Global Physical Vapor Deposition Market Size, Share, and COVID-19 Impact Analysis, By Type (Sputter Deposition, Thermal Evaporation Deposition, Cathodic Arc Evaporation, Others), By Application (Data Storage, Microelectronics, Solar Products, Cutting Tools, Medical Equipment, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Specialty & Fine ChemicalsGlobal Physical Vapor Deposition Market Insights Forecasts to 2033

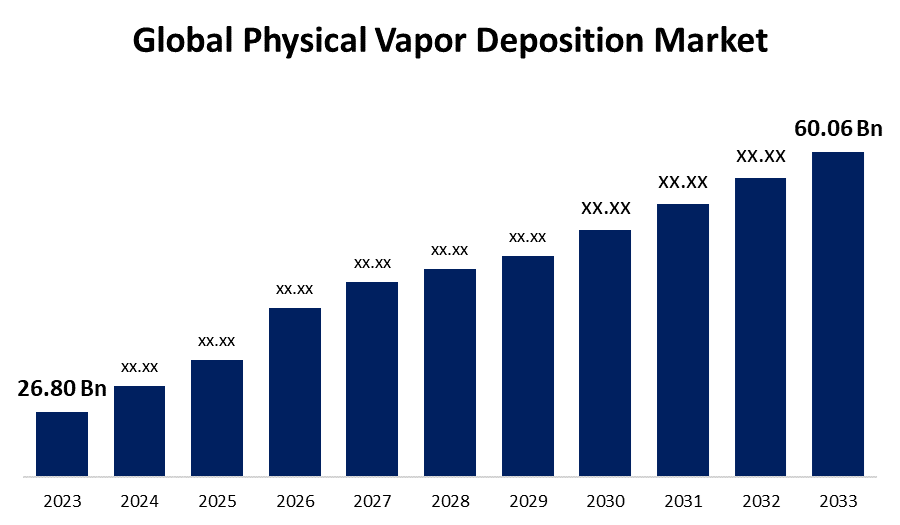

- The Global Physical Vapor Deposition Market Size was Valued at USD 26.80 Billion in 2023

- The Market Size is Growing at a CAGR of 8.40% from 2023 to 2033

- The Worldwide Physical Vapor Deposition Market Size is Expected to Reach USD 60.06 Billion by 2033

- Aisa Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Physical Vapor Deposition Market Size is Anticipated to Exceed USD 60.06 Billion by 2033, Growing at a CAGR of 8.40% from 2023 to 2033.

Market Overview

Physical vapor deposition (PVD) is a thin-film coating and vacuum-based method that generates coatings of pure metals, metallic alloys, and ceramics with a 1-10µm thickness. Physical vapor deposition is physically depositing atoms, ions, or molecules of a coating species over a substrate. Physical vapor deposition processes include evaporation, transportation, reaction, and deposition. The procedure is eco-friendly and utilized to improve the surface characteristics of inorganic or organic substrates. PVD's diverse applications in electronics, automotive, medical, and other end-use industries are driving market expansion. Furthermore, the expansion operations of major important companies contribute to the growth of the market in emerging economies.

Report Coverage

This research report categorizes the market for physical vapor deposition market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the physical vapor deposition market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the physical vapor deposition market.

Global Physical Vapor Deposition Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 26.80 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 8.40% |

| 2033 Value Projection: | USD 60.06 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 255 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | Advanced Energy Industries, Inc., Impact Coatings AB, The Kurt J Lesker Company, IHI Corporation, Voestalpine AG, ASM International N.V., Angestrim Engineering, Inc., Denton Vacuum, AJA International, Inc., Oerlikon Balzers, Dynavac, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The physical vapor deposition (PVD) market is propelled by several key factors driving its growth and adoption across industries. The increasing demand from the electronics sector, where PVD coatings are essential for semiconductor manufacturing and enhancing the performance of electronic components. Furthermore, the automotive industry's focus on lightweight materials and improved efficiency fuels the use of PVD coatings to enhance the durability and aesthetics of automotive parts. Functional advantages such as wear resistance and corrosion protection further bolster the appeal of PVD coatings in aerospace, medical devices, and packaging applications. Technological advancements in PVD technology, including improved coating uniformity and deposition rates, continuously expand its capabilities and attractiveness across industries. Additionally, new applications emerge in renewable energy and consumer products sectors, the PVD market continues to grow globally, driven by innovation and expanding industrial needs.

Restraining Factors

The physical vapor deposition (PVD) market faces several challenges that could impede its expansion and widespread acceptance. New entrants and smaller producers face significant challenges due to high initial investment costs for equipment and specialized skills. Additionally, complicated technology and environmental restrictions complicate and increase the cost of operations. PVD's application in a range of industries might be limited by material compatibility and deposition speeds when compared to other technologies such as CVD.

Market Segmentation

The physical vapor deposition market share is classified into type, and application.

- The sputter deposition segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the physical vapor deposition market is classified into sputter deposition, thermal evaporation deposition, cathodic arc evaporation, and others. Among these, the sputter deposition segment is estimated to hold the highest market revenue share through the projected period. The sputter deposition segment dominates the physical vapor deposition market due to its versatility across diverse industries such as microelectronics, optics, and hard materials. This technique involves bombarding a target material with high-energy particles to deposit a thin film onto a substrate. It offers uniform coating on both simple and complex shapes, accommodating various materials including metals, alloys, ceramics, and compounds. Sputter deposition's ability to coat substrates like plastics, glasses, and composites while ensuring good step coverage and uniformity has driven its widespread adoption. In microelectronics, sputter deposition plays a crucial role in manufacturing integrated circuits and chip packaging by depositing precise, adhesive films of metals such as copper and aluminum on silicon wafers.

- The microelectronics segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the physical vapor deposition market is divided into data storage, microelectronics, solar products, cutting tools, medical equipment, and others. Among these, the microelectronics segment is anticipated to hold the largest market share through the forecast period. Microelectronics is a subfield of electronics that employs PVD techniques for device manufacture and seed layers for plating. These coatings are strong and homogenous, with great temperature durability and outstanding abrasion strength, enhancing microelectronics performance. Physical vapor deposition techniques like sputtering and evaporation are widely utilized in microelectronics production processes such as device structuring, metallization, and packaging. Worldwide, the microelectronics market is expanding rapidly. China, India, Japan, the United States, Germany, and Brazil are the primary economies driving the growth of this market.

Regional Segment Analysis of the Physical Vapor Deposition Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the physical vapor deposition market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the physical vapor deposition market over the predicted timeframe. This might be attributed to the robust industrial sectors in nations such as the United States and Canada, which rely significantly on PVD coating technologies. North America's automotive, electronics, and medical device industries are at the forefront of innovation and were among the first to use PVD coatings. North America is also a pioneer in PVD equipment manufacture, with several large companies established in the region. This increases the accessibility of cutting-edge deposition technologies and promotes continual innovation. Furthermore, the solid macroeconomic environment in North America encourages high levels of R&D spending by both public and private players.

Asia Pacific is expected to grow at the fastest CAGR growth of the physical vapor deposition market during the forecast period. Rising production capacities, emerging end-use industries, and increasing adoption rates are all contributing to significant demand for PVD coatings in Asia Pacific. China, Japan, South Korea, and Taiwan are industrial powerhouses with significant manufacturing presence in electronics, automotive, and other industries utilizing PVD technologies. Rapid infrastructure development and industrialization, together with rising per capita incomes in developing Asian countries, are also driving consumption. Furthermore, Asia Pacific players have recognized PVD coatings' ability to increase product lifetimes and improve performance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the physical vapor deposition market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Advanced Energy Industries, Inc.

- Impact Coatings AB

- The Kurt J Lesker Company

- IHI Corporation

- Voestalpine AG

- ASM International N.V.

- Angestrim Engineering, Inc.

- Denton Vacuum

- AJA International, Inc.

- Oerlikon Balzers

- Dynavac

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, IHI Hauzer Techno Coating B.V. (Venlo, the Netherlands) introduced a new batch-coating machine for physical vapor deposition (PVD). The Hauzer Flexicoat 1250 expands on the existing Flexicoat platform, offering 33% greater loading capacity than the Flexicoat 1200.

- In June 2023, Oerlikon Balzers, a leading surface solution brand of Oerlikon, signed a ten-year contract with ITP Aero to apply Oerlikon’s new advanced high-temperature wear-resistant coating BALORA TECH PRO on components of the Pratt & Whitney Canada PW800 turbofan engine that powers the new Gulfstream G500/G600 and Dassault Falcon 6X business jets.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the physical vapor deposition market based on the below-mentioned segments:

Global Physical Vapor Deposition Market, By Type

- Sputter Deposition

- Thermal Evaporation Deposition

- Cathodic Arc Evaporation

- Others

Global Physical Vapor Deposition Market, By Application

- Data Storage

- Microelectronics

- Solar Products

- Cutting Tools

- Medical Equipment

- Others

Global Physical Vapor Deposition Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the physical vapor deposition market over the forecast period?The physical vapor deposition market is projected to expand at a CAGR of 8.40% during the forecast period.

-

2.What is the market size of the physical vapor deposition market?The Global Physical Vapor Deposition Market Size is Expected to Grow from USD 26.80 Billion in 2023 to USD 60.06 Billion by 2033, at a CAGR of 8.40% during the forecast period 2023-2033.

-

3.Which region holds the largest share of the physical vapor deposition market?North America is anticipated to hold the largest share of the physical vapor deposition market over the predicted timeframe.

Need help to buy this report?