Global PBT Resin Market Analysis: Industry Market Size, Plant Capacity, Technology, Production, Operating Efficiency, Demand & Supply, Type, Processing Method, Regional Demand, Company Share, Manufacturing Process, Technology Licensor, 2025-2035

Industry: Chemicals & MaterialsGlobal PBT Resin Market Size Insights Forecasts to 2035

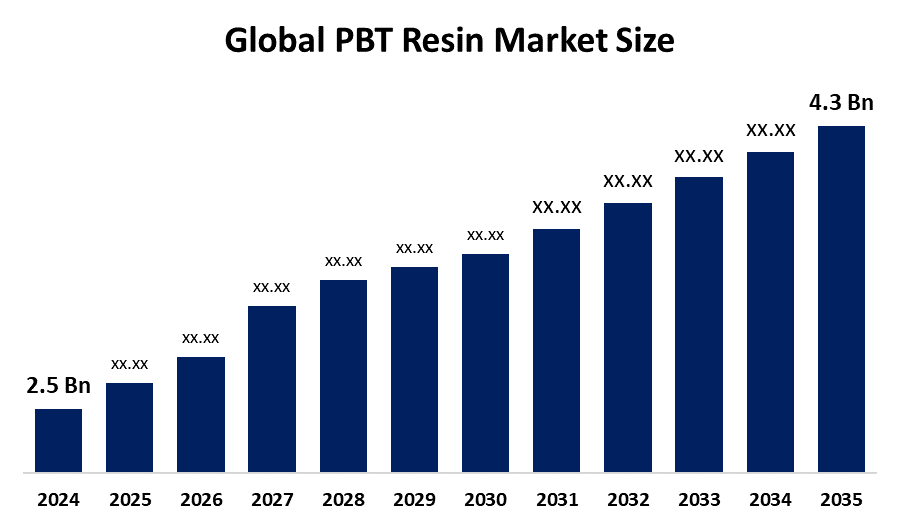

- The Global PBT Resin Market Size Was Estimated at USD 2.5 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.44% from 2025 to 2035

- The Worldwide PBT Resin Market Size is Expected to Reach USD 4.3 Billion by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global PBT Resin Market Size was worth around USD 2.5 Billion in 2024 and is predicted to Grow to around USD 4.3 Billion by 2035 with a compound annual growth rate (CAGR) of 5.44% from 2025 and 2035. The market for PBT resin has a number of opportunities to grow as PBT provides good electrical insulation and durability, rapid moldability, and exceptional heat and chemical resistance. These characteristics make it perfect for electronic connectors and housings, lightweight, long lasting consumer components, and automotive parts.

Market Overview

PBT, a semi crystalline thermoplastic polyester resin, is made by polymerizing 1,4-butanediol and terephthalic acid, referred to as dimethyl terephthalate. PBT resins, which are thermoplastic engineering polymers, are noted for their high strength, thermal stability, and exceptional electrical insulating properties. Because of these properties, they are useful in many markets, including consumer products, automotive, electrical and electronics, as well as industrial use. The US Department of Commerce reported that the global PBT resin market was valued at approximately USD 2.5 billion in 2022 and will continue to grow at a compound annual growth rate of nearly 6.3% between 2023 and 2030. This growth shows the increased use of PBT resins in advanced applications and manufacturing technologies. One of the main drivers for the growth of the PBT resin market is the expanding automotive sector, which has experienced a shift to lightweight materials for fuel efficiency and emissions benefits, which PBT resins demonstrate with favorable strength to weight ratios, making them a choice for various automotive components, including connectors, housing, and interior parts. Growing interest in electric vehicles is also increasing demand for advanced materials for lightweight design and effective energy management of EVs. In 2022, the International Energy Agency indicated that more than 10 billion electric vehicles were sold globally, which underscores the increased need in the automotive sector for sustainable materials.

Governments are strengthening laws and allocating more funds to encourage the use of sustainable plastics, such as PBT resins. To reduce CO2 emissions, Toray, a company based in Japan, used depolymerization and repolymerization procedures to expand its chemically recycled PBT resin line. Persistent, bioaccumulative, toxic compounds are being subject to stricter rules in the United States under TSCA Section 6(h), which forces resin manufacturers to reformulate and guarantee compliance.

Report Coverage

This research report categorizes the PBT resin market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the PBT resin market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the PBT resin market.

Global PBT Resin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.5 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.44% |

| 2035 Value Projection: | USD 4.3 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 149 |

| Tables, Charts & Figures: | 133 |

| Segments covered: | Plant Capacity, Technology and COVID-19 Impact Analysis |

| Companies covered:: | BASF SE, SABIC, DuPont, Celanese Corporation, Polyplastics Co., Ltd., Toray Industries, Inc., DSM, LG Chem Ltd., Chang Chun Group, Nan Ya Plastics Corporation, Shinkong Synthetic Fibers Corporation, PolyOne Corporation, Mitsubishi Chemical Corporation, Hengli Group Co., Ltd., Wuxi Xingsheng New Material Technology Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The PBT resin market is driven by the automobile industry, which uses them for connecting parts, housings, and more under the hood applications. The push for lightweight materials for better fuel efficiency has also accelerated the use of PBT. The growth of electric vehicles is also in favor of PBT resins because PBT provides the properties required to adhere to strict safety and performance requirements. According to market research information, the automotive industry represented nearly 40% of the PBT resin market in 2022. Another significant contributor to the PBT market is PBT resin's ability to be processed to improve performance features.

Restraining Factors

The PBT resin market is restricted by factors like the volatility of raw material prices, particularly crude oil and petrochemical derivatives. These fluctuations in price have the potential to impact production costs and, therefore, the pricing of PBT resin products.

Market Segmentation

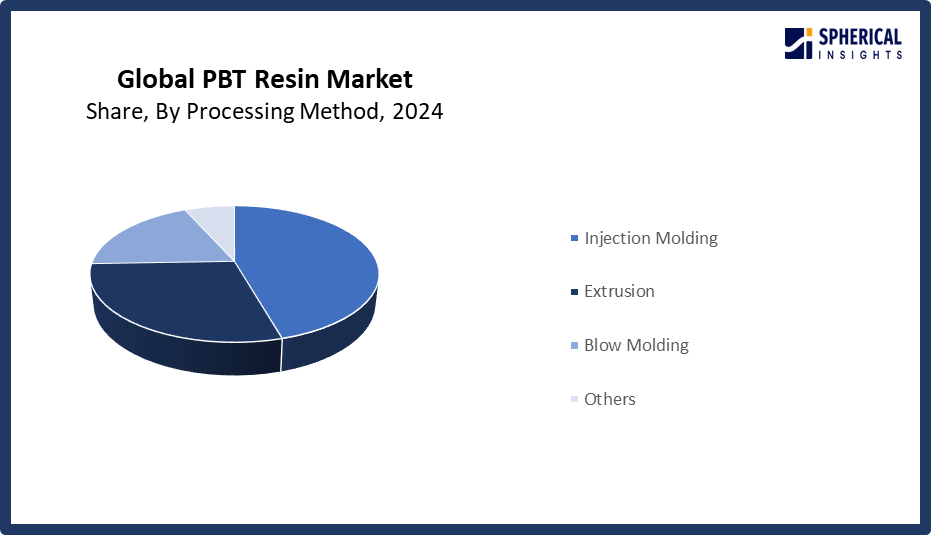

The PBT resin market share is classified into type and processing method.

- The reinforced PBT resin segment dominated the market in 2024, accounting for approximately 64% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the PBT resin market is divided into reinforced PBT resin and unreinforced PBT resin. Among these, the reinforced PBT resin segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven by glass fibers, and other materials can be added to reinforced PBT resin to improve strength and durability. This resin is desired for this application when high performance is needed for mechanical applications. For example, reinforced PBT resin is being used in the automobile industry for components needing strength and resistance to chemicals, heat, and impact. The need for reinforced PBT resin is increasing due to consumer demand and government regulations putting pressure on companies to lower weight without compromising performance or safety.

- The injection molding segment accounted for the largest share in 2024, accounting for approximately 46% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the processing method, the PBT resin market is divided into injection molding, extrusion, blow molding, and others. Among these, the injection molding segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is due to the process being efficient for creating complex pieces with certain design lengths and shapes for the automotive and consumer industries. As manufacturers continue to desire reliability and efficiency, injectable PBT components will continue to be desirable.

Get more details on this report -

Regional Segment Analysis of the PBT Resin Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share, representing nearly 7.53% of the PBT resin market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share, representing nearly 7.53% of the PBT resin market over the predicted timeframe. In the North America market, the demand is rising because the automotive sector remains focused on creating a lightweight materials suite for improved fuel economy, and consequently, the demand for high performance resins like PBT will continue to escalate. Moreover, the region's focus on innovation and technology will continue to improve the material's performance and expand the range of potential applications due to the conditions being almost optimal for developing advanced PBT materials.

The United States dominates the PBT resin market due to the robust automotive, electronics, and appliance sectors in the United States, as well as the country's plentiful and affordable feedstock, supportive infrastructure, and significant R&D investment.

Asia Pacific is expected to grow at a rapid CAGR, representing nearly 7% in the PBT resin market during the forecast period. The Asia Pacific area has a thriving market for PBT Resin due to countries like China, India, Japan, and South Korea, and is likely to be one of the fastest growing regions in the world. These countries are expected to experience significant development in industrial activity in the electronics and automotive markets. As a result of increased urbanization and rising disposable incomes, consumer demands for advanced, high performance, and durable products will cause demand for PBT resin to increase, too. More developments in Asia-Pacific are anticipated for the PBT resin market as increased manufacturing techniques will allow the material to realize its enhanced property potential and applications.

China is the market leader for PBT resin in Asia-Pacific because of its large manufacturing base, high production capacity, and strong demand from important sectors like consumer appliances, electronics, and the automotive industry. Strong infrastructure and pro business economic policies further reinforce the nation's dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the PBT resin market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- SABIC

- DuPont

- Celanese Corporation

- Polyplastics Co., Ltd.

- Toray Industries, Inc.

- DSM

- LG Chem Ltd.

- Chang Chun Group

- Nan Ya Plastics Corporation

- Shinkong Synthetic Fibers Corporation

- PolyOne Corporation

- Mitsubishi Chemical Corporation

- Hengli Group Co., Ltd.

- Wuxi Xingsheng New Material Technology Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2024, Polymer Resources Ltd. introduced a new unfilled, impact modified PBT resin aimed at electrical applications. It features flame retardance, good weatherability, chemical & impact resistance.

- In September 2023, Toray Industries expanded its lineup of chemical recycled PBT resin grades, including glass fiber reinforced, low warpage, and hydrolysis resistant variants. These new products are certified to match the properties of virgin PBT while reducing CO2 footprint.

- In May 2022, SABIC introduced LNP ELCRIN WF0061BiQ, a PBT resin produced from chemically upcycled ocean bound PET bottles, reducing CO2 emissions and energy demand.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the PBT resin market based on the below-mentioned segments:

Global PBT Resin Market, By Type

- Reinforced PBT Resin

- Unreinforced PBT Resin

Global PBT Resin Market, By Processing Method

- Injection Molding

- Extrusion

- Blow Molding

- Others

Global PBT Resin Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the PBT resin market over the forecast period?The global PBT resin market is projected to expand at a CAGR of 5.44% during the forecast period.

-

2. What is the market size of the PBT resin market?The global PBT resin market size is expected to grow from USD 2.5 Billion in 2024 to USD 4.3 Billion by 2035, at a CAGR of 5.44% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the PBT resin market?North America is anticipated to hold the largest share of the PBT resin market over the predicted timeframe.

-

4. Who are the top 15 companies operating in the global PBT resin market?BASF SE, SABIC, DuPont, Celanese Corporation, Polyplastics Co., Ltd., Toray Industries, Inc., DSM, LG Chem Ltd., Chang Chun Group, Nan Ya Plastics Corporation, Shinkong Synthetic Fibers Corporation, PolyOne Corporation, Mitsubishi Chemical Corporation, Hengli Group Co., Ltd., Wuxi Xingsheng New Material Technology Co., Ltd., and Others.

-

5. What factors are driving the growth of the PBT resin market?The PBT resin market growth is driven by growing consumer demand for long lasting, high performance materials, growing use in electronics and electrical applications for connectors, switches, and miniaturized components, growing demand from the automotive industry for lightweight, heat and chemical resistant materials, and regulatory and sustainability pressures urging the use of recyclable, environmentally friendly polymer materials.

-

6. What are the market trends in the PBT resin market?The PBT resin market trends include sustainability & recycling, mechanical performance, growing use in electronics & automotive, vertical integration & raw material control, and customization & digital processes.

-

7. What are the main challenges restricting wider adoption of the PBT resin market?The PBT resin market trends include price fluctuations for raw materials, making it hard to control production costs and reduce profit margins. Strict and diverse environmental restrictions hinder innovation, force reformulation, and increase compliance costs.

Need help to buy this report?