Global Polyether Polyols Market Size Size, Share, and COVID-19 Impact Analysis, By Product Type (Flexible, Rigid, and Others), By End User (Automotive, Construction, Packaging, Furnishing, Electrical & Electronics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Polyether Polyols Market Size Insights Forecasts to 2035

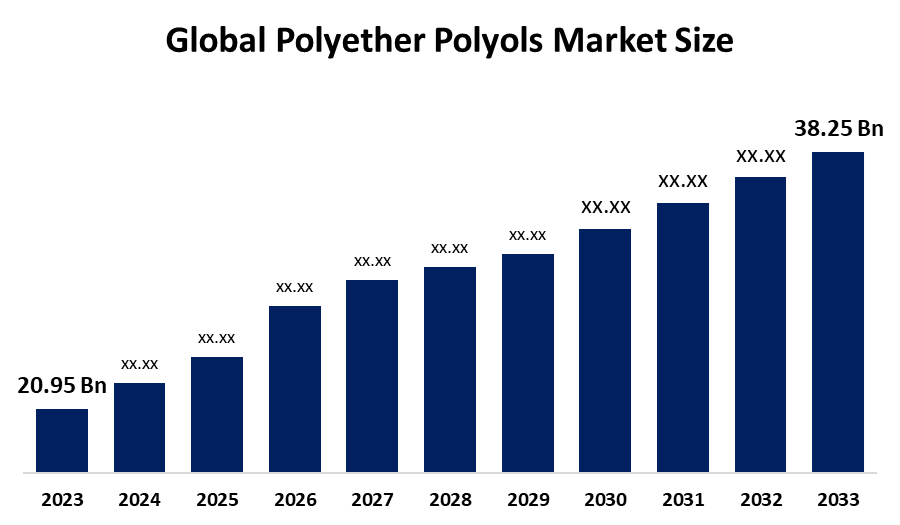

- The Global Polyether Polyols Market Size Was Estimated at USD 20.95 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.63% from 2025 to 2035

- The Worldwide Polyether Polyols Market Size is Expected to Reach USD 38.25 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Polyether Polyols Market Size was worth around USD 20.95 Billion in 2024 and is Predicted to Grow to around USD 38.25 Billion by 2035 with a compound annual growth rate (CAGR) of 5.63% from 2025 and 2035. The market for polyether polyols has a number of opportunities to grow due to its widespread application in solvents, adhesives, inks, plasticizers, and defoaming applications. Further, technological advancements that lead to innovative applications and improved product performance are promoting the Polyether Polyols Market Size.

Market Overview

The Global Industry of Polyether Polyols is focused on manufacturing essential raw materials for polyurethanes, driven by its increased demand for flexible/rigid foams in furniture, bedding, and automotive. Polyether polyol is defined as the polymeric reaction product formed from an organic oxide and an initiator compound containing two or more active hydrogen atoms, resulting in a product whose functionality and molecular weight are influenced by the type of initiator used and its ratio to the organic oxide. Major brand names include Acclaim, Arcol, Multranol (Covestro), Voranol (Dow), and EXEFLEX/EXECOL (Expanded Polymer Systems), which are based on starters like propylene glycol, glycerol, and sorbitol.

Innovation and market expansion are anticipated as a result of major players' growing R&D expenditures for developing high-performance, sustainable, and bio-based products in the automotive, construction, and furniture sectors and the strategic acquisition for acquiring shares. For instance, in October 2024, ADNOC International Germany Holding AG announced a voluntary public takeover offer to acquire all shares of Covestro AG at 62.00 euros per share, marking the largest acquisition of a European company by a Middle Eastern firm.

Report Coverage

This research report categorizes the Polyether Polyols Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Polyether Polyols Market Size. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Polyether Polyols Market Size.

Polyether Polyols Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 20.95 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.63% |

| 2035 Value Projection: | USD 38.25 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By End User |

| Companies covered:: | Arpadis Benelux NV, BASF, China Petrochemical Corporation, CNOOC, Covestro AG, Dow, Expanded Polymer Systems Private Limited, Huntsman International LLC, Manali Petrochemicals Limited, Mitsui Chemicals, MOLGROUP, PCC Group, Purinova Sp. z o.o., Repsol, Shell plc, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

An increased demand for polyether polyols in the automotive and construction sectors, as a critical raw material for polyurethane foams, coatings, and sealants, is driving the market. Further, with the rapid urbanization, the adoption of lightweight vehicles for improving fuel efficiency, lightweight construction, and better car thermal insulation is propelling the market demand. Additionally, a strong inclination towards sustainable and bio-based materials, along with stringent regulations on VOC emissions are fueling the Polyether Polyols Market Size.

Restraining Factors

The Polyether Polyols Market Size is restricted by factors like raw price volatility, especially propylene oxide and an emerging micro-plastics legislation. Further, the hazardous nature of polyols for human health is also responsible for restraining market growth.

Market Segmentation

The Polyether Polyols Market Size share is classified into product type and end user.

- The rigid segment dominated the market with the largest share of about 51.9% in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the Polyether Polyols Market Size is divided into flexible, rigid, and others. Among these, the rigid segment dominated the market with the largest share of about 51.9% in 2024 and is projected to grow at a substantial CAGR during the forecast period. Rigid polyurethane foam stands out as the most effective insulation material used to increase energy efficiency in the construction industry and support environmental sustainability. Globally, governments are emphasizing energy conservation and building energy-efficient infrastructure, which is propelling the segmental market growth.

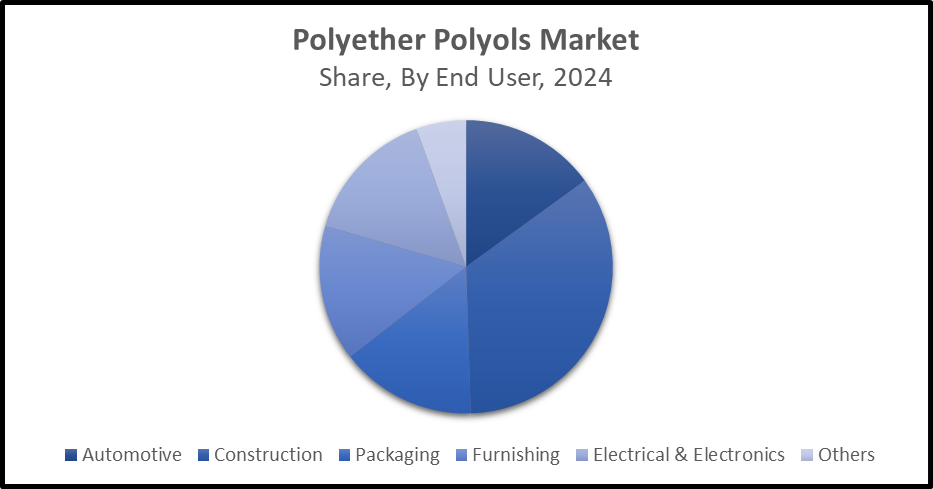

- The construction segment accounted for the largest share of around 34.5% share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the Polyether Polyols Market Size is divided into automotive, construction, packaging, furnishing, electrical & electronics, and others. Among these, the construction segment accounted for the largest share of around 34.5% share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. In the construction sector, polyether polyols are used for producing high-performance polyurethane rigid foams, sealants, coatings, and adhesives. They enhance energy efficiency while providing structural durability primarily for thermal insulation in walls, roofs, and pipes. An increasing use of polyether polyols in the building and construction industry is propelling the market.

Get more details on this report -

Regional Segment Analysis of the Polyether Polyols Market Size

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the Polyether Polyols Market Size over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of about 44.5% of the Polyether Polyols Market Size over the predicted timeframe. The market ecosystem in the region is strong, with the region’s localized supply chains, scale economies that benefit producers, and an integrated propylene-oxide assets. The demand for polyether polyols has been driven by the increasing number of brands launching healthy beverages and snacks devoid of refined sugar. China is the dominant country in the Asia Pacific polyether polyols, owing to the increasing construction and automotive industries and an extensive use of polyether polyols in flexible and rigid polyurethane foams. For instance, in February 2017, BASF launched a new polyol grade to reduce VOCs inside cars. New Lupranol grade to help OEMs meet stringent government regulations and industry standards.

North America is expected to grow at a rapid CAGR of 4.8% in the Polyether Polyols Market Size during the forecast period. The area has a thriving market for polyether polyols due to the automotive industry’s preference for polyol-based polyurethane, as well as the need for sustainable packaging solutions for the storage and transportation of perishable products. For instance, in January 2025, Dow announced the production of VORANOL WK5750, an advanced Polyether Polyol, at its Freeport plant. Designed for higher-performance foam applications like mattresses and furniture, it offers superior softness, resilience, and purity. The United States is dominating the North America Polyether Polyols Market Size due to its large, established chemical manufacturing base and an increasing demand across industries like automotive, construction, furniture, bedding, and advanced polyurethane processing infrastructure.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Polyether Polyols Market Size, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Arpadis Benelux NV

- BASF

- China Petrochemical Corporation

- CNOOC

- Covestro AG

- Dow

- Expanded Polymer Systems Private Limited

- Huntsman International LLC

- Manali Petrochemicals Limited

- Mitsui Chemicals

- MOLGROUP

- PCC Group

- Purinova Sp. z o.o.

- Repsol

- Shell plc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2025, American specialty chemicals company Monument kicked off the first US-based production of polyols made from renewable carbon at its Brandenburg, Kentucky facility, marking a major milestone in sustainable materials innovation. The new line, branded Poly-CO2, uses Econic Technologies’ proprietary process to replace fossil-based feedstocks with captured carbon dioxide, cutting global warming potential by 20–30%.

- In October 2025, United States-based Novoloop Inc. is advancing its circular plastics technology through a new manufacturing partnership with Shanghai Huide Science & Technology Co. Ltd. aimed at scaling chemically upcycled thermoplastic polyurethane (TPU) in China.

- In May 2024, Chimcomplex SA Borzesti, based in Onesti, Bacau county, wrapped up its project at the Rm Valcea plant. The initiative received co-financing through the “Business Development, Innovation, and SMEs” program, operating under contract number 2021/331014, with Innovation Norway overseeing the program.

- In January 2024, Aether Industries Limited, one of India’s leading speciality and fine chemical manufacturers and provider of contract research and manufacturing services, made a joint announcement with H.B. Fuller and Saudi Aramco Technologies Company for the first commercialization of the sustainable Converge polyols technology.

- In June 2023, Aether Industries, one of India's leading specialty and fine chemical manufacturers and preferred provider of contract research and manufacturing services, signed a license agreement with Saudi Aramco Technologies Company for the commercialization of the sustainable Converge polyols technology.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Polyether Polyols Market Size based on the below-mentioned segments:

Global Polyether Polyols Market Size, By Product Type

- Flexible

- Rigid

- Others

Global Polyether Polyols Market Size, By End User

- Automotive

- Construction

- Packaging

- Furnishing

- Electrical & Electronics

- Others

Global Polyether Polyols Market Size, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Polyether Polyols Market Size?The global Polyether Polyols Market Size is expected to grow from USD 20.95 Billion in 2024 to USD 38.25 Billion by 2035, at a CAGR of 5.63% during the forecast period 2025-2035.

-

2. Which region holds the largest portion of the Polyether Polyols Market Size?Asia Pacific is anticipated to hold the largest share of the Polyether Polyols Market Size over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global Polyether Polyols Market Size from 2024 to 2035?The market is expected to grow at a CAGR of around 5.63% during the period 2024–2035.

-

4. Who are the top companies operating in the Global Polyether Polyols Market Size?Key players include Arpadis Benelux NV, BASF, China Petrochemical Corporation, CNOOC, Covestro AG, Dow, Expanded Polymer Systems Private Limited, Huntsman International LLC, Manali Petrochemicals Limited, Mitsui Chemicals, MOLGROUP, PCC Group, Purinova Sp. z o.o., and Repsol, Shell plc.

-

5. What are the key drivers of the Polyether Polyols Market Size?An increased demand in the automotive and construction sectors, adoption of lightweight vehicles, and inclination towards sustainable and bio-based materials are major market growth drivers of the Polyether Polyols Market Size.

-

6. What are the challenges in the Polyether Polyols Market Size?The hazardous nature of polyols, raw price volatility, especially propylene oxide, and an emerging micro-plastics legislation remain key restraints in the Polyether Polyols Market Size.

Need help to buy this report?