Global Poly Alpha Olefin Market Size, Share, and COVID-19 Impact Analysis, By Grade (Homopolymers, Copolymers, Terpolymers, and Others), By Application (Automotive and Transportation, Packaging and Films, Building and Construction, Consumer Products, and Medical Applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Chemicals & MaterialsGlobal Poly Alpha Olefin Market Insights Forecasts to 2035

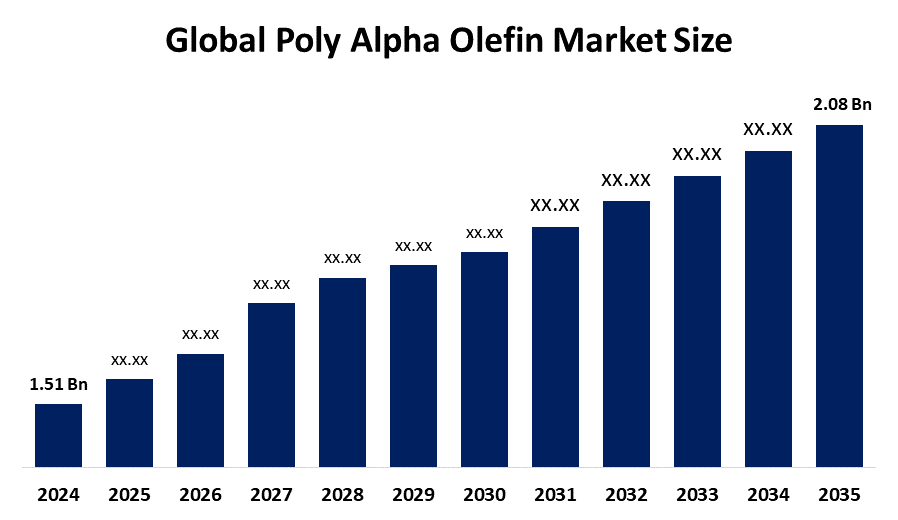

- The Global Poly Alpha Olefin Market Size Was Estimated at USD 1.51 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.95 % from 2025 to 2035

- The Worldwide Poly Alpha Olefin Market Size is Expected to Reach USD 2.08 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Poly Alpha Olefin Market Size was valued at around USD 1.51 Billion in 2024 and is predicted to Grow to around USD 2.08 Billion by 2035 with a compound annual Growth rate (CAGR) of 2.95 % from 2025 to 2035. Opportunities in the poly alpha olefin market include growing demand for high-performance synthetic lubricants, advances in vehicle economy, industrial growth, and a growing inclination toward long-lasting, energy-efficient materials.

Market Overview

The poly alpha olefin (PAO) sector focusses the global distribution, production, and consumption of synthetic hydrocarbons generated from alpha olefins. The PAO metalloids are high-end synthetic oils that serve as the foundation for high-performance lubricants in automotive, industrial, and aerospace applications. By lowering emissions and prolonging service life, they lessen their negative effects on the environment while facilitating efficient machinery operation in challenging circumstances. PAOs, which are highly valued for their remarkable performance throughout a wide temperature range, reduced volatility, oxidation resistance, and enhanced thermal stability, are made by polymerizing alpha olefins. For instance, in September 2023, ExxonMobil launched a USD 2 billion Baytown expansion to strengthen poly alpha olefin and specialty chemical output, adding Vistamaxx and Exact polymer units to boost high-performance products from its U.S. Gulf Coast facilities nationwide markets. The demand for high performance, growing acceptance in the automotive industry, and technological improvements supported by innovation and improved R&D are the main factors propelling the poly alpha olefin market expansion. The market is expected to develop due to rising demand for synthetic base oil in food-grade lubricants for packaging. Growing eco-friendly and sustainable tendencies are expected to drive market expansion.

Report Coverage

This research report categorizes the poly alpha olefin market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the poly alpha olefin market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the poly alpha olefin market.

Global Poly Alpha Olefin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.51 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.95% |

| 2035 Value Projection: | USD 2.08 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Type, By Application |

| Companies covered:: | APALENE TECHNOLOGY, Chevron Phillips Chemical Company LLC, Dowpol Corporation, Exxon Mobil Corporation, INEOS, LANXESS, NACO Corporation, PetroChina Company Limited, Shanxi Lu’an, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the main factors propelling this industry's expansion is the growing demand for poly alpha olefins from the automobile sector. The use of poly alpha olefins is increasing in the oil and gas sector, mainly because of their superior lubricating qualities and strong performance under harsh circumstances. The growing usage of poly alpha olefin (POA) in industrial applications such as compressor oils, gear oils, and hydraulic fluids is another important reason. The market for poly alpha olefins is expected to be driven by the automotive industry's noticeable rise in demand for lightweight and fuel-efficient materials. Because of its exceptional durability and performance, PAO is a great option for various uses, which has raised demand.

Restraining Factors

The market for poly alpha olefin is restricted by high manufacturing costs, reliance on the volatility of crude oil prices, scarcity of raw materials, and competition from less expensive synthetic and bio-based lubricant substitutes.

Market Segmentation

The poly alpha olefin market share is classified into grade and application.

The homopolymers segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the grade, the poly alpha olefin market is divided into homopolymers, copolymers, terpolymers, and others. Among these, the homopolymers segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The homopolymers offer higher heat stability, an excellent viscosity index, and improved lubricating qualities due to their constant molecular structure. Homopolymers are ideal for high-performance applications in the automotive, industrial, and aerospace sectors because of their qualities.

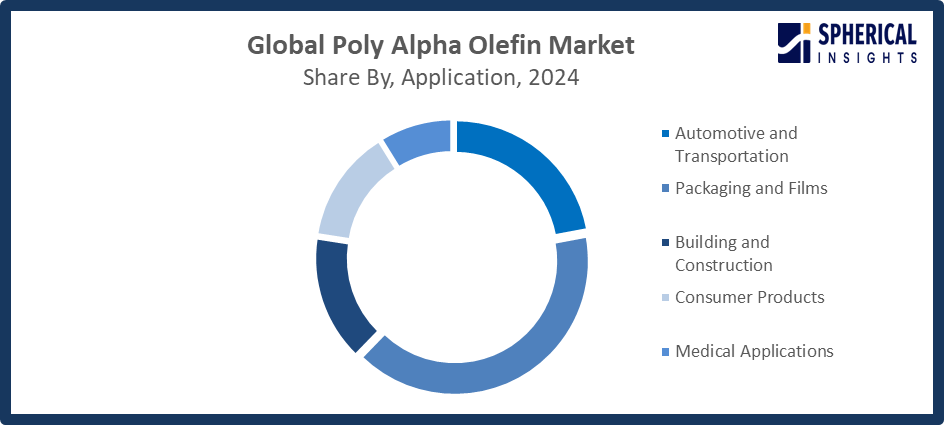

- The packaging and films segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the poly alpha olefin market is divided into automotive and transportation, packaging and films, building and construction, consumer products, and medical applications. Among these, the packaging and films segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growing need for high-performance, long-lasting, and lightweight packaging solutions in the consumer goods, food, and pharmaceutical sectors is driving the packaging and films market. PAO-based materials are perfect for flexible films, laminates, and specialty packaging applications because of their superior mechanical strength, chemical resistance, and thermal stability.

Get more details on this report -

Regional Segment Analysis of the Poly Alpha Olefin Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the poly alpha olefin market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the poly alpha olefin market over the predicted timeframe. Asia-Pacific due to reasons including rising automobile production and fast industrialization. This demand is largely driven by the region's expanding automobile sector. Because China, South Korea, and India are the nations that produce the most cars in this region, high-performance solutions like POA lubricants are in high demand. Additionally, the market for lubricants is indirectly supported by a number of government programs that encourage Poly Alpha Olefin, such as China's National Green Manufacturing Initiative and India's 2025 Sustainable Lubricants Promotion Scheme. Additionally, the expansion of refinery capacities, the infrastructure capabilities of large chemical producers, and continuous R&D efforts are theThis demand is largely driven by the region's expanding automobile sector.

Get more details on this report -

North America is expected to grow at a rapid CAGR in the poly alpha olefin market during the forecast period. The constantly growing need for lubricants with advanced features in the sectors of automotive, aerospace, and industry, occasioned by stringent emission regulations, and technology plays a significant role in the market's growth. Among the government initiatives are the EPA's biofuel-lubricant compatibility guidelines, which are to be completed by December 2025 and will help in reducing volatility, and the U.S. Department of Energy's Advanced Synthetic Lubricants Program, launched in March 2025, which is providing USD 50 million for the research and development of low-emission PAOs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the poly alpha olefin market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- APALENE TECHNOLOGY

- Chevron Phillips Chemical Company LLC

- Dowpol Corporation

- Exxon Mobil Corporation

- INEOS

- LANXESS

- NACO Corporation

- PetroChina Company Limited

- Shanxi Lu'an

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2025, Chevron Phillips Chemical launched an expanded low-viscosity PAO unit at its Beringen, Belgium site, doubling capacity to 120,000 metric tons annually, establishing Europe’s largest decene-based LV PAO facility by volume.

- In April 2023, DL Chemical launched its new APAO plant in Yeosu through subsidiary D-REX Polymer, a joint venture with REXtac, producing environmentally friendly amorphous poly-alpha-olefin hot melt adhesives.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the poly alpha olefin market based on the below-mentioned segments:

Global Poly Alpha Olefin Market, By Grade

- Homopolymers

- Copolymers

- Terpolymers

- Others

Global Poly Alpha Olefin Market, By Application

- Automotive and Transportation

- Packaging and Films

- Building and Construction

- Consumer Products

- Medical Applications

Global Poly Alpha Olefin Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the poly alpha olefin market over the forecast period?The global poly alpha olefin market is projected to expand at a CAGR of 2.95% during the forecast period.

-

2.What is the market size of the poly alpha olefin market?The global Poly Alpha Olefin market size is expected to grow from USD 1.51 billion in 2024 to USD 2.08 billion by 2035, at a CAGR of 2.95 % during the forecast period 2025-2035.

-

3.Which region holds the largest share of the poly alpha olefin market?North America is anticipated to hold the largest share of the poly alpha olefin market over the predicted timeframe.

-

4.Who are the top 10 companies operating in the global poly alpha olefin market?APALENE TECHNOLOGY, Chevron Phillips Chemical Company LLC, Dowpol Corporation, Exxon Mobil Corporation, INEOS, LANXESS, NACO Corporation, PetroChina Company Limited, Shanxi Lu'an, and Others.

-

5.What factors are driving the growth of the poly alpha olefin market?The Poly Alpha Olefin market is driven by rising demand for high-performance synthetic lubricants, stricter emission regulations, technological advancements, industrial growth, and increasing adoption in automotive, aerospace, and manufacturing sectors globally.

-

6.What are the market trends in the poly alpha olefin market?The creation of low-viscosity and bio-based PAOs, strategic alliances, capacity increases, improved lubricant formulations, and an increasing focus on energy efficiency and eco-friendly solutions are some of the major developments in the Poly Alpha Olefin market.

-

7.What are the main challenges restricting the wider adoption of the poly alpha olefin market?High production costs, unstable raw material supplies, competition from conventional and bio-based lubricants, complicated manufacturing procedures, and little knowledge of PAO benefits in some areas are some of the market's challenges.

Need help to buy this report?