Global Polyimide Film Market Size, Share, and COVID-19 Impact Analysis, By Application (Specialty Fabricated Product, Motor/Generator, Flexible Printed Circuit, Wire & Cable, Pressure Sensitive Tape, Others), By End-Use (Electronics, Aerospace, Automotive, Packaging, Medical & Healthcare, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: Chemicals & MaterialsGlobal Polyimide Film Market Insights Forecasts to 2032.

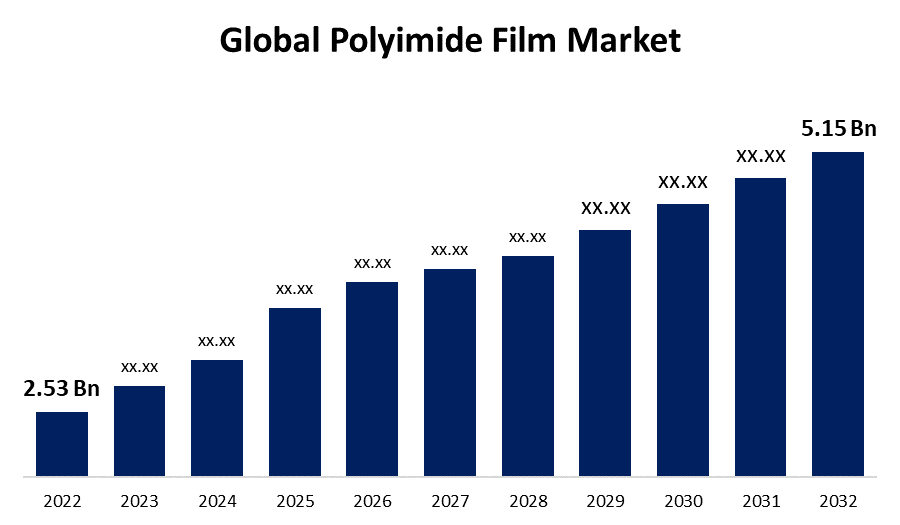

- The Global Polyimide Film Market Size was valued at USD 2.53 Billion in 2022.

- The Market is Growing at a CAGR of 7.3% from 2022 to 2032

- The Worldwide Polyimide Film Market Size is expected to reach USD 5.15 Billion by 2032

- North America is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Polyimide Film Market Size is expected to reach USD 5.15 Billion by 2032, at a CAGR of 7.3% during the forecast period 2022 to 2032.

Polyimide film is a thin, flexible polymer-based material with high heat and chemical resistance. Temperatures ranging from -269° C to 400° C can be tolerated by polyimide film. Polyimide film provides strong insulating qualities as well as excellent thermal insulation. Polyimide film is commonly used in multi-layer insulating layers for space, flexible electronics, tapes, and a variety of other high-heat products. Polyimide films are utilized in applications that require dependable, long-lasting performance, typically in severe environments. Furthermore, polyimide film is employed in systems that require dependable, long-lasting performance, particularly in severe settings. It can also be developed and modified to fulfill specific mechanical, electrical, thermal, and chemical qualities. The increasing demand from the electrical industry is driving the global polyimide films market forward. These items are utilized in a wide range of applications, including digital cameras, electronic displays, and portable computing devices.

Global Polyimide Film Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 2.53 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.3% |

| 2032 Value Projection: | USD 5.15 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Application, By End-Use, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | 3M Company, DuPont, Toray Industries Inc., Kolon Industries Inc., FLEXcon Company, Inc., Goodfellow, I.S.T Corporation, Taimide Tech. Inc., Compagnie de Saint-Gobain, Kaneka Corporation, Shinmax Technology Ltd., UBE Industries Ltd., Arakawa Chemicals Industries Inc., PI Advanced Material Co., Ltd., and other key venders. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increase in the popularity of consumer electronics such as contemporary computers, LEDs, mobile phones, and others is projected to propel this expansion of the polyimide films market over the period of forecasting. Polyimide films have a lot of applications in aircraft because of their superior thermal stability, electrical insulation, and durability. Polyimide films have excellent insulation properties and thermal stability, making them ideal to be employed as an isolating and protective layer for electrically susceptible and delicate electronic components such as semiconductor products, cable and wire connections, printed circuit boards, motors, and generators. This is a major contributor that drives the worldwide polyimide film market. Aerospace industry also uses it in specific labeling applications. These films are primarily used in wire insulation and electric motors that operate in demanding environments where electricity, as well as heat management, are critical.

In the long term, the advancement of transparent polyimide films with flexible substrates is expected to provide new opportunities. Furthermore, the emergence of polyimide films with elastic substrates has expanded the use of polyimide films in flexible active-matrix organic light-emitting diode (AMOLED) displays, substituting hard glass with flexible substrates and resulting in displays more compact, lighter, and less dispersed. This is expected to bring along new opportunities for global market advancement during the estimated time frame. Consumer electronics, automotive, aerospace, and medical are among the industries that rely on these films. Furthermore, the automobile industry is predicted to continue to have a significant role in market growth. In addition, rising consumer disposable revenue in emerging countries is likely to fuel market expansion.

Restraining Factors

However, the substantial manufacturing cost of the polyimide film is limiting market expansion. Polyimide film production comprises numerous phases, including resin mixture preparation, synthesizing, polymerization, and imine processing. In order to provide significant qualities like as high tensile strength, superior electrical insulation, a high degree of thermal stability, and good dielectric properties, these techniques necessitate trained people and extremely advanced machines.

Market Segmentation

By Application Insights

The flexible printed circuit segment is dominating the market with the largest revenue share over the forecast period.

On the basis of application, the global polyimide film market is segmented into the specialty fabricated product, motors/generators, flexible printed circuits, wire & cable, pressure sensitive tape, and others. Among these, the flexible printed circuit segment is dominating the market with the largest revenue share of 41.6% over the forecast period. This dominance is mostly due to the superior qualities of polyimide films, which make them an attractive option in a variety of end-use industries such as semiconductors and automobiles. Development in the electronics sector, as well as increasing digitalization improvements in the automotive sector, continue to boost FPC demand, attracting polyimide manufacturers to further develop their range of products for the field of application. Flexible printed circuits are utilized as connectors in a variety of applications where production restrictions, space savings, and flexibility limit the solid circuit board's reliability. These reasons are projected to drive demand for flexible printed polyimide films in the industry.

By End-Use Insights

The electronics segment accounted for the largest revenue share of more than 36.8% over the forecast period.

On the basis of end-use, the global polyimide film market is segmented into electronics, aerospace, automotive, packaging, medical & healthcare, and others. Among these, the electronics segment is dominating the market with the largest revenue share of 36.8.2% over the forecast period. This is because it is an excellent substrate for high-temperature applications, making it ideal for electric and electronic equipment. In addition, polyimide films have outstanding chemical, thermal, and mechanical characteristics throughout a wide temperature range, making them ideal for thermal insulation applications. It is frequently utilized in the production of printed circuit boards, wires and cables, electronic components, generators, motors, electronic circuits, speakers, rotating machines, tape-automated bonding, devices, heavy machinery, medical technologies, and recording devices. Moreover, producers in the consumer electronics sector are actively searching for alternatives to metal and glass, and such polyimide films offer these companies the optimal combination of affordability and durability.

Regional Insights

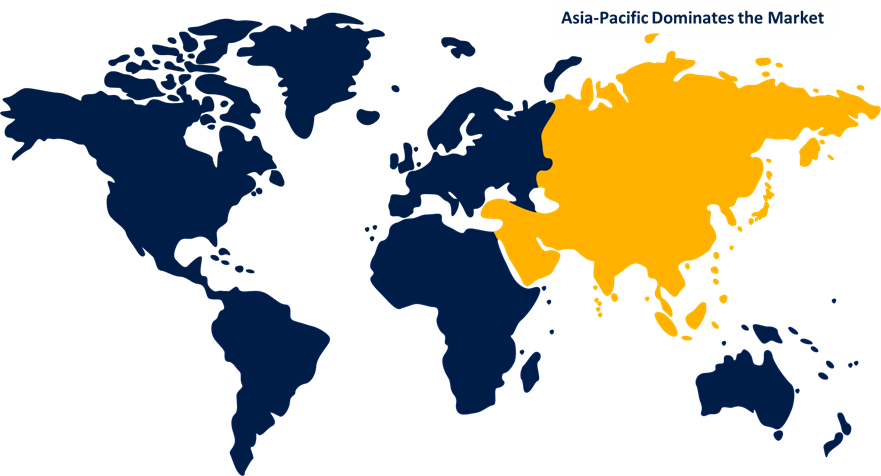

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the market with more than 43.7% market share over the forecast period. The region's expanding electronics manufacturing sector has resulted in an enormous market for polyimide films. Polyimide films are used as an alternative to glass in the manufacture of mobile device displays because they are less costly, thinner, and more difficult to shatter. Furthermore, infrastructural expansion and enhanced digitalization are likely to boost the development of the industry. The increasing need for flexible films is projected to fuel market expansion further. Moreover, the region is experiencing a tremendous surge in demand for technological products.

North America, on the contrary, is expected to grow the fastest during the forecast period. Because of the region's developing electronics, automotive, and aerospace sectors, this business sector is expected to rise rapidly over the forecast period. Financial support from the government and R&D activities are expected to drive a significant increase in the polyimide films market demand throughout the forecast period. The advancement of printed electronics is a crucial driver in the region's increased demand for this product region.

The Europe market is expected to register a substantial CAGR growth rate during the forecast period. This is due to the advancement of electric vehicles, the establishment of a widely recognized printing and labeling business, and the existence of multiple large market players. Polyimide films give a dependable and long-lasting method of tracking the goods by producing appropriate labeling. Globalization in these industries is helping to drive the growth of polyimide films in Europe. The advancement of printed electronics is a crucial driver in the region's increased demand for this product area.

List of Key Market Players

- 3M Company

- DuPont

- Toray Industries Inc.

- Kolon Industries Inc.

- FLEXcon Company, Inc.

- Goodfellow

- I.S.T Corporation

- Taimide Tech. Inc.

- Compagnie de Saint-Gobain

- Kaneka Corporation

- Shinmax Technology Ltd.

- UBE Industries Ltd.

- Arakawa Chemicals Industries Inc.

- PI Advanced Material Co., Ltd.

Key Market Developments

- On June 2023, Arkema is acquiring a 54% stake in Glenwood Private Equity's South Korean polyimide specialist PI Advanced Materials. The remaining 46% of the shares are traded on the stock exchange in South Korea. Arkema's initial foray into the polyimide sector. DuPont, Kaneka, and Taimide are major rivals in polyimide films. PIAM has two factories in Gumi (north of Daegu) and Jincheon (south of Seoul), each with four PI film extrusion lines.

- On December 2022, Toray Industries Inc. has released a new version of its photosensitive polyimide coating substance PHOTONEECE. To reduce the potential environmental hazards of N-Methyl-2-pyrrolidone (NMP), this redesigned material adopts NMP-free technology. For this new offering, the company has created a mass-production infrastructure and will begin full-fledged sales, primarily for power semiconductor applications.

- On January 2022, DuPont Interconnect Solutions has announced the completion of its Circleville, OH manufacturing expansion project. The $250 million investment would increase manufacturing of Kapton polyimide film and Pyralux flexible circuit materials, ensuring supply to satisfy expanding global demand in DuPont's automotive, consumer electronics, telecommunications, specialized industrial, and defense markets. The Kapton polyimide film is also at the heart of DuPont's Pyralux series of flexible copper-clad laminates, which come in a number of copper kinds, thicknesses, and construction options and offer good thermal, chemical, electrical, and mechanical qualities.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Polyimide Film Market based on the below-mentioned segments:

Polyimide Film Market, Application Analysis

- Specialty Fabricated Product

- Motor/Generator

- Flexible Printed Circuit

- Wire & Cable

- Pressure Sensitive Tape

- Others

Polyimide Film Market, End-Use Analysis

- Electronics

- Aerospace

- Automotive

- Packaging

- Medical & Healthcare

- Others

Polyimide Film Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the polyimide film market?The Global Polyimide Film Market is expected to grow from USD 2.53 billion in 2022 to USD 5.15 billion by 2032, at a CAGR of 7.3% during the forecast period 2022-2032.

-

2. Which are the key companies in the market?3M Company, DuPont, Toray Industries Inc., Kolon Industries Inc., FLEXcon Company, Inc., Goodfellow, I.S.T Corporation, Taimide Tech. Inc., Compagnie de Saint-Gobain, Kaneka Corporation, Shinmax Technology Ltd., UBE Industries Ltd., Arakawa Chemicals Industries Inc., PI Advanced Material Co., Ltd.

-

3. Which segment dominated the polyimide film market share?The electronics segment in end-use type dominated the polyimide film market in 2022 and accounted for a revenue share of over 36.8%.

-

4. What are the elements driving the growth of the polyimide film market?The substantial demand from the electronics and automotive industries is projected to drive growth in the market for polyimide films worldwide. This market is expanding primarily as a result of its higher thermal and physical attributes when compared to other thermoplastic films.

-

5. Which region is dominating the polyimide film market?Asia Pacific is dominating the polyimide film market with more than 43.7% market share.

-

6. Which segment holds the largest market share of the polyimide film market?The flexible printed circuit segment based on application type holds the maximum market share of the polyimide film market.

Need help to buy this report?