Global PCR Based Transplant Diagnostics Market Size, Share, and COVID-19 Impact Analysis, By Test Type (CMV PCR Test, EBV PCR Test, BKV PCR Test, VZV PCR Test, and Others), By Transplant Type (Kidney Transplantation, Liver Transplantation, Heart Transplantation, Lung Transplantation, and Other Transplantations), By Application (Diagnostic Applications and Research Applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal PCR Based Transplant Diagnostics Market Insights Forecasts to 2035

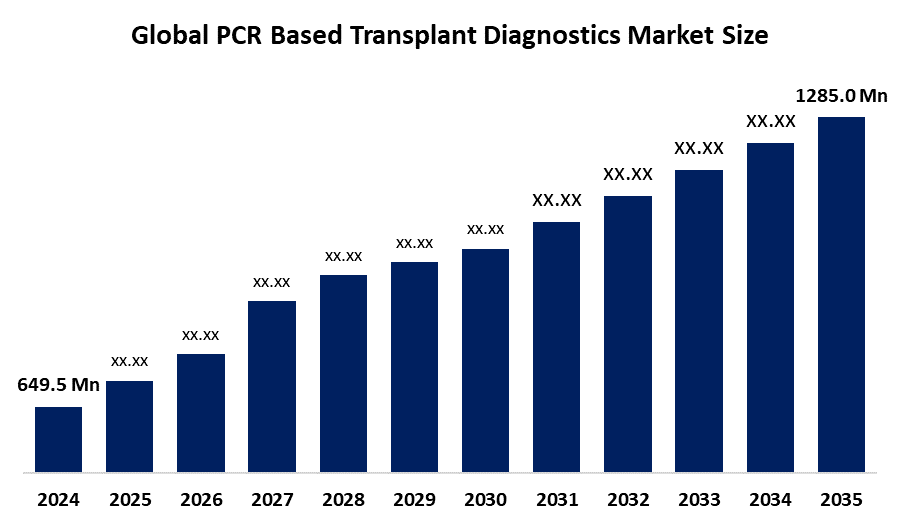

- The Global PCR Based Transplant Diagnostics Market Size Was Estimated at USD 649.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.40% from 2025 to 2035

- The Worldwide PCR Based Transplant Diagnostics Market Size is Expected to Reach USD 1285.0 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global PCR Based Transplant Diagnostics market size was worth around USD 649.5 million in 2024 and is predicted to grow to around USD 1285.0 million by 2035 with a compound annual growth rate (CAGR) of 6.40% from 2025 and 2035. The market for PCR-based transplant diagnostics presents numerous opportunities for growth, driven by the incorporation of PCR into digital health platforms. This is fueled by the growing need for transplants, resulting from an increase in chronic disease prevalence and an ageing population, as well as advancements in molecular diagnostics.

Market Overview

The global industry of PCR-based transplant diagnostics focuses on utilising the polymerase chain reaction (PCR) to enhance organ transplant success by ensuring donor-recipient compatibility and monitoring for post-transplant complications, such as rejection or infection. Digital PCR provide quantification of donor-derived cfDNA (dd-cfDNA) in the monitoring of solid organ transplants, offering faster turnaround times, lower costs, and better sample control than sequencing. PCR-based diagnostics, especially in kidney transplantation, facilitate targeted treatment, optimization of antimicrobial use, and help in avoiding unnecessary immunosuppression adjustments, ultimately improving graft outcomes.

Innovation and market expansion are anticipated as a result of an ongoing research study on evaluating test kit technology. For instance, in June 2025, iMDx announced positive study results showing the equivalence of GraftAssureIQ with NGS dd-cfDNA test kits in kidney transplant monitoring. The emergence of non-invasive biomarkers and molecular imaging techniques for early and accurate detection of transplant rejection is driving a huge surge in the global market demand for enabling personalized management strategies in transplant patients.

Report Coverage

This research report categorizes the PCR based transplant diagnostics market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the PCR based transplant diagnostics market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the PCR based transplant diagnostics market.

Global PCR Based Transplant Diagnostics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 649.5 Million |

| Forecast Period: | 2024 – 2035 |

| Forecast Period CAGR 2024 – 2035 : | CAGR of 6.40% |

| 024 – 2035 Value Projection: | USD 1285.0 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Test Type, By Transplant Type |

| Companies covered:: | Quest Diagnostics Incorporated, Laboratory Corporation of America Holdings (Labcorp), Eurofins Viracor, LLC, Sonic Healthcare USA, ARUP Laboratories, Ambar Lab, Dr. Lal PathLabs, And Other players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The PCR based transplant diagnostics market is primarily driven by an increasing number of organ transplant. For instance, as per the latest data of 2022 from the Global Observatory on Donation and Transplantation indicates that more than 150,000 solid organ transplants (≤ 10% of global needs) are performed worldwide annually, which is an increase of 52% compared with 2010. Advancements in molecular diagnostics for detecting pathogens, genetic mutations, and other biomarkers precisely during organ transplantation are anticipated to propel the market growth. Furthermore, the increased prevalence of chronic disease, accuracy in compatibility testing, increasing ageing population, and government support for organ donation & health infrastructure are all contributing factors in driving the PCR based transplant diagnostics market.

Restraining Factors

The PCR based transplant diagnostics market is restricted by the limited availability of donor organs against the increasing demand for transplantation procedures. Further, strict regulations and reimbursement policies are challenging factors in PCR based transplant diagnostics market.

Market Segmentation

The PCR based transplant diagnostics market share is classified into test type, transplant type, and application.

- The CMV PCR test segment accounted for the largest market revenue share, approximately 28.7%, in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the test type, the PCR based transplant diagnostics market is divided into CMV PCR test, EBV PCR test, BKV PCR test, VZV PCR test, and others. Among these, the CMV PCR test segment accounted for the largest market revenue share, approximately 28.7%, in 2024 and is expected to grow at a significant CAGR during the forecast period. CMV-DNAemia in blood samples (cytomegalovirus DNA) quantification represents active viral replication in transplant recipients; thus, CMV PCR testing aids in providing accurate information on viral load kinetics during post-transplant monitoring of CMV infection, particularly in patients receiving LMV. The critical demand for CMV monitoring in solid organ and hematopoietic stem cell transplant recipients is propelling the market.

- The kidney transplantation segment accounted for the largest market share of about 39.5% in 2024 and is expected to grow at a significant CAGR during the projected period.

Based on the transplant type, the PCR based transplant diagnostics market is divided into kidney transplantation, liver transplantation, heart transplantation, lung transplantation, and other transplantations. Among these, the kidney transplantation segment accounted for the largest market share of about 39.5% in 2024 and is expected to grow at a significant CAGR during the projected period. The segment includes the use of stool multiplex PCR for determining the etiological spectrum of diarrhoea in kidney transplant recipients. The increased volume of kidney transplants with the routine use of PCR diagnostics for post-operative monitoring leads to drives the segmental market growth.

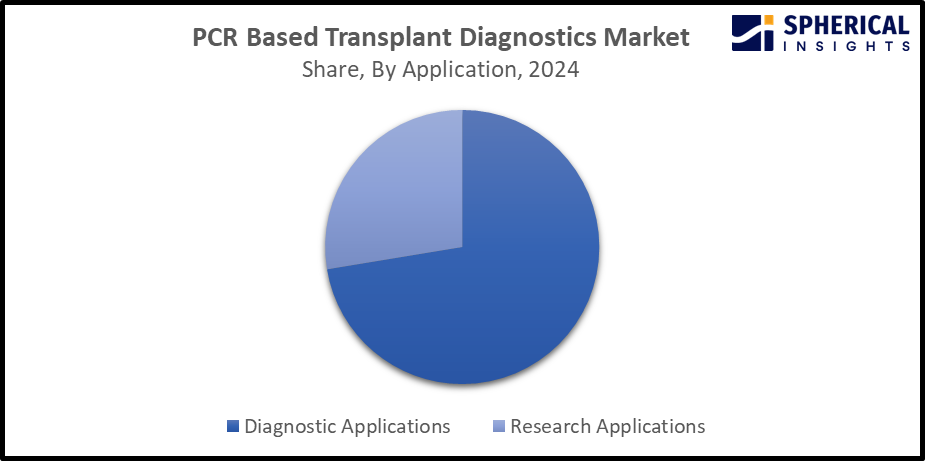

- The diagnostic applications segment dominated the market with the largest share of 72.4% in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the application, the PCR based transplant diagnostics market is divided into diagnostic applications and research applications. Among these, the diagnostic applications segment dominated the market with the largest share of 72.4% in 2024 and is projected to grow at a substantial CAGR during the forecast period. Due to the high sensitivity of PCR as molecular diagnostic techniques lead to the detection of earlier detection of viral replication in the post transplant period, before the onset of symptoms. The widespread application of PCR testing in routine transplant patient management and monitoring contributes to driving market expansion in the diagnostic applications segment.

Get more details on this report -

Regional Segment Analysis of the PCR Based Transplant Diagnostics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the PCR based transplant diagnostics market over the predicted timeframe.

North America is anticipated to hold the largest share of about 41.5% in the PCR based transplant diagnostics market over the predicted timeframe. The market for PCR based transplant diagnostics has been driven by the region's increasing strategic collaborations between healthcare professionals and laboratory experts. Due to their innovative PCR based transplant diagnostics products and partnerships with other industry players, well-known North American businesses like Thermo Fisher Scientific, Bio-Rad Laboratories, Inc., QIAGEN, and other industries have played a significant role in propelling the market's expansion. For instance, in November 2022, Roche announced plans for the U.S. launch of the cobas 5800 System, a compact, fully-automated molecular laboratory instrument that offers a flexible, PCR testing solution that aids clinicians in the diagnosis of infectious diseases. The U.S. is dominating the North America PCR based transplant diagnostics market, accounting for significant growth, driven by the launch of an AI-driven diagnostic platform, along with an increasing strategic collaborations between diagnostic companies, research institutes, and transplant centres.

Asia Pacific is expected to grow at a rapid CAGR in the PCR based transplant diagnostics market during the forecast period. The Asia Pacific area has a thriving market for PCR based transplant diagnostics due to the high prevalence of chronic illness and use of stem cell therapy & personalized medications. For instance, in August 2025, according to The Logical Indian, India set a record with 18.911 organ transplants in 2024, which reflects medical progress and high awareness. Due to their governments' active support towards providing quality medical care by the adoption of NAT screening for transfusion-transmitted infections, this significantly contributes to the market growth. China is dominating the Asia Pacific PCR-based transplant diagnostics market, owing to the improvement in healthcare infrastructure, increasing public awareness, and government-led measures for upgrading hospitals, providing access to new diagnostic technology.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the PCR based transplant diagnostics market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Quest Diagnostics Incorporated

- Laboratory Corporation of America Holdings (Labcorp)

- Eurofins Viracor, LLC

- Sonic Healthcare USA

- ARUP Laboratories

- Ambar Lab

- Dr. Lal PathLabs

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2025, CareDx, Inc., the Transplant Company, a leading precision medicine company focused on the discovery, development, and commercialization of clinically differentiated, high-value healthcare solutions for transplant patients and caregivers, announced new data presentations featuring CareDx technologies at American Society of Nephrology (ASN) Kidney Week 2025, underscoring the power of molecular biomarkers to advance transplant care.

- In October 2024, Seegene Inc., a leading South Korean company providing a total solution for PCR molecular diagnostics, announced the finalization of a partnership agreement with Werfen, a worldwide leader in specialized diagnostics, on the technology-sharing initiative. This partnership builds on the momentum of the technology-sharing initiative, which includes the first NewCo partnership in March 2023 with Hylabs, a leading diagnostic company in Israel.

- In April 2024, Bio-Rad Laboratories, Inc., a global leader in life science research and clinical diagnostics products, announced a collaboration agreement with Oncocyte Corporation, a precision diagnostics company, to develop and commercialize transplant monitoring products using Bio-Rad’s Droplet Digital PCR (ddPCR) instruments and reagents.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the PCR based transplant diagnostics market based on the below-mentioned segments:

Global PCR Based Transplant Diagnostics Market, By Test Type

- CMV PCR Test

- EBV PCR Test

- BKV PCR Test

- VZV PCR Test

- Others

Global PCR Based Transplant Diagnostics Market, By Transplant Type

- Kidney Transplantation

- Liver Transplantation

- Heart Transplantation

- Lung Transplantation

- Other Transplantations

Global PCR Based Transplant Diagnostics Market, By Application

- Diagnostic Applications

- Research Applications

Global PCR Based Transplant Diagnostics Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the PCR based transplant diagnostics market?The global PCR based transplant diagnostics market size is expected to grow from USD 649.5 Million in 2024 to USD 1285.0 Billion by 2035, at a CAGR of 6.40% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the PCR based transplant diagnostics market?North America is anticipated to hold the largest share of the PCR based transplant diagnostics market over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global PCR Based Transplant Diagnostics Market from 2024 to 2035?The market is expected to grow at a CAGR of around 6.40% during the period 2024–2035.

-

4. Who are the top companies operating in the Global PCR Based Transplant Diagnostics Market?Key players include Quest Diagnostics Incorporated, Laboratory Corporation of America Holdings (Labcorp), Eurofins Viracor, LLC, Sonic Healthcare USA, ARUP Laboratories, Ambar Lab, and Dr. Lal PathLabs.

-

5. Can you provide company profiles for the leading PCR Based Transplant Diagnostics manufacturers?Yes. For example, Quest Diagnostics Incorporated is a leading global provider of diagnostic testing, services, and information systems that patients and doctors rely on to make healthcare decisions. Laboratory Corporation of America Holdings (Labcorp) provides laboratory services used for diagnosis and healthcare decisions, operating as one of the largest clinical laboratory networks in the world and has operations in over 100 countries.

-

6. What are the main drivers of growth in the PCR based transplant diagnostics market?An increasing number of organ transplants, prevalence of chronic diseases, advancement in molecular diagnostics, and government support are major market growth drivers of the PCR based transplant diagnostics market.

-

7. What challenges are limiting the PCR based transplant diagnostics market?Lack of trained workforce, as well as limited availability and unfavourable reimbursement policies, remain key restraints in the PCR based transplant diagnostics market.

Need help to buy this report?