Global Pipeline Monitoring System Market Size, Share, and COVID-19 Impact Analysis, By Pipe Type (Metallic, Non-Metallic, Others), By Technology (Acoustic/Ultrasonic, PIGs, Smart Ball, LIDAR, Vapor Sensing, Mass Volume/Balance, Magnetic Flux Leakage, Fiber Optic Technology, Others), By Application (Leak Detection, Operating Condition, Pipeline Break Detection, Others), By End-Users (Oil Industry, Natural Gas, Biofuel, Petrochemical Industries, Water & Wastewater Treatment, Chemical Industries, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Machinery & EquipmentGlobal Pipeline Monitoring System Market Size Insights Forecasts to 2032

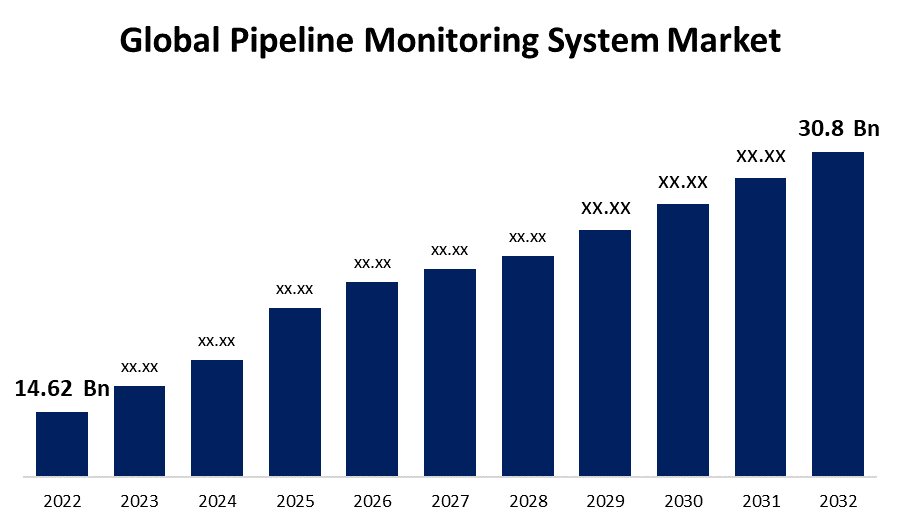

- The Global Pipeline Monitoring System Market Size was valued at USD 14.62 Billion in 2022.

- The Market is Growing at a CAGR of 7.5% from 2022 to 2032.

- The Worldwide Pipeline Monitoring System Market Size is expected to reach USD 30.8 Billion by 2032.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Pipeline Monitoring System Market Size is expected to reach USD 30.8 Billion by 2032, at a CAGR of 7.5% during the forecast period 2022 to 2032.

The pipeline monitoring system is a complex combination of hardware and software solutions for monitoring, managing, and analyzing pipelines that can be utilized in a variety of industries such as oil and gas, water delivery, and other fluid transportation networks. The key objective of this type of system is to maintain the pipeline infrastructure's safety, integrity, and performance. Pipeline monitoring systems are critical to assuring the safe and effective functioning of pipelines, decreasing downtime, preventing environmental damage, and lowering the cost of repairs and maintenance. A pipeline monitoring system's essential parts and characteristics tend to involve sensors and devices, data collecting, data processing, alarms and notifications, remote surveillance, safety and accessibility control, compliance and reporting, and numerous additional features. Furthermore, the major goal of such a system is to make sure the pipeline infrastructure's effective and secure functioning while limiting the danger of accidents, spills, leaks, and other occurrences that might result in ecological harm, safety hazards, or supply chain interruptions. Pipeline monitoring systems market growth is being driven by trends such as the rapidly occurring leakage problems within the oil and gas industries, as well as the growing global consumption of fossil fuels. As a result of the increasing adoption of smart products and services that can control, monitor, and optimize operations, the pipeline monitoring system market is currently growing.

Global Pipeline Monitoring System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 14.62 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.5% |

| 2032 Value Projection: | USD 30.8 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | COVID-19 Impact Analysis, By Pipe Type, By Technology, By Application, By End-Users, By Region |

| Companies covered:: | Schneider Electric SE, Siemens AG, Honeywell International Inc., Huawei Technologies Co. Ltd., BAE Systems, TransCanada Pipe Lines Limited, ABB Ltd., Emerson Electric Co., Generic Electric Co., ORBCOMM Inc., QinetiQ Group Plc, Rockwell Automation Inc., PSI AG, Pentair PLC, Sentar Inc., Pure Technology, Orbcomm Inc. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global pipeline monitoring system market has grown significantly as a result of many factors such as rising demand for crude oil and natural gas, increasing worries regarding pipeline safety and transparency, regulatory constraints, and technological improvements in pipeline monitoring. To facilitate the ongoing development of pipeline infrastructure in various countries, the industry has been constantly rising. In addition, firms are working on adopting tangible safety solutions such as aerial and ground monitoring and video surveillance to safeguard pipelines from terrorist attacks and vandalism. As a result, pipeline infrastructure expansion will create a profitable market for monitoring system manufacturers over the forecast period.

The increasing demand for fossil fuels, as well as the requirement to transmit them effectively and with minimal risk, have driven investments in the pipeline network and monitoring technologies. The integration of cutting-edge technologies such as fiber optics, ultrasonic testing, acoustic leak detection, satellite-based monitoring, and the Internet of Things (IoT) to improve pipeline system monitoring is expected to provide lucrative market potential. Furthermore, new pipeline facilities also make substantial use of technological advances in communication and information technology such as Supervisory Control and Data Acquisition, Intelligent Video Surveillance, Human Machine Interface, and Programmable Logic Controller. These innovations are helping build an interactive pipeline infrastructure that allows oil and gas corporations to remotely oversee and operate their business activities. As a result, organizations are boosting their investment in network monitoring and are installing robust monitoring solutions to protect networks from cyber-attacks.

Restraining Factors

However, the lack of awareness and apprehension regarding the adoption of monitoring systems among operators is a major restrain for monitoring solution providers in the oil and gas industry.

Market Segmentation

By Pipe Type Insights

The metallic segment is dominating the market with the largest revenue share over the forecast period.

On the basis of pipe type, the global pipeline monitoring system market is segmented into the metallic, non-metallic, and others. Among these, the metallic segment is dominating the market with the largest revenue share of 78.6% over the forecast period. Metallic pipes are used extensively for both production and distribution in oil and gas, petrochemical, refinery, and power facilities. Metallic pipes include ductile iron pipes, stainless steel pipes, aluminum pipes, and other varieties such as cast-iron pipes, corrugated pipes, and copper pipes. Iron-based pipes are susceptible to corrosion if treated with strongly oxygenated water steam; as such, the end-user sectors prefer steel-based pipes. Metallic pipes also tend to be less corrosion-resistant and more heat-resistant than non-metallic pipes. Because these pipes are inexpensive and require little maintenance, they are becoming more popular.

By Technology Insights

The acoustic/ultrasonic segment is witnessing significant CAGR growth over the forecast period.

On the basis of technology, the global pipeline monitoring system market is segmented into acoustic/ultrasonic, PIGs, smart ball, LIDAR, vapor sensing, mass volume/balance, magnetic flux leakage, fiber optic technology, and others. Among these, the acoustic/ultrasonic segment is witnessing significant CAGR growth over the forecast period. Acoustic and ultrasonic monitoring systems identify leaks, fractures, and other pipeline safety problems using sound waves. To detect anomalies, these systems are used to analyze the vibrating patterns produced by flowing fluids. An acoustic detection system identifies leaks by distinguishing and classifying leak sounds from normal water flow, accelerating market expansion in the coming year.

By Application Insights

The leak detection segment is expected to hold the largest share of the global pipeline monitoring system market during the forecast period.

Based on the Application, the global pipeline monitoring system market is divided into leak detection, operating condition, pipeline break detection, and others. Among these, the leak detection segment is expected to hold the largest share of the global pipeline monitoring system market during the forecast period. This section emphasizes pipeline leak detection and detection technology and systems. Pipeline operators are able to enhance the efficient operation of their leak detection systems by using leak detection solutions. Leak detection technologies automatically inform controllers in the event of a pipeline failure, allowing them to take immediate action to reduce spill duration and volume. To identify and respond to leaks as quickly as possible, many approaches are used, including acoustic sensors, infrared imaging systems, vapor sensing, and flow balance monitoring.

By End-Users Insights

The oil industry segment accounted for the largest revenue share of more than 57.2% over the forecast period.

On the basis of End-Users, the global pipeline monitoring system market is segmented into the oil industry, natural gas, biofuel, petrochemical industries, water & wastewater treatment, chemical industries, and others. Among these, the oil industry segment is dominating the market with the largest revenue share of 57.2% over the forecast period. Crude oil, biogas fuels, petroleum, and refineries are all aspects of the oil industry market. Because pipelines are the foundation of transportation in the oil industry, manufacturers are introducing pipeline monitoring systems to assure safety and avoid disasters. Furthermore, adding detecting systems decreases environmental impact, and waste, and enables real-time data, allowing for swift fault discovery and solution execution. Furthermore, pipeline detection/monitoring systems have effectively minimized ruptures, thefts, and internal leakage, pushing market expansion in the coming year.

Regional Insights

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with more than 48.7% market share over the forecast period. The North American territory, which includes the United States and Canada, has the largest share of the worldwide pipeline monitoring system market. The development of a significant number of oil and gas pipelines, as well as severe safety and ecological standards, has increased the demand for pipeline monitoring systems market in this region. The increasing emphasis on repairing outdated pipeline systems and mitigating leaks, spills, and accidents has increased the widespread use of monitoring technologies.

Asia Pacific, on the contrary, is expected to grow the fastest during the forecast period. With its growing economies such as China and India, the Asia Pacific region is experiencing rapid expansion in the oil and gas sector. Pipeline monitoring systems are in high demand due to the region's developing pipeline infrastructure to fulfill increased energy demand. Furthermore, rising investments in oil and gas exploration and pipeline building are fueling the expansion of the pipeline monitoring systems market in the region. Furthermore, government programs targeted at improving pipeline safety and mitigating environmental impacts assist the market's expansion.

The Europe market is expected to register a substantial CAGR growth rate during the forecast period. Another key player in the global industry pipeline monitoring system market is Europe. Pipelines transporting oil, gas, and other petrochemical goods are extensive throughout nations such as Germany, the United Kingdom, and Russia. The rapid adoption of monitoring systems in this region has resulted from the necessity of constantly tracking these transmission lines for operational efficiency, safety, and compliance with regulatory requirements.

List of Key Market Players

- Schneider Electric SE

- Siemens AG

- Honeywell International Inc.

- Huawei Technologies Co. Ltd.

- BAE Systems

- TransCanada Pipe Lines Limited

- ABB Ltd.

- Emerson Electric Co.

- Generic Electric Co.

- ORBCOMM Inc.

- QinetiQ Group Plc

- Rockwell Automation Inc.

- PSI AG

- Pentair PLC

- Sentar Inc.

- Pure Technology

- Orbcomm Inc.

Key Market Developments

- On March 2023, Eni, the Italian energy giant, has launched Enivibes, a new business focused to maximizing the market value of its unique vibroacoustic pipeline monitoring system technology. The launch of the new company comes as Eni seeks to increase the market value of its unique technology known as e-vpms (Eni Vibroacoustic Pipeline Monitoring System), which is used to monitor liquid transportation pipelines and ensure their integrity.

- On December 2022, Sensi+TM, a breakthrough analyzer for monitoring natural gas quality, is introduced by ABB. The Sensi+ analyzer from ABB is a dependable new solution that simplifies and lowers the cost of pipeline operation and maintenance. The AnalyzerExpertTM capabilities of ABB's Sensi+ analyzer enable experts with actions and insights directly from the instrument. Built-in self-diagnostics, automated laser line-locking, real-time cross-interference compensation, and health monitoring are among the capabilities.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Pipeline Monitoring System Market based on the below-mentioned segments:

Pipeline Monitoring System Market, Pipe Type Analysis

- Metallic

- Non-Metallic

- Others

Pipeline Monitoring System Market, Technology Analysis

- Acoustic/Ultrasonic

- PIGs

- Smart Ball

- LIDAR

- Vapor Sensing

- Mass Volume/Balance

- Magnetic Flux Leakage

- Fiber Optic Technology

- Others

Pipeline Monitoring System Market, Application Analysis

- Leak Detection

- Operating Condition

- Pipeline Break Detection

- Others

Pipeline Monitoring System Market, End-Users Analysis

- Oil Industry

- Natural Gas

- Biofuel

- Petrochemical Industries

- Water & Wastewater Treatment

- Chemical Industries

- Others

Pipeline Monitoring System Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Pipeline Monitoring System market?The Global Pipeline Monitoring System Market is expected to grow from USD 14.62 billion in 2022 to USD 30.8 billion by 2032, at a CAGR of 7.5% during the forecast period 2022-2032

-

2. Which are the key companies in the market?Schneider Electric SE, Siemens AG, Honeywell International Inc., Huawei Technologies Co. Ltd., BAE Systems, TransCanada Pipe Lines Limited, ABB Ltd., Emerson Electric Co., Generic Electric Co., ORBCOMM Inc., QinetiQ Group Plc, Rockwell Automation Inc., PSI AG, Pentair PLC, Sentar Inc., Pure Technology, Orbcomm Inc.

-

3. Which segment dominated the Pipeline Monitoring System market share?The oil industry segment in end-use type dominated the Pipeline Monitoring System market in 2022 and accounted for a revenue share of over 57.2%.

-

4. What are the elements driving the growth of the Pipeline Monitoring System market?The rise in demand for pipeline monitoring systems in end-use sectors, particularly the crude and refined petroleum industries, is driving the expansion of the pipeline monitoring system market.

-

5. Which region is dominating the Pipeline Monitoring System market?North America is dominating the Pipeline Monitoring System market with more than 48.7% market share.

-

6. Which segment holds the largest market share of the Pipeline Monitoring System market?The metallic segment based on pipe type holds the maximum market share of the Pipeline Monitoring System market.

Need help to buy this report?