Global Plant Moisture Tester Market Size, Share, and COVID-19 Impact Analysis, By Measurement Type (Single Parameter Instruments, and Multiparameter Instruments), By Application (Coastal Ecology, Plant Research, Environmental Research, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: AgricultureGlobal Plant Moisture Tester Market Insights Forecasts to 2035

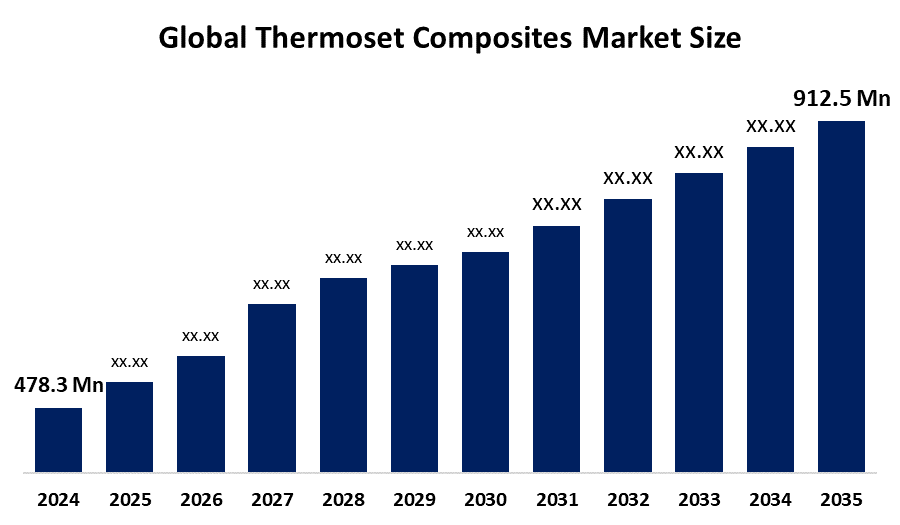

- The Global Plant Moisture Tester Market Size Was Estimated at USD 478.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.62% from 2025 to 2035

- The Worldwide Plant Moisture Tester Market Size is Expected to Reach USD 912.5 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Plant Moisture Tester Market Size was worth around USD 478.3 Million in 2024 and is predicted to grow to around USD 912.5 Million by 2035 with a compound annual growth rate (CAGR) of 8.62% from 2025 to 2035. Opportunities in the plant moisture tester market include growing indoor gardening, the need for precise irrigation, smart agriculture adoption, technical improvements, sustainability initiatives, and the global expansion of horticultural and landscaping applications.

Market Overview

The market for plant moisture testers includes high-precision tools that measure the salinity, tension, and volumetric water content of soil and plant substrates in order to optimize irrigation, increase crop output, and monitor the environment. These tools help make well-informed irrigation decisions and provide the best possible care for plants by evaluating the water availability in the soil. The market consists of multifunctional testers, digital and analog moisture testers, and smart sensor-based equipment used in greenhouse operations, commercial agriculture, horticulture, landscaping, and residential gardening. Government initiatives supporting market growth include Missouri’s 2025 Soil Monitoring Project, funded by the American Rescue Plan Act to install over 35 sensors statewide for drought mitigation, and the USGA Moisture Meter, launched in February 2025 for advanced lawn maintenance. The growing use of precision measuring instruments in plant research facilities, marine ecology assessment initiatives, and agricultural monitoring settings supports the market for plant moisture testers. As research institutes look for efficient measurement systems that reduce resource waste while preserving operational efficacy during field testing and data gathering situations, the demand for environmental monitoring infrastructure accelerates plant moisture tester market expansion.

Report Coverage

This research report categorizes the plant moisture tester market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the plant moisture tester market. Recent market developments and competitive strategies, such as expansion, measurement type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the plant moisture tester market.

Global Plant Moisture Tester Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 478.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.05% |

| 2035 Value Projection: | USD 912.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Measurement Type, By Application |

| Companies covered:: | Dr. Meter Extenuating Threads Kensizer Luster Leaf REOTEMP SONKIR TEKCOPLUS VIVOSUN XLUX and others key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The expansion of indoor and urban gardening, the adoption of precision agriculture techniques, growing awareness of effective water management, and technological developments in sensor accuracy and connectivity are all factors driving this market's growth. Plant moisture testers offer superior monitoring capabilities that allow agricultural researchers to meet strict data accuracy standards without incurring excessive equipment costs, supporting research operations and environmental monitoring missions that require precise moisture measurement applications. This is why precision agriculture expansion drives primary adoption. With geographic concentration in developed markets shifting toward mainstream adoption in emerging economies, driven by agricultural modernization and environmental research awareness, adoption accelerates in coastal ecology and plant research sectors, where data accuracy justifies equipment costs.

Restraining Factors

The growing demand for precision irrigation and effective water management, the plant moisture tester market is restricted by high device costs, low awareness among small-scale farmers, a lack of standardized calibration techniques, and technological complexity.

Market Segmentation

The plant moisture tester market share is classified into measurement type and application.

- The single parameter instruments segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the measurement type, the plant moisture tester market is divided into single parameter instruments and multiparameter instruments. Among these, the single parameter instruments segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Researchers can find appropriate moisture monitoring in a variety of plant research and environmental monitoring conditions due to single-parameter instruments' enhanced measurement qualities, which include outstanding sensor accuracy, cost optimization, and ease of operation. Researchers' choice for dependable measuring systems that offer consistent monitoring performance, lower operational complexity, and data correctness without requiring major equipment modifications boosts the sector.

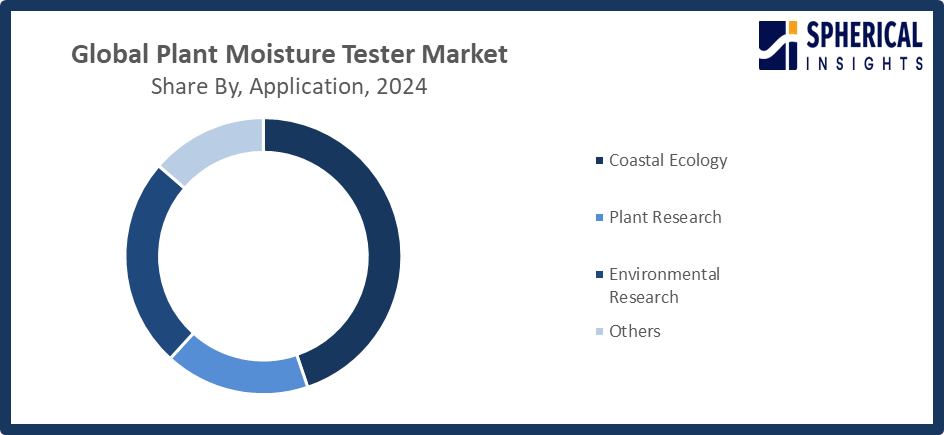

- The coastal ecology segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the plant moisture tester market is divided into coastal ecology, plant research, environmental research, and others. Among these, the coastal ecology segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The broad use of precision moisture monitoring and the increasing focus on habitat management, environmental protection, and ecosystem research applications that reduce monitoring errors while upholding environmental research requirements are the reasons behind the coastal ecology segment.

Get more details on this report -

Regional Segment Analysis of the Plant Moisture Tester Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the plant moisture tester market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the plant moisture tester market over the predicted timeframe. The region's widespread agricultural activity, expanding use of precision farming methods, and rising understanding of effective water management techniques are mostly the result of the Asia Pacific region. China, India, and Japan, amongst others, are pouring huge amounts of money into the latest agricultural technologies, such as soil and plant moisture monitoring systems, aimed at boosting crop yields and saving water through smart irrigation. A case in point is China's "Made in China 2025" project, which is set to spend CNY 1.2 trillion in 2025 for advanced greenhouse sensors that will allow a 20% increase in yields, which is actually speeding up the use of such technology. For Instance, in October 2025, the Indian government's Pradhan Mantri Krishi Sinchayee Yojana will roll out the distribution of 50,000 moisture testers in dry regions for crop irrigation that will not waste a drop of water.

Get more details on this report -

North America is expected to grow at a rapid CAGR in the plant moisture tester market during the forecast period. The region's growing use of smart agriculture and precision farming techniques, bolstered by technology developments in digital and sensor-based moisture monitoring equipment, is a major factor in North America's rise. The broad use of plant moisture testers is also being encouraged by government programs and initiatives that support drought mitigation and sustainable water management. Expansion is supported by government initiatives, such as the USDA's February 2025 improvement of the Cropland Data Layer, which incorporates 10-meter resolution moisture data from 150 million acres for climate-adaptive farming. In order to fight aridification, Missouri's 2025 Soil Monitoring Project, which received USD 15 million from the American Rescue Plan, erected more than 35 testers throughout the state.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the plant moisture tester market, along with a comparative evaluation primarily based on their measurement type offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes measurement type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dr. Meter

- Extenuating Threads

- Kensizer

- Luster Leaf

- REOTEMP

- SONKIR

- TEKCOPLUS

- VIVOSUN

- XLUX

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2025, XIAO launched its Soil Moisture Sensor, powered by ESP32-C6, enabling real-time plant monitoring, seamless Home Assistant integration, and innovative features that redefine gardening and soil moisture management for enthusiasts.

- In June 2025, Researchers at Gauhati University launched low-cost Plant Moisture Tester sensors using pencil, paper, and graphene oxide, enabling farmers to monitor crop humidity and detect harmful gases efficiently and affordably.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the plant moisture tester market based on the below-mentioned segments:

Global Plant Moisture Tester Market, By Measurement Type

- Single Parameter Instruments

- Multiparameter Instruments

Global Plant Moisture Tester Market, By Application

- Coastal Ecology

- Plant Research

- Environmental Research

- Others

Global Plant Moisture Tester Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the plant moisture tester market over the forecast period?The global plant moisture tester market is projected to expand at a CAGR of 6.05% during the forecast period.

-

2. What is the market size of the plant moisture tester market?The global plant moisture tester market size is expected to grow from USD 478.3 million in 2024 to USD 912.5 million by 2035, at a CAGR of 8.62% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the plant moisture tester market?Asia Pacific is anticipated to hold the largest share of the plant moisture tester market over the predicted timeframe

-

4. Who are the top 10 companies operating in the global plant moisture tester market?Dr. Meter, Extenuating Threads, Kensizer, Luster Leaf, REOTEMP, SONKIR, TEKCOPLUS, VIVOSUN, XLUX, and Others.

-

5. What factors are driving the growth of the plant moisture tester market?The plant moisture tester market is driven by precision agriculture adoption, smart irrigation demand, water conservation awareness, technological advancements in sensors, and growing horticulture, landscaping, and indoor gardening applications.

-

6. What are the market trends in the plant moisture tester market?The Key trends include digital and sensor-based devices, IoT integration, multifunctional testers, smart irrigation compatibility, urban gardening growth, sustainable water management, and increasing demand for real-time soil and plant moisture monitoring.

-

7. What are the main challenges restricting the wider adoption of the plant moisture tester market?High gadget costs, technological complexity, low knowledge among small-scale farmers, a lack of standardized calibration, and opposition to implementing cutting-edge moisture monitoring systems in conventional farming all hinder market expansion.

Need help to buy this report?