Global PET Rigid Film Market Size, Share, and COVID-19 Impact Analysis, By Type (Amorphous PET and Crystalline PET), By Application (Food & Beverage Packaging, Pharmaceutical Packaging, Electronics Packaging, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal PET Rigid Film Market Insights Forecasts to 2035

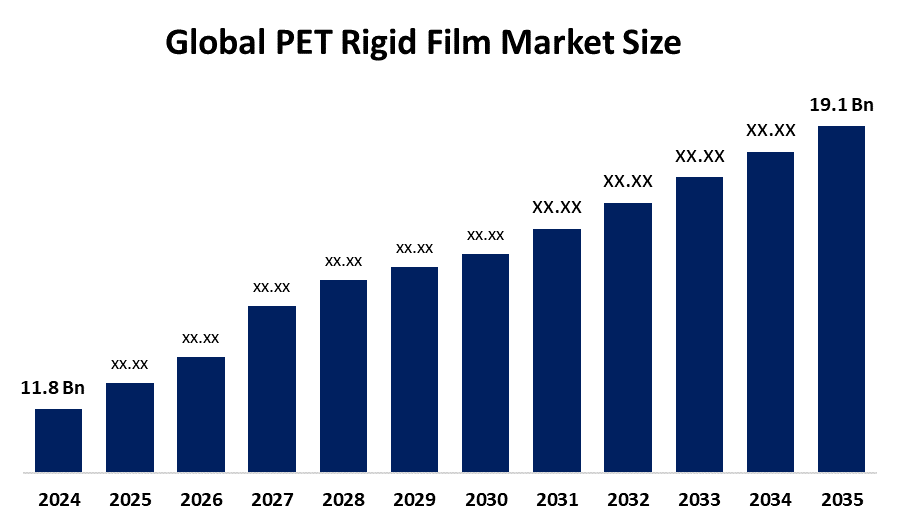

- The Global PET Rigid Film Market Size Was Estimated at USD 11.8 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.48% from 2025 to 2035

- The Worldwide PET Rigid Film Market Size is Expected to Reach USD 19.1 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global PET Rigid Film market size was worth around USD 11.8 Billion in 2024 and is predicted to grow to around USD 19.1 Billion by 2035 with a compound annual growth rate (CAGR) of 4.48% from 2025 and 2035. The market for PET rigid film has several opportunities to grow due to its remarkable clarity, robust mechanical and barrier qualities, lightweight and recyclable nature, and adaptability to a variety of uses, including electronics and food packaging.

Market Overview

PET rigid film, also known as A-PET sheet or film or hard PET film, is a kind of sheet or film material composed of the polyethylene terephthalate polymer that is comparatively thick and rigid in comparison to normal flexible PET films. The growing need for robust and lightweight packaging solutions across a range of industries, including consumer products, medical, and food and beverage, is the main driver of the market expansion. The market is growing as a result of consumers' growing desire for environmentally friendly packaging solutions. The market is developing due to many factors, including the expanding customer base in emerging regions and the growing popularity of ecommerce, which calls for protective packaging. OCTAL, Klockner Pentaplast, Shinkong Synthetic Fibers, Toray, and Retal are some of the major companies in the sector. To meet the changing needs of the market, these businesses are concentrating on capacity development, product innovation, and strategic partnerships.

Rigid PET films with recycled material are possible because of an amendment made to the Packaging Regulations by the Food Safety and Standards Authority of India in March 2025 that specifically allows the use of recycled PET in food contact packaging. The feedstock for premium rigid PET films is also being strengthened by strategic investments such as the 205-crore made by British International Investment in Magpet Polymers to construct extensive bottle to bottle recycling infrastructure in India.

Report Coverage

This research report categorizes the PET rigid film market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the PET rigid film market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the PET rigid film market.

Global PET Rigid Film Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 11.8 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.48% |

| 2035 Value Projection: | USD 19.1 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Application |

| Companies covered:: | DuPont Teijin Films, SKC Co., Ltd., Polyplex Corporation Ltd., Jindal Poly Films Ltd., Klöckner Pentaplast Group, Ester Industries Ltd., Mitsui Chemicals America, Inc., Uflex Ltd., Covestro AG, SABIC, Kolon Industries, Inc., Terphane LLC, Avery Dennison Corporation, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The PET rigid film market is driven this is becoming more and more popular in the pharmaceutical and medical sectors for packaging applications because of its excellent clarity, resilience to chemicals, and compatibility with sterilization. The demand for sterile medical packaging solutions has increased dramatically as a result of the COVID-19 epidemic, and stiff PET films have become an essential component for blister packing and the protection of medical devices. Rigid PET film producers have long term prospects in the medical packaging industry, since global Chemicals and Materials spending is expected to continue growing steadily. Furthermore, the material is essential in this industry due to its capacity to preserve product integrity while adhering to strict pharmaceutical packaging rules.

Restraining Factors

The PET rigid film market is restricted by factors like price fluctuations for raw materials, especially for pure terephthalic acid and monoethylene glycol, the main feedstocks for PET manufacture. Manufacturers find it challenging to control costs in the unpredictable pricing environment brought about by supply chain interruptions and geopolitical conflicts.

Market Segmentation

The PET rigid film market share is classified into type and application.

- The amorphous PET segment dominated the market in 2024, accounting for approximately 38% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the PET rigid film market is divided into amorphous PET and crystalline PET. Among these, the amorphous PET segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven because of their exceptional thermoformability and clarity, which make them perfect for packaging applications requiring high transparency. These movies are becoming more popular in the food and beverage sector, where products need to be seen. In keeping with the growing trend towards sustainable packaging solutions, amorphous PET films are also in high demand due to their environmental advantages and capacity for recycling.

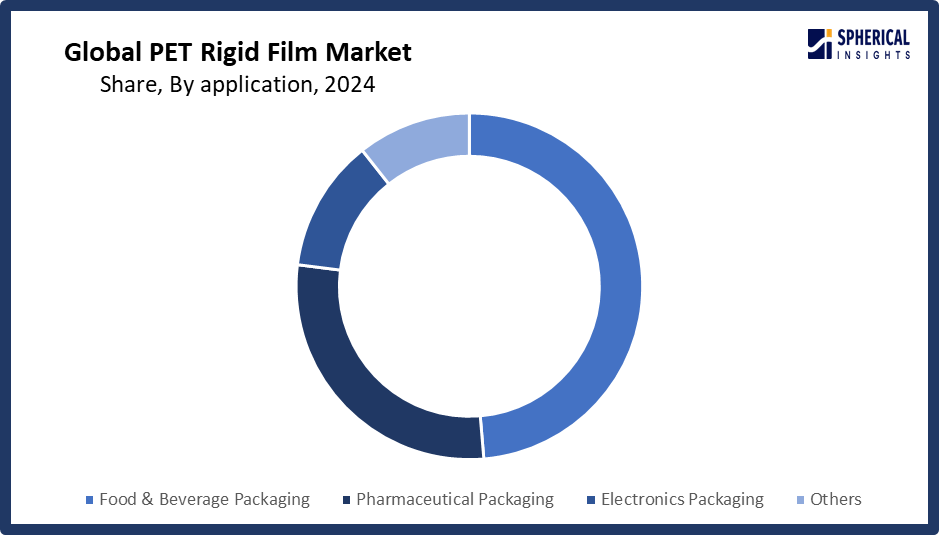

- The food & beverage segment accounted for the largest share in 2024, accounting for approximately 49% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the PET rigid film market is divided into food & beverage packaging, pharmaceutical packaging, electronics packaging, and others. Among these, the food & beverage segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is due to the necessity for transparent and safe packaging solutions has led to the food and beverage industry becoming the main end user of PET rigid films. PET films provide superior barrier qualities, guaranteeing food products' safety and freshness. PET film adoption in this industry is also being aided by the rising demand for prepared meals and convenience foods.

Get more details on this report -

Regional Segment Analysis of the PET Rigid Film Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share, representing nearly 40% of the PET Rigid Film market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share, representing nearly 40% of the PET rigid film market over the predicted timeframe. Asia-Pacific accounts for more than half of the world's rigid PET film demand, which is driven by China's enormous packaging industry and growing manufacturing sector. Low production costs, growing middle class consumption, and robust export-oriented economies all help the region. With major uses in consumer electronics, i.e, 20% and food packaging, about 60% of domestic use, China alone accounts for roughly 35% of the region's consumption of rigid PET film. India's expanding processed food industry is driving up demand, as seen by the 7% yearly growth in rigid PET film usage.

Get more details on this report -

North America is expected to grow at a rapid CAGR, representing nearly 20% in the PET rigid film market during the forecast period. The North American area has a thriving market for PET rigid film due to high performance applications in medical and specialty packaging defines the North American market, where producers concentrate on high end goods. Due to strict FDA rules for goods that come into contact with food and sophisticated packaging requirements for pharmaceuticals, the United States accounts for 80% of regional demand. Recycled PET films are becoming more and more popular in the area, and big firms are pledging to use sustainable packaging. Despite its maturity, the industry is still expanding at a steady rate of 4-5% per year due to advancements in barrier coatings and functional qualities.

Europe's stringent PET film industry prioritizes sustainability, and laws governing recycled content and extended producer responsibility programs have an impact on product development. Currently, recycled material makes up over 30% of PET films, placing France and Germany at the forefront of the circular economy's use. The region still has a high need for high barrier films for pharmaceutical packaging, but strict environmental regulations and developed end use sectors limit their growth. Policies aimed at reducing plastic use across the EU are driving innovation in PET film architectures that are mono material and readily recyclable.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the PET rigid film market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DuPont Teijin Films

- SKC Co., Ltd.

- Polyplex Corporation Ltd.

- Jindal Poly Films Ltd.

- Klöckner Pentaplast Group

- Ester Industries Ltd.

- Mitsui Chemicals America, Inc.

- Uflex Ltd.

- Covestro AG

- SABIC

- Kolon Industries, Inc.

- Terphane LLC

- Avery Dennison Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, JPFL Films Private Limited, a subsidiary of flexible packaging giant Jindal Poly Films Limited, announced a capacity expansion with new BOPP, PET, and CPP lines in Nashik, Maharashtra. The new lines, expected to be commissioned in the next 2-3 years’ time, will see a capex commitment of above Rs 700 crore.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the PET rigid film market based on the below-mentioned segments:

Global PET Rigid Film Market, By Type

- Amorphous PET

- Crystalline PET

Global PET Rigid Film Market, By Application

- Food & Beverage Packaging

- Pharmaceutical Packaging

- Electronics Packaging

- Others

Global PET Rigid Film Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the CAGR of the PET rigid film market over the forecast period?The global PET rigid film market is projected to expand at a CAGR of 4.48% during the forecast period.

-

What is the market size of the PET rigid film market?The global PET rigid film market size is expected to grow from USD 11.8 Billion in 2024 to USD 19.1 Billion by 2035, at a CAGR of 4.48% during the forecast period 2025-2035.

-

Which region holds the largest share of the PET rigid film market?Asia Pacific is anticipated to hold the largest share of the PET rigid film market over the predicted timeframe.

-

Who are the top 15 companies operating in the global PET rigid film market?Toray Industries, Inc., Mitsubishi Polyester Film, Inc., DuPont Teijin Films, SKC Co., Ltd., Polyplex Corporation Ltd., Jindal Poly Films Ltd., Klockner Pentaplast Group, Ester Industries Ltd., Mitsui Chemicals America, Inc., Uflex Ltd, Covestro AG, SABIC, Kolon Industries, Inc., Terphane LLC, Avery Dennison Corporation, and Others.

-

What factors are driving the growth of the PET rigid film market?The PET rigid film market growth is driven by its superior clarity, durability, and barrier qualities. PET films are becoming more and more popular in the food & beverage, Chemicals and Materials, and electronics industries. At the same time, brand owners and converters are being pushed toward more recyclable, high performance materials like stiff PET films due to regulatory pressure and increased environmental awareness.

-

What are the market trends in the PET rigid film market?The PET rigid film market trends include sustainability & circular economy push, smart & value added packaging functionality, emerging applications beyond food packaging, regional production shifts and capacity expansions, and competition and substitution pressures.

-

What are the main challenges restricting wider adoption of the PET rigid film market?The PET rigid film market trends include the price volatility of raw materials, especially for petroleum derived feedstocks like PTA and MEG, which makes cost control challenging for manufacturers.

Need help to buy this report?