Global Phosphoric Acid Market Size, Share, and COVID-19 Impact Analysis, By Process Type (Wet, Thermal), By Grade (Technical, Industrial), By Concentration (75%, 85%, 92%), By Application (Fertilizers, Feed & Food Additives, Catalyst, Water Treatment Chemicals, Metal Treatment, Cleaning & Sanitizing Agent, Industrial Use, Animal Feed, Others), By Industry Verticals (Agriculture, Energy, Industrial Cleaning, General Industrial, Construction, Water Treatment, Food & Beverage, Others), By Sales Channel (Direct Sale, Indirect Sale), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Specialty & Fine ChemicalsGlobal Phosphoric Acid Market Insights Forecasts to 2032

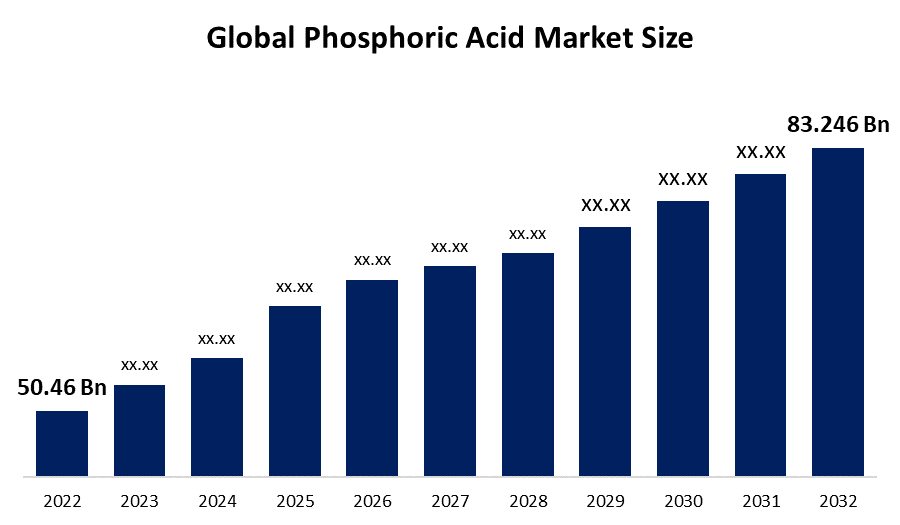

- The Global Phosphoric Acid Market Size was valued at USD 50.46 billion in 2022.

- The market is growing at a CAGR of 5.13% from 2022 to 2032

- The Worldwide Phosphoric Acid Market is expected to reach USD 83.246 billion by 2032

- North America is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Phosphoric Acid Market Size is expected to reach USD 83.246 billion by 2032, at a CAGR of 5.13% during the forecast period 2022 to 2032. Phosphoric acid consumption is being boosted by a rising need to make chemical fertilizers from phosphoric acid, which is being fueled by the increasing global population. The growing population increases the demand for food, which is met by growing crops fertilized with fertilizers. Fertilizer use is substantially higher among developing nations and territories than in emerging nations.

Phosphoric acid is a chemical compound that has the formula H3PO4, commonly referred to as orthophosphoric acid, and which is a dense liquid triprotic acid. The acid is a colorless, odorless, and non-volatile liquid that is usually available as an aqueous solution (nearly 85%). Phosphoric acid is typically made or synthesized utilizing two distinct processes: the wet process and the thermal procedure. Phosphoric acid is among the most widely used acids in numerous industries, particularly in the manufacturing process of fertilizers, accounting for nearly 80% of total output. Phosphoric acid in food-grade or weak solutions is utilized to acidify foods and beverages for example colas and jams, imparting a tangy or sour flavor. Phosphoric acid is also used in water treatment products as a preservative. Phosphoric acid may be utilized as well to chemically polish (etch) metals such as aluminum or to passivate steel goods in a process known as phosphatization.

The major key players in the Global Phosphoric Acid Market include Arkema, Eurochem Group AG, OCP Group S.A., Phosagro Group of Companies, ICL Group Ltd., Nutrien Ltd., IFFCO, The Mosaic Company, Solvay S.A., OCP, and PhosAgro. In order to boost their worldwide market position, these companies tend to concentrate on new product development, mergers and acquisitions, and business expansions. The ever-changing sector has resulted in a number of additional strategic efforts launched by important producers in order to enhance their market share.

For instance, On May 2023, Wesson Group’s Lionsbridge and Westech Group to establish an $875 million phosphoric acid production plant in Safaga, Egypt as part of an Australian consortium. The consortium will establish a company named Osiris to implement the project which will be located in the city on the Red Sea coast, with a total annual production capacity of 692K tons. The plant will be executed in two phases; the first phase will cost $312 million in investments to produce 346,000 tons of phosphoric acid, while the second phase will be implemented with investments of up to $563 million.

Global Phosphoric Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 50.46 billion |

| Forecast Period: | 2022 - 2032 |

| Forecast Period CAGR 2022 - 2032 : | 5.13% |

| 2032 Value Projection: | USD 83.246 billion |

| Historical Data for: | 2018 - 2021 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Grade, By Concentration, By Application, By Industry Verticals, By Sales Channel, By Region |

| Companies covered:: | Arkema, Eurochem Group AG, OCP Group S.A., Phosagro Group of Companies, ICL Group Ltd., Nutrien Ltd., IFFCO, The Mosaic Company, Solvay S.A., OCP, PhosAgro, ArrMaz Products, Inc., Chuanlin Chemical, Nutrien, Haifa Group, Aditya Birla Chemicals, Hydrite Chemical Co., Chuandong Chemical Co., Ltd., LANXESS |

Get more details on this report -

Driving Factors

Phosphoric acid market growth can be attributable to increasing requirements for food additives as well as fertilizer products, and animal feed. Furthermore, increasing demographics and higher standards of living are driving the expansion of this industry. Food grade, farm grade, and industrial grade are the three grades. Phosphoric acid is a common component in many foods and beverages. Consumers were particularly interested in the dairy industry during the coronavirus outbreak. Furthermore, as people become increasingly conscious of the significance of food additives in food preservation, product utilization in the production of packaged meals and cold drinks will increase. Furthermore, agriculture grade phosphoric acid dominates the global market in terms of both value and volume, owing to its widespread use in fertilizer manufacture.

The ongoing controversy about food safety in terms of crop output and effective crop cultivation also has had a beneficial effect on the market. However, issues emerging from the overuse of phosphate and nitrogen-based chemical substances have resulted in the development of more sustainable alternatives, such as micronutrients and organic compounds. The growing popularity of such products made from bio-based materials has increased the importance of their comparative advantages compared to conventional fertilizers currently on the market. All of this, in consequence, will have a detrimental impact on the growth of the phosphoric acid market over the forecast period.

Restraining Factors

Phosphates are utilized as a starting material in the manufacture of phosphatic acid and phosphate products, which include fertilizers, food, and drinks. Nonetheless, the overuse of phosphate as a fertilizer has resulted in widespread contamination and eutrophication. Thus, globally appears to be running out of big resources. As a result, a lack of phosphates is a significant growth constraint.

Market Segmentation

By Process Type Insights

The wet process segment is dominating the market with the largest revenue share over the forecast period.

On the basis of process type, the global phosphoric acid market is segmented into the wet and thermal. Among these, the wet process segment is dominating the market with the largest revenue share of 68.6% over the forecast period. The phosphoric acid produced by the wet method is impure, but it can be utilized directly in fertilizer manufacturing without purification. The wet process is primarily driven by the rapid development in fertilizer demand. The phosphoric acid market is growing because of its low operating costs, short processing time, low ambient temperatures, and ease of use. Because there is no substitute for phosphate, it is critical to take necessary precautions to assure phosphate supply in future periods. Although phosphate recycling from wastewater is technically conceivable, it is yet to become economically viable.

By Grade Type Insights

The industrial segment is witnessing significant CAGR growth over the forecast period.

On the basis of grade type, the global phosphoric acid market is segmented into technical and industrial. Among these, the industrial segment is witnessing significant CAGR growth over the forecast period. Food additives, fertilizers, animal feed, detergents (liquid laundry detergent), and other sectors utilize industrial grade phosphoric acid. Industrial grade phosphoric acid features a lower proportion of contaminants and less than 85% phosphorus pentoxide than reagent grade phosphoric acid.

By Concentration Insights

The 75% concentration segment is witnessing the highest growth rate over the forecast period.

Based on the concentration, the global phosphoric acid market is segmented into 75%, 85%, and 92%. Among them, the 75% concentration segment is expected to develop at a faster rate over the projected period. This expansion is due to the product's broad use in food and beverages as an etching, sanitizing, chelating, and flavoring agent, pH adjuster, and rust inhibitor. Phosphoric acid 75% continues to increase in popularity in a variety of industrial applications such as detergents and fertilizers. The increase in government investment in agriculture is also expected to increase phosphoric acid output by 75%, particularly in emerging markets.

By Application Insights

The fertilizers segment is dominating the market with the largest revenue share over the forecast period.

On the basis of application, the global phosphoric acid market is segmented into the fertilizers, feed & food additives, catalyst, water treatment chemicals, metal treatment, cleaning & sanitizing agent, industrial use, animal feed, and others. Among these, the fertilizers segment is dominating the market with the largest revenue share of 75.0% over the forecast period. The increasing worldwide population and higher consumption of fertilizers to meet growing demands for food are driving the market for phosphoric acid in the fertilizers segment. Fertilizers are chemical substances that mostly contain nitrogen, phosphorus, and potassium. They are essential for plant and agricultural growth and development. Phosphoric acid is used to make fertilizers such as Monoammonium Phosphate (MAP), Diammonium Phosphate (DAP), and Trisodium Phosphate (TSP).

By Industry Verticals Insights

The agriculture segment accounted for the largest revenue share of more than 59.2% over the forecast period.

On the basis of industry verticals, the global phosphoric acid market is segmented into agriculture, energy, industrial cleaning, general industrial, construction, water treatment, food & beverage, and others. Among these, the agriculture segment is dominating the market with the largest revenue share of 59.2% over the forecast period. Agriculture is one of the largest sectors in the world, which is also a net food exporter. Agriculture is practiced in all developing and developed nations, ranging from small-scale producers to large-scale agricultural enterprises. Farmers' increasing preference for maize production is projected to increase the requirement for phosphatic fertilizers and, as a result, phosphoric acid globally. The fast development in food production worldwide, as well as economic advancement in developing countries, has increased the demand for phosphoric acid for fertilizers. As a result, the worldwide manufacturing and national consumption of phosphoric acid have increased in the global phosphoric acid market. Additionally, increased agricultural activity and expanding fertilizer exports are predicted to have an advantageous effect on production. Furthermore, rising agricultural activity and favorable government policies in Asia Pacific, Latin America, the Middle East, and Africa have boosted both demand and production.

Regional Insights

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the market with more than 53.7% market share over the forecast period. This dominance can be attributed to the region's tremendous demand for processed food and the significant number of key fertilizer producers. At present, Asia Pacific leads the agriculture sector and consumes the most fertilizer. This is mostly due to the accessibility of rich areas, a significant population, favorable weather, and huge exports from emerging countries. The increased fertilizer use in China, India, and Indonesia fuels the expansion of the phosphoric acid market. Rising demand for processed foods in emerging markets such as India and China also contribute to industry expansion. Due to substantial phosphate mineral deposits in China, which also makes it a key producer, the region is expected to maintain its dominant position during the anticipated years. The nation also produces a lot of phosphate fertilizer and yellow phosphorus. On the contrary, the chemical industry is expected to develop significantly in India, both in terms of manufacturing and consumer demand. Aditya Birla Grasun Chemicals Limited (ABGCL) is the world's largest producer of food-grade phosphoric acid, which is mostly produced through the thermal process.

North America, on the contrary, is expected to grow the fastest during the forecast period. The market's expansion can be attributable mostly to rising phosphoric acid demand from the food, beverage, and pharmaceutical industries. Increased use of this acid as food additives and animal feed would boost demand in the region. Furthermore, severe government phosphoric acid regulations in North America are stimulating the industry.

The Europe market is expected to register a substantial CAGR growth rate during the forecast period. The expansion of the market may be ascribed mostly to rising phosphoric acid demand in the pharmaceutical industry, as well as rising demand from fertilizer producers. In addition, the European phosphate market is rising as a result of stringent regulatory regulations. Furthermore, the Middle East region is the leader in Phosphoric Acid production. The quantity of mineral phosphorous in this region is the primary source of the large production of Phosphoric Acid.

List of Key Market Players

- Arkema

- Eurochem Group AG

- OCP Group S.A.

- Phosagro Group of Companies

- ICL Group Ltd.

- Nutrien Ltd.

- IFFCO

- The Mosaic Company

- Solvay S.A.

- OCP

- PhosAgro

- ArrMaz Products, Inc.

- Chuanlin Chemical

- Nutrien

- Haifa Group

- Aditya Birla Chemicals

- Hydrite Chemical Co.

- Chuandong Chemical Co., Ltd.

- LANXESS

Key Market Developments

- On April 2023, LiqTech International, Inc., a clean technology company that manufactures and markets highly specialized filtration products and systems, and Silicon Filter, a China-based company focused on chemical application technologies, have entered into a distribution agreement to supply LiqTech's advanced filtration systems for phosphoric acid purification in China. Silicon Filter specializes in commercializing industrial technology for process design and operations optimization into diverse chemical industry production processes.

- On May 2023, Jordan Phosphate Mines Company (JPMC) and Transpet, a Turkish business, struck a deal to jointly develop a phosphoric acid factory with a production capacity of 165,000 tonnes per year in the Sheidiya district of Maan Governorate.

- On November 2022, Pengyue Eco-technology, a subsidiary of Guizhou Chanhen Chemical Corporation, has started up its new phosphoric acid facility. The project's overall design capacity is approximately 400 000 t P2O5 per year. Merchant grade phosphoric acid (MGA, P2O552%), refined phosphoric acid, feed grade phosphate, anhydrous hydrogen fluoride, and other products are available. The company just completed the final valuation procedure after successfully participating in the BCIC tender for phosphoric acid. Guizhou Chanhen has also established business partnerships with significant MGA clients, including those from India.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Phosphoric Acid Market based on the below-mentioned segments:

Phosphoric Acid Market, Process Type Analysis

- Wet

- Thermal

Phosphoric Acid Market, Grade Analysis

- Technical

- Industrial

Phosphoric Acid Market, Concentration Analysis

- 75%

- 85%

- 92%

Phosphoric Acid Market, Application Analysis

- Fertilizers

- Feed & Food Additives

- Catalyst

- Water Treatment Chemicals

- Metal Treatment

- Cleaning & Sanitizing Agent

- Industrial Use

- Animal Feed

- Others

Phosphoric Acid Market, Industry Verticals Analysis

- Agriculture

- Energy

- Industrial Cleaning

- General Industrial

- Construction

- Water Treatment

- Food & Beverage

- Others

Phosphoric Acid Market, Sales Channel Analysis

- Direct Sale

- Indirect Sale

Phosphoric Acid Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the Phosphoric Acid market?The Global Phosphoric Acid Market is expected to grow from USD 50.46 billion in 2022 to USD 83.246 billion by 2032, at a CAGR of 5.13% during the forecast period 2022-2032.

-

Which are the key companies in the market?Arkema, Eurochem Group AG, OCP Group S.A., Phosagro Group of Companies, ICL Group Ltd., Nutrien Ltd., IFFCO, The Mosaic Company, Solvay S.A., OCP, and PhosAgro

-

Which segment dominated the Phosphoric Acid market share?The agriculture segment in the industrial vertical type dominated the Phosphoric Acid market in 2022 and accounted for a revenue share of over 59.2%.

-

What are the elements driving the growth of the Phosphoric Acid market?Some of the primary drivers driving market expansion include increased phosphate fertilizer output, government laws and regulations, environmental concerns, and a shrinking phosphate supply.

-

Which region is dominating the Phosphoric Acid market?Asia Pacific is dominating the Phosphoric Acid market with more than 53.7% market share.

-

Which segment holds the largest market share of the Phosphoric Acid market?The wet process segment based on process type holds the maximum market share of the Phosphoric Acid market.

Need help to buy this report?