Global Plant-Derived Heme Protein Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Soy-Based Heme Protein, Pea-Based Heme Protein, Wheat-Based Heme Protein, and Others), By Application (Meat Alternatives, Functional Foods, Nutritional Supplements, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Food & BeveragesGlobal Plant-Derived Heme Protein Market Insights Forecasts to 2035

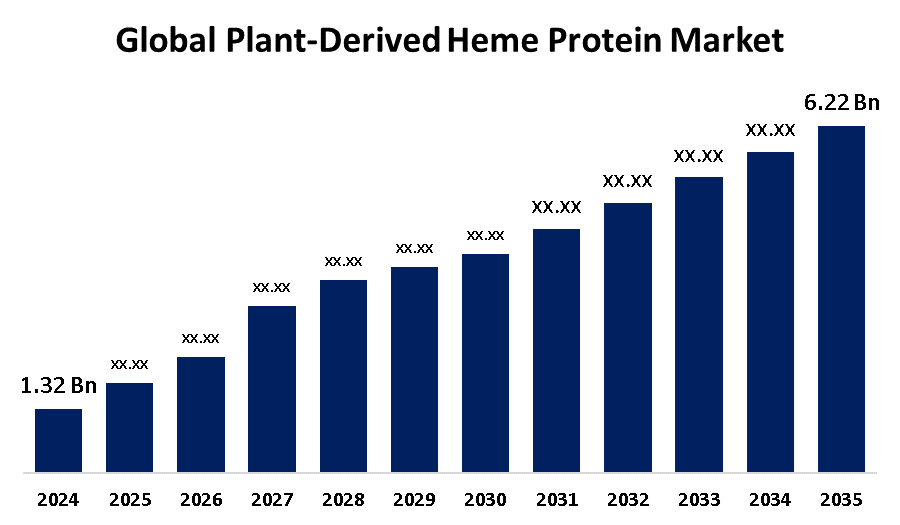

- The Global Plant-Derived Heme Protein Market Size Was Estimated at USD 1.32 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 15.13% from 2025 to 2035

- The Worldwide Plant-Derived Heme Protein Market Size is Expected to Reach USD 6.22 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The global plant-derived heme protein market size was worth around USD 1.32 billion in 2024 and is predicted to grow to around USD 6.22 billion by 2035 with a compound annual growth rate (CAGR) of 15.13% from 2025 and 2035. The growing demand for sustainable meat substitutes, developments in food biotechnology, growing vegan populations, and rising investments in functional foods and nutraceutical innovations all present opportunities for the plant-derived heme protein market.

Market Overview

The global industry devoted to the manufacture, marketing, and use of heme proteins derived from plant sources like wheat, peas, and soy is known as the "plant-derived heme protein market." These proteins are crucial for plant-based meat substitutes and functional foods because they replicate the flavor, color, and scent of animal-based heme. The market is divided into a number of segments, such as product kinds, applications, distribution methods, and end users in the pharmaceutical, food, and nutraceutical industries. The global trend toward plant-based diets, driven by growing concerns about animal welfare, environmental sustainability, and health consciousness, is a major growth factor for the market of plant-derived heme protein market. Growing consumer demand for plant-based meat substitutes, growing consciousness of sustainable protein sources, and quick developments in food technology that have made it possible to extract and commercialize plant-derived heme proteins on a large scale are the main drivers of this impressive expansion.

Report Coverage

This research report categorizes the plant-derived heme protein market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the plant-derived heme protein market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the plant-derived heme protein market.

Global Plant-Derived Heme Protein Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.32 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 15.13% |

| 2035 Value Projection: | USD 6.22 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 247 |

| Tables, Charts & Figures: | 97 |

| Segments covered: | By Product, By Application, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Shiru Inc., Meati Foods, VeganZeastar, Nature’s Fynd, Redefine Meat, Perfect Day Inc., Greenleaf Foods SPC, Beyond Meat Inc., Novozymes A/S, Impossible Foods Inc., Motif FoodWorks Inc., Future Meat Technologies, Ingredion Incorporated, Triton Algae Innovations Ltd., Others, and others key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for plant-derived heme protein is driven by several convergent forces. The demand for plant-based protein substitutes has increased due to growing consumer awareness of environmental sustainability and ethical food supply. The market for plant-derived heme protein is anticipated to develop and become more competitive as a result of regulatory support for novel food additives and the expansion of patent portfolios. Increased sensory qualities and scalable manufacturing have been made possible by technological developments in protein extraction and precision fermentation. The growing popularity of vegan, flexitarian, and health-conscious lifestyles, especially among younger populations, speeds up market adoption even more.

Restraining Factors

The market for plant-derived heme protein is restricted by a number of factors, such as high manufacturing costs, low consumer awareness, complicated regulations, difficulties with scaling, and problems with taste optimization. These factors work together to prevent broad adoption and business growth.

Market Segmentation

The plant-derived heme protein market share is classified into product type and application.

- The soy-based heme protein segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the plant-derived heme protein market is divided into soy-based heme protein, pea-based heme protein, wheat-based heme protein, and others. Among these, the soy-based heme protein segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The soy-based heme protein's outstanding functional qualities and long history of use in the food sector are the reasons for this. Due to their high protein content, superior amino acid profile, and capacity to closely mimic the flavor and color of animal-based heme, soy-based heme proteins are preferred.

- The meat alternatives segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the plant-derived heme protein market is divided into meat alternatives, functional foods, nutritional supplements, and others. Among these, the meat alternatives segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The increasing need for plant-based meat substitutes that use heme proteins to mimic the taste, scent, and appearance of traditional meat is driving the market for meat alternatives worldwide. Due to their ability to provide a realistic meat-like sensation, these proteins are very appealing to consumers that are vegan, flexitarian, or health-conscious.

Regional Segment Analysis of the Plant-Derived Heme Protein Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the plant-derived heme protein market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the plant-derived heme protein market over the predicted timeframe. The United States is leading the way in market expansion due to its highly informed and health-conscious customer base, powerful market leaders, and advantageous regulatory environments that encourage the commercialization of innovative food components. The market in North America is anticipated to continue growing due to the rising acceptance of plant-based diets and the expanding availability of products made from plant-derived heme protein in mainstream retail channels. The area also gains from a thriving ecosystem of existing and new food firms that specialize in alternative proteins, as well as strong investment activity.

Asia Pacific is expected to grow at a rapid CAGR in the plant-derived heme protein market during the forecast period. The demand for plant-based meat substitutes and functional foods is being driven by the Asia Pacific region's fast urbanization, growing disposable incomes, and growing adoption of Western dietary patterns in nations like China, Japan, and Australia. The region also benefits from a robust agricultural base for the production of raw materials, including wheat, peas, and soy, as well as a sizable and expanding population of health-conscious consumers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the plant-derived heme protein market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Shiru Inc.

- Meati Foods

- VeganZeastar

- Nature’s Fynd

- Redefine Meat

- Perfect Day Inc.

- Greenleaf Foods SPC

- Beyond Meat Inc.

- Novozymes A/S

- Impossible Foods Inc.

- Motif FoodWorks Inc.

- Future Meat Technologies

- Ingredion Incorporated

- Triton Algae Innovations Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2025, A new European partnership called PLANTOMYC was officially launched with the goal of revolutionizing the alternative protein industry by creating hybrid ingredients that combine the benefits of mycelial protein biomass (MPB) and plant-based proteins. The project seeks to develop consumer-friendly, scalable, and sustainable protein substitutes with enhanced flavor, texture, and scent.

- In September 2023, A ground-breaking revelation from Korean food tech startup HN Novatech has the potential to completely change the landscape of plant-based meat in the future. The business launched ACOMS, the first patented heme-based seaweed ingredient for plant-based meat substitutes, on August 16, 2023. Singapore Tembusutech Innovation and KILSA Global collaborated to organize the launch event in Singapore, which was attended by prominent investors from Southeast Asia.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the plant-derived heme protein market based on the below-mentioned segments:

Global Plant-Derived Heme Protein Market, By Product Type

- Soy-Based Heme Protein

- Pea-Based Heme Protein

- Wheat-Based Heme Protein

- Others

Global Plant-Derived Heme Protein Market, By Application

- Meat Alternatives

- Functional Foods

- Nutritional Supplements

- Others

Global Plant-Derived Heme Protein Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the plant-derived heme protein market over the forecast period?The global plant-derived heme protein market is projected to expand at a CAGR of 15.13% during the forecast period.

-

2. What is the market size of the plant-derived heme protein market?The global plant-derived heme protein market size is expected to grow from USD 1.32 Billion in 2024 to USD 6.22 Billion by 2035, at a CAGR of 15.13% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the plant-derived heme protein market?North America is anticipated to hold the largest share of the plant-derived heme protein market over the predicted timeframe.

Need help to buy this report?