Global Phosphorus Pentachloride Market Size, Share, and COVID-19 Impact Analysis, By Form (Liquid and Solid), By Application (Chemical Synthesis, Water Treatment, Pharmaceuticals, Agriculture, and Laboratory Reagents), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Phosphorus Pentachloride Market Insights Forecasts to 2035

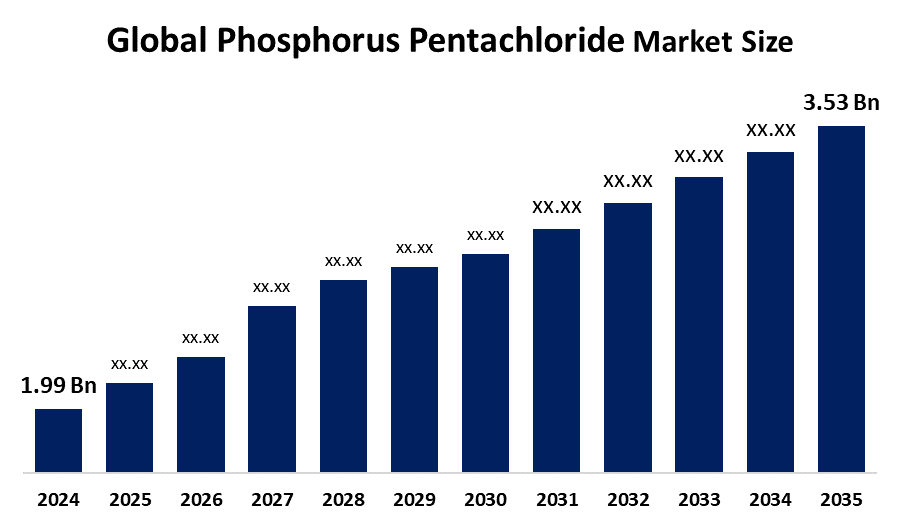

- The Global Phosphorus Pentachloride Market Size Was Estimated at USD 1.99 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.35% from 2025 to 2035

- The Worldwide Phosphorus Pentachloride Market Size is Expected to Reach USD 3.53 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Phosphorus Pentachloride Market Size Was Valued At Around USD 1.99 Billion In 2024 And Is Predicted To Grow To Around USD 3.53 Billion By 2035 With A Compound Annual Growth Rate (CAGR) of 5.35% From 2025 to 2035. Opportunities in the phosphorus pentachloride market include growing applications in chemical synthesis and catalyst production worldwide, growing demand in pharmaceuticals, agrochemicals, and dye manufacturing, and technological advancements and industrial expansion in emerging economies.

Market Overview

The manufacture, trade, and use of this adaptable inorganic compound white crystalline solid known for its function as a chlorinating and dehydrating agent in organic synthesis are all included in the global ecosystem known as the phosphorus pentachloride market. This industry comprises manufacturers, suppliers, and end consumers from various sectors, including plastics, agrochemicals, pharmaceuticals, and dyes. The synthesis of organic intermediates, especially acid chlorides, which are necessary for the production of medications, insecticides, and other specialty chemicals, depends heavily on phosphorus pentachloride. Phosphorus pentachloride market presence appears to be significantly expanding worldwide due to the growing demand for it in the manufacturing of pharmaceuticals and agrochemicals. The market for phosphorus pentachloride is seeing a significant rise in demand due to its vital function in chemical synthesis. One of the main factors contributing to the global expansion of phosphorus pentachloride is the quickly expanding chemical sector.

Report Coverage

This research report categorizes the Phosphorus Pentachloride Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the phosphorus pentachloride market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the phosphorus pentachloride market.

Global Phosphorus Pentachloride Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.99 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.35% |

| 2035 Value Projection: | USD 3.53 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | United Phosphorus Limited Tongshan Hongda Fine Chemical Suzhou Hantech Chemical Co., Ltd Jiangxi Jixiang Pharmchemical Co., Ltd. Shijiazhuang Zhonghao Chemical Co., Ltd. Xuzhou JianPing Chemical Co., Ltd. And Others Key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for Phosphorus Pentachloride is characterized by a highly competitive environment that is fueled by rising demand from a number of industries, including specialty chemicals, pharmaceuticals, and agrochemicals. The market for phosphorus pentachloride is mostly driven by the increasing need for phosphorus-based compounds in a variety of industrial sectors, especially in chemical manufacture, agrochemicals, and pharmaceuticals. In addition to being used as a dehydrating agent, phosphorus pentachloride is also used to make plasticizers and stabilizers for plastics and elastomers, as well as to enhance the grain structure in metal casting. The compound's widespread use as a chlorinating and dehydrating agent, which is crucial for creating acid chlorides, essential intermediates in the manufacture of insecticides, dyes, and medicinal ingredients, is one of the main motivating factors in the phosphorus pentachloride market.

Restraining Factors

The market for phosphorus pentachloride is restricted by strict environmental restrictions, high toxicity, complicated handling requirements, and volatile raw material prices. Its broad industrial adoption and commercial expansion are further constrained by growing consumer demand for environmentally friendly substitutes and safety concerns.

Market Segmentation

The phosphorus pentachloride market share is classified into form and application.

- The liquid segment accounted for the largest share in 2024, and is anticipated to grow at a significant CAGR during the forecast period.

Based on the form, the Phosphorus Pentachloride Market Size is divided into liquid and solid. Among these, the liquid segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The liquid segment's great efficiency, ease of use, and applicability for large-scale industrial processes, particularly in chemical synthesis, agrochemicals, and pharmaceuticals, are the main reasons for its popularity. Its use in a variety of chemical reactions is improved by the liquid form's higher solubility and reactivity. Because of their adaptability and effectiveness in chemical processes, liquid forms are desired by both producers and researchers.

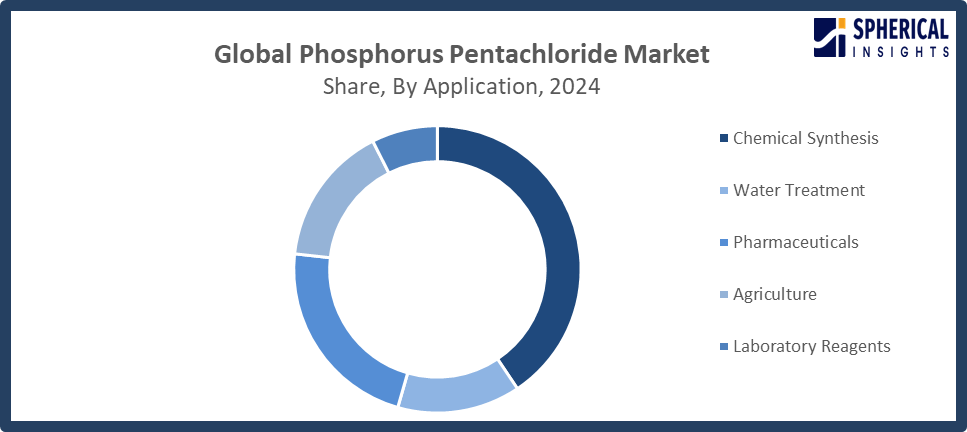

- The chemical synthesis segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the chemical synthesis market is divided into chemical synthesis, water treatment, pharmaceuticals, agriculture, and laboratory reagents. Among these, the chemical synthesis segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Phosphorus pentachloride is used by the pharmaceutical industry to create active medicinal components and by the agricultural industry to make fertilizer and pesticides. Due to its crucial function as a chlorinating and dehydrating agent in the production of organic and inorganic intermediates, chemical synthesis is a main application. Its adaptability in both industrial and scientific contexts is further demonstrated by its application in laboratory reagents and water treatment.

Get more details on this report -

Regional Segment Analysis of the Phosphorus Pentachloride Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

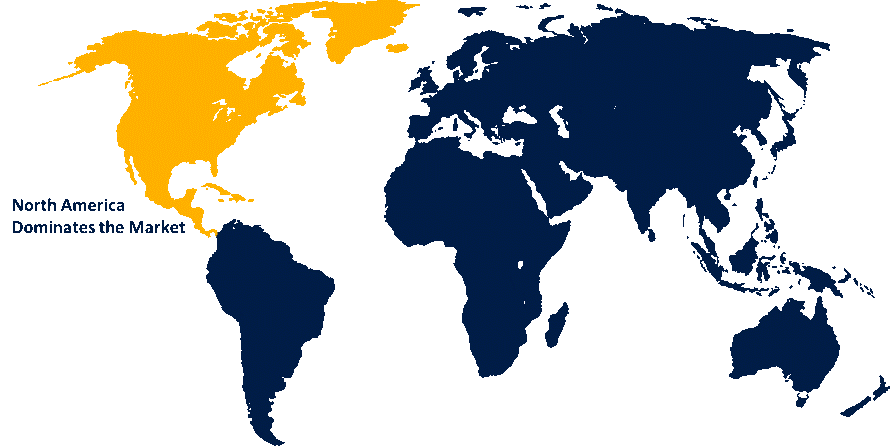

North America is anticipated to hold the largest share of the phosphorus pentachloride market over the predicted timeframe.

North America is anticipated to hold the largest share of the Phosphorus Pentachloride Market Size over the predicted timeframe. The pharmaceutical and agrochemical industries' growing demand is what propels North America. Initiatives aiming at sustainable practices and safety standards, along with regulatory support for chemical manufacturing and innovation, further drive this expansion. The United States, which is home to important companies like Albemarle Corporation and Huntsman Corporation, is the dominant nation in this area. The competitive environment is defined by large R&D expenditures and an emphasis on increasing production capabilities. In March 2025, the U.S. launched an Executive Order on Immediate Measures to Increase American Mineral Production, expediting permits for phosphorus derivative facilities and reducing import vulnerabilities from Asia.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR in the Phosphorus Pentachloride Market during the forecast period. Strong industrial growth, expanding chemical production, and growing end-use industry demand are the main drivers of the Asia-Pacific region. Due to their sophisticated chemical manufacturing industries and access to affordable labor and raw materials, nations like China, India, Japan, and South Korea are major drivers of this expansion. Government programs to improve food security and agricultural productivity are important growth drivers, as are growing investments in chemical manufacture.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Phosphorus Pentachloride Market Size, along with a comparative evaluation primarily based on their types of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- United Phosphorus Limited

- Tongshan Hongda Fine Chemical

- Suzhou Hantech Chemical Co., Ltd

- Jiangxi Jixiang Pharmchemical Co., Ltd.

- Shijiazhuang Zhonghao Chemical Co., Ltd.

- Xuzhou JianPing Chemical Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, BASF SE (DE) launched a new digital platform for phosphorus pentachloride supply chain operations, leveraging AI and advanced analytics to enhance efficiency, reduce lead times, and set industry benchmarks for digital transformation.

- In August 2025, Albemarle Corporation (US) launched a major investment in a new phosphorus pentachloride production facility, boosting capacity to meet global demand, particularly in agrochemicals, while reinforcing the company’s focus on innovation and sustainability.

- In July 2025, Solvay SA (BE) launched a strategic partnership with a leading agricultural technology firm to develop sustainable phosphorus pentachloride applications, fostering innovation, addressing environmental concerns, and advancing modern agriculture within the competitive chemical industry.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the phosphorus pentachloride market based on the below-mentioned segments:

Global Phosphorus Pentachloride Market, By Form

- Liquid

- Solid

Global Phosphorus Pentachloride Market, By Application

- Chemical Synthesis

- Water Treatment

- Pharmaceuticals

- Agriculture

- Laboratory Reagents

Global Phosphorus Pentachloride Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the phosphorus pentachloride market over the forecast period?The global phosphorus pentachloride market is projected to expand at a CAGR of 5.35% during the forecast period.

-

2. What is the market size of the phosphorus pentachloride market?The global phosphorus pentachloride market size is expected to grow from USD 1.99 billion in 2024 to USD 3.53 billion by 2035, at a CAGR of 5.35% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the phosphorus pentachloride market?North America is anticipated to hold the largest share of the phosphorus pentachloride market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global phosphorus pentachloride market?United Phosphorus Limited, Tongshan Hongda Fine Chemical, Suzhou Hantech Chemical Co., Ltd, Jiangxi Jixiang Pharmchemical Co., Ltd., Shijiazhuang Zhonghao Chemical Co., Ltd., Xuzhou JianPing Chemical Co., Ltd., and Others.

-

5. What factors are driving the growth of the phosphorus pentachloride market?The growth of the phosphorus pentachloride market is propelled by rising demand in agrochemicals and pharmaceuticals, expanding chemical‑synthesis applications, and increasing adoption of high‑purity reagents in emerging industrial sectors

-

6. What are the market trends in the phosphorus pentachloride market?Key trends in the Phosphorus Pentachloride market include sustainable production methods, the shift towards high‑purity grades, digitalized supply‑chain optimisation, and growth in applications in emerging regions such as Asia‑Pacific

Need help to buy this report?