Global Pharmaceutical Cleaning Validation Market Size, Share, and COVID-19 Impact Analysis, By Product (Small molecule drug, Peptides, Proteins, and Cleaning detergent), By Test (Non-Specific Tests and Product-Specific Analytical Tests), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Pharmaceutical Cleaning Validation Market Insights Forecasts to 2035

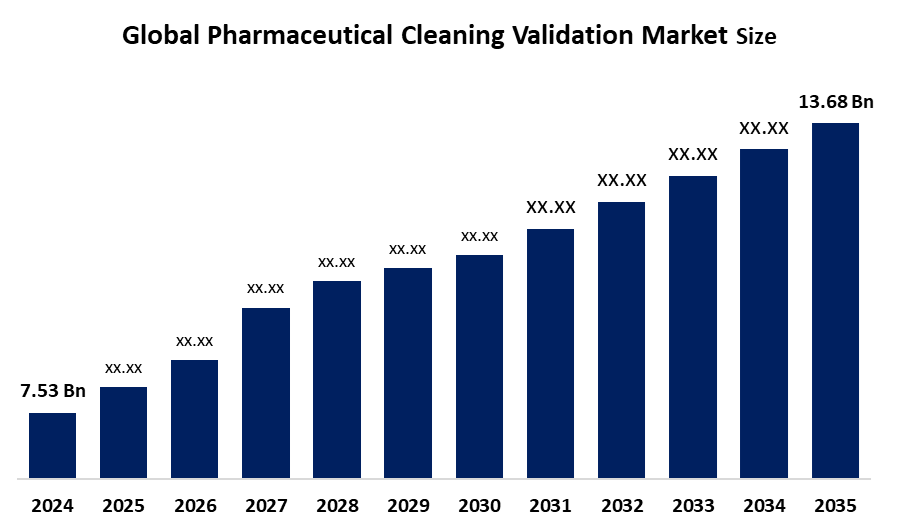

- The Global Pharmaceutical Cleaning Validation Market Size Was Estimated at USD 7.53 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.58 % from 2025 to 2035

- The Worldwide Pharmaceutical Cleaning Validation Market Size is Expected to Reach USD 13.68 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The global pharmaceutical cleaning validation market size was worth around USD 7.53 Billion in 2024 and is predicted to Grow to around USD 13.68 Billion by 2035 with a compound annual growth rate (CAGR) of 5.58% from 2025 to 2035. Future opportunities in the pharmaceutical cleaning validation market include AI-driven automation, real-time monitoring technologies, stricter regulatory compliance, expansion in biologics production, demand for continuous manufacturing, and growth in emerging markets.

Market Overview

The pharmaceutical cleaning validation market refers to processes, services, and technologies used to ensure manufacturing equipment is consistently cleaned to predefined standards, preventing cross-contamination and ensuring product safety and regulatory compliance. Market growth is driven by the rising number of drug manufacturing facilities, increasing production of generics and biologics, and stringent regulations from authorities such as the U.S. Food and Drug Administration and European Medicines Agency. Over 60% of regulatory inspections highlight cleaning and contamination control as critical compliance areas, encouraging adoption of validated cleaning processes. Government initiatives, including Good Manufacturing Practices (GMP) enforcement, pharmaceutical quality reforms, and incentives for domestic drug manufacturing in countries like India and China, further support demand. Increased focus on patient safety and audit readiness continues to strengthen market expansion.

Report Coverage

This research report categorizes the pharmaceutical cleaning validation market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the pharmaceutical cleaning validation market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the pharmaceutical cleaning validation market.

Global Pharmaceutical Cleaning Validation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 13.68 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.58% |

| 2035 Value Projection: | USD 7.53 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product |

| Companies covered:: | Kymos Pharma Services, ProPharma Group, QPharma, Lucideon, Avomeen Analytical Services, Teledyne Technologies Inc, Intertek Group PLC, SGS AG, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growth of the pharmaceutical cleaning validation market is driven by strict regulatory requirements for contamination control and patient safety. Rising production of generic drugs, biologics, and complex formulations increases the need for validated cleaning processes. Expansion of pharmaceutical manufacturing facilities, frequent regulatory audits, and emphasis on Good Manufacturing Practices further support demand. Additionally, growing outsourcing to contract manufacturing organizations and adoption of automated and data-driven validation methods are accelerating market growth globally.

Restraining Factors

High implementation costs, complex validation procedures, limited skilled professionals, time-consuming documentation, and frequent regulatory updates restrict faster adoption of pharmaceutical cleaning validation solutions.

Market Segmentation

The pharmaceutical cleaning validation market share is classified into product and test.

- The small molecule drug segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product, the pharmaceutical cleaning validation market is divided into small molecule drug, peptides, proteins, and cleaning detergent. Among these, the small molecule drug segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The small molecule drug segment leads due to its large-scale production, high batch volumes, and frequent product changeovers in pharmaceutical facilities. These drugs involve complex chemical processes, increasing contamination risks and necessitating rigorous, repeated cleaning validation. Additionally, strong demand for generic medicines, stringent regulatory scrutiny, and widespread use across therapeutic areas support sustained growth and a significant CAGR for this segment.

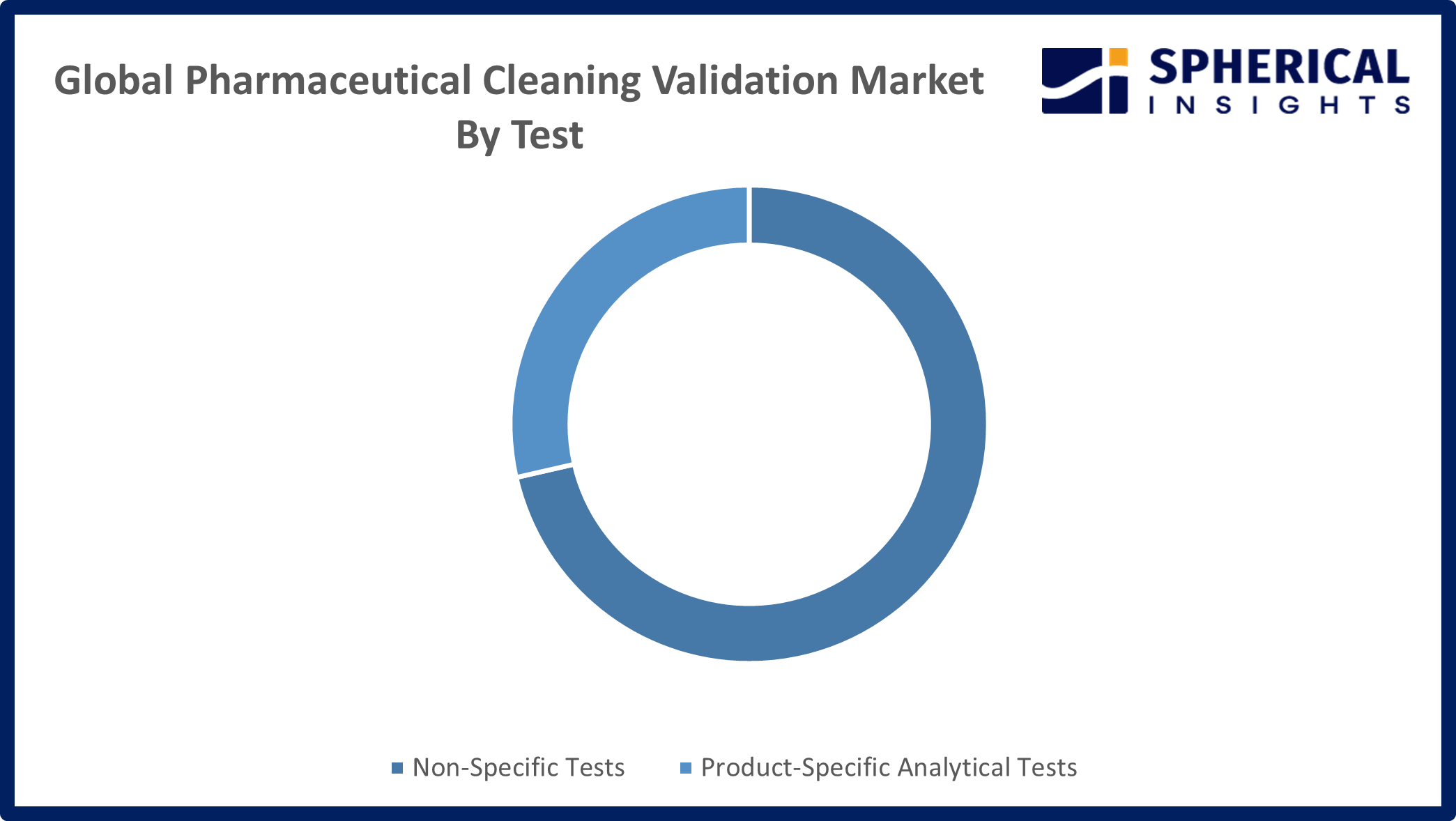

- The product-specific analytical tests segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the test, the pharmaceutical cleaning validation market is divided into non-specific tests and product-specific analytical tests. Among these, the product-specific analytical tests segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is due to the strong preference among pharmaceutical manufacturers for advanced, precise testing methods such as high-performance liquid chromatography (HPLC) and UV spectroscopy that reliably detect specific drug residues and contaminants, making them essential for stringent cleaning validation compliance.

Get more details on this report -

Regional Segment Analysis of the Pharmaceutical Cleaning Validation Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the pharmaceutical cleaning validation market over the predicted timeframe.

North America is anticipated to hold the largest share of the pharmaceutical cleaning validation market over the predicted timeframe. Due to its well-established pharmaceutical industry, stringent regulatory frameworks enforced by agencies like the FDA, and high adoption of advanced cleaning validation technologies across manufacturing facilities. These factors together sustain strong regional demand and leadership.

Asia Pacific is expected to grow at a rapid CAGR in the pharmaceutical cleaning validation market during the forecast period. Asia Pacific is expected to grow rapidly due to expanding pharmaceutical manufacturing in India and China, rising generic and biologics production, increasing regulatory compliance requirements, growing outsourcing to contract manufacturers, and government initiatives promoting domestic drug manufacturing and quality standards.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the pharmaceutical cleaning validation market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kymos Pharma Services

- ProPharma Group

- QPharma

- Lucideon

- Avomeen Analytical Services

- Teledyne Technologies Inc

- Intertek Group PLC

- SGS AG

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2025, Tema Sinergie has launched ZEROC, a new automatic integrity verification system for Rapid Transfer Ports used in pharmaceutical isolators and RABS, enhancing contamination control and manufacturing safety with fast, reliable testing compatible across systems.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the pharmaceutical cleaning validation market based on the below-mentioned segments:

Global Pharmaceutical Cleaning Validation Market, By Product

- Small molecule drug

- Peptides

- Proteins

- Cleaning detergent

Global Pharmaceutical Cleaning Validation Market, By Test

- Non-Specific Tests

- Product-Specific Analytical Tests

Global Pharmaceutical Cleaning Validation Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the CAGR of the pharmaceutical cleaning validation market over the forecast period?The global pharmaceutical cleaning validation market is projected to expand at a CAGR of 5.58% during the forecast period.

-

What is the market size of the pharmaceutical cleaning validation market?The global pharmaceutical cleaning validation market size is expected to grow from USD 7.53 billion in 2024 to USD 13.68 billion by 2035, at a CAGR of 5.58 % during the forecast period 2025-2035

-

Which region holds the largest share of the pharmaceutical cleaning validation market?North America is anticipated to hold the largest share of the pharmaceutical cleaning validation market over the predicted timeframe.

-

Who are the top 10 companies operating in the global pharmaceutical cleaning validation market?Kymos Pharma Services, ProPharma Group, QPharma, Lucideon, Avomeen Analytical Services, Teledyne Technologies Inc, Intertek Group PLC, and SGS AG.

-

What factors are driving the growth of the pharmaceutical cleaning validation market?Strict regulatory standards, increasing pharmaceutical production, contamination risk reduction, quality assurance emphasis, advanced technologies adoption, and rising generics market drive pharmaceutical cleaning validation growth.

-

What are the market trends in the pharmaceutical cleaning validation market?Key trends in the pharmaceutical cleaning validation market include increased automation and digitalization, risk-based & single-use systems adoption, advanced analytics integration, stringent regulatory compliance focus, and outsourced validation services growth

-

What are the main challenges restricting the wider adoption of the pharmaceutical cleaning validation market?Key challenges restricting wider pharmaceutical cleaning validation adoption include high validation costs, complex procedures/equipment, stringent evolving regulations, cross-contamination risk management, and resource-intensive documentation/training demands.

Need help to buy this report?