Global PEG Lipids Market Size, Share, and COVID-19 Impact Analysis, By Product Type (PEG-2000, PEG-3000, PEG-4000, and PEG-5000), By Application (Pharmaceuticals, Cosmetics, Food & Beverages, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal PEG Lipids Market Insights Forecasts to 2035

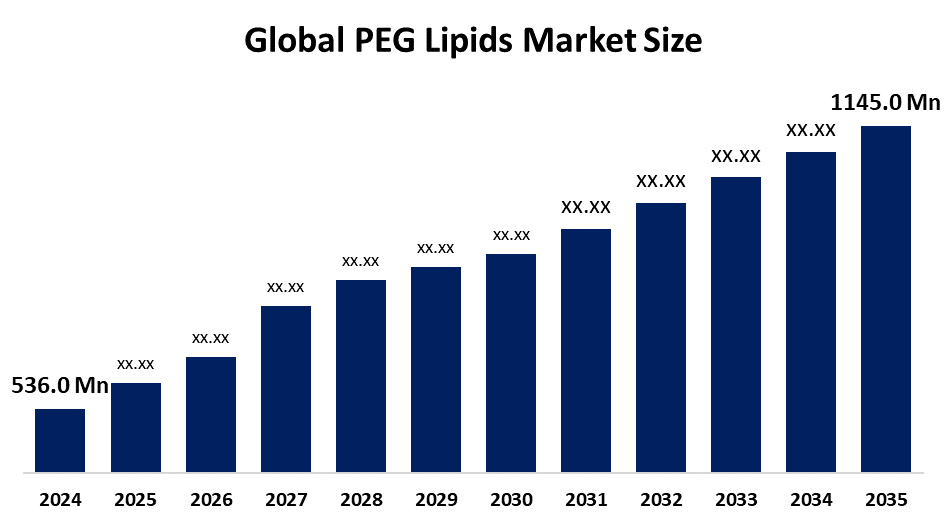

- The Global PEG Lipids Market Size Was Estimated at USD 536.0 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.14% from 2025 to 2035

- The Worldwide PEG Lipids Market Size is Expected to Reach USD 1145.0 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global PEG Lipids Market Size was worth around USD 536.0 Million in 2024 and is predicted to grow to around USD 1145.0 Million by 2035 with a compound annual growth rate (CAGR) of 7.14% from 2025 and 2035. The market for PEG lipids has a number of opportunities to grow due to the increasing adoption of nanotechnology in drug delivery, along with the growing technological advancements and their versatile applications in various industries.

Market Overview

The global industry of PEG lipids focuses on the production and sale of polyethylene glycol (PEG) attached to lipids, primarily used in pharmaceuticals, especially for targeted drug delivery systems such as lipid nanoparticles in vaccines and other therapies. PEG lipids are a class of PEG derivatives attached to a lipid moiety like DMG or DSPE, and are extensively used for improving circulation times for liposome-encapsulated (LNP) drugs and reducing non-specific uptakes. For instance, DMG-PEG 2000 is used for liposome preparation, known for lipid nanoparticle (LNP) preparation for siRNA delivery in the COVID-19 vaccine development.

Innovation and market expansion are anticipated as a result of major players' growing R&D expenditures and the expanding partnerships between the pharmaceutical and biotechnology industries, along with an expanding global healthcare infrastructure. For instance, in May 2025, five leading companies, namely Phosphorex, NOF CORPORATION, NeoSome Life Sciences, NanoImaging Services, and Envol Biomedical, established the LNP alliance to advance lipid nanoparticle technology for next-generation therapeutics. The development of smart drug delivery systems for improving therapeutic outcomes and reducing off-target effects is driving a huge surge in the global PEG lipids market.

Report Coverage

This research report categorizes the PEG Lipids market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the PEG Lipids market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the PEG Lipids market.

Global PEG Lipids Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 536.0 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.14% |

| 2035 Value Projection: | USD 1145.0 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Product Type, By Application and By Region |

| Companies covered:: | NOF Corporation, Nippon Fine Chemical Co., Ltd., Croda International Plc, JenKem, Xiamen Sinopeg, Croda International Plc, CD Bioparticles, Merck KGaA, Avanti Polar Lipids, Inc., Lipoid GmbH, CordenPharma, Evonik Industries AG, Ashland Global Holdings Inc., Gattefossé, Stepan Company, Others, and |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

An increasing development and scale-up of lipid nanoparticles for delivering mRNA vaccines into cells is contributing to driving the PEG lipids market. For instance, the US FDA EUA authorized Pfizer-BioNTech and mRNA-1273 (Moderna), which are mRNA-based vaccines for COVID-19, developed using lipid nanoparticles. The increasing prevalence of chronic diseases, along with surging emphasis on creating drug delivery systems by the integration of PEG-lipid conjugates, is propelling the market growth. Additionally, growing R&D investments in the pharmaceutical & biotechnology industries, healthcare infrastructure, and demand for PEGylated lipid-based personalized therapy are bolstering the market growth for PEG lipids.

Restraining Factors

The PEG lipids market is restricted by factors including the increased cost of PEGylation processes and the complex regulatory approval. Further, the increased production cost and continuous demand for innovation with the evolving consumer demand are hampering the market growth.

Market Segmentation

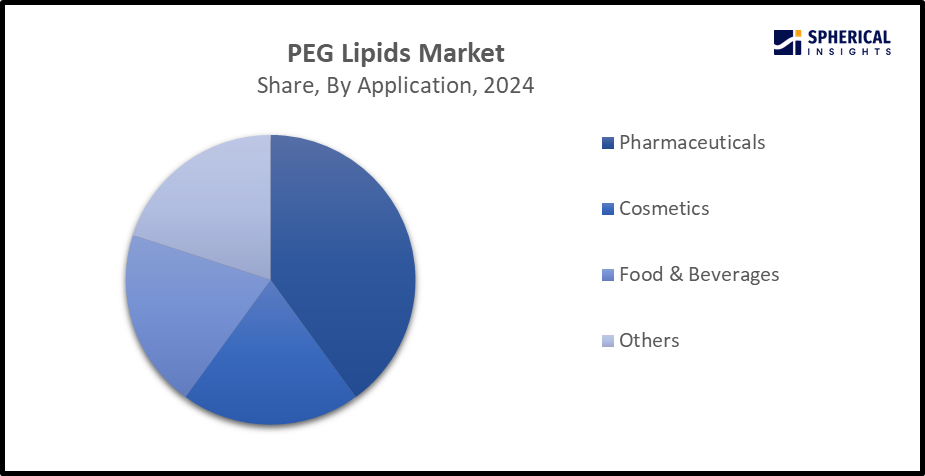

The PEG lipids market share is classified into product type and application.

- The PEG-2000 segment dominated the PEG lipids market in 2024 and is projected to grow at a substantial CAGR of 5-7% during the forecast period.

Based on the product type, the PEG lipids market is divided into PEG-2000, PEG-3000, PEG-4000, and PEG-5000. Among these, the PEG-2000 segment dominated the PEG lipids market in 2024 and is projected to grow at a substantial CAGR of 5-7% during the forecast period. PEG-2000 lipids are phospholipid-PEG conjugates where 2000 indicates the molecular weight of approximately 2000 Daltons for the PEG chain. DMG-PEG 2000 is a synthetic lipid formed by the PEGylation of myristoyl diglyceride, frequently used for manufacturing lipid nanoparticles that are used in mRNA vaccines as a part of the drug delivery systems. With its widespread application in pharmaceutical formulations, the surging development of complex drug formulation and emphasis on targeted drug delivery systems are propelling the market.

- The pharmaceuticals segment accounted for the largest market share of about 30-60% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the PEG lipids market is divided into pharmaceuticals, cosmetics, food & beverages, and others. Among these, the pharmaceuticals segment accounted for the largest market share of about 30-60% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. In the pharmaceutical sector, PEGylated lipid-based delivery system is widely used for developing medicines owing to their long circulating half-life time, low toxicity, biocompatibility, and may provide a platform for targeting the delivery of nucleic acids. They function as a promising platform in the generation of more siRNA drugs. Advancements in drug delivery systems, with the growing biotechnology research and development of novel therapeutics, are propelling the market growth.

Get more details on this report -

Regional Segment Analysis of the PEG Lipids Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the PEG lipids market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share, ranging from 32% to 38% in the PEG lipids market over the predicted timeframe. The market ecosystem in North America is strong, due to the presence of leading companies in mRNA delivery lipid nanoparticles, along with an increasing significance of technologies like pharmacogenomics, digital therapeutics, and artificial intelligence. The demand for PEG lipids has been driven by the region's advanced healthcare infrastructure and strong regulatory support. Furthermore, a strategic alliance for accelerating LNP-based drug development is supporting the market growth of PEG lipids. For instance, in January 2024, CordenPharma International and pHLIP, Inc. announced their strategic alliance to collaborate in developing and commercializing the pHLIP-LNP targeted delivery platform for RNA-based and genetic therapeutics. The United States is dominating the PEG lipids market in the North America region with nearly 32% share, due to the increasing investment in R&D for developing innovative PEG lipid formulations.

Asia Pacific is expected to grow at a rapid CAGR of about 7.8% in the PEG lipids market during the forecast period. The Asia Pacific area has a thriving market for PEG lipids due to the growing prevalence of chronic diseases, demand for lipids in the food, beverage, and cosmetic industry, and an increase in drug development. Due to their governments actively supporting the research and development, relying on PEG lipids in LNPs. For instance, in September 2025, as per a research study, a multifunctional ingredient, polyethylene glycol (PEG) 23 glyceryl distearate (GDS-23), has been shown to enhance skin barrier function, moisture retention, and antioxidant activity, according to a new study by researchers at Showa Medical University. China is leading the Asia Pacific PEG lipids market during the forecast period at a CAGR value of 8.3%, driven by the growing need for innovative drug delivery systems, with the changing inclination towards preventive healthcare.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the PEG lipids market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- NOF Corporation

- Nippon Fine Chemical Co., Ltd.

- Croda International Plc

- JenKem

- Xiamen Sinopeg

- Croda International Plc

- CD Bioparticles

- Merck KGaA

- Avanti Polar Lipids, Inc.

- Lipoid GmbH

- CordenPharma

- Evonik Industries AG

- Ashland Global Holdings Inc.

- Gattefossé

- Stepan Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, Curapath and Cayman Chemical partner to expand access to PEG-free shielding lipids for advanced LNP formulations. The strategic partnership with Cayman Chemical would make Curapath's proprietary PEG-free shielding lipids more accessible to researchers worldwide.

- In August 2025, Phosphorex, NOF Corporation, NeoSome Life Sciences, NanoImaging Services (NIS), and Envol Biomedical have joined forces to establish the LNP Alliance, a strategic partnership dedicated to advancing lipid nanoparticle (LNP) technology and accelerating the development of next generation therapeutics.

- In February 2024, Evonik and the University of Mainz signed a license agreement to commercialize randomized polyethylene glycols (rPEGs), a new class of PEGs. Commercialization of rPEG lipids designed to improve immunogenicity profile for nucleic acid delivery.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the PEG lipids market based on the below-mentioned segments:

Global PEG Lipids Market, By Product Type

- PEG-2000

- PEG-3000

- PEG-4000

- PEG-5000

Global PEG Lipids Market, By Application

- Pharmaceuticals

- Cosmetics

- Food & Beverages

- Others

Global PEG Lipids Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the PEG lipids market?The global PEG lipids market size is expected to grow from USD 536.0 Million in 2024 to USD 1145.0 Million by 2035, at a CAGR of 7.14% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the PEG lipids market?North America is anticipated to hold the largest share of the PEG lipids market over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global PEG lipids Market from 2024 to 2035?The market is expected to grow at a CAGR of around 7.14% during the period 2024–2035.

-

4. Who are the top companies operating in the Global PEG lipids Market?Key players include NOF Corporation, Nippon Fine Chemical Co., Ltd., Croda International Plc, JenKem, Xiamen Sinopeg, Croda International Plc, CD Bioparticles, Merck KGaA, Avanti Polar Lipids, Inc., Lipoid GmbH, CordenPharma, Evonik Industries AG, Ashland Global Holdings Inc., Gattefossé, and Stepan Company.

-

5. Can you provide company profiles for the leading PEG lipids manufacturers?Yes. For example, NOF Corporation is the leading commercial supplier of Drug Delivery Products, including linear and branched hetero-activated PEGs, single molecule PEG linkers for the development of next generation Antibody Drug Conjugates (ADCs), phospholipids nanoparticle formulations, and SS-cleavable lipids for nucleic acid and gene deliveries. Croda International Plc. is committed to empowering biologics delivery, offering high-purity pharmaceutical excipients, world-leading vaccine adjuvants, innovative lipids and in-house formulation expertise.

-

6. What are the main drivers of growth in the PEG lipids market?Use of lipid nanoparticles for delivering mRNA vaccines, along with the growing prevalence of chronic diseases, are major market growth drivers of the PEG lipids market.

-

7. What challenges are limiting the PEG lipids market?An increased cost of PEGylation processes and the complex regulatory approval remain key restraints in the PEG lipids market.

Need help to buy this report?