Global Penicillin G Sodium Market Size, Share, and COVID-19 Impact Analysis, By Sales Channel (Direct and Indirect), By End User (Bacterial Infections, Syphilis, Prophylaxis, Meningitis, Combination Therapies, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Penicillin G Sodium Market Size Insights Forecasts To 2035

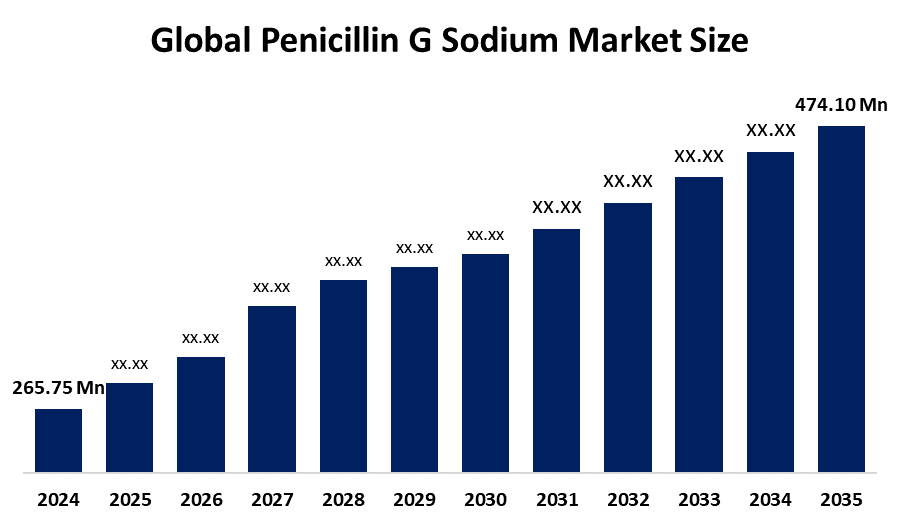

- The Global Penicillin G Sodium Market Size Was Valued At USD 265.75 Million In 2024

- The Market Size Is Expected To Grow At A CAGR Of Around 5.4 % From 2025 To 2035

- The Worldwide Penicillin G Sodium Market Size Is Expected To Reach USD 474.10 Million By 2035

- North America Is Expected To Grow The Fastest During The Forecast Period.

Get more details on this report -

According To A Research Report Published By Spherical Insights And Consulting, The Global Penicillin G Sodium Market Size Was Worth Around USD 265.75 Million In 2024 And Is Predicted To Grow To Around USD 474.10 Million By 2035 With A Compound Annual Growth Rate (CAGR) Of 5.4 % From 2025 To 2035. The market for penicillin G sodium has opportunities due to the growing need for injectable antibiotics, the expansion of hospital facilities, the rise in bacterial infections, the expansion of generic medications, and improvements in the efficiency of pharmaceutical manufacturing.

Market Overview

Penicillin G Sodium Is One Of The Water-Soluble Forms Of Penicillin G. It is the main intravenous antibiotic and is used to treat very serious bacterial infections such as syphilis, endocarditis, and streptococcal pneumonia. The total global environment, which covers everything from its manufacturing and supply chain to compliance with regulations and the sale of the product, is referred to as the penicillin G sodium Market. Penicillin G sodium is a common antibiotic used in hospitals and clinics to treat infections caused by certain Gram-positive and some Gram-negative bacteria. It is mainly delivered by injection. The fifth cycle of the Production Linked Incentive (PLI) program, which aims to create 9,600 new jobs and lessen reliance on imports, was introduced in May 2025 by India's Department of Pharmaceuticals. For Instance, in July 2024, Centrient Pharmaceuticals launched its membership in the Critical Medicines Alliance, strengthening Europe’s pharmaceutical supply chains and ensuring consistent availability of essential antibiotics such as Penicillin G. The need for parenteral antibiotics has increased due to the construction of healthcare infrastructure, particularly in emerging nations, which has greatly expanded access to hospital-based therapies.

Report Coverage

This research report research report categorizes The Penicillin G Sodium Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. the report analyses the key growth drivers, opportunities, based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. the report analyses the key growth drivers, opportunities and challenges influencing the penicillin G sodium market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the penicillin G sodium market.

Penicillin G Sodium Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 265.75 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 5.4% |

| 2023 Value Projection: | USD 474.10 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Sales Channel, By Region |

| Companies covered:: | Asia Pioneer Pharmaceuticals, Aurobindo Pharma Ltd., Bristol Myers Squibb, CSPC Zhongnuo Pharmaceutical (Shijiazhuang) Co., Ltd., Fresenius Kabi / Fresenius SE & Co. KGaA, Harbin Pharmaceutical Group, Henan Xinxiang Huaxing Pharmaceutical, Inner Mongolia Changsheng Pharmaceutical, Kangyuan Pharmaceutical Group, North China Pharmaceutical Company Ltd., Pfizer Inc., Sandoz, Shandong Lukang Pharmaceutical Group Co., Ltd., Sterile India Pvt. Ltd., and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A number of important variables related to pharmaceutical development and the demand for healthcare worldwide are driving the expansion of the penicillin g sodium market size. the growing focus on inexpensive and generic drugs is another significant motivator.As a well-known antibiotic, Penicillin G Sodium enjoys high demand in generic form, which promotes broad use in both public and private healthcare systems. Increased use of antibiotics is also a result of greater knowledge of the need for early detection and prompt treatment of infectious diseases. Technological developments in pharmaceutical manufacturing have enhanced supply reliability, quality control, and production efficiency, all of which have contributed to penicillin G sodium market expansion.

Restraining Factors

Rising antibiotic resistance, the availability of substitute antibiotics strict regulatory requirements, unfavorable allergic responses, and doctors' preference for more advanced and broader-spectrum treatments over older antibiotics are all factors restricting the penicillin G sodium market.

Market Segmentation

The penicillin G sodium market share is classified into sales channel and end user.

- The direct segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based On the sales channel, The Penicillin G Sodium Market Size is divided into direct and indirect. among these, the direct segment accounted for the largest share in 2024 and is anticipated to grow at a significant cagr during the forecast period. hospitals,,clinics, and other healthcare facilities are the main drivers of the direct sales market since they purchase antibiotics directly from producers or approved distributors to guarantee a steady supply and high quality. Healthcare providers can maintain inventory stability, obtain large quantities, and adhere to stringent regulations for injectable drugs by using direct procurement.

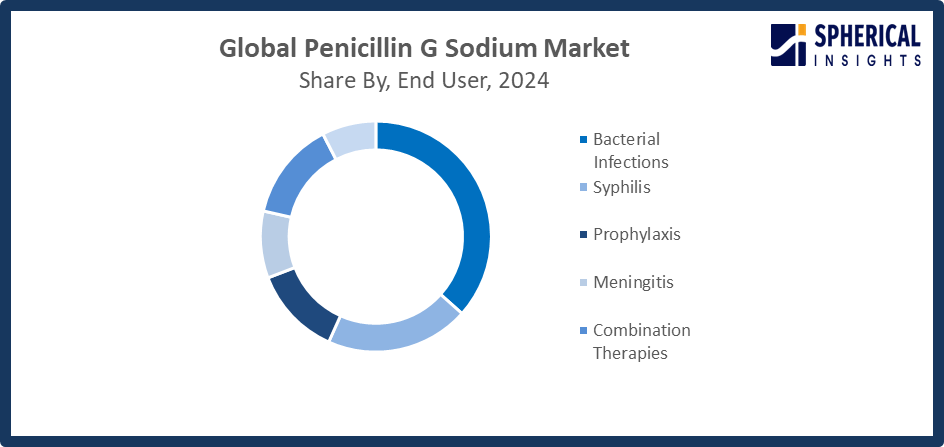

- The bacterial infections segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, The Penicillin G Sodium Market Size is divided into bacterial infections, syphilis, prophylaxis, meningitis, combination therapies, and others. Among these, the bacterial infections segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The global prevalence of bacterial diseases is the reason for the bacterial infections section. The bacterial infections market is growing as a result of increased knowledge of the importance of prompt antibiotic treatment, an increase in hospital admissions, and the urgent need for efficient infection control.

Get more details on this report -

Regional Segment Analysis of the Penicillin G Sodium Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the penicillin G sodium market over the predicted timeframe.

Asia Pacific Is Anticipated to hold the largest share of the Penicillin G Sodium Market Size Over The Predicted Timeframe. The region's high incidence of bacterial infections and sizable population base greatly contribute to the ongoing need for efficient and reasonably priced antibiotics. Access to hospital-based therapies where injectable antibiotics are commonly utilized has grown due to the rapid expansion of healthcare infrastructure, especially in nations like China, India, and Southeast Asian countries. China's Q2 2025 pricing leveled down at USD 46,450 per metric ton, supporting export levels of more than 11 million kg of enzymes in November. In December 2025, Meiji Seika Pharma in Japan made a historic announcement that strengthened regional supply chains against interruptions by reviving domestic 6-APA production after 31 years.

North america is expected to grow at a rapid CAGR In The Penicillin G Sodium Market Size During The Forecast Period. High healthcare spending and well-established hospital networks in the area support the ongoing use of injectable antibiotics for serious bacterial infections. In addition to Q2 2025 price peaks of USD 47,500/MT and a September decrease of USD 30/MT due to relaxed supply limitations, new advances include enhanced production protocols that produce 15% efficiency increases. The FDA's July 2025 supply resilience rule, which requires stockpiling and diversification, and the October reports on the federal push for improving R&D pipelines for next-generation penicillins are among the major announcements.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within The Penicillin G Sodium Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Asia Pioneer Pharmaceuticals

- Aurobindo Pharma Ltd.

- Bristol Myers Squibb

- CSPC Zhongnuo Pharmaceutical (Shijiazhuang) Co., Ltd.

- Fresenius Kabi / Fresenius SE & Co. KGaA

- Harbin Pharmaceutical Group

- Henan Xinxiang Huaxing Pharmaceutical

- Inner Mongolia Changsheng Pharmaceutical

- Kangyuan Pharmaceutical Group

- North China Pharmaceutical Company Ltd.

- Pfizer Inc.

- Sandoz

- Shandong Lukang Pharmaceutical Group Co., Ltd.

- Sterile India Pvt. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2024, Lyfius Pharma launched a new Penicillin G manufacturing facility in Kakinada, Andhra Pradesh, with 15,000-tonne capacity, reducing India’s dependence on imported APIs under the PLI scheme.

- In August 2024, CSPC Pharmaceutical Group announced interim results, reporting a 6.4% decline in bulk antibiotic sales, including Penicillin G Sodium, due to lower overseas demand, while optimizing its global network.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the penicillin G sodium market based on the below-mentioned segments:

Global Penicillin G Sodium Market, By Sales Channel

- Direct

- Indirect

Global Penicillin G Sodium Market, By End User

- Bacterial Infections

- Syphilis

- Prophylaxis

- Meningitis

- Combination Therapies

- Others

Global Penicillin G Sodium Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the penicillin G sodium market over the forecast period?The global Penicillin G Sodium market is projected to expand at a CAGR of 5.4% during the forecast period.

-

2. What is the market size of the penicillin G sodium market?The global Penicillin G Sodium market size is expected to grow from USD 265.75 million in 2024 to USD 474.10 million by 2035, at a CAGR of 5.4 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the penicillin G sodium market?Asia Pacific is anticipated to hold the largest share of the Penicillin G Sodium market over the predicted timeframe.

-

4. Who are the top companies operating in the global penicillin G sodium market?Asia Pioneer Pharmaceuticals, Aurobindo Pharma Ltd., Bristol Myers Squibb, CSPC Zhongnuo Pharmaceutical (Shijiazhuang) Co., Ltd., Fresenius Kabi / Fresenius SE & Co. KGaA, Harbin Pharmaceutical Group, Henan Xinxiang Huaxing Pharmaceutical, Inner Mongolia Changsheng Pharmaceutical, Kangyuan Pharmaceutical Group, North China Pharmaceutical Company Ltd., Pfizer Inc., Sandoz, Shandong Lukang Pharmaceutical Group Co., Ltd., Sterile India Pvt. Ltd., and Others.

-

5. What factors are driving the growth of the penicillin G sodium market?The market for penicillin G sodium is developing due to a number of factors, including rising bacterial infections, expanding hospital infrastructure, rising demand for injectable antibiotics, affordable generic formulations, regulatory backing, and improvements in pharmaceutical manufacturing.

-

6. What are the market trends in the penicillin G sodium marketA concentration on hospital-based injectable medicines, increased usage of generic antibiotics, increased awareness of the importance of prompt infection treatment, increased access to healthcare in developing nations, and the incorporation of new manufacturing technology.

-

7. What are the main challenges restricting the wider adoption of the penicillin G sodium market?Adoption of Penicillin G Sodium is restricted by antibiotic resistance, the availability of substitute broad-spectrum antibiotics, unpleasant allergic responses, strict regulatory restrictions, and a decline in physician preference for older antibiotics.

Need help to buy this report?