Global Pharmaceutical Grade Lactose Market Size, Share, and COVID-19 Impact Analysis, By Type (Crystalline Monohydrate Lactose, Granulated Lactose, Spray Dried Lactose, and Inhalation Grade Lactose), By Application (Tablet Manufacturing, Capsule Manufacturing, Dry Powder Inhalers (DPIs), and Parenteral & Lyophilized Formulations), By End-User (Pharmaceutical Companies, Contract Development & Manufacturing Organizations, Nutraceutical Manufacturers, and Research & Academic Institutions), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsThe tablet manufacturing segment accounted for the largest share in 2024, approximately Global Insights Forecasts to 2035

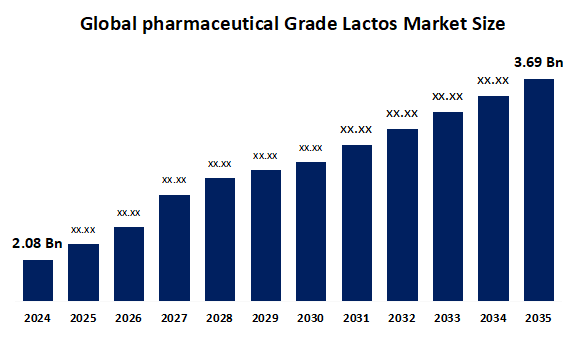

- The Global Pharmaceutical Grade Lactose Market Size Was Estimated at USD 2.08 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.35% from 2025 to 2035

- The Worldwide Pharmaceutical Grade Lactose Market Size is Expected to Reach USD 3.69 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Pharmaceutical Grade Lactose Market Size Was Worth Around USD 2.08 Billion In 2024 And Is Predicted To Grow To Around USD 3.69 Billion By 2035 With A Compound Annual Growth Rate (CAGR) of 5.35% from 2025 to 2035. The Market For Pharmaceutical Grade Lactose is expanding due to the rising manufacture of solid dosage forms (such as tablets and capsules), increasing need for generic medications and strict quality standards that support the use of high-purity, uniform excipients. Progress in drug delivery methods, including powder inhalers, additionally drives this growth.

Market Overview

The worldwide Pharmaceutical Grade Lactose Market Size refers to the manufacturing and distribution of pure lactose, mainly utilized as an excipient in drug formulations. It is commonly used as a filler, binder and carrier in tablets, capsules and oral suspensions because of its stability, solubility and inert characteristics. The market growth is propelled by the growing sector, increasing incidence of chronic illnesses, and the expanding elderly population, all of which enhance the demand for oral solid dosage forms. Furthermore, the rising consumer demand for excipients that are high-quality and purity-compliant, alongside progress in lactose processing techniques, is driving expansion.

In May 2025, the Biden administration issued an executive order directing the FDA to streamline regulations for domestic production of APIs, excipients, and key materials. The initiative aims to reduce capacity-building delays, incentivise facility repurposing, and potentially boost U.S. pharmaceutical-grade lactose production by 10-15% through faster approvals. There are prospects in the growing application of lactose within nutraceuticals, functional foods and novel drug delivery methods. Leading companies such as DairyChem, Fonterra Co-operative Group, DMV International, Ingredion Incorporated and Meggle Group emphasize growth, product development and adherence to strict regulatory requirements to enhance their worldwide footprint and satisfy increasing demand in the pharmaceutical and healthcare sectors.

Report Coverage

This research report categorizes The Pharmaceutical Grade Lactose Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the pharmaceutical grade lactose market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the pharmaceutical grade lactose market.

Global Pharmaceutical Grade Lactose Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.08 billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.35% |

| 2035 Value Projection: | USD 3.69 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | DFE Pharma, ARMOR PROTEINES, Kerry Group plc, MEGGLE GmbH & Co. KG, FrieslandCampina, DMV International, Fonterra Co-operative Group, BASF Corporation, Charotar Casein Company, Alpavit, Ingredion Incorporated, DairyChem, Surfachem Group Ltd., Fengchen Group Co., Ltd., Others, and players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The worldwide market for Pharmaceutical Grade Lactose is chiefly propelled by sector growth and the increasing demand for solid dosage forms such as tablets and capsules, where lactose is commonly used as an excipient. The rising occurrence of diseases and an expanding elderly population globally are driving production, thus enhancing usage. Moreover, the heightened emphasis on excipients that meet quality and purity standards for drug formulation also aids the market’s expansion. Progress in processing techniques, the rise in over-the-counter drug usage and the addition of lactose in nutraceuticals and functional foods all drive demand, thereby promoting market growth.

Restraining Factors

The Pharmaceutical Grade Lactose Market Size faces restraints from lactose intolerance concerns, which limit its use in certain populations. Additionally, the availability of alternative excipients like microcrystalline cellulose, high production costs, and stringent regulatory requirements for pharmaceutical-grade purity pose challenges, potentially slowing market growth and adoption.

Market Segmentation

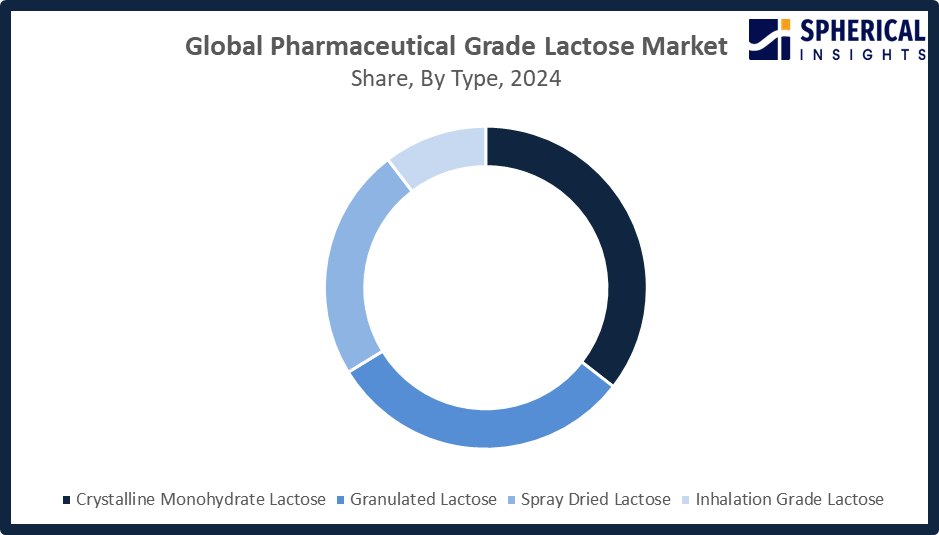

The pharmaceutical grade lactose market share is classified into type, application, and end-user.

- The crystalline monohydrate lactose segment dominated the market in 2024, approximately 35% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the Pharmaceutical Grade Lactose Market Size is divided into crystalline monohydrate lactose, granulated lactose, spray dried lactose, and inhalation grade lactose. Among these, the crystalline monohydrate lactose segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The market is dominated by the crystalline monohydrate lactose segment owing to its flow properties, outstanding compressibility and uniform particle dimensions, rendering it ideal for direct compression and tablet production. Its stability, minimal moisture absorption and robust compatibility with APIs contribute to its application in solid oral dosage formulations. Adherence to pharmacopeial criteria additionally enhances its favorability, among pharmaceutical producers.

Get more details on this report -

- 48% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the Pharmaceutical rade Lactose Market Size is divided into tablet manufacturing, capsule manufacturing, dry powder inhalers (DPIs), and parenteral & lyophilized formulations. Among these, the tablet manufacturing segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The tablet manufacturing growth is owing to the widespread worldwide dependence on tablets as the most prevalent and economical form of medication. Pharmaceutical-grade lactose is highly favored in tablet compositions because of its compressibility, flow characteristics and adhesive qualities. Its suitability with a variety of APIs, combined with increasing demand for excipients suitable for large-scale manufacturing, additionally propels the segment's expansion.

- The pharmaceutical companies segment accounted for the highest market revenue in 2024, approximately 55% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-user, the Pharmaceutical Grade Lactose Market Size is divided into pharmaceutical companies, contract development & manufacturing organizations, nutraceutical manufacturers, and research & academic institutions. Among these, the pharmaceutical companies segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The pharmaceutical companies market growth is due to their large-scale production of tablets, capsules, and other oral solid dosage forms that heavily rely on pharmaceutical-grade lactose. Growing demand for generics, expanding manufacturing capacities, and adherence to stringent quality standards drive consistent lactose usage. Additionally, increased investment in formulation development and global drug commercialization further strengthens this segment’s dominance.

Regional Segment Analysis of the Pharmaceutical Grade Lactose Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the pharmaceutical grade lactose market over the predicted timeframe.

North America is anticipated to hold the largest share of the Pharmaceutical Grade Lactose Market Size over the predicted timeframe. North America is expected to have a 38% market share of the pharmaceutical grade lactose market owing to its developed pharmaceutical manufacturing infrastructure, high demand for solid oral dosage forms, and stringent regulatory requirements that promote the use of high-purity excipients. The United States spearheads the region, propelled by large-scale tablet and generic drug manufacturing, innovative R&D expertise and ongoing investments in drug formulation technologies. Canada also plays a role in expanding pharmaceutical outsourcing activities and compliance with international quality standards. Broad acceptance of premium excipients and growth of production plants further strengthen North America’s leading market status.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR in the Pharmaceutical Grade Lactose Market Size during the forecast period. The pharmaceutical-grade lactose market in the Asia Pacific is expected to have a 22% market share, driven by the expansion of pharmaceutical production, increased healthcare expenditures and a surge in demand for generic drugs. India and China are at the forefront of this growth due to manufacturing capabilities, enhanced regulatory frameworks and export growth, whereas Japan and South Korea play key roles through sophisticated formulation technologies. The rising use of premium excipients has heightened research and development funding and government backing, further reinforcing the market in the APAC region. In May 2025, a location in Gujarat, India obtained EXCiPACT GMP and GDP certification, guaranteeing adherence, traceability and dependable international supply.

The European market for pharmaceutical-grade lactose is steadily expanding as a result of regulations, superior manufacturing quality and robust demand for solid oral dosage forms. Germany, the UK and France are at the forefront, bolstered by established pharmaceutical sectors and compliance with pharmacopeial standards. In April 2025, Europe highlighted the importance of sovereignty in response to supply chain interruptions with Lactalis Ingredients Pharma manufacturing lactose domestically to guarantee a stable supply, boost autonomy and reduce risks, strengthening the continent's commitment to secure and sustainable sourcing of pharmaceutical ingredients.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the pharmaceutical grade lactose market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DFE Pharma

- ARMOR PROTEINES

- Kerry Group plc

- MEGGLE GmbH & Co. KG

- FrieslandCampina

- DMV International

- Fonterra Co-operative Group

- BASF Corporation

- Charotar Casein Company

- Alpavit

- Ingredion Incorporated

- DairyChem

- Surfachem Group Ltd.

- Fengchen Group Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2025, LBB Specialties partnered with Kerry Group to become its preferred U.S. distributor, expanding access to Kerry’s Sheffield pharmaceutical lactose. The collaboration provides formulators with high-quality lactose excipients in diverse forms, grades, and particle sizes, supporting optimized solutions for various pharmaceutical applications across North America.

- In March 2025, FrieslandCampina Ingredients launched Nutri Whey ProHeat, a heat-stable whey protein designed for performance and active nutrition products. Utilizing microparticulation technology, it overcomes formulation challenges like viscosity, enabling brands to deliver whey’s health benefits in trending formats such as ready-to-drink beverages efficiently

- In November 2024, Kerry Group acquired LactoSens technology from DirectSens, enhancing its lactase enzyme offerings. The acquisition leverages DirectSens’ advanced biosensor expertise, integrating LactoSens with Kerry’s ingredient solutions to provide food manufacturers with a comprehensive, analytical tool for verifying lactose content and improving product development efficiency

- In October 2023, Lactalis Ingredients Pharma launched Lactalpha, a range of milled and sieved lactose monohydrate. Compliant with Ph. Eur., USP-NF, and JP standards, Lactalpha supports manufacturers in formulating oral solid dose medicines with versatile particle size options.

- In July 2022, DFE Pharma expanded its Dry Powder Inhalation (DPI) portfolio with Lactohale 400, enhancing its inhalation-grade lactose range. The new grade is customizable for pharmaceutical companies, allowing joint development with formulators to achieve precise outcomes, strengthening DFE Pharma’s position in high-quality excipients for patient-centric applications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the pharmaceutical grade lactose market based on the below-mentioned segments:

Global Pharmaceutical Grade Lactose Market, By Type

- Crystalline Monohydrate Lactose

- Granulated Lactose

- Spray Dried Lactose

- Inhalation Grade Lactos

Global Pharmaceutical Grade Lactose Market, By Application

- Tablet Manufacturing

- Capsule Manufacturing

- Dry Powder Inhalers (DPIs)

- Parenteral & Lyophilized Formulations

Global Pharmaceutical Grade Lactose Market, By End-User

- Pharmaceutical Companies

- Contract Development & Manufacturing Organizations

- Nutraceutical Manufacturers

- Research & Academic Institutions

Global Pharmaceutical Grade Lactose Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the pharmaceutical grade lactose market over the forecast period?The global pharmaceutical grade lactose market is projected to expand at a CAGR of 5.35% during the forecast period.

-

2. What is the market size of the pharmaceutical grade lactose market?The global pharmaceutical grade lactose market size is expected to grow from USD 2.08 billion in 2024 to USD 3.69 billion by 2035, at a CAGR of 5.35% during the forecast period 2025-2035.

-

3. What is the pharmaceutical grade lactose market?The pharmaceutical grade lactose market is a global market for high-purity lactose used as an excipient in medicines, primarily as a filler or binder in tablets and capsules

-

4. Which region holds the largest share of the pharmaceutical grade lactose market?North America is anticipated to hold the largest share of the pharmaceutical grade lactose market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global pharmaceutical grade lactose market?DFE Pharma, ARMOR PROTEINES, Kerry Group plc, MEGGLE GmbH & Co. KG, FrieslandCampina, DMV International, Fonterra Co-operative Group, BASF Corporation, Charotar Casein Company, Alpavit, and Others.

-

6. What factors are driving the growth of the pharmaceutical grade lactose market?Growth in the pharmaceutical grade lactose market is driven by increasing healthcare spending, the rise of generic and solid oral drug formulations, advancements in drug delivery methods like direct compression and dry powder inhalers, and a growing demand for infant formula

-

7. What are the market trends in the pharmaceutical grade lactose marketKey trends in the pharmaceutical grade lactose market include the increasing demand for orally disintegrating tablets (ODTs) and generic drugs, a rise in inhalation therapy applications, and advancements in processing technologies to improve product quality and consistency.

-

8. What are the main challenges restricting wider adoption of the pharmaceutical grade lactose market?The main challenges restricting the wider adoption of the pharmaceutical grade lactose market involve public health concerns like lactose intolerance, complex and stringent regulatory demands, supply chain vulnerabilities in the dairy industry, and competition from alternative excipients

Need help to buy this report?