Global Polyurethane Foam Insulation Materials Market Size, Share, and COVID-19 Impact Analysis, By Type (Flexible Foam, Rigid Foam, and Spray Foam), By Application (Automotive, Medical, Building and Construction, Packaging, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 - 2030.

Industry: Advanced MaterialsGlobal Polyurethane Foam Insulation Materials Market Insights Forecasts to 2030

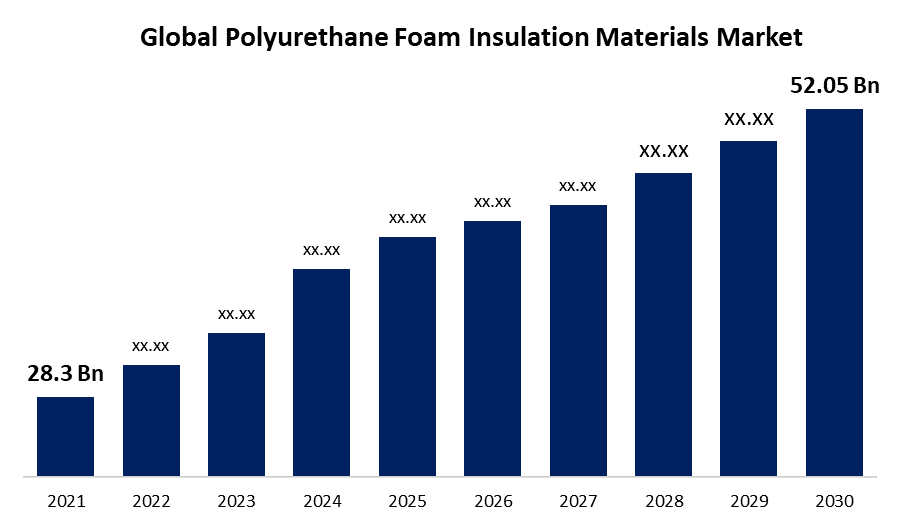

- The global polyurethane foam insulation materials market was valued at USD 28,314.75 million in 2021.

- The market is growing at a CAGR of 7% from 2022 to 2030

- The global polyurethane foam insulation materials market is expected to reach USD 52,055 million by 2030

- North America is expected to grow the fastest during the forecast period

Get more details on this report -

The global polyurethane foam insulation materials market is expected to reach USD 52,055 million by 2030, at a CAGR of 7% during the forecast period 2022 to 2030. The polyurethane foam insulation market is growing due to the expansion of end-use industries in developing countries like India, Thailand, and others, including bedding and furniture, electronics, automotive, and building and construction.

Market Overview

In residential construction, polyurethane foam insulation is used for several purposes, such as lowering air infiltration, lowering energy usage, and offering thermal protection. Due to their lower cost compared to other insulated building materials, polyurethane foams are very frequently utilized to insulate homes. Rigid polyurethane foam can reduce energy expenditures while preserving a consistent temperature, according to the U.S. Department of Energy. One of the primary growth drivers of the polyurethane foam insulation materials market is the expansion of end-use industries in developing countries like India, Thailand, and others, including bedding and furniture, electronics, automotive, and building & construction.

The increasing use of polyurethane foams in building insulation for energy conservation and their versatility and distinctive physical properties are other reasons fueling the growth of the polyurethane foam insulation materials market. The advantages of rigid and flexible foams are combined in a single product with semi-flexible polyurethane foam. It is hugely thermally, acoustically, moisture-controlling, and fire-resistant. It may be twisted or molded more quickly than solid polyurethane sheets because it is less rigid. Semi-flexible foam insulation, which absorbs sound waves better than other forms of insulation, also lowers noise levels.

Major market players are concentrating on new launches, product expansions, mergers, acquisitions, and partnerships to grow their businesses in the industry. For example, in March 2021, Technical Corporation, a major producer and supplier of roofing, waterproofing, thermal insulation, and sound absorption materials, announced the launch of a new product category called Polyurethane Foams by Technonicol to complement its existing line of premium-quality construction materials in India.

The new category includes foam for professional sealing, gluing, and fire resistance. High-performance spray foam insulation is also a part of it. Additionally, Wanhua Chemical Group Co. Ltd., a market leader in polyurethanes, purchased Chematur Technologies AB in August 2019, a prominent supplier of raw materials for polyurethane foams.

Global Polyurethane Foam Insulation Materials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 28,314.75 Million |

| Forecast Period: | 2022-2030 |

| Forecast Period CAGR 2022-2030 : | 7 % |

| 2030 Value Projection: | USD 52,055 Million |

| Historical Data for: | 2019-2020 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | Bayer Ag, Armacell GmbH, Compagnie De Saint-Gobain S A, Huntsman Corporation, Nitto Denko Corporation, Inoac Corporation, The Dow Chemical Company, T, soh Corporation, Trelleborg Ab, Sekisui Chemical, Wanhua Chemical Group Co. Ltd. & others |

| Growth Drivers: | The polyurethane foam insulation market is growing due to the expansion of end-use industries in developing countries like India, Thailand, and others, including bedding and furniture, electronics, automotive, and building and construction. |

| Pitfalls & Challenges: | On credit portfolios, the COVID-121.9 epidemic has had a negative effect. The enormous growth has hampered the solvency of customers and businesses in unemployment and interruption of economic activity. |

Get more details on this report -

Report Coverage

This research report categorizes the market for global polyurethane foam insulation materials based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global polyurethane foam insulation materials market.

Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each global polyurethane foam insulation materials market sub-segments.

Segmentation Analysis

- In 2021, the flexible foam segment dominated the market with the largest market share of 39% and market revenue of 11,042 million.

Based on the type, the global polyurethane foam insulation materials market is categorized into Flexible Foam, Rigid Foam, and Spray Foam. In 2021, the flexible foam segment dominated the market with the largest market share of 39% and market revenue of 11,042 million. Due to its exceptional qualities, including durability, resiliency, energy absorption, and handling strength, flexible foam is widely used in various industries, including furniture, transportation, bedding, packaging, and textiles.

- In 2021, the building and construction segment accounted for the largest share of the market, with 36% and market revenue of 10,193 million.

Based on the application, the polyurethane foam insulation materials market is categorized into Automotive, Medical, Building and Construction, Packaging, and Others. In 2021, the building and construction segment accounted for the largest share of the market, with 36% and a market revenue of 10,193 million.

The building and construction sector uses polyurethane foam most frequently for domestic, industrial, and commercial purposes. Flexible chemical material polyurethane foam can be used for insulation, filling, sealing, and bonding in various building applications. It is perfect for uses including water pipe insulation, roof, and wall bonding, sealing, and, most crucially, door and window frame installation because of its excellent thermal and acoustic insulation qualities. The US Censor Bureau estimates that the overall construction cost in April 2022 will be USD 1,744.8 billion, 12.3% more than the predicted USD 1,5553.5 billion in April 2021.

Regional Segment Analysis of the Polyurethane Foam Insulation Materials Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Get more details on this report -

Asia-Pacific emerged as the largest market for the global polyurethane foam insulation materials market, with a market share of around 34.5% and 28,314.75 million of the market revenue in 2021.

- In 2021, Asia- Pacific emerged as the largest market for the global polyurethane foam insulation materials market, with a market share of around 34.5% and 28,314.75 million of the market revenue. It is anticipated that the Asia-Pacific region will control the market. China is the largest economy in the region in terms of GDP. China is one of the world's fastest-growing rising economies, followed by India. As the world's largest footwear producer, China is also the top user of PU. China dominates the global market as the top producer and exporter of footwear. In 2021, China exported more than 8 billion pairs of footwear. China, on the other hand, is the largest producer and consumer of automobiles worldwide. OICA claims that with a total vehicle output of 26.08 million units in 2021—an increase of 3% over the 25.23 million units produced the previous year—China would have the world's most significant automotive production base.

- The North America market is expected to grow at the fastest CAGR between 2021 and 2030, due to the expanding usage of polyurethane foams in the furniture, bedding, and automotive industries.

Competitive Landscape

The report offers the appropriate analysis of the key organizations/companies involved within the global polyurethane foam insulation materials market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Market Players:

- Bayer Ag

- Armacell GmbH

- Compagnie De Saint-Gobain S A

- Huntsman Corporation

- Nitto Denko Corporation

- Inoac Corporation

- The Dow Chemical Company

- Tosoh Corporation

- Trelleborg Ab

- Sekisui Chemical

- Wanhua Chemical Group Co. Ltd.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Third-party knowledge providers

- Value-Added Resellers (VARs)

Some of the Key Developments:

- In June 2021, Using BASF's Elastopor Cryo polyurethane rigid foam system, Harvest Insulation Engineering Co., Ltd., and BASF inked a Joint Development Agreement (JDA) to produce prefabricated cryogenic pipes.

- In July 2020, For the collection and supply of post-consumer polyurethane foam for the RENUVATM Mattress Recycling Program, Dow and Eco-Mobilier formed a new cooperation.

Market Segment

This study forecasts global, regional, and country revenue from 2019 to 2030. Spherical Insights has segmented the global polyurethane foam insulation materials market based on the below-mentioned segments:

Global Polyurethane Foam Insulation Materials Market, By Type

- Flexible Foam

- Rigid Foam

- Spray Foam

Global Polyurethane Foam Insulation Materials Market, By Application

- Automotive

- Medical

- Building and Construction

- Packaging

- Others

Global Polyurethane Foam Insulation Materials Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the Polyurethane Foam Insulation Materials market?As per Spherical Insights, the size of the Polyurethane Foam Insulation Materials market was valued at USD 28,314.75 million in 2022 to USD 52,055 million by 2030.

-

What is the market growth rate of the Polyurethane Foam Insulation Materials market?The Polyurethane Foam Insulation Materials market is growing at a CAGR of 7% from 2022 to 2030.

-

Which country dominates the Polyurethane Foam Insulation Materials market?Asia Pacific emerged as the largest market for Polyurethane Foam Insulation Materials.

-

Who are the key players in the Polyurethane Foam Insulation Materials market?Key players in the Polyurethane Foam Insulation Materials market are Bayer Ag, Armacell GmbH, Compagnie De Saint-Gobain S A, Huntsman Corporation, Nitto Denko Corporation, Inoac Corporation, The Dow Chemical Company, Tosoh Corporation, Trelleborg Ab, Sekisui Chemical, and Wanhua Chemical Group Co. Ltd.

-

Which factor drives the growth of the Polyurethane Foam Insulation Materials market?Increasing demand from the bedding and furniture industry is expected to drive the market's growth over the forecast period.

Need help to buy this report?