Global Pet Insurance Market Size, Share, and COVID-19 Impact Analysis, By Coverage Type (Accident Only, Accident & Illness, & Others), By Animal Type (Dogs, Cats & Others), By Distribution Channel (Agency, Broker, Direct & Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Industry: HealthcareGlobal Pet Insurance Market Insights Forecasts to 2033.

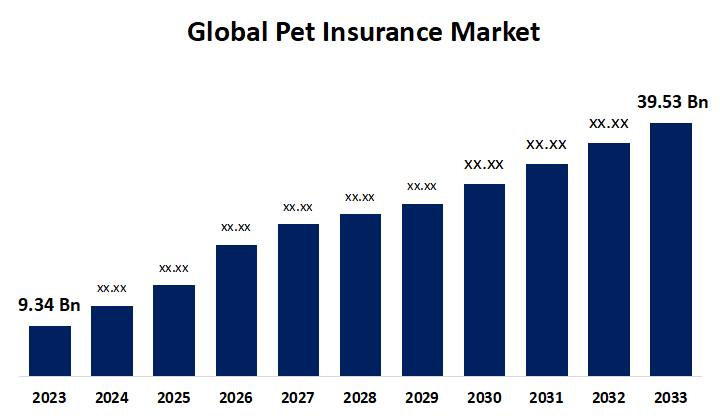

- The Global Pet Insurance Market Size was Valued at USD 9.34 Billion in 2023.

- The Market Size is Growing at a CAGR of 15.52% from 2023 to 2033.

- The Worldwide Pet Insurance Market Size is Expected to Reach USD 39.53 Billion by 2033.

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Pet Insurance Market Size is Anticipated to Exceed USD 39.53 Billion by 2033, Growing at a CAGR of 15.52% from 2023 to 2033.

Market Overview

Pet insurance is a specific type of property and liability insurance that pet owners get to help with unanticipated costs for their pets' medical care, surgeries, accidents, and prescription drugs. In light of the growing expense of veterinary care, this insurance provides a range of coverage that is advantageous to pet owners. Some policies include coverage for a wide range of problems, including chronic, inherited, and congenital diseases like cancer. They also cover diagnostic tests, ultrasound imaging, CAT scanning, veterinarian examination costs, prescription drugs, MRI testing, and non-routine dental therapy. It is important that some insurance policies not provide coverage for routine dental cleanings, illnesses, preventative flea treatments, or serious genetic or congenital conditions. Pet owners who file claims with the insurance company after giving their animals the treatment they require are covered by pet insurance, which functions similarly to property and casualty insurance. Additionally, the market is expanding due to the increased demand for pet insurance to help with the costs associated with catastrophic health issues like cancer and unintentional accidents.

Report Coverage

This research report categorizes the market for the global pet insurance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global pet insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global pet insurance market.

Global Pet Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 9.34 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 15.52% |

| 2033 Value Projection: | USD 39.53 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Coverage Type, By Distribution Channel , By Animal Type, By Region. |

| Companies covered:: | Agria Pet Insurance Ltd., Anicom Holdings Inc., Direct Line Insurance Group plc, dotsure.co.za, Embrace Pet Insurance Agency LLC, Figo Pet Insurance LLC, PTZ Insurance Agency, Ltd., Healthy Paws Pet Insurance LLC, Medibank Private Limited, MetLife Services and Solutions LLC, Nationwide Mutual Insurance Company, Pethealth Inc., Petplan (Allianz Insurance plc), The Oriental Insurance Company Ltd., Trupanion, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving factor

The global pet insurance market is driven by various factors, including the steady and significant rise in veterinary expenses, which is one of the main drivers of the industry. Pet owners are paying more for increasingly complex and potent therapies as a result of advances in veterinary science. Pet owners are becoming more and more prepared to make financial investments in the health of their animals, and insurance provides a safety net that allows them to accomplish this without concern about paying huge veterinary expenses. This trend is especially noticeable in developed economies, where there is an increasing need for comprehensive insurance coverage due to a shift in culture toward perceiving dogs as family members and a greater understanding of pet health. In addition, the market has been greatly impacted by the growth in pet ownership and the widespread tendency toward humanizing pets. The emotional bond people have with their dogs increases as more people adopt pets into their homes. As people with their own health requirements, pet owners are looking for methods to provide their beloved friends with the finest healthcare possible. A more holistic approach to pet health and well-being is reflected in the increased demand for insurance policies that cover routine wellness visits, vaccines, and preventative treatment in addition to accidents and diseases.

Restraining Factors

Pet insurance is becoming more well known, but many pet owners are still confused about what it covers and how it works. Adoption of pet insurance may be hampered by a lack of knowledge about the available coverage options, policy conditions, and exclusions.

Market Segmentation

The Global Pet Insurance Market share is classified into coverage type, animal type and distribution channel.

- The accident & illness segment are expected to hold the largest share of the global pet insurance market during the forecast period.

Based on the coverage type, the global pet insurance market is divided into accident only, accident & illness, and others. Among these, the accident & illness segment are expected to hold the largest share of the global pet insurance market during the forecast period. Several significant reasons, such as the rising expense of veterinary care and diagnostics, the rise in the number of companion animals, and the expanding recognition of the value of pet insurance, are responsible for this expansion. Pet insurance companies usually include accident and sickness policies, which provide extensive coverage for a variety of disorders, including acute and chronic diseases, medicines, diagnostic testing, and more.

- The dog segment is expected to hold the largest share of the global pet insurance market during the forecast period.

Based on the animal type, the global pet insurance market is divided into dogs, cats and others. Among these, the dog segment is expected to hold the largest share of the global pet insurance market during the forecast period. Growing pet adoption, insurance firms' expanding service offerings, and rising disposable income in important areas are major factors influencing this proportion. Trupanion, Inc., Petplan, PetFirst Healthcare LLC, Nationwide Mutual Insurance Company, and Embrace Pet Insurance Agency, LLC are a few of the leading companies in this market.

- The direct sales segment is expected to hold the largest share of the global pet insurance market during the forecast period.

Based on the distribution channel, the global pet insurance market is divided into agency, broker, direct and others. Among these, the direct sales segment is expected to hold the largest share of the global pet insurance market during the forecast period. One of the primary drivers has been the notable use of direct sales techniques by large pet insurance companies. Deutsche Familienversicherung AG, for instance, reported that in 2023, direct sales constituted 8% of its new business, a significant rise over the prior year.

Regional Segment Analysis of the Global Pet Insurance Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

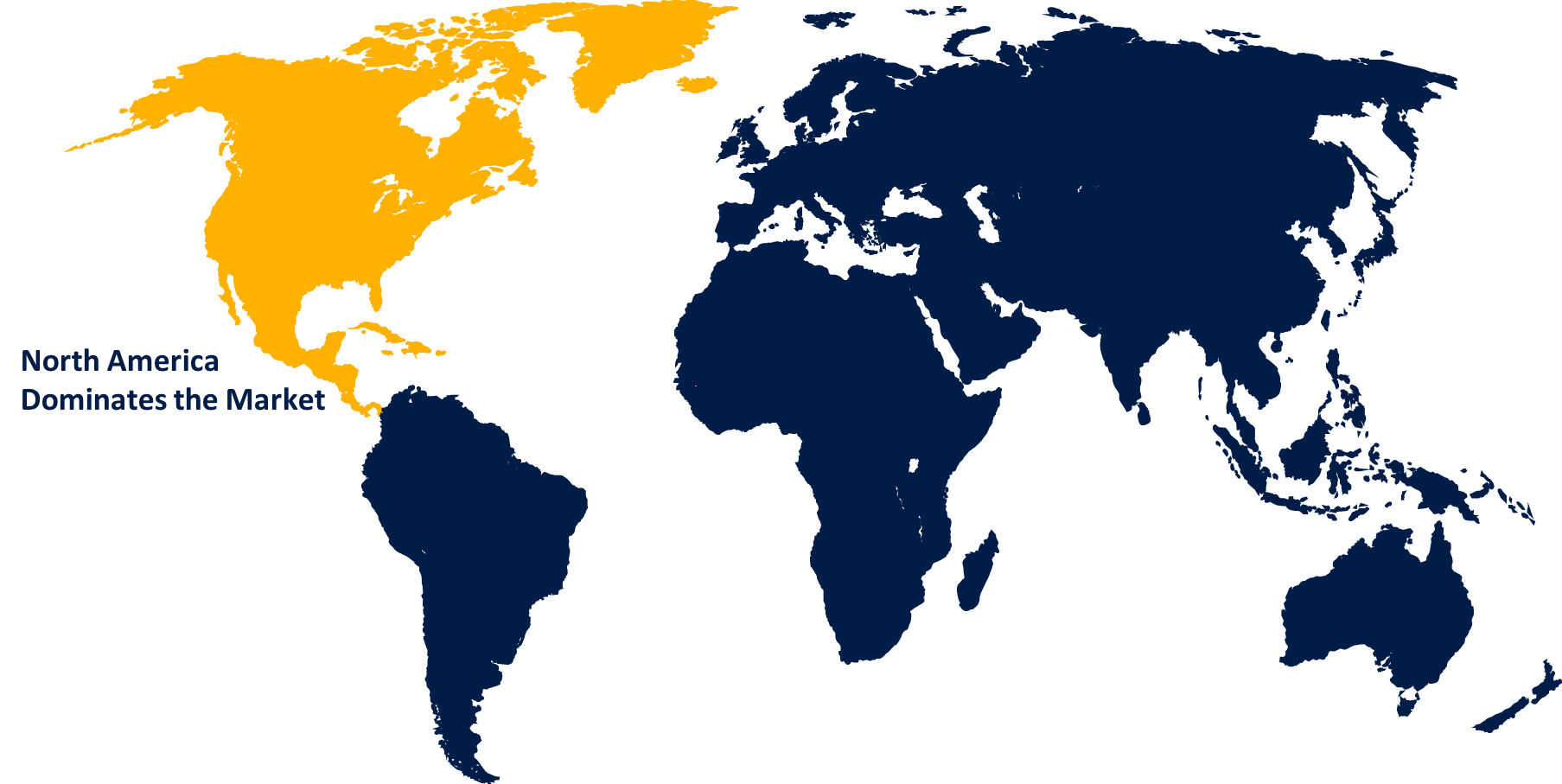

North America is anticipated to hold the largest share of the global pet insurance market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global pet insurance market over the predicted timeframe. According to The North American Pet Health Insurance Association (NAPHIA), there were 5.36 million insured pets in North America in 2022, a 22% rise from the previous year. It is anticipated that the industry will continue to expand as more pet owners choose to insure their animals. However, it is anticipated that the region's market competitiveness would rise as a result of the launch of new insurance products by significant new market competitors. It is anticipated that as the industry develops, there will be more competition and a higher number of claims being handled.

Asia Pacific is expected to grow the fastest during the forecast period. Increased pet ownership is a result of changing lifestyles, increased disposable incomes, and increasing urbanization in nations like Australia, China, and Japan. Pet insurance is in more demand as people become more conscious of the health and welfare of their pets. The Asia-Pacific area offers a significant development opportunity for pet insurance providers, even if the industry is still developing. With a growing middle class and a shift in cultural perception toward the value of insurance in guaranteeing the finest care for dogs, this region is ideal for pet owners.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global pet insurance along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Agria Pet Insurance Ltd.

- Anicom Holdings Inc.

- Direct Line Insurance Group plc

- dotsure.co.za

- Embrace Pet Insurance Agency LLC

- Figo Pet Insurance LLC

- PTZ Insurance Agency, Ltd.

- Healthy Paws Pet Insurance LLC

- Medibank Private Limited

- MetLife Services and Solutions LLC

- Nationwide Mutual Insurance Company

- Pethealth Inc.

- Petplan (Allianz Insurance plc)

- The Oriental Insurance Company Ltd.

- Trupanion

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, Odie Pet Insurance, a business focused on lowering the cost and increasing the accessibility of pet insurance, and Five Sigma, a leader in cloud-based claims management software, has collaborated.

- In November 2023, Fetch and Best Friends Animal Society, a nationwide nonprofit dedicated to putting a stop to the killing of dogs and cats in American shelters by 2025, partnered in November 2023.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Pet Insurance Market based on the below-mentioned segments:

Global Pet Insurance Market, By Coverage Type

- Accident Only

- Accident and Illness

- Others

Global Pet Insurance Market, By Animal Type

- Dogs

- Cats

- Others

Global Pet Insurance Market, By Distribution Channel

- Agency

- Broker

- Direct

- Others

Global Pet Insurance Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is pet insurance?Pet insurance is a specific type of property and liability insurance that pet owners get to help with unanticipated costs for their pets' medical care, surgeries, accidents, and prescription drugs.

-

2.Which segment has the largest growth in pet insurance market?North America has the largest growth in the pet insurance market

-

3.What is the segmentation of the pet insurance market?The pet insurance market is segmented into coverage type, animal type and distribution channel.

Need help to buy this report?