Global Photoimageable Solder Resist Ink Market Size, Share, and COVID-19 Impact Analysis, By Application (Printed Circuit Boards, Semiconductor Packaging, and Others), By End-User (Electronics, Automotive, Aerospace, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Semiconductors & ElectronicsGlobal Photoimageable Solder Resist Ink Market Insights Forecasts to 2035

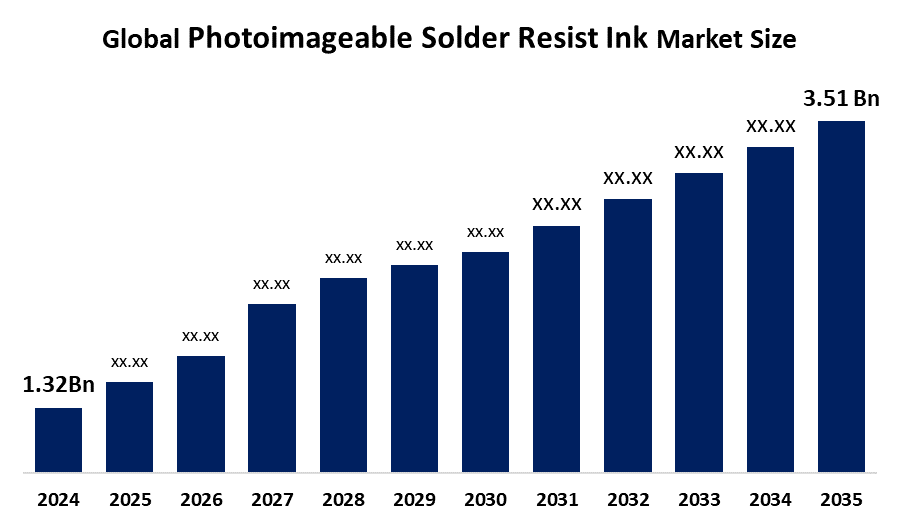

- The Global Photoimageable Solder Resist Ink Market Size Was Estimated at USD 1.32 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.3% from 2025 to 2035

- The Worldwide Photoimageable Solder Resist Ink Market Size is Expected to Reach USD 3.51 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global photoimageable solder resist ink market size was worth around USD 1.32 billion in 2024 and is predicted to grow to around USD 3.51 billion by 2035 with a compound annual growth rate (CAGR) of 9.3% from 2025 to 2035. The photoimageable solder resist ink market is growing due to increased demand for high-efficiency electronic devices, the advent of innovative technologies such as 5G and IoT, and the need for precision in printed circuit board (PCB) manufacturing

Market Overview

The global photoimageable solder resist ink market comprises polymer-based inks designed to form protective, electrically insulating layers on printed circuit boards (PCBS). These inks are patterned through ultraviolet (UV) light exposure, enabling high precision and fine feature definition critical requirements in modern electronics manufacturing. Photoimageable solder resist inks are widely used across consumer electronics, automotive electronics, telecommunications, industrial equipment, and medical devices to safeguard circuits against oxidation, moisture ingress, and electrical short circuits.Market growth is primarily driven by the rising demand for high-density and high-performance PCBS, along with the rapid expansion of technologies such as 5G the Internet of Things (IOT), electric vehicles (EVS), and advanced electronics packaging solutions. Continuous innovation in miniaturization and multilayer PCB designs further supports market expansion.

Report Coverage

This research report categorizes the photoimageable solder resist ink market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the photoimageable solder resist ink market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the photoimageable solder resist ink market.

Global Photoimageable Solder Resist Ink Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.32 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 9.3% |

| 2035 Value Projection: | USD 3.51 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Taiyo Ink Mfg, Atotech, Tamura Corporation, Hitachi Chemical, Element Solutions Inc., Huntsman Corporation, Kolon Industries, Inc., Sun Chemical Corporation, DuPont de Nemours, Inc., Electra Polymers Ltd, Agfa-Gevaert N.V., Fujifilm Holdings Corporation, Eternal Materials Co., Ltd., Shenzhen Rongda Photosensitive & Technology, and Others players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global solder resist ink market is primarily driven by growth in the electronics and PCB manufacturing sectors, supported by the rising demand for high-density multilayer printed circuit boards in consumer electronics, telecommunications and industrial automation industries. The transition to devices and the broad acceptance of technologies, like 5G, IoT, vehicles and autonomous systems, necessitate solder resist inks that provide accuracy and reliability. Advancements in ink formulations that improve adhesion, heat tolerance and eco-friendly properties also fuel demand, while the Asia-Pacific region’s dominance in electronics manufacturing further accelerates market expansion. Growing regulatory emphasis on sustainability encourages the development of ink solutions.

Restraining Factors

The photoimageable solder resist ink market faces restraints from high material and processing costs, stringent environmental regulations on chemical usage, and complex manufacturing requirements. Limited awareness among small PCB manufacturers and challenges in achieving consistent performance across advanced applications further hinder widespread adoption and market growth.

Market Segmentation

The photoimageable solder resist ink market share is classified into product type, application, and end-user.

- The liquid photoimageable solder resist ink segment dominated the market in 2024, approximately 45% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the photoimageable solder resist ink market is divided into liquid photoimageable solder resist ink and dry film photoimageable solder resist ink. Among these, the liquid photoimageable solder resist ink segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Liquid photoimageable solder mask ink is prized for its affordability and adaptability in PCB manufacturing. Its precise patterning aligns with electronics, and its liquid state conforms to different PCB layers, providing excellent insulation and protection. This versatility makes it perfect for production environments where efficiency, quick processing and dependable results are crucial.

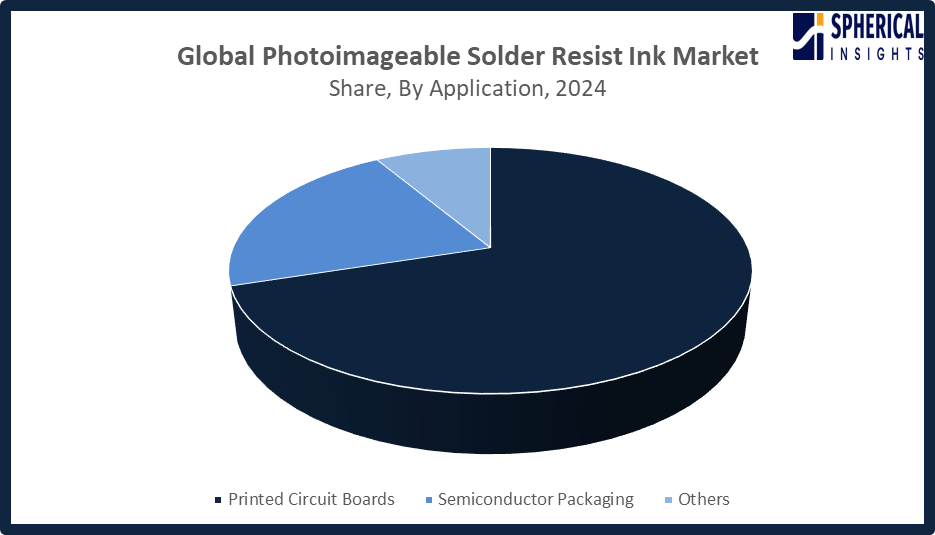

- The printed circuit boards segment accounted for the largest share in 2024, approximately 70% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the photoimageable solder resist ink market is divided into printed circuit boards, semiconductor packaging, and others. Among these, the printed circuit boards segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Photoimageable solder resist inks are utilized in PCBs propelled by the growing electronics industry and the movement toward advanced devices. These inks provide a layer that stops solder bridges and enhances the durability of PCBs. The rising demand for high-density interconnect (HDI) boards, which require precise solder masking to maintain connections, also drives expansion in this field.

Get more details on this report -

- The electronics segment accounted for the highest market revenue in 2024, approximately 40% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-user, the photoimageable solder resist ink market is divided into electronics, automotive, aerospace, and others. Among these, the electronics segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The electronics industry is the primary end-user of photoimageable solder resist inks, spanning consumer to industrial applications. Trends such as miniaturization and multifunctionality increase demand for advanced PCBs, boosting the need for high-quality inks. Rapid adoption of IoT, 5G, and AI technologies in electronics is expected to further drive market growth and innovation.

Regional Segment Analysis of the Photoimageable Solder Resist Ink Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the photoimageable solder resist ink market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the photoimageable solder resist ink market over the predicted timeframe. The Asia Pacific region is expected to have a 40% market share of the photoimageable solder resist ink market, with China, Japan and South Korea dominating the electronics and PCB manufacturing sectors. Increasing demand for smartphones, IoT gadgets, electric vehicles and 5G networks fuels the requirement for superior solder resist inks. Accelerated growth and governmental motivations, such as India’s broadened PLI initiatives alongside programs like SIP, SPECS and EMC 2.0, enhance local PCB manufacturing and supply networks, thereby indirectly increasing the need for these inks, positioning Asia Pacific as the biggest and quickest expanding market region.

Get more details on this report -

North America is expected to grow at a rapid CAGR in the photoimageable solder resist ink market during the forecast period. North America is expected to have a 25% market share of the photoimageable solder resist ink sector, fueled by robust electronics and semiconductor sectors in the U.S. and Canada. The implementation of IoT, 5G, AI and electric vehicles boosts the need for high-density PCBs. Ongoing research and development, governmental backing and the escalating output of consumer electronics drive this growth forward. The 2024 U.S. CHIPS and Science Act designates $52.7 billion toward semiconductor research and development well as manufacturing incentives, enhancing PCB investments and favoring solder resist providers, with IPC supporting this funding to challenge China’s 90% share of the global market.

Europe’s photoimageable solder resist ink market is steadily growing, led by Germany, France, and the UK, driven by strong electronics, automotive, and industrial sectors. Rising adoption of high-density PCBs, advanced devices, and eco-friendly materials fuels demand. Stricter 2024 EU regulations, including RoHS and REACH, push manufacturers to adopt low-VOC, halogen-free formulations, promoting sustainability and innovation, supporting market expansion, and shaping the global market toward safer, environmentally responsible electronic materials.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the photoimageable solder resist ink market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Taiyo Ink Mfg

- Atotech

- Tamura Corporation

- Hitachi Chemical

- Element Solutions Inc.

- Huntsman Corporation

- Kolon Industries, Inc.

- Sun Chemical Corporation

- DuPont de Nemours, Inc.

- Electra Polymers Ltd

- Agfa-Gevaert N.V.

- Fujifilm Holdings Corporation

- Eternal Materials Co., Ltd.

- Shenzhen Rongda Photosensitive & Technology

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2025, Sun Chemical announced it will showcase its new SVHC-free Imagecure Soldermask at Productronica 2025 in Munich, Europe’s leading PCB trade fair. The solution helps PCB fabricators meet global environmental regulations while delivering high performance and compliance without compromise.

- In October 2025, DuPont announced its joint presence at Printing United 2025, showcasing Artistri and Tyvek brands. Artistri digital inks, offering vibrant, reliable, and sustainable water-based pigment solutions, will serve Home & Office, Commercial, Packaging, and Textile segments, highlighting DuPont’s innovation in digital printing and graphics.

- In May 2024, DuPont celebrated 35 years of innovation with its Artistri inks by launching the PN 1000 series at drupa 2024. The low-viscosity, water-based pigment inks offer commercial printing solutions compatible with standard drying technologies.

- In April 2024, Taiyo launched a high-resolution photoimageable ink for AI chip packaging, offering <5µm line resolution and enhanced thermal stability, expanding its product portfolio into semiconductor applications and supporting advanced, high-performance electronics manufacturing.

- In January 2019, Agfa’s DiPaMat SolderMask ink contributed to Meyer Burger’s PiXDRO inkjet PCB solution, winning the 2019 IPC APEX Innovation Award. The digital inkjet process replaces traditional methods, reducing waste and enhancing production flexibility by precisely applying multiple ink layers for required physical and electrical properties.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the photoimageable solder resist ink market based on the below-mentioned segments:

Global Photoimageable Solder Resist Ink Market, By Product Type

- Liquid Photoimageable Solder Resist Ink

- Dry Film Photoimageable Solder Resist Ink

Global Photoimageable Solder Resist Ink Market, By Application

- Printed Circuit Boards

- Semiconductor Packaging

- Others

Global Photoimageable Solder Resist Ink Market, By End-User

- Electronics

- Automotive

- Aerospace

- Others

Global Photoimageable Solder Resist Ink Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the photoimageable solder resist ink market over the forecast period?The global photoimageable solder resist ink market is projected to expand at a CAGR of 9.3% during the forecast period

-

2. What is the photoimageable solder resist ink market?The photoimageable solder resist ink market involves specialized polymer coatings for printed circuit boards (PCBs), preventing solder bridges and protecting circuits, driven by demand from automotive, consumer electronics, and IoT sectors for miniaturized devices

-

3. What is the market size of the photoimageable solder resist ink market?The global photoimageable solder resist ink market size is expected to grow from USD 1.32 billion in 2024 to USD 3.51 billion by 2035, at a CAGR of 9.3% during the forecast period 2025-2035.

-

4. Which region holds the largest share of the photoimageable solder resist ink market?Asia Pacific is anticipated to hold the largest share of the photoimageable solder resist ink market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global photoimageable solder resist ink market?Taiyo Ink Mfg, Atotech, Tamura Corporation, Hitachi Chemical, Element Solutions Inc., Huntsman Corporation, Kolon Industries, Inc., Sun Chemical Corporation, DuPont de Nemours, Inc., Electra Polymers Ltd, and Others.

-

6. What factors are driving the growth of the photoimageable solder resist ink market?Market growth is driven by rising demand for high-density PCBs, miniaturization of electronic devices, adoption of IoT, 5G, and electric vehicles, and the need for reliable, eco-friendly solder resist inks.

-

7. What are the market trends in the photoimageable solder resist ink market?Key trends include adoption of eco-friendly inks, miniaturization of PCBs, high-density interconnects, and growth in IoT, 5G, and automotive electronics

-

8. What are the main challenges restricting wider adoption of the photoimageable solder resist ink market?The main challenges restricting the wider adoption of the photoimageable solder resist (SM) ink market involve regulatory hurdles, fluctuating material costs, and technical performance limitations in demanding applications.

Need help to buy this report?