the virtual management of chronic diseases, and minimizing in-person hospital visits.

Regional Segment Analysis of the Positive Airway Pressure Devices Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the positive airway pressure devices market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the positive airway pressure devices market during the forecast period. In 2024, the North America region accounted for the largest share of the global positive airway pressure (PAP) devices market. This was mainly due to the increase in the incidence of obstructive sleep apnea and the higher awareness level about the treatment options. Sleep apnea is estimated to affect approximately 18 million people in the U.S., which accounts for 6.62% of the total population; thus, there is already a significant demand. Besides that, the market is becoming more competitive due to globalisation, changes in lifestyles, and an increase in consumers' disposable incomes. In the U.S., there are policies in place that give a favourable reimbursement for the PAP therapy, and with an increase in healthcare spending, the PAP devices are becoming more and more accessible.

Asia Pacific is expected to grow at a significant CAGR in the positive airway pressure devices market over the predicted timeframe. The positive airway pressure (PAP) devices market in the Asia Pacific is experiencing significant growth, largely benefiting from increased healthcare awareness and the rising cases of sleep apnea. The industry is innovating to create less noisy, more comfortable devices equipped with features like smart connectivity and remote monitoring, which greatly enhance patient compliance and lead to better treatment outcomes. The market in China is experiencing growth thanks to increased knowledge and adoption of sophisticated treatment options, along with an ageing population that is more vulnerable to sleep disorders. Moreover, to improve patient experience, manufacturers are paying more attention to ergonomics, quietness, and the integration of digital technology.

ResMed has officially launched the AirSense 11 CPAP device in India. It is designed to simplify the initiation of therapy and improve adherence for patients with obstructive sleep apnea (OSA). It integrates advanced digital health features, making CPAP therapy more accessible and effective for Indian users.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the positive airway pressure devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Armstrong Medical Inc.

- BMC Medical

- Breas Medical

- Drive DeVilbiss Healthcare

- Fisher & Paykel Healthcare Limited

- Koninklijke Philips N.V.

- Lowenstein Medical UK Ltd

- React Health (3B Medical)

- ResMed

- SEFAM

- Transcend Inc. (Somnetics International, Inc.)

- Trudell Medical (Vyaire)

- Wellell (Apex Medical)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2026, Inogen launched its new Aurora CPAP masks in the U.S., marking its entry into the sleep apnea market. The Aurora line includes full face, nasal cushion, and nasal pillow variants, designed for comfort, reliability, and compatibility with most CPAP devices.

- In December 2025, the U.S. FDA granted 510(k) clearance (Dec 17, 2025) to SleepRes’s Kricket PAP device, powered by Kairos Positive Airway Pressure (KPAP). This next-generation technology adapts pressure delivery dynamically across the breathing cycle, aiming to improve comfort and adherence for obstructive sleep apnea patients. Commercial launch is expected in the first half of 2026.

- In September 2024, ResMed announced its first-ever fabric CPAP mask, the AirTouch™ N30i. This nasal mask features a fabric-wrapped frame with breathable, moisture-wicking materials, designed to improve comfort, aesthetics, and long-term adherence to CPAP therapy. It became available in the U.S. in late October 2024.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the positive airway pressure devices market based on the below-mentioned segments:

Global Positive Airway Pressure Devices Market, By Product Type

- Automatic Positive Airway Pressure (APAP) Devices

- Continuous Positive Airway Pressure (CPAP) Devices

- Bi-level Positive Airway Pressure (BiPAP) Devices

Global Positive Airway Pressure Devices Market, By End Use

- Hospitals and Sleep Labs

- Home Care

- Others

Global Positive Airway Pressure Devices Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the current size of the global Positive Airway Pressure Devices market?The market was valued at USD 2.27 billion in 2024.

-

2. What is the projected market size by 2035?It is expected to reach USD 4.22 billion by 2035.

-

3. What is the CAGR for the market from 2025 to 2035?The market is projected to grow at a CAGR of 5.8%.

-

4. What are the main product types in the PAP devices market?The segments include Automatic Positive Airway Pressure (APAP) Devices, Continuous Positive Airway Pressure (CPAP) Devices, and Bi-level Positive Airway Pressure (BiPAP) Devices.

-

5. Which end-user segment led the market in 2024?Hospitals and sleep labs accounted for the highest revenue in 2024.

-

6. Which region is expected to hold the largest?North America is anticipated to hold the largest CAGR during the forecast period.

-

7. What are the primary drivers of market growth?Key drivers include rising sleep apnea prevalence, increased awareness, technological advancements, and expanding home healthcare services.

-

8. Who are some key players in the market?Major companies include ResMed, Koninklijke Philips N.V., Fisher & Paykel Healthcare, and React Health (3B Medical).

Need help to buy this report?