Global Penicillin G Acylase Market Size, Share, and COVID-19 Impact Analysis, By Type (Free Enzyme, Immobilized Enzyme, and Others), By Application (β-Lactam Antibiotic Production, Cephalosporin Derivatives, Industrial Biocatalysis, Research & Development, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Penicillin G Acylase Market Insights Forecasts to 2035

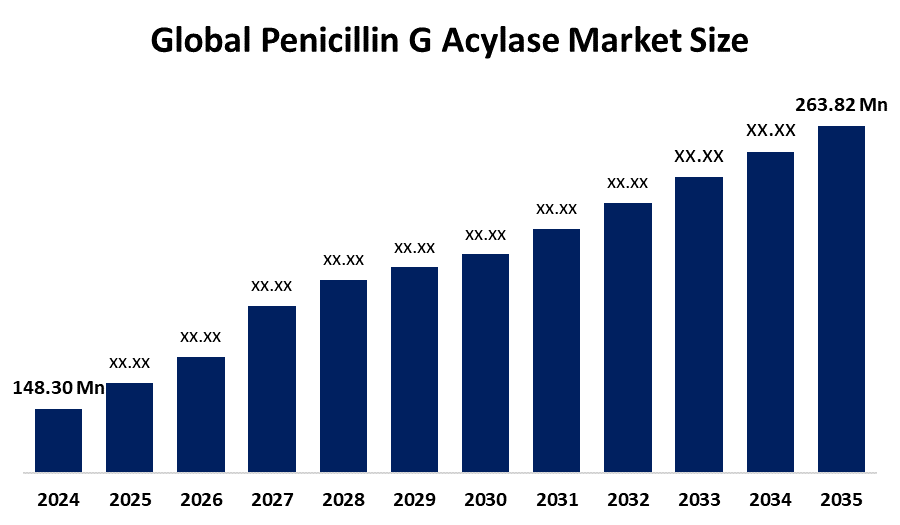

- The Global Penicillin G Acylase Market Size Was Estimated at USD 148.30 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.38% from 2025 to 2035

- The Worldwide Penicillin G Acylase Market Size is Expected to Reach USD 263.82 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Penicillin G Acylase Market Size was worth around USD 148.30 Million in 2024, growing to USD 156.54 Million in 2025, and is predicted to grow to around USD 263.82 Million by 2035 with a compound annual growth rate (CAGR) of 5.38% from 2025 to 2035. The expansion of the penicillin G acylase market is influenced by growing demand for semi-synthetic antibiotics, rising antibiotic resistance, and increasing pharma production. Advances in enzyme manufacture, the availability of economical biocatalysis procedures, and the need for more healthcare in developing economies additionally propel market growth, and enzyme-based synthesis becomes increasingly appealing.

Global Penicillin G Acylase Market Forecast and Revenue Outlook

- 2024 Market Size: USD 148.30 Million

- 2025 Market Size: USD 156.54 Million

- 2035 Projected Market Size: USD 263.82 Million

- CAGR (2025-2035): 5.38%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Market Overview

The penicillin G acylase (PGA) market refers to the business that deals with the production and use of the enzyme Penicillin G Acylase, which is used extensively in the pharmaceutical industry for the synthesis of 6-aminopenicillanic acid (6-APA), an important intermediate in the manufacture of semi-synthetic penicillins. Being an essential enzyme utilized in the manufacture of antibiotics, PGA plays an important role in the fight against bacterial infections. The market is fueled by an increasing demand for beta-lactam antibiotics, an increase in cases of antibiotic resistance, and a greater need for healthcare across the world. Advances in biotechnology and enzyme engineering have enhanced production efficiency, further driving market growth.

Opportunities exist in increasing applications in new forms of antibiotic formulations and enzyme-based green chemistry processes. Furthermore, emerging economies offer untapped opportunities with growing healthcare infrastructure and antibiotic usage. Key industry players are large pharma and biotech firms such as Novozymes, DSM, and Biocon, which are making R&D investments to improve the yield of enzymes and lower the cost of production. Supportive government schemes for pharma production, research expenditure on antibiotic resistance, and incentives on biotech research have also played a role in the favorable market forces. India will begin domestic production of Penicillin G from June 2024, announced Minister Dr. Mansukh Mandaviya. He inaugurated 51 greenfield projects under the PLI scheme for bulk drugs and medical devices, emphasizing the need for self-reliance in essential medicines and pharmaceutical manufacturing.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the penicillin G acylase market during the forecast period.

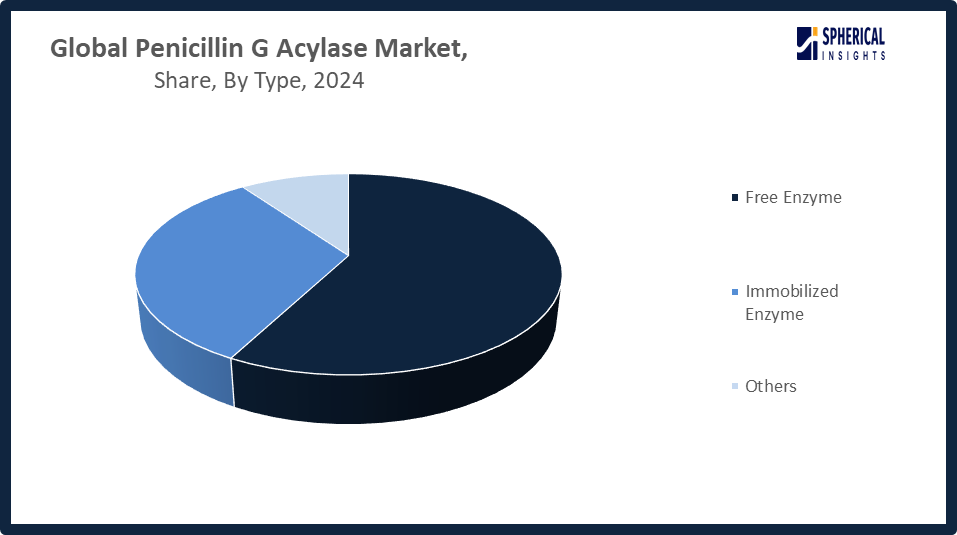

- In terms of type, the immobilized enzyme segment is projected to lead the penicillin G acylase market throughout the forecast period

- In terms of application, the β-lactam antibiotic production segment captured the largest portion of the market

Penicillin G Acylase Market Trends

- Enzyme-based green synthesis is replacing traditional chemical methods in antibiotic production.

- Demand for Penicillin G Acylase is growing due to increased production of β-lactam antibiotics.

- Government support for domestic API manufacturing is driving investments in PGA-related infrastructure.

- Immobilized PGA systems are gaining popularity for their reusability and process efficiency.

- Technological advancements in enzyme engineering are improving the performance and specificity of PGA.

Report Coverage

This research report categorizes the penicillin G acylase market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the penicillin G acylase market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the penicillin G acylase market.

Global Penicillin G Acylase Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 148.30 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.38% |

| 2035 Value Projection: | USD 263.82 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | Merck KGaA, BioCatalytics Inc., Novozymes A/S, Codexis, Inc., Fermenta Biotech Ltd., Amano Enzyme Inc, Biocon Limited, Kyowa Hakko Bio Co., Ltd., AB Enzymes GmbH, ACS Dobfar S.p.A., Takeda Pharmaceutical Company Limited, MuseChem Chemicals, Advanced Enzymes Technologies Ltd., Others, and |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving factors

Growing antibiotic need, government API programs, green synthesis implementation, enzyme technology innovation, and drug industry expansion are strong drivers of the penicillin G acylase (PGA) market. Rising bacterial infections drive the demand for effective antibiotic production. India's PLI scheme and similar government programs support domestic API production. Environment-friendly enzymatic processes, technological advancements in PGA stability and effectiveness, and growing pharmaceutical industries, particularly in developing markets, are all driving the global demand for PGA.

Restraining Factor

The penicillin G acylase market is restrained primarily due to expensive production costs, low enzyme stability, and stringent regulatory measures. Expensive production costs stem from the use of sophisticated fermentation technology, skilled manpower, and expensive raw materials. Low enzyme stability lowers shelf life and process efficiency. Moreover, stringent regulatory measures enhance compliance burdens, slowing down approvals and increasing operational costs for manufacturers.

Market Segmentation

The global penicillin G acylase market is divided into type and application.

Global Penicillin G Acylase Market, By Type:

What made the immobilized enzyme segment lead the penicillin G acylase market in 2024?

The immobilized enzyme segment led the penicillin G acylase market, accounting for approximately 58% market share, as it is utilized in the production of semi-synthetic penicillins, providing greater stability, reusability, and purity. Penicillin G acylase (PGA) is widely used to produce semi-synthetic penicillins by hydrolyzing Penicillin G into 6-APA. Immobilizing PGA enhances its stability, reusability, and efficiency, making it more resistant to pH and temperature changes. It also prevents substrate contamination, ensuring high-purity products and extended enzyme lifespan.

Get more details on this report -

The free enzyme segment in the penicillin G acylase market is expected to grow at the fastest CAGR over the forecast period, approximately 32% of market share. The free enzyme segment of the penicillin G acylase market is anticipated to grow at the highest rate owing to its cost-effectiveness, simplicity of use, versatility in applications, and the facility to enhance stability and separation upon immobilization, leading to improved overall process efficiency.

Global Penicillin G Acylase Market, By Application:

Why did the β-lactam antibiotic production segment hold the largest market share in 2024?

The segment of β-lactam antibiotic production led the market share of approximately 68%, due to its critical role in the production of semi-synthetic penicillin and cephalosporin, which are highly effective and less toxic antibiotics. Penicillin G acylase is a vital biocatalyst in producing β-lactam antibiotics, widely used for synthesizing semi-synthetic penicillin and cephalosporin. These antibiotics are favored in clinical treatments due to their broad-spectrum activity, strong efficacy, and low toxicity.

The industrial biocatalysis segment in the penicillin G acylase market is expected to grow at the fastest CAGR over the forecast period. The industrial biocatalysis sector within the penicillin G acylase market is anticipated to expand the most due to rising demand for effective enzyme-based operations, expanding pharmaceutical production, and the expanding utilization of PGA for green production of 6-aminopenicillanic acid (6-APA).

Regional Segment Analysis of the Global Penicillin G Acylase Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific Penicillin G Acylase Market Trends

Get more details on this report -

How did Asia Pacific lead the penicillin G acylase market in 2024?

Asia Pacific led the market for penicillin G acylase with a 40% market share, aided by robust healthcare facilities, growing demand for antibiotics, developments in enzyme technology, and stringent regulations for antibiotic quality. The increasing demand for semisynthetic penicillins, such as ampicillin and amoxicillin, due to bacterial infections, drives growth. R&D spending in the pharmaceutical sector and healthcare expenses further stimulate the market. Cooperation among enzyme manufacturers, API drugmakers, CDMOs, and academia drives innovation, driving market growth and customized biocatalysis solutions in the country.

Why is India experiencing growth in the penicillin G acylase market?

India's advancement in the penicillin G acylase market is fueled by increasing demand for antibiotics, advances in enzyme technology, rising healthcare expenditure, high pharmaceutical R&D investments, and expanding partnerships among enzyme manufacturers and manufacturers for innovative biocatalysis solutions.

What are the current trends in China’s penicillin G acylase market?

Trends in China's penicillin G acylase market currently include rising demand for antibiotics, technological development in enzyme technology, expanding pharmaceutical R&D expenditure, rigorous quality regulations, and strategic partnerships among enzyme manufacturers and producers in order to create innovative and efficient biocatalysis solutions.

Why is Japan important in the global penicillin G acylase market?

Japan plays a significant role in the world penicillin G acylase market on account of its cutting-edge enzyme technology, robust pharmaceuticals sector, high R&D expenditures, rigorous standards of quality, and partnerships with international manufacturers, fueling research and development and providing high-quality production of antibiotics and biocatalysts.

North America Penicillin G Acylase Market Trends

What is the reason for North America's rapid growth in the penicillin G acylase market?

The fastest growth in the penicillin G acylase market is anticipated in North America, approximately 28% of market share, due to its highly developed health infrastructure, supportive laws, and increasing demand for penicillin-containing drugs. The growing incidence of infectious diseases is driving demand for potent antibiotics, fueling market growth. Major players are engaged in strategic collaborations to spread their presence and invest in novel enzyme engineering technologies to achieve higher efficiency. Continuous research into PGA production is focused on reducing costs and improving performance, inducing expanded use in biopharmaceutical and pharmaceutical industries throughout the region over the forecast years.

Why does the U.S. play a leading role in the penicillin G acylase market?

The U.S. dominates the penicillin G acylase market through developed healthcare, major players in the market, increased expenditure on bacterial infections, and continuous research. PGA plays a vital role in the manufacture of semi-synthetic antibiotics such as ampicillin and amoxicillin, greatly addressing infectious diseases.

Europe Penicillin G Acylase Market Trends

What factors drive the growth of Europe’s penicillin G acylase market?

Europe's penicillin G acylase market expansion is induced by rising need for semi-synthetic antibiotics, improved enzyme technology, strict regulatory requirements guaranteeing antibiotic quality, and increased healthcare spending. Besides this, the high investments in pharmaceutical R&D and cooperation among enzyme manufacturers, manufacturers and research entities promote innovation, raising production effectiveness and offering new applications in the pharmaceutical and biopharmaceutical sectors within the region.

Why is Germany experiencing growth in the penicillin G acylase market?

Germany's growth in the penicillin G acylase market is driven by cutting-edge pharmaceutical R&D, surging demand for semi-synthetic antibiotics, stringent regulatory requirements, robust healthcare infrastructure, and partnerships between enzyme manufacturers and producers to establish effective and innovative biocatalysis solutions.

What are the major trends in the U.K. penicillin G acylase market?

Key trends in the UK penicillin G acylase market are increasing demand for semi-synthetic antibiotics, advances in enzyme technology, growing pharmaceutical R&D, stringent quality regulation, and expanding cooperation between enzyme manufacturers and producers for innovation and market development.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global penicillin G acylases market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players In The Penicillin G Acylase Market Include

- Merck KGaA

- BioCatalytics Inc.

- Novozymes A/S

- Codexis, Inc.

- Fermenta Biotech Ltd.

- Amano Enzyme Inc

- Biocon Limited

- Kyowa Hakko Bio Co., Ltd.

- AB Enzymes GmbH

- ACS Dobfar S.p.A.

- Takeda Pharmaceutical Company Limited

- MuseChem Chemicals

- Advanced Enzymes Technologies Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In August 2025, ECHO India launched a three-year Antimicrobial Stewardship Programme in Punjab and Andhra Pradesh to combat antimicrobial resistance. The initiative engages 400 healthcare professionals to promote rational antibiotic use and infection prevention, inaugurated at the NHSRC.

- In June 2025, Wockhardt Ltd. announced plans to enter the USD 7 billion US and European markets with its new antibiotic Zaynich for gram-negative infections. The company also seeks regulatory approvals in Europe, emerging markets, and India by FY2025.

- In May 2025, Vietnam’s Imexpharm announced a USD 58 million plant in Quang Khanh Industrial Cluster to diversify its product portfolio, meet domestic pharmaceutical demand, and expand into international export markets.

- In July 2023, Codexis, Inc. launched a mini documentary highlighting its new Enzyme Catalyzed Oligonucleotide (ECO) Synthesis technology. This platform, built on CodeEvolver, aims to enable large-scale RNAi therapeutic manufacturing, supporting World Health Day initiatives.

- In June 2022, Merck & Co.'s researchers developed a novel method using engineered penicillin G acylase enzymes to selectively cap insulin’s amines. Inspired by protecting groups, this approach enables precise chemical modification and efficient production of modified insulin molecules.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the penicillin G acylase market based on the following segments:

Global Penicillin G Acylase Market, By Type

- Free Enzyme

- Immobilized Enzyme

- Others

Global Penicillin G Acylase Market, By Application

- β-Lactam Antibiotic Production

- Cephalosporin Derivatives

- Industrial Biocatalysis

- Research & Development

- Others

Global Penicillin G Acylase Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the penicillin G acylase market over the forecast period?The global penicillin G acylase market is projected to expand at a CAGR of 5.38% during the forecast period.

-

2. What is the penicillin G acylase market?The Penicillin G Acylase market involves the production and sale of penicillin G acylase (PGA), an enzyme used to synthesize semi-synthetic penicillins and other antibiotics.

-

3. What is the market size of the penicillin G acylase market?The global penicillin G acylase market size is expected to grow from USD 148.30 million in 2024 to USD 263.82 million by 2035, at a CAGR 5.38% of during the forecast period 2025-2035.

-

4. What factors are driving the growth of the penicillin G acylase market?The penicillin G acylase (PGA) market is driven by rising global demand for semi-synthetic antibiotics like ampicillin and amoxicillin, a strong shift towards green chemistry in pharmaceutical manufacturing, and advancements in enzyme technology, including immobilization and genetic engineering.

-

5. What are the main challenges restricting the wider adoption of the penicillin G acylase market?The main challenges restricting the wider adoption of the penicillin G acylase (PGA) market primarily relate to high production costs, low enzyme stability, competition from alternative production methods, and supply chain vulnerabilities.

-

6. Which region holds the largest share of the penicillin G acylase market?Asia Pacific is anticipated to hold the largest share of the penicillin G acylase market over the predicted timeframe.

-

7. What are the market trends in the penicillin G acylase market?Key market trends for Penicillin G Acylase (PGA) include increasing demand for β-lactam antibiotics, a shift toward sustainable and green chemistry in pharmaceutical manufacturing, and technological advancements in enzyme engineering, such as recombinant DNA technology and enzyme immobilization.

-

8. Who are the top 10 companies operating in the global penicillin G acylase market?The major players operating in the penicillin G acylase market are Merck KGaA, BioCatalytics Inc., Novozymes A/S, Codexis, Inc., Fermenta Biotech Ltd., Amano Enzyme Inc., Biocon Limited, Kyowa Hakko Bio Co., Ltd., AB Enzymes GmbH, ACS Dobfar S.p.A., Takeda Pharmaceutical Company Limited, MuseChem Chemicals, Advanced Enzymes Technologies Ltd., and Others.

Need help to buy this report?