Global Polybutylene Adipate Terephthalate (PBAT) Market Size, Share, and COVID-19 Impact Analysis, By Type (Modified/Blended PBAT and Pure PBAT), By Application (Mulch Films, Shopping Bags, Garbage/Bin Bags, Food Packages, and Others), By End-User (Agriculture & Fishery, Packaging, Consumer Goods, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Polybutylene Adipate Terephthalate (PBAT) Market Insights Forecasts to 2035

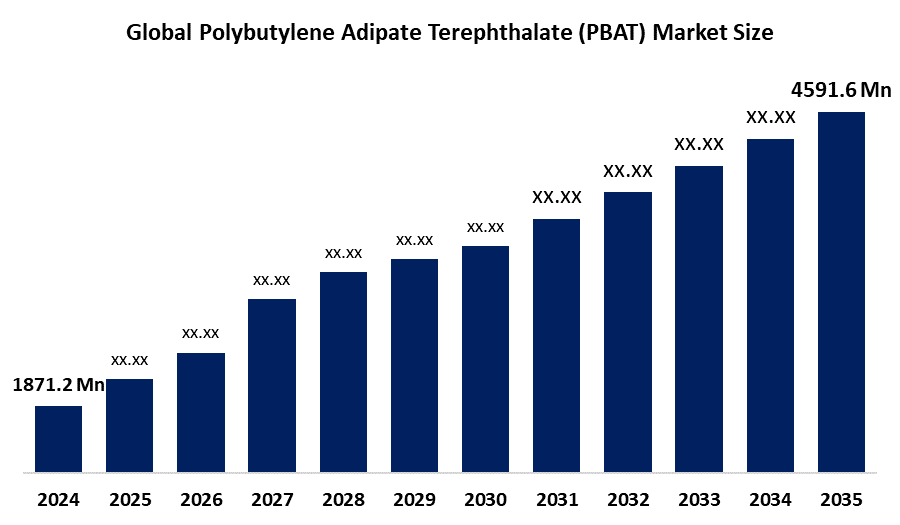

- The Global Polybutylene Adipate Terephthalate (PBAT) Market Size Was Estimated at USD 1871.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.5% from 2025 to 2035

- The Worldwide Polybutylene Adipate Terephthalate (PBAT) Market Size is Expected to Reach USD 4591.6 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Polybutylene Adipate Terephthalate (PBAT) Market Size Was Worth Around USD 1871.2 Million In 2024 And Is Predicted To Grow To Around USD 4591.6 Million By 2035 With A Compound Annual Growth Rate (CAGR) of 8.5% from 2025 to 2035. The factors influencing the growth in the global polybutylene adipate terephthalate market include strict environmental regulations against single-use plastics, increasing demand by consumers for sustainable alternatives, and its excellent properties for compostable packaging and agricultural films.

Market Overview

The international Polybutylene Adipate Terephthalate (PBAT) Market Size refers to PBAT, a biodegradable, compostable, and aliphatic-aromatic copolyester that has a reputation throughout the world due to its flexibility, strength, and compatibility with other biodegradable plastics. Among its principal applications are its use in films, bags, cutlery, agricultural film, and food packing, providing a biodegradable, eco-friendly option to traditional plastic materials. It has been noticed that this market develops because of a rising demand for sustainable, eco-friendly materials, which develops based on government restrictions and legislation regarding single-use plastics, as well as its rising use in e-commerce and food delivery boxes.

Opportunities in this market will be found in research on improved blending of PBAT, penetrating emerging markets, and uses of recent breakthroughs in biodegradable plastic technology to lower production costs. The principal participants in the development of this market, through research, manufacture, and collaboration, would include the likes of BASF SE, China National Bluestar, Anhui Wanwei Group, Zhejiang Hisun Biomaterials, and Shenzhen Esun Industrial. The market will continue to move at an even pace due to sustainability and regulatory factors under which the plastics industry operates on a global scale. The first month of May 2024 saw the release of a 71-page document concerning the Chinese bio-based and biodegradable plastics market, namely PLA, PA, PHA, and PBAT, from nova-Institute. It presents market trends, technology, and companies, providing information from companies based in China to help chemical companies enter this market.

Report Coverage

This research report categorizes the Polybutylene Adipate Terephthalate (PBAT) Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the polybutylene adipate terephthalate (PBAT) market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the polybutylene adipate terephthalate (PBAT) market.

Global Polybutylene Adipate Terephthalate (PBAT) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1871.2 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR Of 8.5% |

| 2035 Value Projection: | USD 4591.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type, By Application |

| Companies covered:: | BASF SE Kingfa Sci. & Tech. Co., Ltd. Novamont S.p.A. Anhui Wanwei Group China National Bluestar Shenzhen Esun Industrial Dow Inc. SKC Global Mitsubishi Chemical Corporation Chang Chun Group Zhejiang Hisun Biomaterials ExxonMobil Corporation Eastman Chemical Company GO YEN CHEMICAL INDUSTRIAL CO., LTD And Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The major drivers within the global PBAT market include the growing demand for biodegradable and compostable plastic packaging alternatives. The growing concerns for the environment and government regulations on the usage of single-use plastics accelerate the adoption trend for renewable biodegradable alternatives such as PBAT. Different applications of PBAT in flexible packaging films, bags, and packaging products lead to an increased market for the same. Development of mechanically enhanced properties and biocompatibility-enhanced technologies and advancements can boost and advance the market related to PBAT. The surge in the e-commerce market and growing interest in sustainable packaging propel the market. Growing interest and incentives for government initiatives on biobased plastics also surged the market of PBAT.

Restraining Factors

The PBAT market worldwide is challenged by the relatively high cost of production, the unavailability of raw materials, and lower mechanical property strength when compared to traditional plastics. Slow biodegradability under certain conditions, the unavailability of facilities for composting, and the existence of competing bioplastics are also obstacles.

Market Segmentation

The polybutylene adipate terephthalate (PBAT) market share is classified into type, application, and end-user.

- The modified/blended PBAT segment dominated the market in 2024, approximately 65% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the Polybutylene Adipate Terephthalate (PBAT) Market Size is divided into modified/blended PBAT and pure PBAT. Among these, the modified/blended PBAT segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth dominance of the modified/blended PBAT segment is due to superior flexibility, mechanical strength, and processability compared to that of pure PBAT. Blending with such materials as PLA or starch results in improved performance and reduced costs, hence its applications in packaging, shopping bags, garbage bags, and agricultural films. This is attributed to the increasing demand for biodegradable, eco-friendly plastics globally, thus driving further adoption and market share.

- The garbage/bin bags segment accounted for the largest share in 2024, approximately 36% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the Polybutylene Adipate Terephthalate (PBAT) Market Size is divided into mulch films, shopping bags, garbage/bin bags, food packages, and others. Among these, the garbage/bin bags segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The garbage/bin bags category had the highest contribution in the market from the perspective of the regulations imposed worldwide regarding the use of single-use plastics, along with the rising demands from consumers about biodegradable waste management products. The compostability, strength, and flexibility of PBAT make it suitable and popular in the production of strong biodegradable garbage bags.

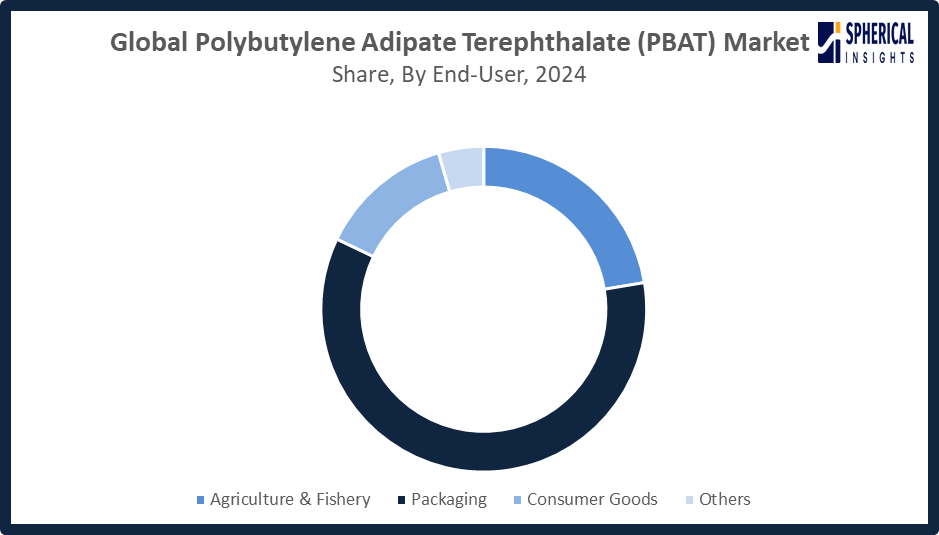

- The packaging segment accounted for the highest market revenue in 2024, approximately 60% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-user, the Polybutylene Adipate Terephthalate (PBAT) Market Size is divided into agriculture & fishery, packaging, consumer goods, and others. Among these, the packaging segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The packaging sector is experiencing growth in the market due to high demand for sustainable and biodegradable packaging solutions from most parts of the world. Strong regulations related to single-use plastics, rising e-commerce, and consumer preference towards eco-friendly products drive the adoption of PBAT in shopping bags, food packaging, and other applications involving flexible packaging, hence considered a key growth driver in the global market.

Get more details on this report -

Regional Segment Analysis of the Polybutylene Adipate Terephthalate (PBAT) Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the polybutylene adipate terephthalate (PBAT) market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the Polybutylene Adipate Terephthalate (PBAT) Market Size over the predicted timeframe. The Asia Pacific market is anticipated to represent the 38% market share for PBAT due to rapid industrialization and urbanization and increasing biodegradable packaging and agriculture film demand. The market will be fueled by China, India, and Japan, with China being the major contributing country due to the stringent government rules against single-use plastic packaging and the growing production capacity for biobased polymer. The growing environmental consciousness and government support are also aiding the market. China has banned the manufacture and sale of non-biodegradable plastic packaging and products, excluding biodegradable plastic and PLA bioplastics, under the GB/T 19277 standards by 2024.

Get more details on this report -

North America is expected to grow at a rapid CAGR in the Polybutylene Adipate Terephthalate (PBAT) Market Size during the forecast period. North America is anticipated to have a 20% of the PBAT market due to strict environmental norms, increasing demands from consumers to have environmentally friendly packaging, and a rising adoption of biodegradable plastics. The United States, being a primary contributor to this market growth, has been driven by initiatives that support eco-friendly materials in food, retail, and e-commerce packaging. R&D investments, along with government schemes that favor biodegradable polymers, have been fueling the adoption of PBAT, and its rising use in agricultural and waste management has fueled growth in this market.

The market in Europe is experiencing the use of PBAT as a result of a strong ban on single-use plastics, environmental consciousness, and the support of government regulations. The German market in Europe currently drives the market in Europe by ensuring biodegradable packaging, which results from strong regulations in the German government on the use of biodegradable packaging. Food packaging, shopping bags, and farm films are contributing to the increase in demand in Europe.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Polybutylene Adipate Terephthalate (PBAT) Market Size , along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Kingfa Sci. & Tech. Co., Ltd.

- Novamont S.p.A.

- Anhui Wanwei Group

- China National Bluestar

- Shenzhen Esun Industrial

- Dow Inc.

- SKC Global

- Mitsubishi Chemical Corporation

- Chang Chun Group

- Zhejiang Hisun Biomaterials

- ExxonMobil Corporation

- Eastman Chemical Company

- GO YEN CHEMICAL INDUSTRIAL CO., LTD

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, Dow launched DOWSIL 5-1050 Polymer Processing Aid (PPA) for film packaging, offering a fluoropolymer-free alternative. It improves linear low-density polyethylene processing by mitigating melt fracture and suppressing die lip build-up, enabling the production of high-quality films while meeting growing demand for safer, sustainable packaging solutions.

- In June 2024, BASF launched ecoflex F Blend C1200 BMB, a biomass-balanced PBAT biopolymer fully replacing fossil feedstocks with renewable alternatives. Certified compostable, it offers 60% lower carbon footprint, high flexibility, and PLA compatibility. Target applications include sustainable packaging, agricultural films, and hygiene products, expanding BASF’s eco-friendly portfolio amid EU regulations.

- In May 2024, SK Leaveo, SKC’s eco-friendly materials arm, began construction of the world’s largest PBAT plant in Hai Phong, Vietnam. Attended by SKC executives, Korean and Vietnamese officials, the joint venture with Daesang Corp. leverages high-strength PBAT technology from KRICT, aiming to commercialize advanced biodegradable plastics globally.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Polybutylene Adipate Terephthalate (PBAT) Market Size based on the below-mentioned segments:

Global Polybutylene Adipate Terephthalate (PBAT) Market, By Type

- Modified/Blended PBAT

- Pure PBAT

Global Polybutylene Adipate Terephthalate (PBAT) Market, By Application

- Mulch Films

- Shopping Bags

- Garbage/Bin Bags

- Food Packages

- Others

Global Polybutylene Adipate Terephthalate (PBAT) Market, By End-User

- Agriculture & Fishery

- Packaging

- Consumer Goods

- Others

Global Polybutylene Adipate Terephthalate (PBAT) Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the polybutylene adipate terephthalate (PBAT) market over the forecast period?The global polybutylene adipate terephthalate (PBAT) market is projected to expand at a CAGR of 8.5% during the forecast period

-

2. What is the market size of the polybutylene adipate terephthalate (PBAT) market?The global polybutylene adipate terephthalate (PBAT) market size is expected to grow from USD 1871.2 million in 2024 to USD 4591.6 million by 2035, at a CAGR of 8.5% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the polybutylene adipate terephthalate (PBAT) market?Asia Pacific is anticipated to hold the largest share of the polybutylene adipate terephthalate (PBAT) market over the predicted timeframe

-

4. What is the polybutylene adipate terephthalate (PBAT) market?The PBAT market involves producing and selling biodegradable, compostable plastics used in packaging, agriculture, and consumer goods globally.

-

5. Who are the top 10 companies operating in the global polybutylene adipate terephthalate (PBAT) market?BASF SE, Kingfa Sci. & Tech. Co., Ltd., Novamont S.p.A., Anhui Wanwei Group, China National Bluestar, Shenzhen Esun Industrial, Dow Inc., SKC Global, Mitsubishi Chemical Corporation, Chang Chun Group, and Others.

-

6. What factors are driving the growth of the polybutylene adipate terephthalate (PBAT) market?The PBAT market is driven by rising demand for biodegradable plastics, stringent single-use plastic regulations, environmental awareness, growth in packaging and agriculture applications, and increasing adoption of sustainable, eco-friendly polymer solutions globally

-

7. What are the market trends in the polybutylene adipate terephthalate (PBAT) market?Growing biodegradable packaging demand, regulatory plastic bans, innovation in PBAT blends, expanded agricultural use, and rising sustainability focus drive market trends

-

8. What are the main challenges restricting wider adoption of the polybutylene adipate terephthalate (PBAT) market?The main challenges restricting the wider adoption of the polybutylene adipate terephthalate (PBAT) market are primarily high costs, performance limitations compared to traditional plastics, an underdeveloped waste management infrastructure, and consumer confusion

Need help to buy this report?