Global Pectin Market Size, Share, and COVID-19 Impact Analysis, By Function (Thickener, Stabilizer, Gelling agent, Fat replacer, and Others), By Application (Food & Beverage, Pharmaceuticals, Bakery, Dairy products, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Pectin Market Size Insights Forecasts to 2035

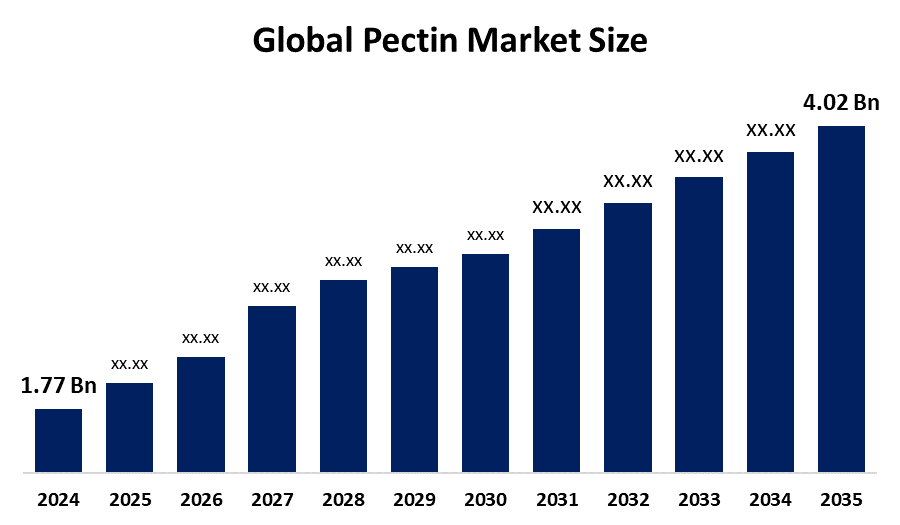

- The Global Pectin Market Size Was Estimated at USD 1.77 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.74 % from 2025 to 2035

- The Worldwide Pectin Market Size is Expected to Reach USD 4.02 Billion by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Pectin Market Size was valued at around USD 1.77 Billion in 2024 and is predicted to Grow to around USD 4.02 Billion by 2035 with a compound annual growth rate (CAGR) of 7.74 % from 2025 to 2035. The greater consumer desire for natural food additives, expanding pharmaceutical applications, greater health consciousness, clean-label tendencies, and growing use in plant-based and functional products are all factors driving the pectin market.

Market Overview

The production, extraction, processing, distribution, and sale of pectin, a natural polymer mostly obtained from citrus peels, apple pomace, and other fruit materials, are all included in the global market. Pectin has been approved as a multifunctional hydrocolloid by the WHO, FDA, and EU food regulators. In food and beverage products, medicines, personal care products, and novel industrial uses, it can be utilized as a gelling agent, thickener, stabilizer, and fat substitute. Growth is further accelerated by government-backed initiatives, such as China's draft regulations supporting pectin in candies and beverages, and EU sustainability mandates, such as Regulation 2025/40 on recyclable packaging, which promote natural polymers and encourage eco-friendly extraction and less use of synthetic additives. For instance, in September 2023, Cargill launched a new variety of LM conventional (LMC) pectins, produced with patented technology, enabling novel textures and appropriateness for goods marketed with organic claims, boosting versatility in culinary applications. The market is anticipated to be driven in the near future by rising health concerns and the increasing use of organic and healthful raw ingredients in the production of food products.

Report Coverage

This research report categorizes the pectin market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the pectin market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the pectin market.

Global Pectin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.77 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.74% |

| 2035 Value Projection: | USD 4.02 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 148 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Function, By Application and COVID-19 Impact Analysis |

| Companies covered:: | B&V srl, CEAMSA, Cargill, Incorporated, CP Kelco USA, Inc., Devson Impex Private Limited, DuPont Nutrition & Health, FMC Corporation, Herbstreith & Fox, Lucid Colloids Ltd, Naturex Group, Quadra Chemicals, Silvateam Food Ingredients, Yantai Andre Pectin Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the main factors driving the market is consumer desire for natural plant-based clean-label ingredients in food and beverage goods. The current market demand is satisfied by pectin, a naturally occurring hydrocolloid. For a variety of fruit products, such as marmalades and fruit-based preparations used in yogurts, desserts, and baked products, pectin acts as a gelling, thickening, and stabilizing agent. Through massive citrus processing enterprises in China and India that use waste valorization initiatives to turn peel by-products into pectin feedstock, the Asia Pacific market grows. Market expansion is fueled by the growing demand for processed and convenience goods, such as jams and jellies, dairy products, and candies.

Restraining Factors

The pectin market is constrained by high production and extraction costs, changing availability of raw materials, price volatility, competition from synthetic substitutes, and tight regulatory requirements influencing quality standards, approvals, and worldwide market expansion.

Market Segmentation

The pectin market share is classified into function and application.

- The thickener segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the function, the pectin market is divided into thickener, stabilizer, gelling agent, fat replacer, and others. Among these, the thickener segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Pectin's chemical and physical characteristics allow it to be widely used as a thickening agent in a variety of culinary products. It can create highly hydrated cross-linked polymer networks. Pectin is in higher demand as a natural substitute for artificial thickeners due to consumers' growing preference for clean-label and plant-based products.

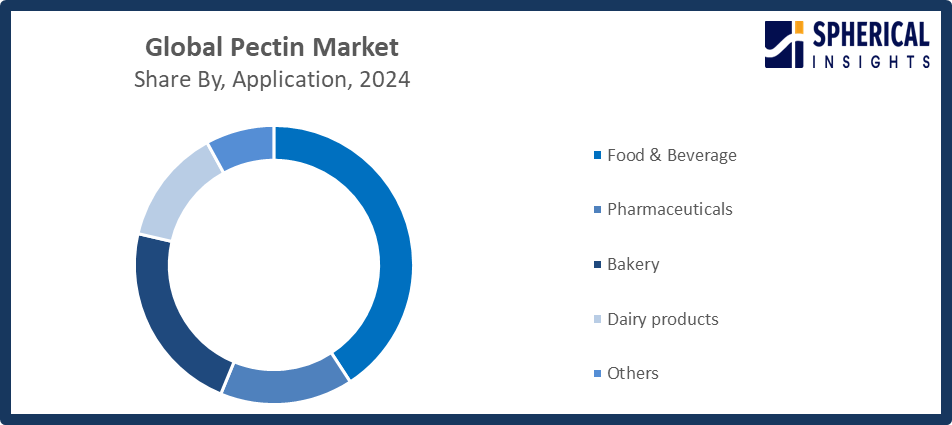

- The food & beverage segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the pectin market is divided into food & beverage, pharmaceuticals, bakery, dairy products, and others. Among these, the food & beverage segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Pectin is widely used as a natural thickening, stabilizing, and gelling ingredient in the food and beverage market. It is often used to improve texture, consistency, and shelf life in products like jams, jellies, confections, dairy products, drinks, and sauces. Demand in this market has been further fueled by consumers' growing desire for plant-based and clean-label products.

Get more details on this report -

Regional Segment Analysis of the Pectin Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

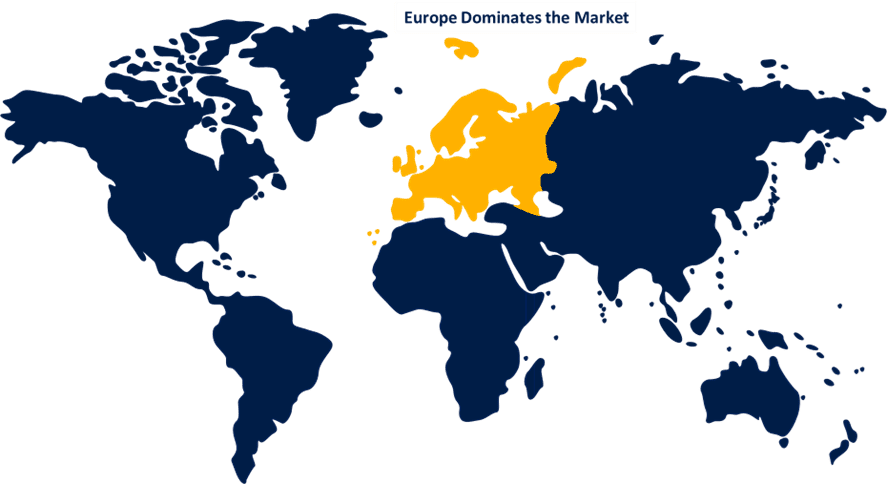

Europe is anticipated to hold the largest share of the pectin market over the predicted timeframe.

Get more details on this report -

Europe is anticipated to hold the largest share of the pectin market over the predicted timeframe. Pectin is highly sought after in the European region for usage as a gelling and stabilizing agent in traditional food products such as jams, jellies, confections, and baked goods. Another important nation for the production of citrus fruits is Argentina. However, due to adverse weather patterns and declining demand for lime juice, the country lacks a significant production capacity. Growing health consciousness among consumers has also raised demand for functional foods and dietary fiber, supporting pectin consumption. Natural polymers like pectin in recyclable composites are encouraged by the European Commission's Single-Use Plastics Directive and Regulation 2025/40 on sustainable packaging, which stimulates investments and awards for research and development.

Asia Pacific is expected to grow at a rapid CAGR in the pectin market during the forecast period. Asia Pacific is a promising market due to the existence of developing nations like India and Chain. The need for pectin as a functional food ingredient is being greatly increased by rising consumption of processed and convenience foods in nations like China, India, and Japan. Market expansion is also being aided by population growth, rapid urbanization, and rising disposable incomes. Indonesia's government-backed circular economy programs (ongoing since 2023, financed by the Asian Development Bank) incentivise agro-industrial waste valorization, transforming citrus peels into pectin feedstock.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the pectin market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- B&V srl

- CEAMSA

- Cargill, Incorporated

- CP Kelco USA, Inc.

- Devson Impex Private Limited

- DuPont Nutrition & Health

- FMC Corporation

- Herbstreith & Fox

- Lucid Colloids Ltd

- Naturex Group

- Quadra Chemicals

- Silvateam Food Ingredients

- Yantai Andre Pectin Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2024, Tate & Lyle launched a strategic expansion by acquiring CP Kelco for USD 1.8 billion, incorporating its pectin and citrus fiber portfolio to strengthen global specialty ingredient offerings.

- In January 2024, IFF launched Grindsted Pectin FB 420, a label-friendly, process-efficient solution for baking, offering unique sensory attributes and bake-stable fruit fillings, enhancing versatility in bakery applications.

- In December 2023, Herbstreith & Fox launched H&F Italy SRL in Milan, expanding its operations to serve the Italian market and strengthen regional presence in specialty ingredients and pectin products.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the pectin market based on the below-mentioned segments:

Global Pectin Market, By Function

- Thickener

- Stabilizer

- Gelling agent

- Fat replacer

- Others

Global Pectin Market, By Application

- Food & Beverage

- Pharmaceuticals

- Bakery

- Dairy products

- Others

Global Pectin Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the pectin market over the forecast period?The global pectin market is projected to expand at a CAGR of 7.74% during the forecast period.

-

2. What is the market size of the pectin market?The global pectin market size is expected to grow from USD 1.77 billion in 2024 to USD 4.02 billion by 2035, at a CAGR of 7.74 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the pectin market?Europe is anticipated to hold the largest share of the pectin market over the predicted timeframe.

-

4. Who are the top companies operating in the global pectin market?B&V srl, CEAMSA, Cargill, Incorporated, CP Kelco USA, Inc., Devson Impex Private Limited, DuPont Nutrition & Health, FMC Corporation, Herbstreith & Fox, Lucid Colloids Ltd, Naturex Group, Quadra Chemicals, Silvateam Food Ingredients, Yantai Andre Pectin Co., Ltd., and Others.

-

5. What factors are driving the growth of the pectin market?Rising demand for natural, clean-label ingredients, increasing processed food consumption, expanding health consciousness, development of pharmaceutical and nutraceutical uses, and advancements in extraction and processing technology fuel pectin market growth.

-

6. What are the market trends in the pectin market?Innovative extraction methods, growing use in plant-based and functional foods, clean-label adoption, growing demand in dairy and drinks, and growth into pharmaceutical, nutraceutical, and personal care applications are some trends.

-

7. What are the main challenges restricting the wider adoption of the pectin market?High production and extraction costs, fluctuating raw material availability, price volatility, competition from synthetic alternatives, and strict regulatory requirements hinder large-scale adoption and global expansion of the pectin market.

Need help to buy this report?