Global Porphyrias Treatments Market Size, Share, and COVID-19 Impact Analysis, By Treatment Types (Porphyrin, Dextrose, Anticonvulsants, Opioids, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Porphyrias Treatments Market Insights Forecasts to 2035

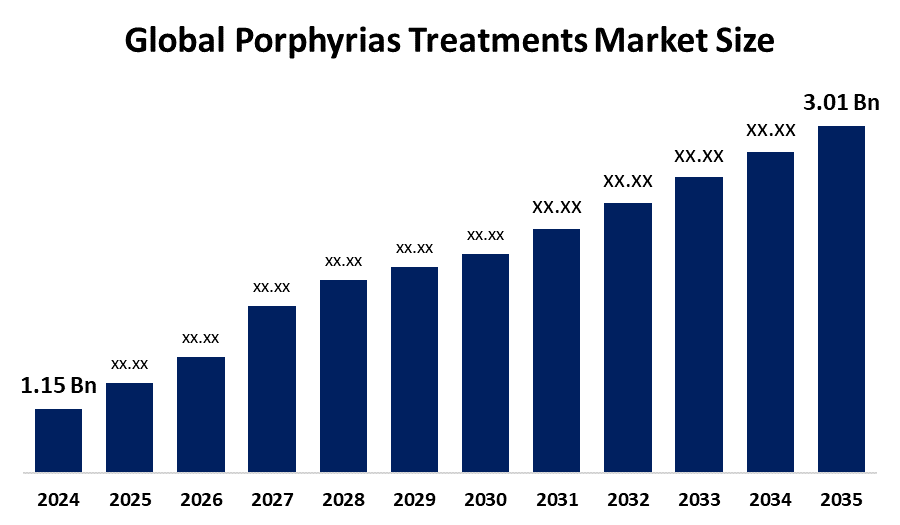

- The Global Porphyrias Treatments Market Size Was Estimated at USD 1.15 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.14% from 2025 to 2035

- The Worldwide Porphyrias Treatments Market Size is Expected to Reach USD 3.01 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global porphyrias treatments market size was worth around USD 1.15 Billion in 2024 and is predicted to grow to around USD 3.01 Billion by 2035 with a compound annual growth rate (CAGR) of 9.14% from 2025 and 2035. The market for porphyrias treatments has a number of opportunities to grow due to ongoing progress in nanotechnology and nanoscience for targeting disease, especially hepatic and erythropoietic related diseases, along with an increasing initiatives and R&D activities.

Market Overview

The global porphyrias treatments industry focuses on managing the symptoms and complications of porphyria, which is a group of rare genetic disorders. In porphyria, substances called porphyrins build up in the body, adversely affecting the skin or nervous system. Most types of porphyria are inherited from one or both of a person’s parents and are due to a mutation in one of the genes that make heme. They may be inherited in an autosomal, dominant, autosomal recessive, or X-linked dominant manner. Depending on the type of porphyria and the person’s symptoms, the treatment generally involves the avoidance of sunlight in case of skin porphyria, while giving intravenous heme or a glucose solution in case of acute porphyria.

Innovation and market expansion are anticipated as a result of major players' growing R&D expenditures and the expanding partnerships. The increasing clinical trials for gene therapy-related medications for treating porphyria are driving a huge surge in the global porphyrias treatments market. For instance, in June 2020, The New England Journal of Medicine published an article on ‘Phase 3 trial of RNAi Therapeutic Givosiran for Acute Intermittent Porphyria’.

Report Coverage

This research report categorizes the porphyrias treatments market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the porphyrias treatments market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the porphyrias treatments market.

Driving Factors

The porphyrias treatments market is driven by the advancement in treating congenital erythropoietic porphyria, along with an increasing research on identifying mutations in patients with congenital erythropoietic porphyria. The increasing awareness regarding prophyrias is supporting the market. For instance, in May 2024, the United Porphyrias Association (UPA) announced Global Porphyria Day, intended to create awareness that prompts action for improved healthcare, increased research, and enhanced support for individuals with porphyria. Furthermore, an increasing emphasis on research, development, and commercialization of novel treatments is anticipated to propel the market growth.

Restraining Factors

The porphyrias treatment market is restricted by factors including increased treatment costs, limited diagnosis, and challenges associated with clinical trials of novel drugs. Further, intense competition and continuously changing market demands are challenging the market growth.

Market Segmentation

The porphyrias treatments market share is classified into treatment types and distribution channel.

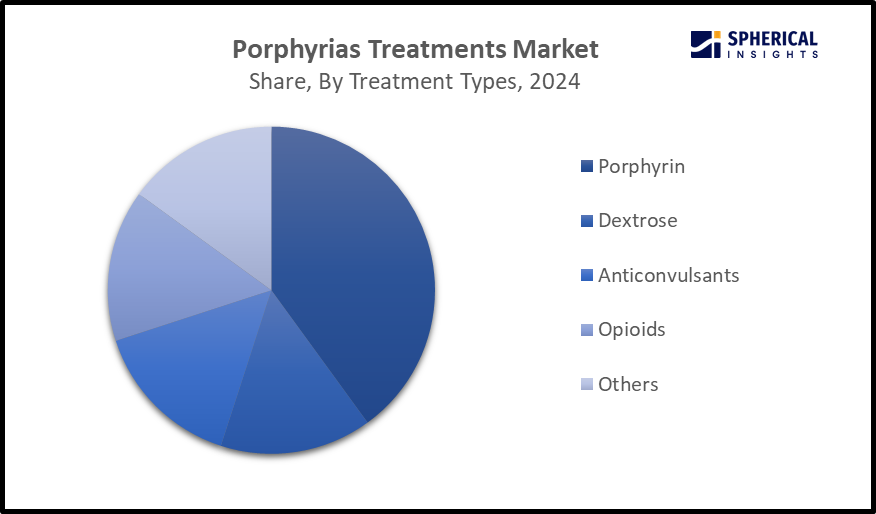

- The porphyrin segment dominated the market with the largest share of about 40% in 2024 and is expected to grow at a significant CAGR during the projected period.

Based on the treatment types, the porphyrias treatments market is divided into porphyrin, dextrose, anticonvulsants, opioids, and others. Among these, the porphyrin segment dominated the market with the largest share of about 40% in 2024 and is expected to grow at a significant CAGR during the projected period. Porphyrins are being used as sensitizers in photodynamic therapy as well as in sonodynamic therapy. Further, hemin, which is iron iron-containing porphyrin prescribed for certain blood disorders (porphyria) related symptoms. The increasing prevalence of porphyria diseases and the increase in the number of diagnostic laboratories are contributing to propel the market demand in the porphyrin segment.

Get more details on this report -

- The hospital pharmacies segment accounted for the largest market revenue share of about 50% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the porphyrias treatments market is divided into hospital pharmacies, retail pharmacies, and online pharmacies. Among these, the hospital pharmacies segment accounted for the largest market revenue share of about 50% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Several drugs used for treating porphyrias include Panhematin, Givlaari, chlorpromazine, hemin, and givosiran. Further, medications like Scenesse and afamelanotide are used in the prevention of phototoxicity in erythropoietic protoporphyria. For instance, Panhematin is a commercially available heme therapy in the United States recommended only after several days of glucose therapy have been unsuccessful. The ease of accessibility, along with an increased number of hospital admissions, is propelling the market growth.

Regional Segment Analysis of the Porphyrias Treatments Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the porphyrias treatments market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of about 45% in the porphyrias treatments market over the predicted timeframe. The market ecosystem in North America is strong, due to cutting-edge therapies and novel strategies for acute intermittent porphyria. The market demand for porphyrias treatments has been driven by the region's advanced healthcare infrastructure, advancements in diagnostics, the emergence of novel therapeutic modalities, and patient advocacy & awareness. Additionally, the implementation of programs by companies for introducing novel drugs contributes to promoting the market. For instance, in March 2025, Clinuvel introduced a groundbreaking vitiligo program at the World’s biggest dermatology meeting, AAD 2025, illuminating the past, present, and future of photomedicine, including CLINUVEL’s development program with the novel drug SCENESSE (afamelanotide). The U.S. is leading the North America porphyrias treatments market, accounting for about 45% revenue share in the region, owing to the improved diagnostics like genetic testing and new targeted therapies, especially for acute hepatic porphyria.

Asia Pacific is expected to grow at a rapid CAGR of around 9.5% in the porphyrias treatments market during the forecast period. The Asia Pacific area has a thriving market for porphyrias treatments due to its large population base, government initiatives, and growth of healthcare infrastructure. The region’s demographic shifts, economic development, and rapid digital innovation are promoting the growth of the healthcare sector, which ultimately contributes to enhancing the market growth. Japan is anticipated to dominate the Asia Pacific porphyrias treatments market, with a significant market share, driven by ongoing research for optimising clinical findings of therapeutic medicine. For instance, in May 2025, scientific reports published an article on “Efficacy and safety of givosiran in Japanese patients with acute hepatic porphyria: clinical findings from an expanded access study”

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the porphyrias treatments market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ACON Laboratories, Inc.

- Bio-Rad Laboratories, Inc.

- Dahaner

- Hoffmann-La Roche Ltd.

- Siemens AG

- ARKRAY, Inc.

- Sysmex Corporation

- Lundbeck

- Recordati Rare Diseases

- Teva Pharmaceutical

- Apotex

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, GondolaBio, a clinical-stage biopharmaceutical company developing novel medicines for patients living with genetic diseases, announced that the United States Food & Drug Administration had granted Orphan Drug Designation and Fast Track Designation to its affiliate, Portal Therapeutics, for PORT-77, an investigational oral, small-molecule ABCG2 inhibitor, for the treatment of EPP and XLP.

- In September 2025, Disc Medicine, Inc., a clinical-stage biopharmaceutical company, announced the submission for a New Drug Application (NDA) to the U.S. Food and Drug Administration (FDA) for bitopertin for patients aged 12 years and older with erythropoietic protoporphyria (EPP), including X-linked protoporphyria (XLP).

- In August 2023, Clinuvel was awarded a five-year contract with the U.S. Department of Veterans Affairs (VA) to supply Scenesse (afamelanotide) for the treatment of adults with erythropoietic protoporphyria (EPP).

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the porphyrias treatments market based on the below-mentioned segments:

Global Porphyrias Treatments Market, By Treatment Types

- Porphyrin

- Dextrose

- Anticonvulsants

- Opioids

- Others

Global Porphyrias Treatments Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Global Porphyrias Treatments Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the porphyrias treatments market?The global porphyrias treatments market size is expected to grow from USD 1.15 Billion in 2024 to USD 3.01 Billion by 2035, at a CAGR of 9.14% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the porphyrias treatments market?North America is anticipated to hold the largest share of the porphyrias treatments market over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global Porphyrias treatments Market from 2024 to 2035?The market is expected to grow at a CAGR of around 9.14% during the period 2024–2035.

-

4. Who are the top companies operating in the Global Porphyrias treatments Market?Key players include ACON Laboratories, Inc., Bio-Rad Laboratories, Inc., Dahaner, Hoffmann-La Roche Ltd., Siemens AG, ARKRAY, Inc., Sysmex Corporation, Lundbeck, Recordati Rare Diseases, Teva Pharmaceutical, and Apotex.

-

5. Can you provide company profiles for the leading porphyrias treatments manufacturers?Yes. For example, ACON Laboratories, Inc. is an international diagnostic and medical device company with its corporate headquarters in San Diego, California, USA, leading the way in making high-quality diagnostic and medical devices more affordable to people. Bio-Rad Laboratories, Inc. is an American developer and manufacturer of specialized technological products for the life science research and clinical diagnostics markets.

-

6. What are the main drivers of growth in the porphyrias treatments market?Advancements in treating congenital erythropoietic porphyria, technological advancements, growing awareness, and focus on R&D of novel therapeutics are major market growth drivers of the porphyrias treatments market.

-

7. What challenges are limiting the porphyrias treatments market?Increased treatment costs, limited diagnosis, and intense competition remain key restraints in the porphyrias treatments market.

Need help to buy this report?