Global Petroleum Resin Market Size, Share, and COVID-19 Impact Analysis, By Type (C5 Resins, C9 Resins, C5 and C9 Resins, and Hydrogenated Hydrocarbon Resins), By Application (Hot-melt Adhesives, Pressure-sensitive Adhesives, Rubber Compounding & Tires, Road-marking Paints & Industrial Coatings, and Printing Inks & Flexible Packaging Films), By End-Use (Building and Construction, Tire Industry, Personal Hygiene, Consumer Goods, Automotive, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Petroleum Resin Market Size Insights Forecasts to 2035

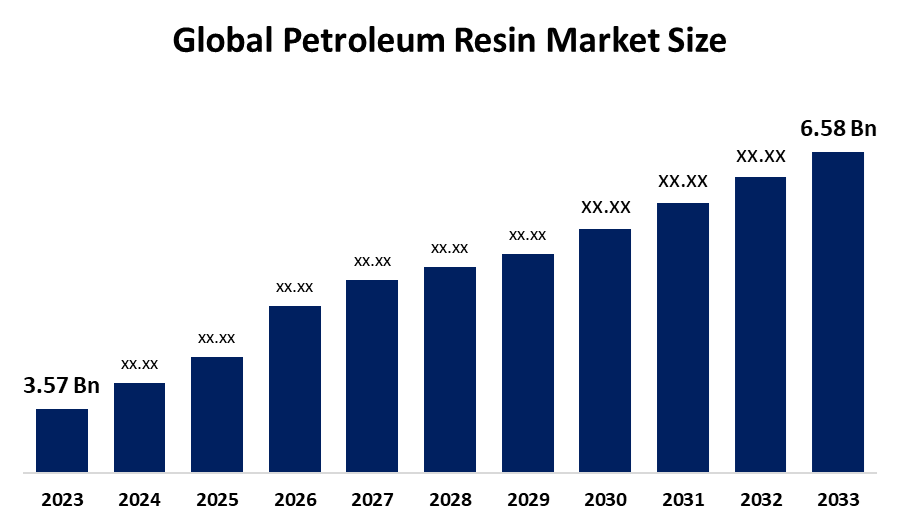

- The Global Petroleum Resin Market Size Was Estimated at USD 3.57 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.72% from 2025 to 2035

- The Worldwide Petroleum Resin Market Size is Expected to Reach USD 6.58 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Petroleum Resin Market Size was worth around USD 3.57 Billion in 2024 and is predicted to grow to around USD 6.58 Billion by 2035 with a compound annual growth rate (CAGR) of 5.72% from 2025 to 2035. The global petroleum resin market is expanding because of increasing requirements for adhesives, sealants and coatings, which the automotive and construction industries need. The main market drivers originate from increased infrastructure projects and urban expansion, and the transition toward materials that emit low volatile organic compounds while delivering high performance.

Market Overview

The Global Petroleum Resin Market Size consists of synthetic resins produced from hydrocarbon materials that petroleum refineries extract through C5 and C9 and DCPD fractionation processes. The resins serve multiple purposes in adhesives, sealants, paints, coatings, rubber compounding, printing inks and road-marking materials because they enhance tackiness and adhesion, compatibility and durability. The market experiences growth because the packaging, construction, automotive and tire industries need petroleum resins to improve their bonding strength and product performance. The market experiences increased demand because infrastructure development expands, and hot-melt and pressure-sensitive adhesive consumption rises.

On July 11, 2025, South Korea implemented five-year antidumping duties that target petroleum resin imports from Mainland China and Taiwan with rates between 2.26% to 18.52%. The final decision resulted from a year-long investigation that the Korea Trade Commission conducted. The high-softening-point C9 resins, which target customs code 3911.10.1000, become exempt from the regulations. The development of hydrogenated and low-VOC resins creates business opportunities while Asia-Pacific industrialization drives demand for hygiene products. Sustainability trends drive the development of high-performance products that meet environmental regulations. The main market players include ExxonMobil, Eastman Chemical Company, Kolon Industries, Arakawa Chemical Industries and TOTAL Cray Valley.

Petroleum Resin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.58 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.72% |

| 2035 Value Projection: | USD 6.58 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application |

| Companies covered:: | ExxonMobil Chemical Company, Kolon Industries, Inc., Eastman Chemical Company, TotalEnergies, Arakawa Chemical Industries, Zeon Corporation, Lesco Chemical Limited, Braskem, Cray Valley, Arkema S.A., Neville Chemical Company, Synthomer PLC, Idemitsu Kosan Co., Ltd., Puyang Tiancheng Chemical Co., Ltd., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Report Coverage

This research report categorizes the petroleum resin market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the petroleum resin market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the petroleum resin market.

Driving Factors

The global petroleum resin market exists because construction and automotive industries need high-performance adhesives, sealants and coatings. The Asian-Pacific region experiences packaging growth because urban areas and industrial centers develop their infrastructure. The product needs three essential features, which require better adhesive properties, thermal protection and long-lasting performance, according to customers who prefer low-VOC (volatile organic compound) solutions. Market expansion accelerates because the rubber and tire sector grows, and printing inks require more hydrogenated hydrocarbon resins, which now offer better color and compatibility through recent developments.

Restraining Factors

The global petroleum resin market operates under three main restrictions, which include fluctuating crude oil prices that impact naphtha feedstock costs, rigorous environmental regulations on VOC emissions and the increasing preference for sustainable bio-based materials. The manufacturers face two obstacles, which include insufficient access to essential raw materials and the high costs associated with meeting regulatory requirements.

Market Segmentation

The Petroleum Resin Market Size share is classified into type, application, and end-use.

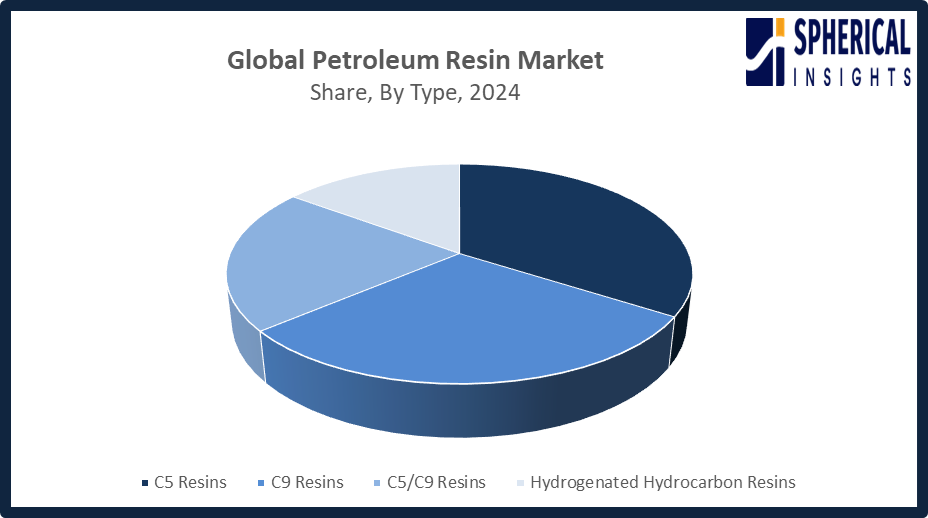

- The C5 resins segment dominated the market in 2024, approximately 34% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the petroleum resin market is divided into C5 resins, C9 resins, C5 and C9 resins, and hydrogenated hydrocarbon resins. Among these, the C5 resins segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. C5 resins, which come from aliphatic hydrocarbons present in pentene and isoprene, provide excellent tackifying capabilities for both adhesives and rubber compounding. The market stays stable because these products find application in tire manufacturing, road markings, and hot-melt adhesive production. The market will grow continuously because the packaging and construction industries expand while production capacity in the Asia-Pacific region continues to increase.

Get more details on this report -

- The hot-melt adhesives segment accounted for the largest share in 2024, approximately 38% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the petroleum resin market is divided into hot-melt adhesives, pressure-sensitive adhesives, rubber compounding & tires, road-marking paints & industrial coatings, and printing inks & flexible packaging films. Among these, the hot-melt adhesives segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Petroleum resins serve as tackifiers in hot-melt adhesives, which improve bonding strength, flexibility and heat resistance. Their fast-setting properties and strong adhesion suit packaging, woodworking, automotive, and construction uses. The flexible packaging market and furniture assembly sector maintain their growth, which leads to increased resin usage within this economical adhesive category that uses no solvents.

- The building and construction segment accounted for the highest market revenue in 2024, approximately 30% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use, the petroleum resin market is divided into building and construction, tire industry, personal hygiene, consumer goods, automotive, and others. Among these, the building and construction segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The use of petroleum resin in coatings and sealants, waterproofing membranes, and road markings drove market expansion because it improved adhesion, durability and weather resistance. The growing need for new buildings in developing countries created greater material requirements. The construction market will experience consistent growth because of the present urban development projects, government investment in roads and housing and the demand for affordable yet efficient materials.

Regional Segment Analysis of the Petroleum Resin Market Size

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the Petroleum Resin Market Size over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the petroleum resin market over the predicted timeframe. The petroleum resin market will see the Asia Pacific region as its 45% share market because industrial development and infrastructure expansion, adhesive and packaging and tire and construction sector development create high demand. China maintains its position as the leading country because of its extensive manufacturing operations and high tire production capabilities, while India fosters development through its increasing construction activities and road-building projects. Japan and South Korea develop their economies through their sophisticated automotive and electronics industries while they build their petrochemical production facilities. South Korea started its anti-dumping investigation against Chinese and Taiwanese hydrocarbon resin imports in August 2024 because it wanted to investigate whether low-cost shipments would harm domestic petroleum resin manufacturers.

North America is expected to grow at a rapid CAGR in the petroleum resin market during the forecast period. The petroleum resin market in North America will experience a 23% share of rapid growth because of increasing demand from the adhesive and construction, automotive and packaging industries. The United States leads with advanced manufacturing and infrastructure modernization while Canada supports growth through road construction and petrochemical investments. The demand for e-commerce packaging materials and sustainable adhesive alternatives continues to increase. The United States started its reciprocal and Section 301 tariff system in April 2025, which imposed 10 to 25% tariffs on resin imports, while some Chinese hydrocarbon resins faced duties that reached 50% because they promoted domestic manufacturing.

The petroleum resin market in Europe experiences growth because the automotive, packaging and construction industries need more sustainable high-performance adhesives. Germany leads the market because of its strong automotive and industrial sectors, while France and Italy contribute to market expansion through their infrastructure improvement projects, packaging and coatings, and specialty adhesives manufacturing. The European Commission launched its Chemicals Industry Action Plan in July 2025 to improve competitiveness by reducing regulatory complexity and supporting the development of environmentally friendly, energy-efficient technologies, which will benefit petroleum resin production companies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the petroleum resin market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ExxonMobil Chemical Company

- Kolon Industries, Inc.

- Eastman Chemical Company

- TotalEnergies

- Arakawa Chemical Industries

- Zeon Corporation

- Lesco Chemical Limited

- Braskem

- Cray Valley

- Arkema S.A.

- Neville Chemical Company

- Synthomer PLC

- Idemitsu Kosan Co., Ltd.

- Puyang Tiancheng Chemical Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, the U.S. Environmental Protection Agency announced new 2026 regulations sharply reducing allowable VOC emissions from industrial coatings and related products. The rules compel adhesive and resin manufacturers to adopt low-VOC formulations, accelerating demand for compliant petroleum resins and more sustainable alternatives.

- In September 2025, TotalEnergies’ Cray Valley affiliate signed an agreement to supply Continental with ISCC Plus-certified Cleartack and Ricon resins. Produced in Carling, France, using bio-feedstock from La Mède, the resins support renewable tire materials while maintaining safety and performance standards.

- In April 2025, Synthomer and Henkel announced a strategic partnership to reduce carbon emissions in Henkel’s TECHNOMELT hot melt adhesives. The agreement covers European, Indian, Middle Eastern, and African markets, advancing sustainable adhesive innovation across the value chain.

- In August 2024, Idemitsu Kosan Co., Ltd. developed IDEMITSU IFG Plantech Racing 0W-20 engine oil using over 80% plant-based materials. The product earned API SP and Biomass Mark certifications, becoming the first plant-based racing engine oil with API SP approval, ahead of its November 2024 launch.

- In May 2023, Kolon Industries Inc. announced a 24 billion won investment to expand its high-purity aromatic petroleum resin facility in Yeosu. The expansion will raise PMR capacity from 11,000 to 21,000 tons, strengthening its global leadership in specialty petroleum resins.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the petroleum resin market based on the below-mentioned segments:

Global Petroleum Resin Market Size, By Type

- C5 Resins

- C9 Resins

- C5/C9 Resins

- Hydrogenated Hydrocarbon Resins

Global Petroleum Resin Market Size, By Application

- Hot-melt Adhesives

- Pressure-sensitive Adhesives

- Rubber Compounding & Tires

- Road-marking Paints & Industrial Coatings

- Printing Inks & Flexible Packaging Films

Global Petroleum Resin Market Size, By End-Use

- Building and Construction

- Tire Industry

- Personal Hygiene

- Consumer Goods

- Automotive

- Others

Global Petroleum Resin Market Size, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Petroleum Resin Market Size over the forecast period?The global petroleum resin market is projected to expand at a CAGR of 5.72% during the forecast period.

-

2. What is the market size of the Petroleum Resin Market Size?The global petroleum resin market size is expected to grow from USD 3.57 billion in 2024 to USD 6.58 billion by 2035, at a CAGR of 5.72% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Petroleum Resin Market Size?Asia Pacific is anticipated to hold the largest share of the petroleum resin market over the predicted timeframe.

-

4. What is the global Petroleum Resin Market Size?The global petroleum resin market involves the production and sales of hydrocarbon resins used in adhesives, coatings, rubber, and construction industries.

-

5. Who are the top 10 companies operating in the global Petroleum Resin Market Size?ExxonMobil Chemical Company, Kolon Industries, Inc., Eastman Chemical Company, TotalEnergies, Arakawa Chemical Industries, Zeon Corporation, Lesco Chemical Limited, Braskem, Cray Valley, Arkema S.A., and Others.

-

6. What factors are driving the growth of the Petroleum Resin Market Size?Growth is driven by rising demand in adhesives, paints, and rubber/tires, rapid urbanization, infrastructure development in APAC, and the need for high-performance hydrogenated resins in packaging.

-

7. What are the market trends in the Petroleum Resin Market Size?Petroleum resin market trends include rising demand for hydrogenated hydrocarbon resins, increased use in adhesives/coatings, growing bio-based alternatives, and high consumption in the Asia-Pacific construction sector.

-

8. What are the main challenges restricting wider adoption of the Petroleum Resin Market Size?Key challenges restricting the petroleum resin market include high raw material price volatility, stringent environmental regulations on VOC emissions, competition from bio-based alternatives, and supply chain disruptions affecting production.

Need help to buy this report?