Global Phosphine Gas Market Size, Share, and COVID-19 Impact Analysis, By Form (Gas, Liquid, and Solid), By Grade (Electronic, Technical, Industrial, and Others), By Application (Agriculture, Metal Phosphide Manufacturing, Chemical Synthesis, Semiconductor Industry, and Phosphine fumigation) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Phosphine Gas Market Insights Forecasts to 2035

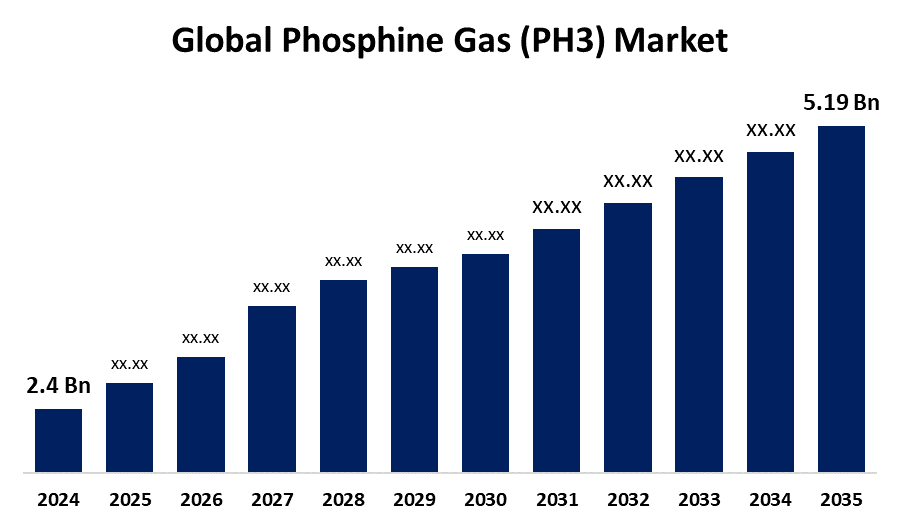

- The Global Phosphine Gas Market Size Was Estimated at USD 2.4 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.26% from 2025 to 2035

- The Worldwide Phosphine Gas Market Size is Expected to Reach USD 5.19 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Phosphine Gas Market Size was worth around USD 2.4 Billion in 2024 and is predicted to Grow to around USD 5.19 Billion by 2035 with a compound annual growth rate (CAGR) of 7.26% from 2025 to 2035. The market for phosphine gas is growing due to its increasing use as a fumigant in agriculture, expanding applications in electronics production, its effectiveness in controlling pests, and improvements in safe handling methods that enhance usability and efficiency.

Market Overview

The global phosphine gas market refers to the global commerce and use of phosphine, a poisonous, colourless gas that is commonly employed as a fumigant in crops and a reducing agent in electronics production. The widespread usage of phosphine gas as a fumigant in grain storage and insect management is what propels the global market for this gas. The U.S. Department of Agriculture reports that the need for phosphine in fumigation has been rising continuously, which is indicative of its vital function in safeguarding grains that have been stored. The necessity for efficient pest management and advancements in safer fumigation techniques sustain market expansion while advancing sustainability. Beyond the field of agriculture, phosphine finds extensive use in the chemical industry as a reducing agent and in the synthesis of metals and phosphides. Another significant driver is the electronics and semiconductor sector, which uses phosphine in the production of thin-film technologies, solar cells, and transistors.

The market for semiconductor phosphine gas was estimated to be worth USD 78 million in 2024, indicating a rise in the need for sophisticated microelectronics. Phosphine's significance across numerous industries is further supported by promising growth prospects presented by emerging uses in lithium batteries, renewable energy, and microelectronics. Phosphine gas has been growing increasingly common in agriculture due to government initiatives. As one instance, the U.S. EPA has made available safety regulations regarding grain fumigation that will protect both employees and consumers. Additionally, international agencies focusing on effective pest management to protect grain reserves, like the FAO and IPPC, recognize the role phosphine gas plays in making sure we are all fed. These regulations and recommendations will provide effective pest management and food security by enabling the relatively safer use of phosphine gas, especially in major agricultural countries like the United States, India, and Brazil.

Report Coverage

This research report categorizes the phosphine gas market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the phosphine gas market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the phosphine gas market.

Global Phosphine Gas (PH3) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.4 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.26% |

| 2035 Value Projection: | USD 5.19 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 175 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Form, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Air Products and Chemicals, Inc., BASF SE, The Linde Group, Nippon Chemical Industrial Co., Ltd., Solvay S.A., Praxair Technology, Inc., Taiyo Nippon Sanso Corporation, Air Liquide S.A., Mitsui Chemicals, Inc., Showa Denko K.K., Arkema S.A., Honeywell International Inc., Evonik Industries AG, Merck KGaA, Sumitomo Chemical Co., Ltd., American Elements, BOC Group Limited, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for phosphine gas is mostly driven by its vital function in fumigating grains and other goods that have been kept, which successfully controls pests without leaving any hazardous leftovers. The market is expanding due to the rising need for agricultural fumigation, particularly in the storage and transportation of grains. Further growth potential is also created by growing applications in semiconductors, electronics, metal production, and chemical manufacturing, as well as research into renewable energy and other purposes. Phosphine's efficiency, dependability, and use across a variety of industries globally are improved by technological developments in microelectronics and safer fumigation techniques.

Restraining Factors

The industry of phosphine gas has challenges in relation to high toxicity and ensuring safety requirements to protect against serious health risks. Production costs can be affected by fluctuations in raw materials, especially white phosphorus. There is a lack of balance between increasing demand and safety and compliance standards because of the risk of environmental pollution and serious regulations that complicate production and distribution.

Market Segmentation

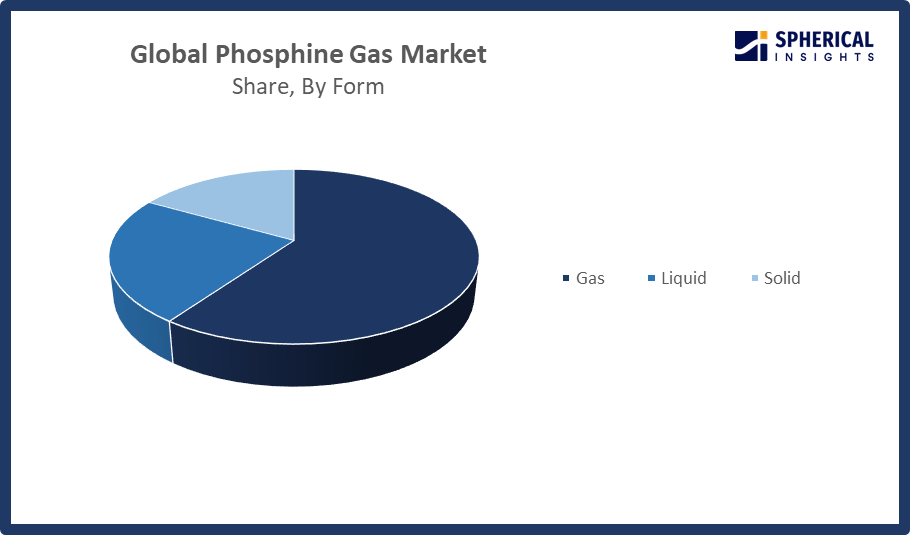

The phosphine gas market share is classified into form, grade and application.

- The gas segment dominated the market in 2024, approximately 66% and is projected to grow at a substantial CAGR during the forecast period.

Based on the form, the phosphine gas market is divided into gas, liquid, and solid. Among these, the gas segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The market is dominated by the gaseous phosphine segment because of its widespread commercial use, especially in the production of electronics and the fumigation of stored grains. It's the best option because it diffuses readily, penetrates bulk items, and effectively and residue-free controls pests. High-purity gas is also necessary for applications in semiconductors and microelectronics, which propels its market dominance.

Get more details on this report -

- The electronic segment accounted for the largest share in 2024, approximately 52% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the grade, the phosphine gas market is divided into electronic, technical, industrial, and others. Among these, the electronic segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This grade is widely prized for its extraordinary purity, which makes it necessary for high-precision applications in sectors such as advanced electronics and semiconductor production. Electronic-grade phosphine gas has been used more frequently as the need for more compact, powerful electronics keeps growing, especially in areas like Asia-Pacific and North America, where tech businesses are heavily represented. Increasingly, this high-purity gas is being used in the manufacturing of integrated circuits and microchips due to the growing trend of electronics miniaturization and advancements in semiconductor technology.

- The agriculture segment accounted for the highest market revenue in 2024, approximately 70% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the phosphine gas market is divided into agriculture, metal phosphide manufacturing, chemical synthesis, semiconductor industry, and phosphine fumigation. Among these, the agriculture segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Grain fumigation treatments around the world rely on phosphine, underscoring its vital role in safeguarding food supplies, guaranteeing pest control, and preserving the quality and longevity of agricultural commodities globally. For this reason, the agriculture segment generates the highest revenue in the phosphine gas market.

Regional Segment Analysis of the Phosphine Gas Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the phosphine gas market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the phosphine gas market over the predicted timeframe. The high demand for grain storage and fumigation in significant agricultural countries, such as China, Japan, and India, is driving the rapid growth of the phosphine gas market in the Asia-Pacific region. The region's considerable agricultural industry, large population, and increasing post-harvest protection demands will all support market growth. Moreover, demand for high-purity phosphine will also be bolstered by the burgeoning electronics and semiconductor industries in the region, further enhancing the Asia-Pacific region's share of the global market.

North America is expected to grow at a rapid CAGR in the phosphine gas market during the forecast period. Phosphine gas is frequently utilised for grain fumigation in this region's well-established food and agricultural businesses, which contribute to its strong market position. As North America continues to prioritise enhancing food security and reducing post-harvest losses, there will likely be an increase in demand for premium food storage solutions and pest management. The market potential for phosphine gas in this area is further enhanced by the existence of significant agricultural producers, particularly in the United States and Canada.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the phosphine gas market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Air Products and Chemicals, Inc.

- BASF SE

- The Linde Group

- Nippon Chemical Industrial Co., Ltd.

- Solvay S.A.

- Praxair Technology, Inc.

- Taiyo Nippon Sanso Corporation

- Air Liquide S.A.

- Mitsui Chemicals, Inc.

- Showa Denko K.K.

- Arkema S.A.

- Honeywell International Inc.

- Evonik Industries AG

- Merck KGaA

- Sumitomo Chemical Co., Ltd.

- American Elements

- BOC Group Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2024, Degesch America, Inc., a leading innovator in fumigation and pest control solutions, introduced U Phos Phosphine Fumigant to the U.S. market. The product offers a cost-effective and reliable fumigation solution, mixed with CO2 or forced air via specialized equipment to create a non-flammable mixture, ensuring safe and efficient pest control for stored grains and commodities.

- In January 2024, WatchGas announced the addition of phosphine (PH3) as a target gas in its SST1 sensor line, enhancing detection capabilities. This expansion allows for more precise monitoring of phosphine in agriculture, electronics, and industrial applications, strengthening safety and compliance measures across multiple sectors.

- In October 2018, ECO2Fume and VaporPH3os were introduced as cylinderized and diluted phosphine formulations, providing safer alternatives to raw phosphine gas. These products reduce handling risks while maintaining effectiveness for fumigation, making them ideal for agriculture and industrial applications requiring controlled and secure phosphine use.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the phosphine gas market based on the below-mentioned segments:

Global Phosphine Gas Market, By Form

- Gas

- Liquid

- Solid

Global Phosphine Gas Market, By Grade

- Electronic

- Technical

- Industrial

- Others

Global Phosphine Gas Market, By Application

- Agriculture

- Metal Phosphide Manufacturing

- Chemical Synthesis

- Semiconductor Industry

- Phosphine fumigation

Global Phosphine Gas Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Phosphine Gas market over the forecast period?The global Phosphine Gas market is projected to expand at a CAGR of 7.26% during the forecast period.

-

2. What is the market size of the Phosphine Gas market?The global Phosphine Gas market size is expected to grow from USD 2.4 Billion in 2024 to USD 5.19 Billion by 2035, at a CAGR of 7.26% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Phosphine Gas market?Asia Pacific is anticipated to hold the largest share of the Phosphine Gas market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global Phosphine Gas market?Air Products and Chemicals, Inc., BASF SE, The Linde Group, Nippon Chemical Industrial Co., Ltd., Solvay S.A., Praxair Technology, Inc., Taiyo Nippon Sanso Corporation, Air Liquide S.A., Mitsui Chemicals, Inc., and Showa Denko K.K., and Others.

-

5. What factors are driving the growth of the Phosphine Gas market?The need for agricultural fumigation, crop protection, growing electronics and semiconductor applications, use as a reducing agent in the chemical and metal sectors, and new prospects in sophisticated technologies and renewable energy are the main factors propelling the phosphine gas market.

-

6. What are the market trends in the Phosphine Gas market?A dynamic, innovation-driven global market is reflected in the phosphine gas market trends, which include growing demand for agricultural fumigation, expanding applications in electronics and semiconductors, improvements in gas purification and handling technologies, and rising regulatory and environmental compliance requirements.

-

7. What are the main challenges restricting wider adoption of the Phosphine Gas market?Phosphine gas's high toxicity, stringent safety rules, potential for environmental pollution, and fluctuating raw material prices are the primary obstacles preventing its extensive market use and complicating production.

Need help to buy this report?